| o Preliminary Proxy Statement | ||

|

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

||

| þ Definitive Proxy Statement | ||

| o Definitive Additional Materials | ||

|

o Soliciting Material Pursuant to Section 240.14a-12

|

||

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NorthWest Indiana Bancorp

9204

Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

| Notice of Annual Meeting of Shareholders |

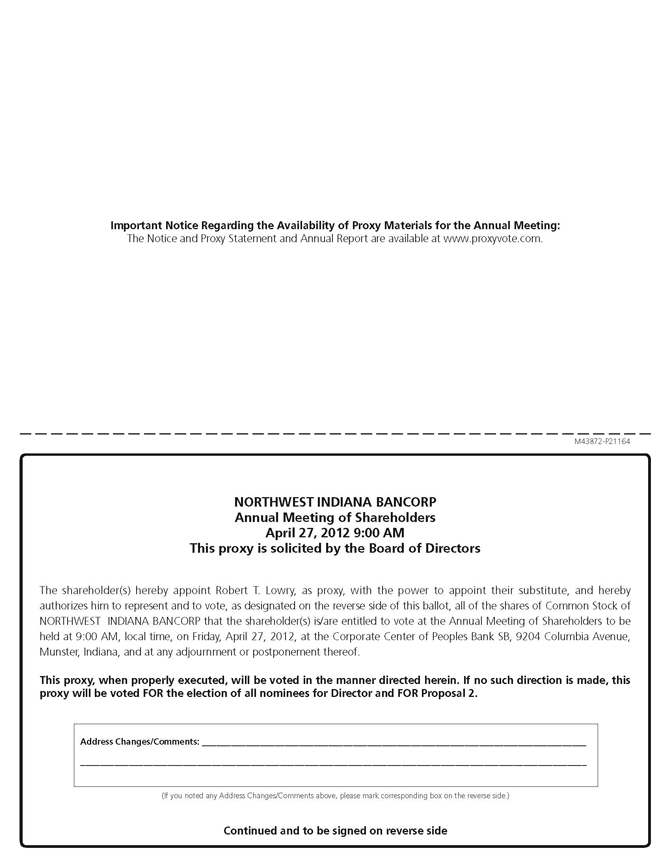

To Be Held On April 27, 2012

The Annual Meeting of Shareholders of NorthWest Indiana Bancorp will be held at the Corporate Center of Peoples Bank SB, 9204 Columbia Avenue, Munster, Indiana, on Friday, April 27, 2012, at 9:00 a.m., local time.

The Annual Meeting will be held for the following purposes:

| 1. | Election of Directors. Election of four directors of the Bancorp to serve three-year terms expiring in 2015; |

| 2. | Ratification of Auditors. Ratification of the appointment of Plante & Moran, PLLC as independent registered public accountants for the Bancorp for the year ending December 31, 2012; and |

| 3. | Other Business. Other matters as may properly come before the meeting or at any adjournment. |

You can vote at the meeting or any adjournment of the meeting if you are a shareholder of record at the close of business on February 24, 2012.

We urge you to read the enclosed proxy statement carefully so you will have information about the business to come before the meeting or any adjournment. At your earliest convenience, please sign, date, and return the accompanying proxy in the postage-paid envelope furnished for that purpose, or follow the related internet or telephone voting instructions. If you hold shares through a broker or other nominees, you should follow the procedures provided by your broker or nominee.

A copy of our Annual Report for the fiscal year ended December 31, 2011, is enclosed. The Annual Report is not a part of the proxy soliciting material enclosed with this letter.

| By Order of the Board of Directors | |

| Leane E. Cerven | |

| Senior Vice President, General Counsel and Secretary |

Munster, Indiana

March 26, 2012

It is important that you return your proxy promptly. Therefore, whether or not you plan to be present in person at the Annual Meeting, please sign, date and complete the enclosed proxy and return it in the enclosed envelope, which requires no postage if mailed in the United States, or follow the related internet or telephone voting instructions.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 27, 2012.

The Proxy Statement and Annual Report are available at:

www.proxyvote.com

| 2 |

NorthWest Indiana Bancorp

9204 Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

| Proxy Statement |

for

Annual Meeting of Shareholders

April 27, 2012

The Board of Directors of NorthWest Indiana Bancorp, an Indiana corporation, is soliciting proxies to be voted at the Annual Meeting of Shareholders to be held at 9:00 a.m., local time, on April 27, 2012, at the Corporate Center of Peoples Bank SB, 9204 Columbia Avenue, Munster, Indiana, and at any adjournment of the meeting. The Bancorp’s principal asset consists of 100% of the issued and outstanding shares of Common Stock of Peoples Bank SB. We expect to mail this proxy statement to our shareholders on or about March 26, 2012.

Items of Business

At the Annual Meeting, shareholders will:

| · | vote on the election of four directors to serve three-year terms expiring in 2015; |

| · | ratify the selection of Plante & Moran, PLLC as auditors for the Bancorp for 2012; and |

| · | transact any other matters of business that properly come before the meeting. |

We do not expect any other items of business because the deadline for shareholder nominations and proposals has already passed. If other matters do properly come before the meeting, the accompanying proxy gives discretionary authority to the persons named in the proxy to vote on any other matters brought before the meeting. Those persons intend to vote the proxies in accordance with their best judgment.

Voting Information

Who is entitled to vote?

Shareholders of record at the close of business on February 24, 2012, the record date, may vote at the Annual Meeting. On the record date, there were 2,837,562 shares of the Common Stock issued and outstanding, and the Bancorp had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting on all matters properly presented.

How many votes are required to elect directors?

The four nominees for director receiving the most votes will be elected. Abstentions and instructions to withhold authority to vote for a nominee will result in the nominee receiving fewer votes but will not count as votes against the nominee.

| 3 |

How many votes are required to ratify the selection of Plante & Moran, PLLC as independent registered public accountants for the Bancorp for 2012?

More votes cast in favor of this proposition than are cast against it are required to ratify Plante & Moran, PLLC as the Bancorp’s auditors for 2012. Abstentions and broker non-votes will have no effect on this proposal.

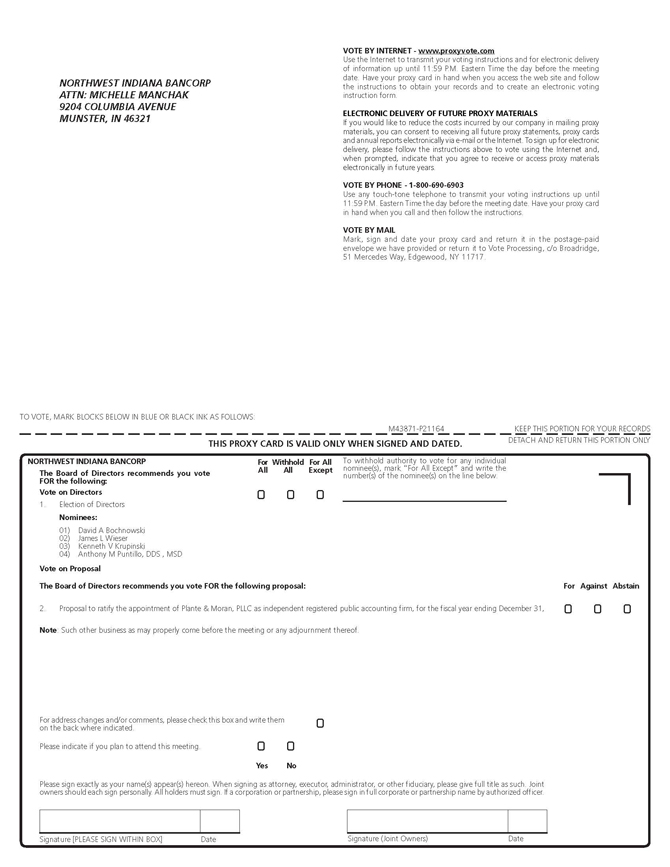

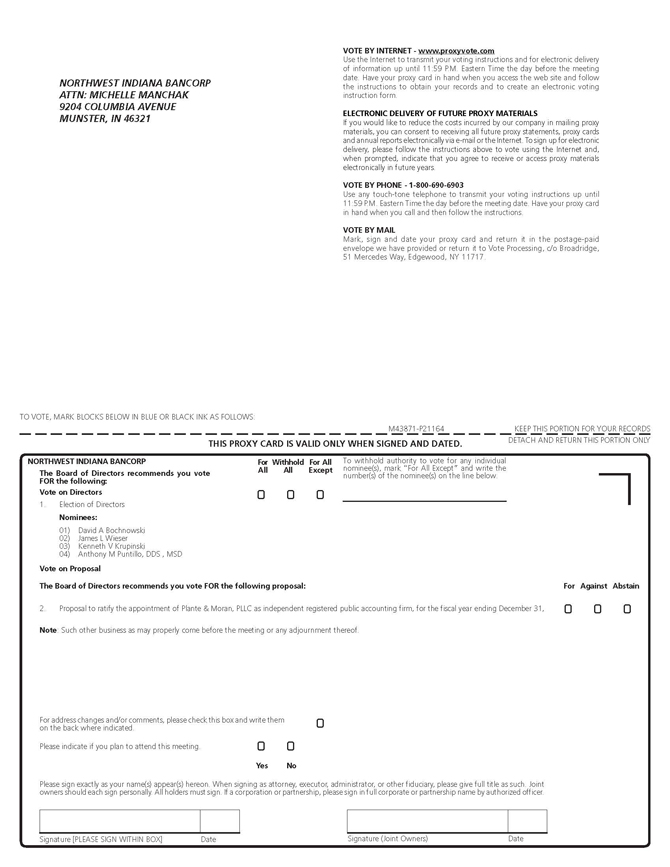

How do I vote my shares?

If you are a “shareholder of record,” you can vote by mailing the enclosed proxy card or by following the related internet or telephone voting instructions. The proxy, if properly signed and returned to the Bancorp and not revoked prior to its use, will be voted in accordance with the instructions contained in the proxy. If you return your signed proxy card but do not indicate your voting preferences, the proxies named in the proxy card will vote on your behalf “FOR” the four nominees for director listed below, and “FOR” the ratification of Plante & Moran, PLLC as auditors of the Bancorp for 2012.

If you have shares held by a broker or other nominee, you may instruct the broker or other nominee to vote your shares by following the instructions the broker or other nominee provides to you. If you do not submit specific voting instructions to your broker, the organization that holds your shares may generally vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not submit specific voting instructions to your broker, the shares will be treated as “broker non-votes.” The proposal to ratify Plante & Moran, PLLC as our auditors for 2012 is considered routine and therefore may be voted upon by your broker if you do not give instructions to your broker. However, brokers will not have discretion to vote your shares on the election of directors. Accordingly, if your shares are held in street name and you do not submit voting instructions to your broker, your shares will not be counted in determining the outcome of the election of the director nominees.

Proxies solicited by this proxy statement may be exercised only at the Annual Meeting and any adjournment and will not be used for any other meeting.

Can I change my vote after I have mailed my proxy card?

You have the right to revoke your proxy at any time before it is exercised by (1) notifying the Bancorp’s Secretary (Leane E. Cerven, 9204 Columbia Avenue, Munster, Indiana 46321) in writing, (2) delivering a later-dated proxy, or (3) voting in person at the Annual Meeting.

Can I vote my shares in person at the meeting?

If you are a shareholder of record, you may vote your shares in person at the meeting. However, we encourage you to vote by proxy card even if you plan to attend the meeting.

If your shares are held by a broker or other nominee, you must obtain a proxy from the broker or other nominee giving you the right to vote the shares at the meeting.

What constitutes a quorum?

The holders of over 50% of the outstanding shares of Common Stock as of the record date must be present in person or by proxy at the Annual Meeting to constitute a quorum. In determining whether a quorum is present, shareholders who abstain, cast broker non-votes, or withhold authority to vote on one or more director nominees will be deemed present at the Annual Meeting. Once a share is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting.

| 4 |

Security Ownership by Certain Beneficial Owners and Management

The following table sets forth, as of February 24, 2012, certain information as to those persons who were known by management to be beneficial owners of more than 5% of the Bancorp’s Common Stock and as to the shares of the Common Stock beneficially owned by the persons named in the “Summary Compensation Table” (referred to in this proxy statement as Named Executive Officers) and by all directors and executive officers as a group. Persons and groups owning more than 5% of the Common Stock are required to file certain reports regarding such ownership with the Bancorp and the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based on such reports, management knows of no persons, other than as set forth in the table below, who owned more than 5% of the Common Stock at February 24, 2012. Individual beneficial ownership of shares by the Bancorp’s directors is set forth in the table below under “Election of Directors.”

| Name and Address of Individual or Identity of Group | Amount and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding | ||||||

| David A. Bochnowski 10203 Cherrywood Lane Munster, IN 46321 | 353,658 | (1) | 12.4 | % | ||||

| Joel Gorelick 8589 West 85th Street Schererville, IN 46375 | 64,492 | (2) | 2.3 | % | ||||

| Robert T. Lowry 730 Clover Lane Crown Point, IN 46307 | 18,601 | (3) | * | |||||

| John Diederich 901 Seneca Drive Crown Point, IN 46307 | 3,700 | (4) | * | |||||

| Leane E. Cerven 8419 Baring Avenue Munster, IN 46321 | 4,900 | (5) | * | |||||

| Banc Fund VI L.P. Banc Fund VII L.P. Banc Fund VIII L.P. | 217,655 | (6) | 7.7 | % | ||||

| 20 North Wacker Drive, Suite 3300 Chicago, IL 60606 | ||||||||

| All current directors and executive officers as a group (14 persons) | 619,522 | (7) | 21.7 | % | ||||

| * | Under 1% of outstanding shares. |

| (1) | Includes 216,349 shares held jointly with Mr. Bochnowski’s spouse, 24,990 shares as to which Mr. Bochnowski’s spouse has voting and dispositive power and 26,400 shares which are owned by his children for which his spouse is custodian or trustee. Also includes stock options representing 7,225 shares of Common Stock which were exercisable at, or within 60 days after, the record date, 9,089 shares held as co-trustee of trusts for the benefit of Mr. Bochnowski’s children, 60,000 shares purchased by Mr. Bochnowski under the Profit Sharing Plan, and 9,605 shares purchased by Mr. Bochnowski under his Individual Retirement Account as to which Mr. Bochnowski has dispositive and voting power. |

| (2) | Includes 5,793 shares held by Mr. Gorelick’s spouse as Trustee of a trust for her benefit. Also includes 6,879 shares held by Mr. Gorelick as Trustee of a trust for his benefit and 34,649 shares held in his Individual Retirement Account. Also includes stock options representing 4,000 shares of Common Stock which were exercisable at, or within 60 days after, the record date, and 1,262 shares owned as custodian for his children. Also includes 11,909 shares purchased by Mr. Gorelick under the Profit Sharing Plan as to which Mr. Gorelick has dispositive and voting power. |

| (3) | Includes 2,788 shares held jointly with Mr. Lowry’s spouse, 1,975 shares held in his Individual Retirement Account, and 602 shares owned by Mr. Lowry’s spouse in an Individual Retirement Account. Also includes stock options representing 1,575 shares of Common Stock that were exercisable at, or within 60 days after, the record date, 150 shares of restricted stock over which Mr. Lowry has voting but not dispositive power and 11,445 shares purchased by Mr. Lowry under the Profit Sharing Plan as to which Mr. Lowry has dispositive and voting power. Excludes options for 250 shares that are not exercisable within 60 days of the record date. |

| 5 |

| (4) | Includes 1,700 shares owned jointly with Mr. Diederich’s spouse. Also includes 2,000 shares of restricted stock over which Mr. Diederich has voting but not dispositive power. |

| (5) | Includes 700 shares owned jointly with Ms. Cerven’s spouse, 300 shares of restricted stock over which Ms. Cerven has voting but not dispositive power, 3,500 shares owned by Ms. Cerven’s spouse in an Individual Retirement Account, and 400 shares owned by Ms. Cerven in an Individual Retirement Account. |

| (6) | Banc Fund VI L.P., Banc Fund VII L.P., and Banc Fund VIII L.P. are each an Illinois limited partnership. Charles J. Moore, who is the manager of these funds, has voting and dispositive power over these shares and controls these entities through The Banc Funds Company, L.L.C., an Illinois corporation, of which he is principal shareholder and which serves as general partner of MidBanc VI L.P., MidBanc VII L.P., and MidBanc VIII L.P., the general partners, respectively, of Banc Fund VI L.P., Banc Fund VII L.P., and Banc Fund VIII L.P. |

| (7) | Includes 16,800 shares as stock options which the Bancorp’s executive officers hold under the 1994 Option Plan and the 2004 Option Plan and which were exercisable at, or within 60 days after, the record date. Such shares have been added to the total shares outstanding in order to determine the ownership percentage of the Bancorp’s directors and executive officers as a group at the record date. Also includes 99,512 shares held under the Profit Sharing Plan and 2,450 shares of restricted stock granted under the 2004 Option Plan. Excludes options for 250 shares that are not exercisable within 60 days of the record date. |

Proposal 1 — Election of Directors

The Board of Directors currently consists of eleven members. The By-Laws provide that the Board of Directors is to be divided into three classes as nearly equal in number as possible. The members of each class are elected for a term of three years (unless a shorter period is specified) and until their successors are elected and qualified. One class of directors is elected annually.

The nominees for director this year are David A. Bochnowski, Kenneth V. Krupinski, Anthony M. Puntillo, D.D.S., M.S.D., and James L. Wieser, each of whom is a current director of the Bancorp. If the shareholders elect these nominees at the Annual Meeting, the terms of Messrs. Bochnowski, Krupinski, Puntillo and Wieser will expire in 2015. No director or nominee for director is related to any other director or executive officer of the Bancorp or nominee for director by blood, marriage, or adoption, except that Frank J. Bochnowski and David A. Bochnowski are cousins. There are no arrangements or understandings between any nominee and any other person pursuant to which the nominee was selected.

The following table provides information on the nominees for the position of director of the Bancorp and for each director continuing in office after the Annual Meeting, including the number and percent of shares of Common Stock beneficially owned as of the record date.

| 6 |

| Name | Age | Present Principal Occupation | Director Since | Shares

Beneficially Owned on February 24, 2012 | Percent of Class | |||||||||

| Nominees for Director | ||||||||||||||

| (Term expiring at annual meeting of shareholders in 2015) | ||||||||||||||

| David A. Bochnowski | 66 | Chairman and Chief Executive Officer of the Bancorp | 1977 | 353,658 | (1) | 12.4 | % | |||||||

| Kenneth V. Krupinski | 64 | Certified Public Accountant and Principal and President of Swartz Retson & Co., P.C., Merrillville, Indiana | 2003 | 7,249 | (2) | * | ||||||||

| Anthony M. Puntillo, D.D.S., M.S.D | 45 | Orthodontist, Chief Executive Officer of Puntillo Orthodontics, P.C. | 2004 | 3,378 | (3) | * | ||||||||

| James L. Wieser | 64 | Attorney with Wieser & Wyllie, LLP, Schererville, Indiana | 1999 | 7,911 | (4) | * | ||||||||

| Directors Continuing in Office | ||||||||||||||

| (Term expiring at annual meeting of shareholders in 2013) | ||||||||||||||

| Edward J. Furticella | 65 | Former Executive Vice President and CFO of the Bancorp. Currently Administrative Head, Department of Accounting, at Purdue University Calumet | 2000 | 66,502 | (5) | 2.3 | % | |||||||

| Amy W. Han, Ph.D | 48 | Executive Director, Northwest Indiana Medical Research Consortium and Asst. Professor of Psychiatry, Indiana University School of Medicine-Northwest | 2008 | 4,926 | (6) | * | ||||||||

| Stanley E. Mize | 70 | Retired; formerly President of Stan Mize Towne & Countree Auto Sales, Inc., Schererville, Indiana | 1997 | 46,309 | (7) | 1.6 | % | |||||||

| (Term expiring at annual meeting of shareholders in 2014) | ||||||||||||||

| Frank J. Bochnowski | 73 | Retired; formerly Executive Vice President and Secretary of the Bancorp | 1999 | 22,983 | (8) | * | ||||||||

| Lourdes M. Dennison | 70 | Realtor with McColly Real Estate; Executive Director Asian American Medical Association | 1983 | 13,011 | (9) | * | ||||||||

| Donald P. Fesko | 39 | Chief Executive Officer of Community Hospital in Munster, Indiana | 2005 | 1,902 | (10) | * | ||||||||

| Joel Gorelick | 64 | President and Chief Administrative Officer of the Bancorp | 2000 | 64,492 | (1) | 2.3 | % | |||||||

| * | Under 1% of outstanding shares. |

| (1) | For further information regarding the beneficial ownership of these shares, see “Security Ownership by Certain Beneficial Owners and Management” above. |

| (2) | Of these shares, 6,249 are held jointly with Mr. Krupinski’s spouse and 1,000 are held in a 401(k) plan for his benefit. |

| (3) | These shares are held in a trust for Dr. Puntillo’s benefit of which Dr. Puntillo serves as trustee. |

| (4) | These shares are held jointly with Mr. Wieser’s spouse. Mr. Wieser has pledged 7,200 of these shares to secure a bank loan made to him and his spouse. |

| (5) | Includes 36,512 shares held jointly with Mr. Furticella’s spouse and 664 shares held by his spouse in her Individual Retirement Account. Also includes stock options for 4,000 shares of Common Stock, which were exercisable at, or within 60 days after, the record date, 16,158 shares allocated to Mr. Furticella under the Profit Sharing Plan, and 9,168 shares held in Mr. Furticella’s Individual Retirement Account. |

| (6) | These shares are held jointly with Ms. Han’s spouse. |

| (7) | Includes 4,075 shares held by his spouse’s Individual Retirement Account, 15,532 shares owned jointly with his spouse, 3,656 shares held in his Individual Retirement Account, 1,822 shares held by Mr. Mize as custodian for his granddaughter, and 15,536 shares held in a trust for the benefit of Mr. Mize’s children, as to which Mr. Mize and his spouse serve as co-trustees, and 5,688 shares that Mr. Mize holds in his own name. |

| (8) | Includes 4,306 shares held by his spouse in her Individual Retirement Account, 3,326 shares held in her trust as Trustee and 5,313 shares held in his trust as Trustee. Also includes 10,038 shares held in his Individual Retirement Account. |

| (9) | Includes 4,130 shares owned by Ms. Dennison’s spouse in an Individual Retirement Account, and 8,088 shares held by Ms. Dennison in her Individual Retirement Account. Also includes 515 shares held in a trust for the benefit of Ms. Dennison’s grandson, and 278 shares that Ms. Dennison holds in her own name. |

| (10) | These shares are held jointly with Mr. Fesko’s spouse. |

Each of the Bancorp’s directors and director nominees has particular experience, qualifications, attributes and skills that qualify him or her to serve as a director of the Bancorp. These particular attributes are set forth below for each such director or director nominee.

| 7 |

(Term expiring at annual meeting of shareholders in 2015)

| · | David A. Bochnowski has been the Chief Executive Officer of the Bancorp for 31 years and has 35 years of banking experience. He has an in-depth knowledge of the Bancorp and its subsidiaries having managed the growth and operations of the companies through numerous business cycles. An attorney with experience in federal laws and regulations applicable to the industry, he has also been actively involved in national and state issues impacting the community banking industry. He maintains a high profile in business and not for profit community activities throughout Northwest Indiana. |

| · | Kenneth V. Krupinski is the President of an accounting firm and has been a CPA since 1973. He is also actively involved in the Bank’s community. Mr. Krupinski’s extensive accounting background enables him to provide value to the Board in his role as the Board’s audit committee financial expert, as a member of the Bancorp’s Risk Management Committee, Asset, Liability, Liquidity, Capital & Technology Management Committee, the Nominating and Corporate Governance Committee, and as Chairman of the Compensation & Benefits Committee. |

| · | Anthony M. Puntillo, D.D.S., M.S.D., as the founder and owner of Puntillo Orthodontics, PC, and a member of various orthodontics associations, has expertise in such areas. He is also active in the Bank’s communities. His experience and profile assist the Bancorp and the Bank with their business lending strategies and he serves as the Chairman of the Bank’s Wealth Management Committee and as a member of the Nominating and Corporate Governance Committee. |

| · | James L. Wieser is an attorney who concentrates in real estate development work and representation of small businesses. This experience assists the Bancorp and the Bank in their real estate lending and lending to small businesses. He has also served on several audit and risk management committees of not-for-profit organizations. This experience assists him in his service as Chairman of the Asset, Liability, Liquidity, Capital & Technology Management Committee. |

(Term expiring at annual meeting of shareholders in 2013)

| · | Edward J. Furticella served as Chief Financial Officer of the Bank from 1995 to 2004. Prior to that time, he served as Controller of the Bank. He has been a CPA since 1992. He currently serves as Administrative Head of the Accounting Department and Professor of Accounting at Purdue University Calumet Campus. This accounting background and experience enables him to provide valuable service to the Bancorp, including with respect to analyzing the Bancorp’s operating results, financial condition, and financial budgets, and as Chairman of the Risk Management Committee and as a member of the Asset, Liability, Liquidity, Capital & Technology Management Committee. |

| · | Amy W. Han, Ph.D., has a Ph.D. in psychology and has served as a human resources management consultant. She lends expertise to the Board in the human resources area. As Executive Director of the Northwest Indiana Medical Research Consortium, she brings leadership skills and the ability to help individuals achieve their goals to the Board of Directors. She is also very knowledgeable about the means and methods of providing good customer service to individuals in Northwest Indiana. This experience assists her in her role as a member of the Asset, Liability, Liquidity, Capital & Technology Management Committee, the Compensation and Benefits Committee, and the Nominating and Corporate Governance Committee. |

| · | Stanley E. Mize, as a prior owner of automobile dealerships and franchises, is familiar with financial accounting and budgets, which expertise is of value to the Bancorp, and assists him in his role as a member of the Bancorp’s Risk Management Committee, the Asset, Liability, Liquidity, Capital & Technology Management Committee, the Compensation and Benefits Committee, and the Nominating and Corporate Governance Committee. |

| 8 |

(Term expiring at annual meeting of shareholders in 2014)

| · | Frank J. Bochnowski, served as General Counsel, Corporate Secretary and head of the Bank’s Trust Department for over 17 years. His knowledge of the Bank’s operations and of laws and regulations applicable to the Bancorp and its subsidiaries assists the Board of Directors in its deliberations. This experience assists him in his role as Chairman of the Nominating and Corporate Governance Committee and as a member of the Asset, Liability, Liquidity, Capital & Technology Management Committee. |

| · | Lourdes M. Dennison is a realtor with broad knowledge of Lake County and Porter County in Indiana as well as the greater Chicago area in addition to her experience in real estate development. She is also familiar with the medical community having worked as a registered nurse and has managed a medical office. Her high profile in the community stems from service on numerous not for profit organizations including the Asian American Medical Association where she serves as Executive Director. This experience assists her in her role as a member of the Wealth Management Committee and the Nominating and Corporate Governance Committee. |

| · | Donald P. Fesko is the Chief Executive Officer of a local hospital and has significant health care expertise. He is also active in the Bank’s community. These attributes are of value to the Bancorp in offering Bank products and services to the health care industry and to other Bank customers. He also served on a compensation committee for the Community Healthcare System, bringing him expertise of value to his service on the Bancorp’s Compensation and Benefits Committee, the Wealth Management Committee, and the Nominating and Corporate Governance Committee. |

| · | Joel Gorelick is President and Chief Administrator of the Bancorp and has over 40 years of banking experience including retail and commercial banking. He has detailed knowledge of commercial lending facilities as well as the intricacies of daily banking operations. His expertise has been utilized as an instructor for educational seminars offered by the Indiana Bankers Association. He has a high profile within the community and is active in numerous community activities. |

Corporate Governance

Director Independence

All of the directors, except David A. Bochnowski, Joel Gorelick, Edward J. Furticella, and James L. Wieser, meet the standards for independence of Board members set forth in the Listing Standards for the NASDAQ Stock Exchange. Director Wieser is not considered to be independent because he is the brother-in-law of Jon E. DeGuilio who served as an Executive Officer of the Bancorp during the past three years. Director Furticella is not considered to be independent because he served as a consultant to the Bancorp and the Bank in 2009. Directors Bochnowski and Gorelick are not independent because they are employees of the Bancorp. Moreover, all members of the Bancorp’s Risk Management Committee (other than Director Furticella), the Compensation & Benefits Committee, and the Nominating and Corporate Governance Committee meet the independence standards applicable to those committees. The Board of Directors of the Bancorp considers the independence of each of the directors under the Listing Standards of the NASDAQ Stock Exchange, which for purposes of determining the independence of the Risk Management Committee members also incorporate the standards of the Securities and Exchange Commission (the “SEC”) included in Reg. § 240.10A-3(b)(1). Among other things, the Board considers current or previous employment relationships as well as material transactions or relationships between the Bancorp or its subsidiaries and the directors, members of their immediate family, or entities in which the directors have a significant interest. The purpose of this review is to determine whether any relationships or transactions exist or have occurred that are inconsistent with a determination that the director is independent.

| 9 |

David A. Bochnowski serves as Chairman and Chief Executive Officer of the Bancorp. The Bancorp has chosen to combine the principal executive officer and board chairman positions because this combined role promotes unified leadership and direction for the Board and for executive management and allows for a single, clear focus for the chain of command to execute the Bancorp’s business plans. Moreover, the Bancorp receives active and effective management and oversight of the Bancorp’s operations by the Board’s independent directors. The Bancorp’s Risk Management, Nominating and Corporate Governance, and Compensation & Benefits Committees are comprised of a majority of independent directors. Furthermore, the Board of Directors does not believe that the size of the Bancorp or the complexity of its operations warrants a separation of the Chairman and Chief Executive Officer functions. For these reasons, the Bancorp believes that it is appropriate for David A. Bochnowski to serve as Chairman and Chief Executive Officer, and has not felt it necessary to appoint a lead independent director.

Meetings of the Board of Directors

During the fiscal year ended December 31, 2011, the Board of Directors of the Bancorp met or acted by written consent 12 times. No director attended fewer than 75% of the aggregate total number of meetings during the last fiscal year of the Board of Directors of the Bancorp held while he served as director and of meetings of committees on which he served during that fiscal year.

Board Committees

The Board of Directors has appointed an Executive Committee, composed of Directors David Bochnowski (Chairman), Frank Bochnowski, Dennison, Mize and Wieser. The Executive Committee is authorized to exercise the powers of the Board of Directors between regular Board meetings, except with respect to the declaration of dividends and other extraordinary corporate transactions.

The Board of Directors has a Nominating and Corporate Governance Committee, which currently consists of Directors Frank Bochnowski (Chairman), Dennison, Fesko, Han, Krupinski, Mize, and Puntillo. The Board of Directors has adopted a written Charter of the Nominating and Corporate Governance Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. The primary functions of the Nominating and Corporate Governance Committee are to retain and terminate any search firm to be used to identify director candidates; to assess the need for new directors; to review and reassess the adequacy of the Bancorp’s Corporate Governance Guidelines and recommend any proposed changes to the Board for approval; to lead the Board in its annual review of the Board’s performance and report its findings to the Board; to recommend to the Board director nominees for each committee of the Bancorp; to review and reassess the adequacy of its written charter; and to annually review its own performance. The Nominating and Corporate Governance Committee identifies potential nominees for director based on specified objectives in terms of the composition of the Board, taking into account such factors as areas of expertise and geographic, occupational, gender, race and age diversity. The Nominating Committee assesses the effectiveness of its efforts to have a diverse Board of Directors by periodically reviewing the current Board members for geographic, occupational, gender, race and age diversity. Nominees will be evaluated on the basis of their experience, judgment, integrity, ability to make independent inquiries, understanding of the Bancorp and willingness to devote adequate time to Board duties. During the year ended December 31, 2011, the Nominating and Corporate Governance Committee held four meetings.

The Nominating and Corporate Governance Committee also will consider director candidates recommended by the Bancorp’s shareholders. A shareholder, who wishes to nominate an individual as a director candidate at next year’s annual meeting of shareholders, rather than recommend the individual to the Board as a potential nominee, must comply with the advance notice requirements described under “Shareholder Proposals.”

| 10 |

The Board of Directors has appointed a Risk Management Committee, formerly the Audit Committee, established in accordance with Section 3(a)(58)(A) of the Exchange Act, which is composed of Directors Furticella (Chairman), Mize and Krupinski. The Board of Directors has determined that Director Krupinski is an “audit committee financial expert,” as that term is defined in the Exchange Act.

The Risk Management Committee functions as the Bancorp’s liaison with its external auditors and reviews audit findings presented by the Bancorp’s internal auditor. The Risk Management Committee, along with the external auditors and internal auditor, monitors controls for material weaknesses and/or improvements in the audit function. The Risk Management Committee also monitors or, if necessary, establishes policies designed to promote full disclosure of the Bancorp’s financial condition. The Board of Directors has adopted a written Charter for the Risk Management Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. During the year ended December 31, 2011, the Risk Management Committee held five meetings.

The Board of Directors has appointed a Compensation & Benefits Committee composed of Directors Krupinski (Chairman), Mize, Fesko and Han. The Compensation & Benefits Committee is responsible for reviewing, determining, and establishing the compensation of directors and (as the Bank’s Compensation & Benefits Committee) the salaries, bonuses, and other compensation of the executive officers of the Bank. The Board of Directors has adopted a written charter for the Compensation & Benefits Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. During the year ended December 31, 2011, the Compensation & Benefits Committee held three meetings. For 2011, the Compensation & Benefits Committee considered surveys provided by the American Bankers Association (Compensation & Benefits Survey Report), Crowe Horwath LLP (Financial Institutions Compensation Survey), and SNL Financial (Executive Compensation Review for Banks and Thrifts), in determining the executive compensation and director compensation.

The Board of Directors has appointed an Asset, Liability, Liquidity, Capital & Technology Management Committee composed of Directors Wieser (Chairman), Frank Bochnowski, Furticella, Krupinski, Han and Mize. The Committee is responsible for monitoring activity, approving initiatives, reviewing reports, and recommending strategies relating to interest rate risk (IRR), liquidity management, investment portfolio activity, capital management, and technology investments.

The Board of Directors has appointed a Wealth Management Committee composed of Directors Puntillo (Chairman), Dennison, and Fesko. The primary function of the Wealth Management Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by monitoring the functioning of the Wealth Management Group. The Committee will also monitor the Wealth Management Group and see it is in compliance with all applicable laws, rules, regulations, and internal policies of the Bank.

Risk Oversight

The Board of Directors plays an active role in the oversight of credit risk, operational risk, liquidity risk, and similar risks of the business of the Bancorp. It performs this role primarily through its Committee structure. The Risk Management Committee of the Bancorp has oversight responsibilities with respect to financial information of the Bancorp, the systems of internal controls established by management and the Board, and risk management, accounting and financial reporting processes. Members of the Risk Management Committee have the opportunity to communicate as needed with the chief risk officer, internal auditor, compliance officer and loan review officer of the Bank as well as the Bancorp’s outside auditor and other directors of the Bancorp. The Committee also is authorized to retain independent counsel and accountants to the extent deemed necessary to assist with its risk oversight responsibilities. In addition, the Compensation & Employee Benefits Committee evaluates the compensation programs of the Bancorp to ensure that they do not create incentives among management employees to take undue risks. The Bank also has an Asset, Liability, Liquidity, Capital & Technology Management Committee which, among other things, monitors risks relating to liquidity, investments, and interest rate risk.

| 11 |

Communications with Directors

The Board of Directors of the Bancorp has implemented a process whereby shareholders may send communications to the Board’s attention. Any shareholder desiring to communicate with the Board, or one or more specific members thereof, should communicate in a writing addressed to the NorthWest Indiana Bancorp, Board of Directors, c/o Secretary, 9204 Columbia Avenue, Munster, Indiana 46321. The Secretary of the Bancorp has been instructed by the Board to promptly forward all such communications to the specified addressees thereof. All of the Bancorp’s directors at the time attended the Annual Meeting of Shareholders held on April 29, 2011.

Code of Ethics

The Bancorp has adopted a Code of Business Conduct and Ethics (the “Ethics Code”) that applies to all of the Bancorp’s directors, officers, and employees, including its principal executive officer, principal financial officer, principal accounting officer, and controller. The Ethics Code is posted on the Bancorp’s website at www.ibankpeoples.com. The Bancorp intends to disclose any waivers of the Ethics Code for directors or executive officers of the Bancorp and any amendments to the Ethics Code by posting such waivers and amendments on its website.

Executive Compensation

The following table presents information for compensation awarded to, earned by, or paid to the Named Executive Officers for 2010 and 2011.

Summary Compensation Table

| Name and Principal Position | Year | Salary

($)(1) | Stock Awards ($)(2) | Option Awards ($) | Non-Equity

Incentive Plan Compensation ($)(3) | All Other

Compensation ($)(4)(5) | Total

($) | |||||||||||||||||||

| David A. Bochnowski | 2011 | $ | 369,624 | $ | 0 | $ | 0 | $ | 0 | $ | 32,952 | $ | 402,576 | |||||||||||||

| Chairman and Chief Executive Officer | 2010 | 369,624 | 0 | 0 | 0 | 35,788 | 405,412 | |||||||||||||||||||

| Joel Gorelick | 2011 | $ | 230,745 | $ | 0 | $ | 0 | $ | 0 | $ | 9,534 | $ | 240,279 | |||||||||||||

| President and Chief Administrative Officer | 2010 | 222,878 | 0 | 0 | 0 | 10,771 | 233,649 | |||||||||||||||||||

| John Diederich | 2011 | $ | 164,832 | $ | 0 | $ | 0 | $ | 0 | $ | 7,738 | $ | 172,570 | |||||||||||||

| Executive Vice President | 2010 | 160,000 | 0 | 0 | 0 | 11,701 | 171,701 | |||||||||||||||||||

| Robert T. Lowry | 2011 | $ | 161,499 | $ | 0 | $ | 0 | $ | 0 | $ | 6,508 | $ | 168,007 | |||||||||||||

| Executive Vice President, Chief Financial Officer and Treasurer | 2010 | 150,057 | 0 | 0 | 0 | 6,583 | 156,640 | |||||||||||||||||||

| Leane E. Cerven (6) | 2011 | $ | 126,171 | $ | 0 | $ | 0 | $ | 0 | $ | 4,722 | $ | 130,893 | |||||||||||||

| Vice President, General Counsel, and Secretary | 2010 | 101,000 | 5,025 | 0 | 989 | 2,160 | 109,174 | |||||||||||||||||||

| (1) | Includes any amounts earned but deferred, including amounts deferred under the Bank’s 401(k) Plan. Executive officers of the Bancorp who serve as directors do not receive director fees. |

| (2) | The 2010 amount reflected in this column is the aggregate grant date fair value of stock options and stock awards calculated in accordance with FAS ASC Topic 718. Assumptions used in the calculation of this amount are included in footnote 12 to the Bancorp’s audited financial statements for the fiscal year ended December 31, 2011, included in the Bancorp’s Annual Report on Form 10-K for 2011. |

| (3) | This column includes the dollar value of all amounts earned during the fiscal year because specified performance criteria have been satisfied pursuant to the Bancorp’s cash incentive plan, whether or not paid to the Named Executive Officer. The Bank’s cash incentive plan is open to all employees who have been employed by September 30th of each plan year. The incentive plan is based upon the Bancorp’s return on assets, return on equity and earnings per share. |

| 12 |

| (4) | “All Other Compensation” includes contributions of the Bank made under its Profit Sharing Plan on behalf of Messrs. Bochnowski, Gorelick, Diederich, Lowry and Ms. Cerven of $9,800, $8,972, $6,441, $5,993 and $0 for 2010, and |

$9,800, $9,125, $6,538, $6,330, and $4,542 for 2011, respectively. Such amount also includes, for the personal benefit of the officers, premiums paid for Split Dollar Plan Life Insurance on their lives in the amounts of $609, $371, $0, $83, and $0 for 2010, and $676, $409, $0, $88 and $0 for 2011, respectively. Such amount also includes dividends paid on restricted stock awards to Messrs. Bochnowski, Gorelick, Diederich, Lowry, and Ms. Cerven in the amounts of $0, $0, $1,560, $507, and $108 for 2010, and $0, $0, $1,200, $90 and $180 for 2011, respectively. Mr. Bochnowski’s other compensation also includes (i) premiums of $17,930 for 2010 and $17,491 for 2011, paid by the Bank for disability insurance and term insurance on Mr. Bochnowski’s life pursuant to his employment agreement described below, and (ii) a credit in the amount of $5,080 for 2010, and $4,985 for 2011 under the Bank’s Unqualified Deferred Compensation Plan. Messrs. Bochnowski, Gorelick, Diederich, Lowry, and Cerven received certain perquisites during 2010 and 2011, but the incremental cost of providing those perquisites did not exceed $10,000.

| (5) | Although there was no change to their annual base salaries, Messrs. Bochnowski, Gorelick and Diederich received additional amounts in compensation as a result of a pay frequency change from semi-monthly to bi-weekly effective November 3, 2010. Such additional amounts are $2,369, $1,428 and $1,026, respectively. Ms. Cerven was not eligible for the Profit Sharing Plan in 2010; therefore, the Bank matched her 2010 wages at the same rate paid to eligible employees under the plan. Ms. Cerven received $2,052. |

| (6) | Ms. Cerven joined the Bancorp and the Bank on May 17, 2010. Her compensation in 2010 reflects an annual amount; however she was only employed for seven months in 2010. |

1994 Stock Option and Incentive Plan

Until its expiration in February 2004, the Bancorp had a 1994 Stock Option and Incentive Plan. Pursuant to the 1994 Option Plan, an aggregate of 240,000 shares of the Bancorp’s Common Stock were reserved for issuance in respect of incentive awards granted to officers and other employees of the Bancorp and the Bank. Awards granted under the 1994 Option Plan were in the form of incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or non-incentive stock options or restricted stock. As of February 24, 2012, there were options for 25,950 shares of the Bancorp’s Common Stock outstanding under the 1994 Option Plan at an average exercise price per share of $27.06. An aggregate of 4,600 restricted shares have been awarded under the 1994 Option Plan. No future awards will be made under the Plan.

The option price of each share of stock is to be paid in full at the time of exercise in cash, by delivering shares of the Bancorp common stock owned for at least six months with a market value of the exercise price, or by a combination of cash and such shares. In the event an option recipient terminates his or her employment or service as an employee or director, the options will terminate during specified periods. In the event of a change in control of the Bancorp all options not previously exercisable shall become fully exercisable. For this purpose, as well as for purposes of the 2004 Stock Option and Incentive Plan described below, change in control includes an acquisition by a third party of 25% or more of the Bancorp’s outstanding shares, a change in a majority of the Bancorp’s directors as a result of a tender offer, merger, sale of assets or similar transaction, or shareholder approval of a sale or disposition of all or substantially all of the Bancorp’s assets or another transaction following which the Bancorp would no longer be an independent publicly-owned entity; provided that such events will not be deemed a change in control if a majority of the Board of Directors of the Bancorp adopts a resolution to provide that such events will not be deemed a change in control.

| 13 |

2004 Stock Option and Incentive Plan

The Board of Directors adopted the Amended and Restated 2004 Stock Option and Incentive Plan, which was approved by shareholders at the 2004 annual meeting, and amended and restated at the 2005 annual meeting of shareholders. The 2004 Option Plan provides for the grant of any or all of the following types of awards: (1) stock options, including incentive stock options and non-qualified stock options; (2) stock appreciation rights; (3) restricted stock; (4) unrestricted stock; and (5) performance shares or performance units. Directors, employees and consultants of the Bancorp and its subsidiaries are eligible for awards under the Plan. Pursuant to the 2004 Option Plan, the maximum number of shares with respect to which awards may be made under the 2004 Option Plan is 250,000 shares. The shares with respect to which awards may be made under the 2004 Option Plan may either be authorized or unissued shares or treasury shares. As of February 24, 2012, 8,550 shares of restricted stock and 1,000 incentive stock options were outstanding under the 2004 Option Plan. Future awards for 240,540 shares may be made under the 2004 Option Plan.

The purpose of the 2004 Option Plan is to promote the long-term interests of the Bancorp and its shareholders by providing a means for attracting and retaining officers and employees of the Bancorp and its subsidiaries. The 2004 Option Plan is administered by the Compensation & Benefits Committee consisting of Directors Krupinski (Chairman), Fesko, Han, and Mize each of whom is a “non-employee director” as provided under Rule 16b-3 of the Exchange Act, and an “outside director” under Section 162(m) of the Code. Options are generally awarded for terms of five years, and at an option price per share equal to the fair market value of the shares on the date of grant of the stock options. Options generally become exercisable in full five years after the date of grant. Options granted are adjusted for capital changes such as stock splits and stock dividends. The Committee has full and complete authority and discretion, except as expressly limited by the Plan, to grant awards and to provide for their terms and conditions.

The option price of each share of stock is to be paid in full at the time of exercise in cash or by delivering shares of the Bancorp common stock owned for at least six months with a market value of the exercise price, or by a combination of cash and such shares. In the event an option recipient terminates his or her employment or service as an employee or director, the options will terminate during specified periods. In the event of a change in control of the Bancorp (as defined above), all options not previously exercisable shall become fully exercisable.

Awards of restricted shares are generally subject to transfer restrictions for five years and fully vest at the end of the five-year period. If the service of an option holder terminates involuntarily within eighteen months after a change in control of the Bancorp (as defined above), any restricted transfer period to which the restricted shares are then subject will terminate and the shares will fully vest.

Employees’ Savings and Profit Sharing Plan. The Bank maintains an Employees’ Savings and Profit Sharing Plan and Trust for all employees who meet the plan qualifications. The Profit Sharing Plan is a defined contribution plan and employees are eligible to participate in the Profit Sharing Plan on January 1st or July 1st next following the completion of one year of employment, the attainment of age 18, and completion of 1,000 hours of employment. The Plan is administered by a third party and employees direct their individual investments into any of several investment options including certificates of deposit at the Bank and the Bancorp’s shares purchased on the open market. Employees eligible for the Profit Sharing Plan may redirect their investments at any time.

Contributions to the Profit Sharing Plan are discretionary, made by the Bank and are non-contributory on the part of the employees. All contributions are also subject to review by the Compensation & Benefits Committee and approval by the Board of Directors. Profit sharing contributions made by the Bank and earnings credited to the employee’s account vest on the following schedule: two years of service, 40% of contributions and earnings; three years of service, 60% of contributions and earnings; four years of service, 80% of contributions and earnings; and five years of service, 100% of contributions and earnings. Participants also become 100% vested in the employer contributions and accrued earnings in their account upon their death, approved disability, or attainment of age 65 while employed at the Bank.

The Profit Sharing Plan is open to all eligible employees and the Bank contributes a percentage of each employee’s base salary. Consistent with the objectives of the executive compensation program, contributions to the plan may increase or decrease based upon the return on assets of the Bancorp. The Board of Directors has approved and the Compensation & Benefits Committee monitors the formula for plan contributions. For the fiscal year ending December 31, 2011, the plan contributed 4% of each eligible employee’s base salary as a result of the Bancorp’s 2011 performance. This compares to 4% for the fiscal year ended December 31, 2010.

| 14 |

The Employees’ Savings Plan feature allows employees to make pre-tax contributions to the Plan, subject to the limitations imposed by Section 401(k) of the Code. Participants electing pre-tax contributions are always 100% vested in their contributions and the earnings on their investments. Participants can also borrow from their pre-tax contributions pursuant to meeting the requirements of the Code, using their account as collateral.

Based upon the Bank’s return on assets for the respective years, $294,992 (including forfeitures of $11,240) was contributed to the Profit Sharing Plan for the year ended December 31, 2011, and $284,884 (including forfeitures of $6,581) was contributed to the Profit Sharing Plan for the year ended December 31, 2010. For 2011, Mr. Bochnowski’s Profit Sharing Plan account was credited with $9,800, compared to $9,800 for 2010; Mr. Gorelick’s Profit Sharing Plan account was credited with $9,125 and $8,972 for such years; Mr. Diederich’s account was credited with 6,538 and $6,441 for such years; Mr. Lowry’s account was credited with $6,330 and $5,993 for such years; and Ms. Cerven’s account was credited with $4,542 and $0 for such years. The contributions made on behalf of executive officers named in the Summary Compensation Table are included in that table under the column “All Other Compensation.”

Group Medical and Insurance Coverage

Group medical and insurance coverage is a customary and competitive employment practice in the community banking industry. The Bank provides a selection of group medical insurance benefits for all full-time employees with employees selecting the type of coverage. The Bank pays 70% for single employee coverage and 58% for employee plus dependent coverage. The Bank also provides two separate life insurance and accidental death and dismemberment insurance benefits. All full-time employees receive a life insurance and accidental death and dismemberment insurance benefit equal to one-half of their annual salary the 1st of the month following 30 days of employment and, once they have completed one year of employment, 1,000 hours of service, and reached their 18th birthday, another life insurance and accidental death and dismemberment insurance benefit is provided on the first of the year following the satisfaction of eligibility requirements that is equal to three times an employee’s salary to a maximum of $500,000.

Post-Retirement Health Benefits

The Bank also sponsors a defined benefit post retirement plan that provides comprehensive major medical benefits to all eligible retirees. Eligible retirees are those who have attained the age of 65, have completed at least 18 years of service and are covered under the group medical plan as of the date of their retirement. Currently, the Bank pays 28% of the retiree medical premium and retirees pay 100% of premiums for dependent coverage.

BOLI Insurance

The Bank has invested in Bank Owned Life Insurance (BOLI) that insures executive officers, senior vice-presidents, and vice-presidents. A feature of this type of insurance provides a split dollar benefit to each insured that is reviewed by the Compensation & Benefits Committee and approved by the Board. The personal benefit portion of premiums paid for executive officers is indicated in the Summary Compensation Table under the column “All Other Compensation.”

| 15 |

Unqualified Deferred Compensation Plan

The Bank adopted an Unqualified Deferred Compensation Plan in 1995 due to the Code’s limitation on the amount of contributions a corporation can make on behalf of an employee to a qualified retirement plan. The Deferred Compensation Plan is designed to provide deferred compensation to key senior management employees of the Bank in order to recognize their substantial contributions to building shareholder value and to provide them with additional financial security as inducement to remain with the Bank. The Compensation & Benefits Committee administers the plan. To be eligible an employee must hold a key management, full time position which significantly impacts the Bank’s operating success.

The Compensation & Benefits Committee selects which persons shall be participants and authorizes the crediting each year of an amount based upon a formula involving the participant’s employer funded contributions under all qualified retirement plans and the limitations imposed by Code subsection 401(a) (17) and Code section 415. In 2011, the maximum compensation level subject to qualified plan limitations was $245,000. The Deferred Compensation Plan provides that following the cessation of employment for any reason, the participant’s account is distributed to the participant or in the event of death, to the designated beneficiary in equal monthly installments over a five-year period unless the Bank’s Board of Directors approves an alternative form of payment at the request of the participant or beneficiary.

Currently, Mr. Bochnowski is the only participant in the Deferred Compensation Plan. For the year ended December 31, 2011, the Bank credited $4,985 to his Deferred Compensation Account, a match of 4% of his base compensation that exceeded the limitation of the Code. These amounts are included in Mr. Bochnowski’s compensation in the Summary Compensation Table under “All Other Compensation.”

Outstanding Equity Awards at December 31, 2011

The following table presents information on stock options and restricted stock held by the Named Executive Officers on December 31, 2011.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable (1) | Option Exercise Price ($) | Date of Full Vesting of Unexercisable Options | Option | Number of Shares of Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | Date of Full Vesting of Stock Awards | ||||||||||||||||||||||||

| David A. Bochnowski | 5,000 | — | $ | 22.15 | — | 2/4/2012 | — | — | — | |||||||||||||||||||||||

| David A. Bochnowski | 4,000 | — | $ | 25.25 | — | 2/19/2013 | — | — | — | |||||||||||||||||||||||

| David A. Bochnowski | 3,225 | — | $ | 30.00 | — | 1/21/2014 | — | — | — | |||||||||||||||||||||||

| Joel Gorelick | 3,000 | — | $ | 22.15 | — | 2/4/2012 | — | — | — | |||||||||||||||||||||||

| Joel Gorelick | 2,500 | — | $ | 25.25 | — | 2/19/2013 | — | — | — | |||||||||||||||||||||||

| Joel Gorelick | 1,500 | — | $ | 30.00 | — | 1/21/2014 | — | — | — | |||||||||||||||||||||||

| John Diederich | — | — | — | — | — | 2,000 | $ | 28,000 | 5/26/2014 | |||||||||||||||||||||||

| Robert T. Lowry | 675 | — | $ | 22.15 | — | 2/4/2012 | 150 | $ | 2,100 | 7/31/2014 | ||||||||||||||||||||||

| Robert T. Lowry | 1,150 | — | $ | 25.25 | — | 2/19/2013 | — | — | — | |||||||||||||||||||||||

| Robert T. Lowry | 425 | — | $ | 30.00 | — | 1//21/2014 | — | — | — | |||||||||||||||||||||||

| Robert T. Lowry | — | 250 | $ | 28.50 | 2/22/2013 | 2/22/2018 | — | — | — | |||||||||||||||||||||||

| Leane E. Cerven | — | — | — | — | — | 300 | $ | 4,200 | 5/20/2015 | |||||||||||||||||||||||

| (1) | The shares represented could not be acquired by the Named Executive Officers as of December 31, 2011. |

| (2) | The market value of these awards is determined by multiplying the number of shares by the closing market price of the Bancorp’s Common Stock on January 3, 2012, which was $14.00 per share. |

Potential Payments upon Termination or Change in Control

The Bancorp has entered into agreements and maintains plans that will require the payment of compensation to the Named Executive Officers in the event of their termination of employment, change in their responsibilities, or a change-in-control of the Bancorp. These agreements are discussed under the heading “Employment Agreements.”

| 16 |

In addition, the Named Executive Officers hold certain options at December 31, 2011, that become exercisable in full upon a change in control of the Bancorp. These options are set forth in the table under “Outstanding Equity Awards at December 31, 2011,” under the column entitled “Number of Securities Underlying Unexercised Options – Unexercisable.” Furthermore, if an employee is involuntarily terminated within 18 months following a change in control of the Bancorp, any remaining transfer restrictions with respect to stock awards he holds will lapse.

Employment Agreements

On December 29, 2008, the Bancorp and Bank entered into an employment agreement with David A. Bochnowski, their Chief Executive Officer, which superseded and replaced his existing employment agreement. The amendments made were designed to comply with the requirements and final regulations of Section 409A of the Code, which regulates agreements with elements of deferred compensation. The employment agreement has a three-year term and provides for daily extensions to maintain its three-year term unless the Bank or the employee gives written notice not to continue such extensions. The employment agreement provides for a base salary equal to the amount Mr. Bochnowski is currently being paid, subject to increases awarded by the Board of Directors and possible decreases based on operating results before a change of control of the Bank. The employee is also entitled to discretionary bonuses, customary fringe benefits and vacation leave. The Bank will continue to pay the premiums on life insurance policies insuring the employee providing for current benefits of approximately $1.6 million.

The employment agreement is terminable by the Bank for cause, defined as (i) the employee’s commission of an act materially and demonstrably detrimental to the Bank or its subsidiaries constituting gross negligence or willful misconduct of the employee in the performance of his material duties to the Bank or (ii) the employee’s conviction of a felony involving moral turpitude.

If the employment agreement terminates because of the employee’s death or disability, because he is discharged for cause, or because of the employee’s resignation without Good Reason (as defined below), the Bank is to pay the employee any amounts owed to him under the employment agreement through his date of termination. In addition, if the agreement terminates because of the employee’s death, within 30 days of employee’s death the Bank is to pay the employee’s estate or heirs a cash lump sum equal to his then-current annual base salary and the amount of his most recent annual bonus. In addition, if the employee’s employment terminates because of his disability, he will be entitled to a cash bonus equal to his most recent annual bonus, compensation until the earlier of his death or attainment of age 70 equal to 66% of his current base salary and annual bonus, and continuation of welfare benefits and senior executive perquisites that would have been provided to the employee had he remained employed during such period, reduced by any payments made to the employee under the Bank’s disability policies or programs.

If the employee is discharged without cause or resigns for Good Reason (defined as the failure to re-elect him as Chairman and Chief Executive Officer or as a director of the Board of Directors of the Bank, a substantial diminution in the employee’s responsibilities or duties, a material breach by the Bank of the agreement, or the Bank’s decision to terminate the daily extension of the agreement), in addition to the benefits described in the preceding paragraph, as applicable, the employee will be entitled to (1) a cash bonus equal to the most recent annual bonus received by the employee, (2) a lump sum amount equal to three times his then-current salary and recent annual bonus, (3) continuation for three years of welfare benefits and senior executive perquisites at least equal to those that would have been provided if he remained employed during that period, (4) a payment required to prefund future premiums on the life insurance policies described above likely to become due prior to the employee attaining age 66, and (5) outplacement services at the expense of the Bank.

| 17 |

The employment agreement provides that if the employee’s employment terminates for any reason after a change of control of the Bank, the employee shall receive the benefits as provided above, except that unless his benefits would thereby be reduced, the computations will be made by using the employee’s most recent annual bonus before the change of control and welfare benefits and senior executive benefits to be continued during the specified period will be provided based on those benefits in effect immediately prior to the change of control of the Bank. For this purpose, a change of control generally occurs upon the following events: (i) acquisition of ownership of stock of the Bank or the Bancorp constituting more than 50% of the total fair market value or total voting power of the stock; (ii) change in the effective control of the Bank or the Bancorp by acquisition of 30% or more of the total voting power of the stock or replacement of a majority of the members of the Bancorp’s Board of Directors in certain circumstances; or (iii) change in ownership of a substantial portion of the Bank’s assets.

If Section 280G of the Code (which generally applies to certain severance payments triggered by a change in control) would cause the payments to be made to the employee to be subject to an excise tax as imposed by Code Section 4999, the employee’s compensation will be “grossed up” to make him whole with respect to such taxes.

If Mr. Bochnowski’s employment had been terminated on December 31, 2011 following a change in control of the Bancorp, he would have been entitled to a lump sum cash payment of $1,633,941 and the continuation of welfare insurance benefits and perquisites at least equal to those which would have been provided if the executive’s employment had continued for three years, with an estimated value of $114,232. These amounts do not include the cost or value of outplacement services to be provided under the agreement.

During a period of one year following his termination of employment, the employee may not solicit or induce any employees or customers of the Bank to leave the Bank.

On December 29, 2008, the Bank entered into an amended and restated employment agreement with Joel Gorelick, its President and Chief Administrative Officer. The amendments made were designed to comply with the requirements and final regulations of Section 409A of the Code, which regulates agreements with elements of deferred compensation. The employment agreement has a three-year term and provides for annual extensions to maintain its three-year term, unless the Bank or the employee provides written notice not to continue such extensions. The employment agreement provides for a base salary equal to the amount Mr. Gorelick is currently being paid, subject to increases awarded by the Board of Directors and possible decreases based on operating results before a change of control of the Bank. The employee is also entitled to discretionary bonuses, customary fringe benefits and vacation leave.

Mr. Gorelick may terminate his employment upon 60 days written notice. He may also terminate his own employment for cause (as defined in the contract). Mr. Gorelick may be discharged for cause (as defined in the contract) at any time. If the Bank terminates Mr. Gorelick’s employment for other than cause or if Mr. Gorelick terminates his own employment for cause (as defined in the contract), he will receive his base compensation under the contract for the balance of the contract unless the termination occurs within one year following a change of control (as defined in the contract) of the Bancorp or the Bank. In addition, during such period, Mr. Gorelick will continue to participate in the group insurance plans and retirement plans, or will receive comparable benefits. If Mr. Gorelick’s employment is terminated because of his disability, he will receive his base compensation for an additional 12 months, reduced by any disability benefits to which he is entitled under the Bank’s disability policies or programs.

If Mr. Gorelick’s employment is terminated within one year following a change of control of the Bancorp or the Bank without cause or for cause by Mr. Gorelick, or as a result of his death or disability, Mr. Gorelick will receive an amount equal to three times his base compensation, payable in a lump sum, within 30 days after his termination of employment. In addition, during the three years following his termination of employment, Mr. Gorelick will continue to participate in the group insurance plans and retirement plans of the Bancorp and the Bank, or receive comparable benefits. Change of control is defined in Mr. Gorelick’s agreement in the same manner as in Mr. Bochnowski’s contract set forth above.

| 18 |

If the payments provided for in the contract, together with any other payments made to Mr. Gorelick, are deemed to be payments in violation of the “golden parachute” rules of the Code, such payments will be reduced to the largest amount, which would not cause the Bank to lose a tax deduction for such payments under those rules. As of December 31, 2011, Mr. Gorelick would be entitled to receive a lump sum cash payment of $692,235 plus the continuation of the group insurance coverage and continued participation in the Bank’s profit sharing plan over a three-year period, with an estimated value of $55,266 if the contract were terminated within one year after a change of control without cause, or for cause by Mr. Gorelick.

The employment agreement also protects confidential business information and protects the Bank from competition by Mr. Gorelick if he voluntarily terminates his employment without cause or is terminated for cause.

Compensation of Directors for 2011

The following table provides information concerning the compensation paid to or earned by the members of the Bancorp’s Board of Directors (except for Messrs. Bochnowski and Gorelick, who do not receive director’s fees) for 2011, whether or not deferred:

| Name (1) | Fees Earned or Paid in Cash ($) | Total ($) | ||||||

| James L. Wieser | $ | 24,195 | $ | 24,195 | ||||

| Kenneth V. Krupinski | $ | 24,195 | $ | 24,195 | ||||

| Anthony M. Puntillo, D.D.S., M.S.D | $ | 24,195 | $ | 24,195 | ||||

| Amy W. Han, Ph.D. | $ | 24,195 | $ | 24,195 | ||||

| Stanley E. Mize | $ | 24,195 | $ | 24,195 | ||||

| Frank J. Bochnowski | $ | 24,195 | $ | 24,195 | ||||

| Lourdes M. Dennison | $ | 24,195 | $ | 24,195 | ||||

| Donald P. Fesko | $ | 24,195 | $ | 24,195 | ||||

| Edward J. Furticella | $ | 24,195 | $ | 24,195 | ||||

| (1) | Information on Messrs. Bochnowski and Gorelick, who are also directors, is included in the Summary Compensation Table. |

Total fees paid to directors for the year ended December 31, 2011, were $217,755 in the aggregate. For 2012, annual director’s fees have remained the same as 2011.

Post 2004 Unfunded Deferred Compensation Plan for the Directors of Peoples Bank SB

Each director of the Bank may elect on or before December 31st of any year to defer all or a portion of his annual director fees for succeeding calendar years. The rate of interest to be paid on deferred fees will be equal to the lower of either (i) the Bank’s regular six-month certificate of deposit, plus 2%, or (ii) 120% of the applicable Federal long-term rate in effect during the month in which the Bank determined or reviews the appropriate interest rate for the Plan. The interest rate will be reset on the first business day of each month.

Amounts deferred under the plan, together with accumulated interest, are distributed in annual installments over a ten-year period beginning with the first day of the calendar year immediately following the year in which the director ceases to be a director, provided that the first annual benefit for any director deemed a “specified employee” under applicable tax regulations may not be paid any earlier than six months after the director terminates his services. Upon the death of a director, the balance of any unpaid deferred fees and interest will be paid in lump sum to the director’s designated beneficiary or estate.

The following directors are deferring fees under this plan: Stanley E. Mize, Kenneth V. Krupinski and Amy W. Han.

| 19 |

Transactions with Related Persons

The Bank follows a policy of offering to its directors, officers, and employees real estate mortgage loans secured by their principal residence as well as other loans. Current law authorizes the Bank to make loans or extensions of credit to its executive officers, directors, and principal shareholders on the same terms that are available with respect to loans made to persons who are not executive officers, directors, or principal shareholders of the Bank. At present, the Bank offers loans to its executive officers, directors, principal shareholders, and employees with an interest rate that is generally available to the public with substantially the same terms as those prevailing for comparable transactions. All loans to directors and executive officers must be approved in advance by a majority of the disinterested members of the Board of Directors. Loans to directors, executive officers, and their associates totaled approximately $7,005,840 or 11.13% of equity capital at December 31, 2011. All such loans were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank, and did not involve more than normal risk of collectability or present other unfavorable features.

Risk Management Committee Report

We have reviewed and discussed with management the Bancorp’s audited financial statements as of and for the year ended December 31, 2011. We have discussed with the Bancorp’s independent registered public accounting firm, Plante & Moran, PLLC, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Accounting Oversight Board in Rule 3200T. We have also received and reviewed the written disclosures and the letter from Plante & Moran, PLLC required by the applicable requirements of the Public Company Accounting Oversight Board for independent auditor communications with Audit Committees overseeing independence, and have discussed with the independent registered public accounting firm the auditors’ independence.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the financial statements referred to above be included in the Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2011.

We have also concluded that the provision by Plante & Moran, PLLC of non-audit related services to the Bancorp and the Bank during 2011 is compatible with maintaining the auditors’ independence.

This Report is respectfully submitted by the Risk Management Committee of the Bancorp’s Board of Directors.

Risk Management Committee Members

Edward J. Furticella (Chairman)

Kenneth V. Krupinski

Stanley E. Mize

Proposal

2 — Ratification of Appointment of Independent

Registered Public Accounting Firm

The Risk Management Committee has engaged Plante & Moran, PLLC, an independent registered public accounting firm, to be its auditors for the year ending December 31, 2012, subject to ratification by shareholders. As discussed below, Plante & Moran, PLLC was engaged to serve as auditors for the Bancorp for the first time in 2009.

| 20 |

Plante & Moran, PLLC audited the Bancorp’s financial statements for 2011. A representative of Plante & Moran, PLLC is expected to be present at the meeting, will have the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

The Board of Directors recommends a

vote FOR ratification of

the appointment of Plante & Moran, PLLC as auditors of the Bancorp for 2012.

Independent Registered Public Accounting Firm’s Services and Fees

The Bancorp incurred the following fees for services performed by Plante & Moran, PLLC in fiscal 2011 and 2010.

Audit Fees

Fees for professional services provided in connection with the audit of the Bancorp’s annual financial statements and review of financial statements included in the Bancorp’s Forms 10-Q were $126,700 for fiscal 2011 and $119,525 for fiscal 2010.

Audit Related Fees

There were audit-related services provided in 2011 of 5,985 and in 2010 of $7,253.

Tax Fees

No tax fees were paid to Plante & Moran, PLLC in fiscal 2011 and 2010.

All Other Fees

Fees for all other permissible services that do not fall within the above categories, including regulatory accounting and reporting compliance, were $0 for fiscal 2011 and $6,200 for fiscal 2010.

Pre Approval Policy

The Risk Management Committee’s policy is to pre approve all audit and permissible non-audit services provided by the independent auditor that exceed $2,500. These services may include audit services, audit related services, tax services and other services. Pre approval is generally provided for up to one year and any pre approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditor and management are required to periodically report to the Risk Management Committee regarding the extent of services provided by the independent auditor in accordance with this pre approval, and the fees for the services performed to date. The Risk Management Committee may also pre approve particular services on a case by case basis.

For fiscal 2011, pre approved non-audit services included only those services described above for “Audit-Related Fees,” “Tax Fees,” and “All Other Fees.”

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that the Bancorp’s officers and directors and persons who own more than 10% of the Bancorp’s Common Stock file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by SEC regulations to furnish the Bancorp with copies of all Section 16(a) forms that they file.

| 21 |

Based solely on its review of the copies of the forms it received and/or written representations from reporting persons, the Bancorp believes that during the fiscal year ended December 31, 2011, all filing requirements applicable to its officers, directors and greater than 10% beneficial owners with respect to Section 16(a) of the Exchange Act were satisfied in a timely manner.

Shareholder Proposals