2012 Annual Report

| David A. Bochnowski | |

| Chairman and | |

| Chief Executive Officer |

Dear Shareholder:

2012 will be remembered as a noteworthy year for banking as our economy recovers from the effects of the Great Recession. The outlook has brightened for Northwest Indiana as job losses stabilized with some jobs returning in the manufacturing sector, although not at the pace that would hasten the recovery. Other positive signs include an upswing in housing prices, the strengthening of exports, and consumer households shedding record high debt and returning to their lowest levels since 1993.

Across the nation and locally, community banks are emerging from the Great Recession with balance sheets that demonstrate historically high levels of capital as well as core deposits. Banks are poised to provide the fuel for household and small business growth, but policy uncertainty by our national government has hampered the emergence of a consistent upward trend of confidence in the economy.

Record Income

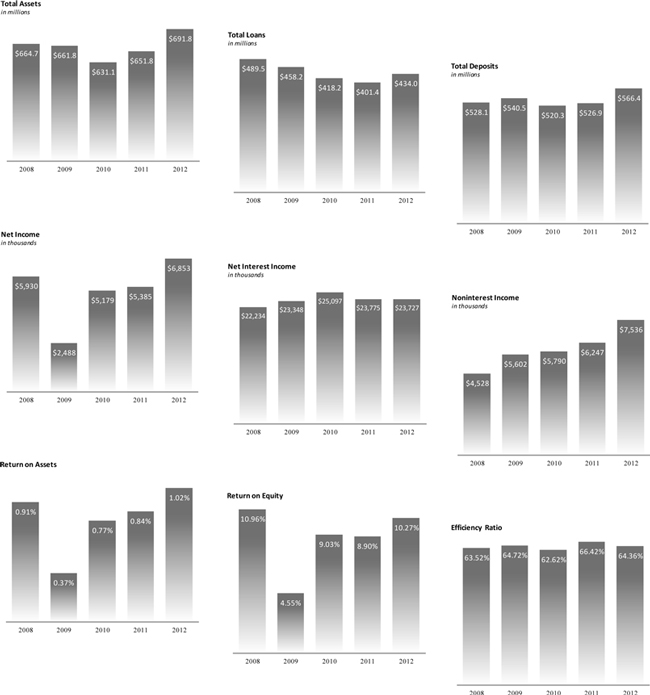

2012 proved to be our best year of performance ever for the Northwest Indiana Bancorp and Peoples Bank as our community banking effort provided record income of $6.9 million.

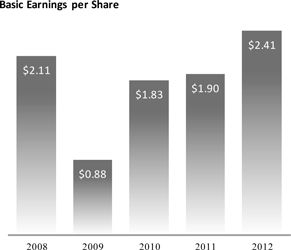

Our results reflect a 27.3% jump in earnings over last year and were driven by loan and core deposit growth, improved asset quality, increased income from banking operations, and stable operating expenses. At year end, our loan balances were up 8.9% over 2011, core deposits were up 12.8%, non-performing loans decreased 19.6%, income from banking operations increased 20.6%, and our operating costs rose only 1% as management carefully controlled expenses to meet the challenges of current economic conditions.

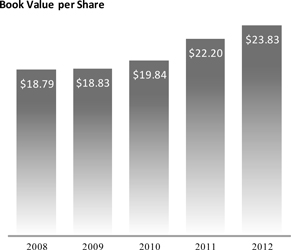

The Bancorp’s key ratios outperformed the industry as we reported an average return on assets (ROA) of 1.02% and a return on equity (ROE) of 10.27%. Our earnings per share increased 26.8% over the prior year and the book value per share of your stock rose to $23.83 at year end.

Strategic Focus

Banking in general, and especially community banks, face the retooling of traditional business models as the most comprehensive banking reforms in 70 years have brought forth new regulatory and compliance requirements. Stakeholders are demanding improved enterprise risk management practices designed to identify and limit risks that could threaten the stability of an individual bank, as well as, bring on systemic risks to the banking system.

The Great Recession and its lingering effects have changed banking in meaningful ways. From new regulations to shifts in our local market, a “new normal” has emerged for banking with an emphasis on higher levels of capital along with streamlined operations.

| 1 |

In the 21st century, community banks will need to shift organization structures so that we remain relevant and drive sustainable performance that differentiates community bankers from larger, impersonal banking companies.

Your Bank will maintain our commitment to serving the credit needs of our consumer and business customers. At the same time we will take advantage of technology to improve customer service by meeting the ever increasing demand of mobile savvy customers for 24/7 access to banking through such services as mobile payments, mobile wallets and remote deposit capture.

The Board of Directors has adopted a five year strategic plan that affirms our commitment to remaining an independent community bank. We plan to achieve a larger scale that will help the Bank absorb increased regulatory and operational costs and reinvest in growing our core business, while continuing to deliver an exceptional “You First Banking” customer experience.

Our franchise will be built on three pillars: asset growth, core funding growth, and income growth, including wealth management, with the pillars resting on a platform of a rigorous Enterprise Risk Management (ERM) program. ERM will support strategic direction rather than dictate strategy. Management will define opportunities for growth and ERM will serve to ensure that value from those opportunities is realized safely.

Leadership

Joel Gorelick, president and chief operating officer of Peoples Bank and the Bancorp since 2005, announced his decision to retire early last year and did so in January of 2013.

When Joel joined the Bank in 1983 as Vice President for Commercial Lending, we had a vision for a community bank that would serve the needs of consumers and small business with exceptional service and competitive products. We have succeeded due to the effort of the entire Peoples team and, in no small measure, to Joel’s leadership ability in understanding the needs of consumer and small business borrowers while providing insight into the Bank’s strategic direction. Throughout his career, Joel has also been recognized for his involvement and leadership in a wide range of community activities and causes.

Every day for the last three decades, Joel has come to work with energy, commitment, and passion for serving the Bank’s customers and community. Although he will no longer have day to day responsibilities at the Bank, and we will miss him, we are pleased that the Bancorp and Peoples Bank will continue to benefit from Joel’s expertise as a director and consultant in our effort to build a unique community bank serving the needs of our customers and community.

During the year, two valuable members of the Peoples team passed away. Marilyn Repp, our Vice-President and Senior Banking Center Manager, joined the Bank in 1981 as a teller. Jane Bridgman came on board in 2003 as a consumer loan processor and later became our Vice-President, Credit Administration Manager. Both of these outstanding women uniquely contributed to the Bank’s success with their highly-skilled performance and commitment to the customers they served. Their presence will be missed, but their legacy will endure in our You First Banking culture.

Shareholder Value

This year’s results demonstrate the ability of the Peoples team to stay on course and successfully engage traditional banking principles that deliver sustainable growth. We focused on growing earnings and capital, improving asset quality, and holding the line on operating expenses.

| 2 |

The market recognized the strength of our performance as the price of our stock increased 32.6% during the year, rising from $14.40 per share at the end of 2011 compared to $19.10 per share on December 31, 2012.

Our core income, or net interest income, held steady during the year despite steadily falling asset yields due to the Federal Reserve’s continuation of its policy decision to maintain a historically low interest rate environment. Net interest income for the year totaled $23.7 million compared to $23.8 million in 2011, a remarkable achievement driven by our low cost of funds, significant core deposit growth, and loan growth.

At year-end, core deposits, which include checking, savings, and money market accounts, totaled $394.7 million, an increase of $44.8 million or 12.8%. Core accounts represent 69.7% of total deposits, with additional growth as a high strategic priority. Loan growth also assisted in sustaining our net interest margin as the loan portfolio grew $35.6 million or 8.9% compared to the prior year.

The beginning of the economic recovery spurred on borrower demand across residential and small business customers. Attractive rates for home loans drove both new home purchases and the refinance of home loans while credit facilities for small business customers increased. Local governments also increased their borrowings in anticipation of revenue due from tax collections. Growing our relationships with small business customers and local government units continues to be a strategic priority.

Our strong earnings performance drove our capital ratios to new highs during the year. Tangible equity capital stood at $67.7 million, or 9.8% of total assets at the end of December 2012. Under all regulatory capital requirements, the Bancorp is considered well capitalized with our tier 1 capital at 9.4%, 14.6% for total capital to risk based assets, and 13.4% for tier 1 capital to risk-weighted assets.

The combination of our capital strength and consistent core earnings will position the Bank to act on growth opportunities to expand our operation to better serve our customers and community.

Improving asset quality in the aftermath of the Great Recession has been a focal point of management over the last several years and 2012 was no exception. At the end of 2012, non-performing loans totaled $11.5 million, a decrease of 19.6% over the prior year. Our ratio of non-performing assets to total assets declined to 1.84% at the end of 2012, compared to 2.68% a year earlier. Management anticipates further declines in non-performing loans during 2013 as the disposition of loan workouts initiated during 2012 are completed.

As the “new normal” dawns on banking, operating expenses will be closely scrutinized for greater efficiency. Doing more with less is the new normal and our 2012 operating costs provide a guidepost for the future. During the last year, operating expenses rose only 1% as management took action to reduce occupancy, equipment, data processing, and marketing costs consistent with the new reality of banking.

| 3 |

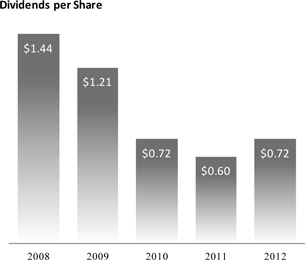

Your Board of Directors was pleased to respond to our positive earnings track during the year by raising our dividend 26.7% from $.15 per share to $.19 per share. The Board will continue to review our dividend policy each year and, among other factors, will take into consideration in its decision matrix the Bancorp’s income, capital needs, and a dividend payout ratio range of 30% to 40% of earnings.

Customer Value

Remaining relevant and providing up to date products and services for our customers will be critical to the long-term growth of community banks. Fortunately, and unlike some other banks who have made headlines, we do not have to repair our public image as a result of issues related to poor performance or reliance on government assistance programs viewed as “bailouts.” Our customer surveys and unsolicited social media comments confirm the success of our “You First Banking” philosophy that provides value and an unparalleled banking experience to our customers. The public continues to put their trust in community banks and, specifically, Peoples Bank.

Your company has weathered the negative perception of banking and emerged even stronger as evidenced by increased customer utilization of our products and services during the year. Not only did we experience record earnings but also our assets grew to $691.8 million resulting from our core account and loan growth. Our 6.2% asset growth rate during the year reflects our consistent effort to garner a higher wallet share from our existing customers and to attract new customers to our brand.

We launched a “Brand Refresh” during the year to carry the philosophy of You First Banking to a broader audience with a new, contemporary look and messaging, emphasizing our commitment to build relationships with our customers and provide appropriate channels for the delivery of our products and services. A prime example of this commitment is the work that began in the fall of 2012 to transform the Bank’s website into an eBranch, enabling us to bring Peoples Bank to our customers and engage them whether they are on their phone, their laptop, or on their home computer.

We are committed to keeping pace with increasing customer preferences for technology-based banking. Our surveys of the Bank’s younger demographic customers substantiated these preferences, and we have also noted that baby boomer customers mirror some of the same expectations. As a result, work also began on plans to deliver mobile banking upgrades like check deposit, business mobile banking, and an iPad application.

Working with our small business customers to build relationships through an understanding of their unique individual needs is the central focus of our You First Banking approach to commercial banking. Our business bankers work to define a pathway for the success of their business customers. We are proud to note that Peoples Bank was awarded the 2012 Lender of the Year award by the Regional Development Company.

| 4 |

Community Value

As a community banking organization, we are committed to serving the needs of our community through financial support and through volunteering in numerous community and faith based organizations. We recognize that a community gathers strength from the well being of its neighborhoods and that neighborhoods gather strength from community organizations.

During the year, our team served side by side with our friends and neighbors to pool our talent and sustain and improve the quality of life in our community. We maintained our commitment to the “Bank On” initiative with the Lake Area United Way to provide banking services to the unbanked and underbanked of our community. And, we continued our financial literacy effort by teaming with the Boys and Girls Clubs of Lake County to teach financial awareness to the youth of our community. Our Community Reinvestment team continued their outreach to forge new relationships and create innovative ways to revitalize neighborhoods.

The Bank’s Community First Committee (CFC), run entirely by employees, again this year set a new record for fund raising among our employees despite the challenges of the economy. Our CFC provided financial support for numerous organizations including the Boys and Girls Clubs of Lake and Porter counties, Haven House, Neighborhoods Inc., Opportunity Enterprises, Legacy Foundation, and the Food Bank of Northwest Indiana. Community First also joined with the Bank in supporting the Boys and Girls Club Tolleston capital campaign. In addition, Peoples Bank provided financial assistance to over 150 community organizations during the year.

Banking on Our Future

Like many of our shareholders and customers, the Bank was buffeted by the ill winds of the Great Recession, but we are wiser and stronger for the experience. However, unlike many banks, we were able to continue to pay a dividend throughout the stress of the last several years. We are grateful for the support of our shareholders and for your commitment to the Northwest Indiana Bancorp.

As the economy recovers, the Bancorp and our operating subsidiary, Peoples Bank, are well positioned to meet the challenges of our industry, just as we have been able to overcome the challenges of the recent past. Your Board of Directors and the entire Peoples team are cautiously optimistic about the future and bullish on the prospect of doing business in Northwest Indiana.

| Sincerely, | |

| |

| David A. Bochnowski | |

| Chairman and Chief Executive Officer |

| 5 |

Financial Highlights

| 6 |

Selected Consolidated Financial Data

in thousands of dollars, except per share data

| Fiscal Year Ended | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Statement of Income: | ||||||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 26,075 | $ | 26,986 | $ | 30,086 | $ | 32,189 | $ | 35,167 | $ | 35,768 | $ | 34,979 | $ | 30,024 | $ | 26,614 | $ | 26,357 | ||||||||||||||||||||

| Total interest expense | 2,348 | 3,231 | 4,989 | 8,841 | 12,933 | 17,882 | 15,737 | 9,758 | 6,858 | 7,521 | ||||||||||||||||||||||||||||||

| Net interest income | 23,727 | 23,755 | 25,097 | 23,348 | 22,234 | 17,886 | 19,242 | 20,266 | 19,756 | 18,836 | ||||||||||||||||||||||||||||||

| Provision for loan losses | 2,350 | 3,510 | 5,570 | 8,540 | 2,388 | 552 | 15 | 245 | 385 | 420 | ||||||||||||||||||||||||||||||

| Net interest income after | ||||||||||||||||||||||||||||||||||||||||

| provision for loan losses | 21,377 | 20,245 | 19,527 | 14,808 | 19,846 | 17,334 | 19,227 | 20,021 | 19,371 | 18,416 | ||||||||||||||||||||||||||||||

| Noninterest income | 7,536 | 6,247 | 5,790 | 5,602 | 4,528 | 4,431 | 4,219 | 3,540 | 3,312 | 2,968 | ||||||||||||||||||||||||||||||

| Noninterest expense | 20,119 | 19,928 | 19,341 | 18,735 | 16,999 | 14,525 | 14,296 | 13,771 | 13,174 | 12,037 | ||||||||||||||||||||||||||||||

| Net noninterest expense | 12,583 | 13,681 | 13,551 | 13,133 | 12,471 | 10,094 | 10,077 | 10,231 | 9,862 | 9,069 | ||||||||||||||||||||||||||||||

| Income tax expenses/(benefit) | 1,941 | 1,179 | 797 | (813 | ) | 1,445 | 1,651 | 2,674 | 3,118 | 3,219 | 3,411 | |||||||||||||||||||||||||||||

| Cumulative effect of changes in accounting | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

| Net income | $ | 6,853 | $ | 5,385 | $ | 5,179 | $ | 2,488 | $ | 5,930 | $ | 5,589 | $ | 6,475 | $ | 6,672 | $ | 6,290 | $ | 5,936 | ||||||||||||||||||||

| Basic earnings per common share | $ | 2.41 | $ | 1.90 | $ | 1.83 | $ | 0.88 | $ | 2.11 | $ | 1.99 | $ | 2.32 | $ | 2.40 | $ | 2.28 | $ | 2.16 | ||||||||||||||||||||

| Diluted earnings per common share | $ | 2.41 | $ | 1.90 | $ | 1.83 | $ | 0.88 | $ | 2.10 | $ | 1.98 | $ | 2.30 | $ | 2.37 | $ | 2.24 | $ | 2.13 | ||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.72 | $ | 0.60 | $ | 0.72 | $ | 1.21 | $ | 1.44 | $ | 1.44 | $ | 1.40 | $ | 1.32 | $ | 1.24 | $ | 1.20 | ||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Balance Sheet: | ||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 691,845 | $ | 651,758 | $ | 631,053 | $ | 661,017 | $ | 664,732 | $ | 628,718 | $ | 617,518 | $ | 627,439 | $ | 557,393 | $ | 508,775 | ||||||||||||||||||||

| Loans receivable | 436,981 | 401,401 | 418,233 | 458,245 | 489,509 | 468,459 | 471,716 | 469,043 | 433,790 | 409,808 | ||||||||||||||||||||||||||||||

| Investment securities | 187,475 | 186,962 | 160,452 | 144,333 | 126,722 | 114,644 | 99,012 | 79,979 | 79,979 | 63,733 | ||||||||||||||||||||||||||||||

| Deposits | 566,409 | 526,881 | 520,271 | 540,527 | 528,148 | 512,931 | 512,931 | 525,731 | 451,573 | 421,640 | ||||||||||||||||||||||||||||||

| Borrowed funds | 49,505 | 52,013 | 48,618 | 63,022 | 74,795 | 76,930 | 51,501 | 51,152 | 57,201 | 40,895 | ||||||||||||||||||||||||||||||

| Total stockholders' equity | 67,651 | 62,960 | 56,089 | 53,078 | 52,773 | 52,733 | 49,902 | 46,433 | 44,097 | 41,554 | ||||||||||||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Interest Rate Spread During Period: | ||||||||||||||||||||||||||||||||||||||||

| Average effective yield on loans and investment securities | 4.14 | % | 4.50 | % | 4.84 | % | 5.16 | % | 5.78 | % | 6.21 | % | 6.02 | % | 5.49 | % | 5.31 | % | 5.65 | % | ||||||||||||||||||||

| Average effective cost of deposits and borrowings | 0.39 | % | 0.56 | % | 0.82 | % | 1.45 | % | 2.19 | % | 3.18 | % | 2.77 | % | 1.82 | % | 1.40 | % | 1.67 | % | ||||||||||||||||||||

| Interest rate spread | 3.75 | % | 3.94 | % | 4.02 | % | 3.71 | % | 3.59 | % | 3.03 | % | 3.25 | % | 3.67 | % | 3.91 | % | 3.98 | % | ||||||||||||||||||||

| Net interest margin | 3.77 | % | 3.96 | % | 4.04 | % | 3.74 | % | 3.65 | % | 3.10 | % | 3.31 | % | 3.71 | % | 3.94 | % | 4.04 | % | ||||||||||||||||||||

| Return on average assets | 1.02 | % | 0.84 | % | 0.77 | % | 0.37 | % | 0.91 | % | 0.91 | % | 1.04 | % | 1.14 | % | 1.17 | % | 1.20 | % | ||||||||||||||||||||

| Return on average equity | 10.27 | % | 8.90 | % | 9.03 | % | 4.55 | % | 10.96 | % | 10.78 | % | 13.42 | % | 14.67 | % | 14.64 | % | 14.65 | % | ||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 14.6 | % | 14.3 | % | 12.9 | % | 11.5 | % | 12.0 | % | 12.0 | % | 11.1 | % | 10.7 | % | 11.2 | % | 11.5 | % | ||||||||||||||||||||

| Total capital to risk-weighted assets | 13.4 | % | 13.1 | % | 11.7 | % | 10.3 | % | 10.8 | % | 11.0 | % | 12.1 | % | 11.6 | % | 12.2 | % | 12.5 | % | ||||||||||||||||||||

| Tier 1 capital leverage ratio | 9.4 | % | 9.2 | % | 8.5 | % | 7.8 | % | 8.2 | % | 8.3 | % | 8.0 | % | 7.9 | % | 8.0 | % | 8.0 | % | ||||||||||||||||||||

| Allowance for loan losses to total loans | 1.93 | % | 1.99 | % | 2.18 | % | 1.33 | % | 1.19 | % | 0.98 | % | 0.90 | % | 0.89 | % | 0.90 | % | 0.92 | % | ||||||||||||||||||||

| Allowance for loan losses to non-performing loans | 73.34 | % | 56.03 | % | 37.82 | % | 32.93 | % | 46.97 | % | 53.16 | % | 153.95 | % | 198.00 | % | 371.00 | % | 220.31 | % | ||||||||||||||||||||

| Non-performing loans to total loans | 2.63 | % | 3.56 | % | 5.77 | % | 4.05 | % | 2.54 | % | 1.02 | % | 0.58 | % | 0.45 | % | 0.24 | % | 0.42 | % | ||||||||||||||||||||

| Total loan accounts | 4,416 | 4,567 | 4,594 | 4,846 | 5,193 | 5,268 | 5,422 | 5,370 | 5,213 | 5,049 | ||||||||||||||||||||||||||||||

| Total deposit accounts | 27,790 | 28,303 | 28,912 | 32,616 | 33,692 | 30,760 | 33,963 | 32,866 | 32,502 | 31,385 | ||||||||||||||||||||||||||||||

| 7 |

Business

NorthWest Indiana Bancorp (the Bancorp) is a bank holding company registered with the Board of Governors of the Federal Reserve System. Peoples Bank (the Bank), an Indiana bank, is a wholly owned subsidiary of the Bancorp. The Bancorp has no other business activity other than being the holding company for the Bank.

The Bancorp conducts business from its Corporate Center in Munster and its twelve full-service offices located in Crown Point, Dyer, East Chicago, Gary, Hammond, Hobart, Merrillville, Munster, St. John, Schererville, and Valparaiso, Indiana. The Bancorp is primarily engaged in the business of attracting deposits from the general public and the origination of loans secured by single family residences and commercial real estate, as well as, construction loans, various types of consumer loans and commercial business loans, and loans to local municipalities. In addition, the Bancorp's Wealth Management Group provides estate and retirement planning, guardianships, land trusts, profit sharing and 401(k) retirement plans, IRA and Keogh accounts, and investment agency accounts. The Wealth Management Group may also serve as the personal representative of estates and act as trustee for revocable and irrevocable trusts.

The Bancorp's common stock is traded in the over-the-counter market and is quoted on the OTC Bulletin Board. On January 31, 2013, the Bancorp had 2,837,396 shares of common stock outstanding and 405 stockholders of record. This does not reflect the number of persons or entities who may hold their stock in nominee or "street" name through brokerage firms.

| 8 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

General

The Bancorp's earnings are dependent upon the earnings of the Bank. The Bank's earnings are primarily dependent upon net interest margin. The net interest margin is the difference between interest income earned on loans and investments and interest expense paid on deposits and borrowings stated as a percentage of average interest earning assets. The net interest margin is perhaps the clearest indicator of a financial institution's ability to generate core earnings. Fees and service charges, wealth management operations income, gains and losses from the sale of assets, provisions for loan losses, income taxes and operating expenses also affect the Bancorp's profitability.

A summary of the Bancorp’s significant accounting policies is detailed in Note 1 to the Bancorp’s consolidated financial statements included in this report. The preparation of our financial statements requires management to make estimates and assumptions that affect our financial condition and operating results. Actual results could differ from those estimates. Estimates associated with the allowance for loan losses, fair values of foreclosed real estate, financial instruments and status of contingencies are particularly susceptible to material change in the near term as further information becomes available and future events occur.

At December 31, 2012, the Bancorp had total assets of $691.8 million and total deposits of $566.4 million. The Bancorp's deposit accounts are insured up to applicable limits by the Deposit Insurance Fund (DIF) that is administered by the Federal Deposit Insurance Corporation (FDIC), an agency of the federal government. At December 31, 2012, stockholders' equity totaled $67.7 million, with book value per share at $23.83. Net income for 2012 was $6.9 million, or $2.41 basic and diluted earnings per common share. The return on average assets was 1.02%, while the return on average stockholders’ equity was 10.27%.

Recent Developments

The Current Economic Environment. We continue to operate in a challenging and uncertain economic environment, including generally uncertain national conditions and local conditions in our markets. Overall economic growth continues to be slow and national and regional unemployment rates remain at elevated levels. The risks associated with our business remain acute in periods of slow economic growth and high unemployment. Moreover, many financial institutions continue to be affected by an uncertain real estate market. While we are continuing to take steps to decrease and limit our exposure to problem loans, we nonetheless retain direct exposure to the residential and commercial real estate markets, and we are affected by these events.

Our loan portfolio includes residential mortgage loans, construction loans, and commercial real estate loans. Declines in real estate values, home sales volumes and financial stress on borrowers as a result of the uncertain economic environment, including job losses, could have an adverse effect on our borrowers or their customers, which could adversely affect our financial condition and results of operations. In addition, the current level of low economic growth on a national scale, the occurrence of another national recession, or a deterioration in local economic conditions in our markets could drive loan losses beyond that which are provided for in our allowance for loan losses and result in the following other consequences: increases in loan delinquencies; problem assets and foreclosures may increase; demand for our products and services may decline; deposits may decrease, which would adversely impact our liquidity position; and collateral for our loans, especially real estate, may decline in value, in turn reducing customers’ borrowing power, and reducing the value of assets and collateral associated with our existing loans.

Impact of Legislation. Over the last four-and-a-half years, Congress and the U.S. Department of the Treasury have enacted legislation and taken actions to address the disruptions in the financial system, declines in the housing market, and the overall regulation of financial institutions and the financial system. In this regard, the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), includes provisions affecting large and small financial institutions alike, including several provisions that profoundly affect the regulation of community banks, thrifts, and small bank and thrift holding companies, such as the Bancorp. Among other things, the Dodd-Frank Act abolished the Office of Thrift Supervision effective July 21, 2011 and transferred its functions to the Office of the Comptroller of the Currency (“OCC”), FDIC, and Federal Reserve. The Dodd-Frank Act also relaxes rules regarding interstate branching, allows financial institutions to pay interest on business checking accounts, changes the scope of federal deposit insurance coverage, imposes new capital requirements on bank and thrift holding companies, and imposes limits on debit card interchange fees charged by issuer banks (commonly known as the Durbin Amendment).

| 9 |

The Dodd-Frank Act also established the Consumer Financial Protection Bureau (the “CFPB”) within the Federal Reserve, which has broad authority to regulate consumer financial products and services and entities offering such products and services, including banks. Many of the consumer financial protection functions formerly assigned to the federal banking and other designated agencies are now performed by the CFPB. The CFPB has a large budget and staff, and has broad rulemaking authority over providers of credit, savings, and payment services and products. In this regard, the CFPB has the authority to implement regulations under federal consumer protection laws and enforce those laws against, and examine, financial institutions. State officials also will be authorized to enforce consumer protection rules issued by the CFPB. This bureau also is authorized to collect fines and provide consumer restitution in the event of violations, engage in consumer financial education, track consumer complaints, request data, and promote the availability of financial services to underserved consumers and communities. The CFPB also is directed to prevent “unfair, deceptive or abusive practices” and ensure that all consumers have access to markets for consumer financial products and services, and that such markets are fair, transparent, and competitive. Although the CFPB has begun to implement its regulatory, supervisory, examination, and enforcement authority, there continues to be significant uncertainty as to how the agency’s strategies and priorities will impact the Bancorp.

The CFPB has indicated that mortgage lending is an area of supervisory focus and that it will concentrate its examination and rulemaking efforts on the variety of mortgage-related topics required under the Dodd-Frank Act, including steering consumers to less-favorable products, discrimination, abusive or unfair lending practices, predatory lending, origination disclosures, minimum mortgage underwriting standards, mortgage loan originator compensation, and servicing practices. The CFPB recently published several final regulations impacting the mortgage industry, including rules related to ability-to-pay, mortgage servicing, and mortgage loan originator compensation. The ability-to-repay rule makes lenders liable if they fail to assess ability to repay under a prescribed test, but also creates a safe harbor for so called “qualified mortgages.” The “qualified mortgages” standards include a tiered cap structure that places limits on the total amount of certain fees that can be charged on a loan, a 43% cap on debt-to-income (i.e., total monthly payments on debt to monthly gross income), exclusion of interest-only products, and other requirements. The 43% debt-to-income cap does not apply for the first seven years the rule is in effect for loans that are eligible for sale to Fannie Mae or Freddie Mac or eligible for government guarantee through the FHA or the Veterans Administration. Failure to comply with the ability-to-repay rule may result in possible CFPB enforcement action and special statutory damages plus actual, class action, and attorneys fees damages, all of which a borrower may claim in defense of a foreclosure action at any time. The Bancorp’s management is currently assessing the impact of these requirements on our mortgage lending business.

In addition, the Federal Reserve and other federal bank regulatory agencies have issued a proposed rule under the Dodd-Frank Act that would exempt “qualified residential mortgages” from the securitization risk retention requirements of the Dodd-Frank Act. Although the Bancorp is primarily a portfolio lender, the final definition of what constitutes a “qualified residential mortgage” may impact the pricing and depth of the secondary market into which we may sell mortgages we originate. At this time, we cannot predict the content of final CFPB and other federal agency regulations or the impact they might have on the Bancorp’s financial results. The CFPB’s authority over mortgage lending, and its authority to change regulations adopted in the past by other regulators (i.e., regulations issued under the Truth in Lending Act, for example), or to rescind or ignore past regulatory guidance, could increase the Bancorp’s compliance costs and litigation exposure.

In addition to the CFPB’s authority over mortgage lending, the Dodd-Frank Act includes a series of provisions covering mortgage loan origination standards affecting, among other things, originator compensation, minimum repayment standards, and pre-payments. Moreover, the Dodd-Frank Act requires public companies like the Bancorp to hold shareholder advisory “say-on-pay” votes on executive compensation at least once every three years and submit related proposals to a vote of shareholders. The Bancorp will hold its first such “say-on-pay” vote at its 2013 annual meeting of shareholders. The Dodd-Frank Act contains numerous other provisions affecting financial institutions of all types, many of which may have an impact on the operating environment of the Bancorp in substantial and unpredictable ways. Consequently, the Dodd-Frank Act is expected to increase our cost of doing business, it may limit or expand our permissible activities, and it may affect the competitive balance within our industry and market areas. The Bancorp’s management continues to actively monitor the implementation of the Dodd-Frank Act and the regulations promulgated thereunder and assess its probable impact on the business, financial condition, and results of operations of the Bancorp. However, the ultimate effect of the Dodd-Frank Act on the financial services industry in general, and the Bancorp in particular, continues to be uncertain.

New Proposed Capital Rules. On June 7, 2012, the Federal Reserve approved proposed rules that would substantially amend the regulatory risk-based capital rules applicable to the Bancorp and the Bank. The FDIC and the OCC subsequently approved these proposed rules on June 12, 2012. The proposed rules implement the “Basel III” regulatory capital reforms and changes required by the Dodd-Frank Act. “Basel III” refers to two consultative documents released by the Basel Committee on Banking Supervision in December 2009, the rules text released in December 2010, and loss absorbency rules issued in January 2011, which include significant changes to bank capital, leverage and liquidity requirements. The proposed rules received extensive comments during a comment period that ran through October 2012. In November 2012, the federal ban regulatory agencies jointly stated that they do not expect any of the proposed rules to become effective on the original target date of January 1, 2013. Further guidance from the bank regulatory agencies is expected in early 2013.

| 10 |

The proposed rules include new risk-based capital and leverage ratios, which would be phased in from 2013 to 2019, and would refine the definition of what constitutes “capital” for purposes of calculating those ratios. The proposed new minimum capital level requirements applicable to the Bancorp and the Bank under the proposals would be: (i) a new common equity Tier 1 capital ratio of 4.5%; (ii) a Tier 1 capital ratio of 6% (increased from 4%); (iii) a total capital ratio of 8% (unchanged from current rules); and (iv) a Tier 1 leverage ratio of 4% for all institutions. The proposed rules would also establish a “capital conservation buffer” of 2.5% above the new regulatory minimum capital requirements, which must consist entirely of common equity Tier 1 capital and would result in the following minimum ratios: (i) a common equity Tier 1 capital ratio of 7.0%, (ii) a Tier 1 capital ratio of 8.5%, and (iii) a total capital ratio of 10.5%. The new capital conservation buffer requirement would be phased in beginning in January 2016 at 0.625% of risk-weighted assets and would increase by that amount each year until fully implemented in January 2019. An institution would be subject to limitations on paying dividends, engaging in share repurchases, and paying discretionary bonuses if its capital level falls below the buffer amount. These limitations would establish a maximum percentage of eligible retained income that could be utilized for such actions. Basel III provided discretion for regulators to impose an additional buffer, the “countercyclical buffer,” of up to 2.5% of common equity Tier 1 capital to take into account the macro-financial environment and periods of excessive credit growth. However, the proposed rules permit the countercyclical buffer to be applied only to “advanced approach banks” ( i.e. , banks with $250 billion or more in total assets or $10 billion or more in total foreign exposures), which currently excludes the Bancorp and the Bank. The proposed rules also implement revisions and clarifications consistent with Basel III regarding the various components of Tier 1 capital, including common equity, unrealized gains and losses, as well as certain instruments that will no longer qualify as Tier 1 capital, some of which would be phased out over time.

The federal bank regulatory agencies also proposed revisions to the prompt corrective action framework, which is designed to place restrictions on insured depository institutions, including the Bank, if their capital levels begin to show signs of weakness. These revisions would take effect January 1, 2015. Under the prompt corrective action requirements, which are designed to complement the capital conservation buffer, insured depository institutions would be required to meet the following increased capital level requirements in order to qualify as “well capitalized:” (i) a new common equity Tier 1 capital ratio of 6.5%; (ii) a Tier 1 capital ratio of 8% (increased from 6%); (iii) a total capital ratio of 10% (unchanged from current rules); and (iv) a Tier 1 leverage ratio of 5% (increased from 4%). The proposed rules set forth certain changes for the calculation of risk-weighted assets, which we would be required to utilize beginning January 1, 2015. The standardized approach proposed rule utilizes an increased number of credit risk exposure categories and risk weights, and also addresses: (i) a proposed alternative standard of creditworthiness consistent with Section 939A of the Dodd-Frank Act Act; (ii) revisions to recognition of credit risk mitigation; (iii) rules for risk weighting of equity exposures and past due loans; (iv) revised capital treatment for derivatives and repo-style transactions; and (v) disclosure requirements for top-tier banking organizations with $50 billion or more in total assets that are not subject to the “advance approach rules” that apply to banks with greater than $250 billion in consolidated assets.

Based on our current capital composition and levels, we believe that we would be in compliance with the requirements as set forth in the proposed rules if they were presently in effect.

Difficult Market Conditions Have Adversely Affected Our Industry. We are particularly exposed to downturns in the U.S. housing market. Dramatic declines in the housing market over the past five years, with falling home prices and increasing foreclosures, unemployment and under-employment, have negatively impacted the credit performance of mortgage and construction loans and securities and resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities, major commercial and investment banks, and regional financial institutions. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have continued to observe tight lending standards, including with respect to other financial institutions, although there have been signs that lending is increasing. These market conditions have led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, and increased market volatility. A worsening of these conditions would likely exacerbate the adverse effects of these difficult market conditions on the Bancorp and others in the financial institutions industry. In particular, the Bancorp may face the following risks in connection with these events:

| § | We are experiencing, and expect to continue experiencing increased regulation of our industry, particularly as a result of the Dodd-Frank Act and the CFPB. Compliance with such regulation is expected to increase our costs and may limit our ability to pursue business opportunities. |

| 11 |

| § | Our ability to assess the creditworthiness of our customers may be impaired if the models and approaches we use to select, manage and underwrite our customers become less predictive of future behaviors. |

| § | The process we use to estimate losses inherent in our credit exposure requires difficult, subjective and complex judgments, including forecasts of economic conditions and how these economic predictions might impair the ability of our borrowers to repay their loans, which may no longer be capable of accurate estimation which may, in turn, impact the reliability of the process. |

| § | Our ability to borrow from other financial institutions on favorable terms or at all could be adversely affected by disruptions in the capital markets or other events, including actions by rating agencies and deteriorating investor expectations. |

| § | Competition in our industry could intensify as a result of the increasing consolidation of financial services companies in connection with current market conditions. |

| § | We may be required to pay significantly higher deposit insurance premiums because market developments have significantly depleted the insurance fund of the Federal Deposit Insurance Corporation (FDIC) and reduced the ratio of reserves to insured deposits. |

In addition, the Federal Reserve Bank has been injecting vast amounts of liquidity into the banking system to compensate for weaknesses in short-term borrowing markets and other capital markets. A reduction in the Federal Reserve’s activities or capacity could reduce liquidity in the markets, thereby increasing funding costs to the Bancorp or reducing the availability of funds to the Bancorp to finance its existing operations.

Concentrations of Real Estate Loans Subjects the Bancorp to Increased Risks. A significant portion of the Bancorp’s loan portfolio is secured by real estate. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value during the time the credit is extended. While real estate values in almost all regions of the country, including the Midwest, have shown signs of stabilizing, the overall real estate market on a national level continues to show relative weakness. A further weakening of the real estate market could result in an increase in the number of borrowers who default on their loans and a reduction in the value of the collateral securing their loans, which in turn could have an adverse effect on our profitability and asset quality. If we are required to liquidate the collateral securing a loan to satisfy the debt during a period of reduced real estate values, our earnings and capital could be adversely affected.

Financial Condition

During the year ended December 31, 2012, total assets increased by $40.1 million (6.2%), to $691.9 million, with interest-earning assets increasing by $45.2 million (7.4%). At December 31, 2012, interest-earning assets totaled $653.1 million and represented 94.4% of total assets. Loans totaled $437.3 million and represented 67.0% of interest-earning assets, 63.2% of total assets and 77.2% of total deposits. The loan portfolio, which is the Bancorp’s largest asset, is a significant source of both interest and fee income. The Bancorp’s lending strategy emphasizes quality growth, product diversification, and competitive and profitable pricing. The loan portfolio includes $154.9 million (35.4%) in residential real estate loans, $148.2 million (33.9%) in commercial real estate loans, $69.3 million (15.9%) in commercial business loans, $31.7 million (7.2%) in multifamily loans, $24.0 million (5.5%) in construction and land development loans, $8.9 million (2.0%) in government and other loans, and $347 thousand (0.1%) in consumer loans. Adjustable rate loans comprised 57.2% of total loans at year-end. During 2012, loan balances increased by $35.9 million (8.9%), with multifamily, commercial real estate, commercial business, residential real estate loans, construction and development, and government balances increasing while consumer balances decreased. The increase in loans during the year is the result of improving credit and economic conditions.

The Bancorp is primarily a portfolio lender. Mortgage banking activities historically have been limited to the sale of fixed rate mortgage loans with contractual maturities greater than 15 years. However, during 2012, as a result of the low interest rate environment, management began selling some newly originated fixed rate mortgage loans with contractual maturities greater than 10 years in an effort to reduce interest rate risk. These loans are identified as held for sale when originated and sold, on a loan-by-loan basis, in the secondary market. During 2012, the Bancorp sold $26.4 million in newly originated fixed rate mortgage loans, compared to $10.6 million during 2011. Net gains realized from the mortgage loan sales totaled $804 thousand for 2012, compared to $256 thousand for 2011. Also, during the second quarter of 2012, the Bancorp conducted a $3.4 million one-time sale of portfolio fixed rate mortgage loans, which the Bancorp’s management considers an interest rate risk mitigation strategy to reduce loan prepayment risk. The segment of loans that were sold had a higher premium value and was projected to prepay significantly faster than the mortgage portfolio's average repayment speed. The gain realized from the prepayment risk reduction strategy totaled $183 thousand and was recorded during the second quarter of 2012. The proceeds from the loan sale were used to fund loans with longer durations and similar yields to the loans that were included in the sales strategy. At December 31, 2012, the Bancorp had $323 thousand in loans that were classified as held for sale.

| 12 |

The allowance for loan losses (ALL) is a valuation allowance for probable incurred credit losses, increased by the provision for loan losses, and decreased by charge-offs net of recoveries. A loan is charged off against the allowance by management as a loss when deemed uncollectible, although collection efforts continue and future recoveries may occur. The determination of the amounts of the ALL and provisions for loan losses is based on management’s current judgments about the credit quality of the loan portfolio with consideration given to all known relevant internal and external factors that affect loan collectability as of the reporting date. The appropriateness of the current period provision and the overall adequacy of the ALL are determined through a disciplined and consistently applied quarterly process that reviews the Bancorp’s current credit risk within the loan portfolio and identifies the required allowance for loan losses given the current risk estimates.

Historically, the Bancorp has successfully originated commercial real estate loans within its primary lending area. However, beginning in the fourth quarter of 2005, in response to a decrease in local loan demand and in an effort to reduce the potential credit risk associated with geographic concentrations, a strategy was implemented to purchase commercial real estate participation loans outside of the Bancorp’s primary lending area. The strategy to purchase these commercial real estate participation loans was limited to 10% of the Bancorp’s loan portfolio. The Bancorp’s management discontinued the out of market strategy during the third quarter of 2007. As of December 31, 2012, the Bancorp’s commercial real estate participation loan portfolio carried an aggregate balance of $28.0 million, of which $18.0 million has been purchased within the Bancorp’s primary lending area and $10.0 million outside of the primary lending area. At December 31, 2012, $5.4 million, or 19.3%, of the Bancorp’s commercial real estate participation loans have been internally classified as substandard and have been placed on non-accrual status. All $5.4 million in substandard commercial real estate participation loans placed on non-accrual status are located outside of the Bancorp’s primary lending area. The discussion in the paragraphs that follow regarding non-performing loans, internally classified loans and impaired loans includes loans from the Bancorp’s commercial real estate participation loan portfolio.

For all of its commercial real estate participation loans, consistent with current regulatory guidelines the Bancorp’s management requires that the lead lenders obtain external appraisals to determine the fair value of the underlying collateral for any collateral dependent loans. The Bancorp’s management requires current external appraisals when entering into a new lending relationship or when events have occurred that materially change the assumptions in the existing appraisal. The lead lenders receive external appraisals from qualified appraisal firms that have expertise in valuing commercial properties and are able to comply with the required scope of the engagement. After the lead lender receives the external appraisal and performs its compliance review, the appraisal is forwarded to the Bancorp for review. The Bancorp’s management validates the external appraisal by conducting an internal in-house review by personnel with expertise in commercial real estate developments. If additional expertise is needed, an independent review appraiser is hired to assist in the evaluation of the appraisal. The Bancorp is not aware of any significant time lapses during this process. Periodically, the Bancorp’s management may make adjustments to the external appraisal assumptions if additional known quantifiable data becomes available that materially impacts the value of a project. Examples of adjustments that may occur are changes in property tax assumptions or changes in capitalization rates. The Bancorp’s management relies on up-to-date external appraisals to determine the current value of its impaired commercial real estate participation loans. These values are appropriately adjusted to reflect changes in market value and, when necessary, is the basis for establishing the appropriate allowance for loan losses (ALL). If an updated external appraisal for a commercial real estate participation loan is received after the balance sheet date, but before the annual or quarterly financial statements are issued, material changes in appraised values are “pushed back” in the yet to be issued financial statements in order that appropriate loan loss provision is recorded for the current reporting period. The Bancorp’s management consistently records loan charge-offs based on the fair value or income approach of the collateral as presented in the current external appraisal.

| 13 |

Non-performing loans include those loans that are 90 days or more past due and those loans that have been placed on non-accrual status. Non-performing loans totaled $11.5 million at December 31, 2012, compared to $14.3 million at December 31, 2011, a decrease of $2.8 million or 19.6%. The ratio of non-performing loans to total loans was 2.63% at December 31, 2012, compared to 3.56% at December 31, 2011. The ratio of non-performing loans to total assets was 1.66% at December 31, 2012, compared to 2.19% at December 31, 2011. The decrease in non-performing loans for 2012 is related to loans moving off of non-accrual status, pay downs and charge-offs. At December 31, 2012, all non-performing loans are also accounted for on a non accrual basis, except for one loan totaling $229 thousand that was classified as accruing and 90 days past due. The current level of non-performing loans is concentrated in two previously reported out of market commercial real estate participation loans totaling $5.4 million in the aggregate. Both of the non-performing commercial real estate participation loans are hotel loans that have been charged down to their fair value based on the current fair value of the respective project’s collateral, less estimated selling costs. For these commercial real estate participation loans, to the extent that actual cash flows, collateral values and strength of personal guarantees differ from current estimates, additional provisions to the allowance for loan losses may be required.

Loans, internally classified as substandard, totaled $19.7 million at December 31, 2012, compared to $24.6 million at December 31, 2011 a decrease of $4.9 million or 19.9%. The current level of substandard loans is concentrated in the previously mentioned two non-performing commercial real estate participation loans and one accruing commercial real estate hotel loan in the amount of $4.9 million, which is the largest loan in this group. Substandard loans include non-performing loans and potential problem loans, where information about possible credit issues or other conditions causes management to question the ability of such borrowers to comply with loan covenants or repayment terms. No loans were internally classified as doubtful or loss at December 31, 2012 or December 31, 2011. In addition to identifying and monitoring non-performing and other classified loans, management maintains a list of watch loans. Watch loans represent loans management is closely monitoring due to one or more factors that may cause the loan to become classified as substandard. Watch loans totaled $17.7 million at December 31, 2012, compared to $16.6 million at December 31, 2011 an increase of $1.1 million or 6.6%. The increase in watch loans is related to the upgrading of one commercial real estate participation loan totaling $935 thousand, which had been previously classified as substandard.

A loan is considered impaired when, based on current information and events, it is probable that a borrower will be unable to pay all amounts due according to the contractual terms of the loan agreement. At December 31, 2012, impaired loans totaled $19.9 million, compared to $21.7 million at December 31, 2011 a decrease of $1.8 million or 8.3%. The December 31, 2012, impaired loan balances consist of twenty-six commercial real estate and commercial business loans totaling $19.2 million that are secured by business assets and real estate, and are personally guaranteed by the owners of the businesses. In addition, seven mortgage loans totaling $692 thousand, which are troubled debt restructurings have also been classified as impaired. The December 31, 2012 ALL contained $2.0 million in specific allowances for collateral deficiencies, compared to $1.6 million at December 31, 2011. During the fourth quarter of 2012, two commercial business loans totaling $435 thousand were newly classified as impaired. There were no other loans considered to be impaired loans as of December 31, 2012. Typically, management does not individually classify smaller-balance homogeneous loans, such as residential mortgages or consumer loans, as impaired, unless they are troubled debt restructurings.

At December 31, 2012, the Bancorp classified fifteen loans totaling $15.1 million as troubled debt restructurings, which involves modifying the terms of a loan to forego a portion of interest or principal or reducing the interest rate on the loan to a rate materially less than market rates, or materially extending the maturity date of a loan. The Bancorp’s troubled debt restructurings include two commercial real estate participation hotel loans in the amount of $5.6 million and one commercial real estate hotel loan in the amount of $4.9 million, for which significant deferrals of principal repayments were granted; one commercial real estate loan in the amount of $2.4 million for which a significant deferral of principal and interest repayment was granted; one commercial real estate loan in the amount of $547 thousand for which a significant deferral of principal and interest repayment was granted by the Bank as required by a bankruptcy plan; two development loans in the amount of $893 thousand for which an interest rate concession was granted; and one commercial business loan in the amount of $88 thousand and seven mortgage loans totaling $692 thousand, for which maturity dates were materially extended. At December 31, 2012, $9.7 million of the Bancorp’s loans classified as troubled debt restructurings are accruing loans. The valuation basis for the Bancorp’s troubled debt restructurings is based on the present value of cash flows, unless consistent cash flows are not present, then the fair value of the collateral securing the loan is the basis for valuation.

At December 31, 2012, management is of the opinion that there are no loans, except those discussed above, where known information about possible credit problems of borrowers causes management to have serious doubts as to the ability of such borrowers to comply with the present loan repayment terms and which will imminently result in such loans being classified as past due, non-accrual or a troubled debt restructure. Management does not presently anticipate that any of the non-performing loans or classified loans would materially impact future operations, liquidity or capital resources.

For 2012, $2.4 million in provisions to the ALL were required, compared to $3.5 million for 2011 a decrease of $1.1 million or 31.4%. The ALL provision decrease for 2012 is primarily a result of improved asset quality. The current year ALL provisions were primarily related to the current credit risk in the commercial real estate loan portfolio and 2012 loan originations. For 2012, charge-offs, net of recoveries, totaled $1.9 million, compared to $4.6 million for 2011. The net loan charge-offs for 2012 were comprised of $765 thousand in commercial real estate participation loans, $582 thousand in commercial business loans, $243 thousand in commercial real estate loans, $332 thousand in residential real estate loans, and $12 thousand in consumer loans. The ALL provisions take into consideration management’s current judgments about the credit quality of the loan portfolio, loan portfolio balances, changes in the portfolio mix and local economic conditions. In determining the provision for loan losses for the current period, management has given consideration to historically elevated risks associated with the local economy, changes in loan balances and mix, and asset quality.

| 14 |

The ALL to total loans was 1.93% at December 31, 2012, compared to 1.99% at December 31, 2011. The ALL to non-performing loans (coverage ratio) was 73.34% at December 31, 2012, compared to 56.03% at December 31, 2011. The December 31, 2012 balance in the ALL account of $8.4 million is considered adequate by management after evaluation of the loan portfolio, past experience and current economic and market conditions. While management may periodically allocate portions of the allowance for specific problem loans, the whole allowance is available for any loan charge offs that occur. The allocation of the ALL reflects performance and growth trends within the various loan categories, as well as consideration of the facts and circumstances that affect the repayment of individual loans, and loans which have been pooled as of the evaluation date, with particular attention given to non-performing loans and loans which have been classified as substandard, doubtful or loss. Management has allocated reserves to both performing and non-performing loans based on current information available.

At December 31, 2012, foreclosed real estate totaled $425 thousand, which was comprised of ten properties, compared to $2.5 million and eleven properties at December 31, 2011. During 2012, loans totaling $1.6 million were transferred into foreclosed real estate, while net sales of foreclosed real estate totaled $3.8 million. Net gains from the 2012 sales totaled $430 thousand. At the end of December 2012 all of the Bancorp’s foreclosed real estate is located within its primary market area.

At December 31, 2012, the Bancorp's investment portfolio totaled $187.5 million and was invested as follows: 53.4% in U.S. government agency mortgage-backed securities and collateralized mortgage obligations, 33.6% in municipal securities, 12.3% in U.S. government agency debt securities, and 0.7% in trust preferred securities. During 2011, management transferred its entire held-to-maturity securities portfolio to available-for-sale in order to provide management with the ability to sell lower balance odd lot securities, divest of certain securities to reduce credit or interest rate risk within the portfolio, and be positioned to take advantage of other portfolio restructuring opportunities. Available-for-sale securities are those the Bancorp may decide to sell if needed for liquidity, asset-liability management or other reasons. The book value of the securities transferred totaled $16.4 million, with an unrealized gain of $1.0 million that was recorded as a component of other comprehensive income at the date of transfer. During 2012, securities increased by $513 thousand (0.3%). In addition, at December 31, 2012, the Bancorp had $3.1 million in FHLB stock.

As of December 31, 2012, three of the Bancorp’s four investments in trust preferred securities are in “payment in kind” status. Payment in kind status results in a temporary delay in the payment of interest. As a result of a delay in the collection of the interest payments, management placed these securities on non-accrual status. At December 31, 2012, the cost basis of the three trust preferred securities on non-accrual status totaled $3.9 million. Current estimates indicate that the interest payment delays may exceed ten years. One trust preferred security with a cost basis of $1.3 million remains on accrual status.

Deposits are a fundamental and cost-effective source of funds for lending and other investment purposes. The Bancorp offers a variety of products designed to attract and retain customers, with the primary focus on building and expanding relationships. At December 31, 2012, deposits totaled $566.4 million. During 2012, deposits increased by $39.5 million (7.5%). The 2012 change in deposits was comprised of the following: certificates of deposit decreased by $5.3 million (3.0%), checking accounts increased by $35.2 million (22.3%), savings accounts increased by $6.2 million (8.7%), and money market deposit accounts (MMDA’s) increased by $3.4 million (2.8%). During 2012, management continues to allow higher cost certificates of deposit to mature while relying on funding from checking, MMDA, and savings deposits. The increase in checking, savings, and MMDA balances is a result of customer preferences for liquid investments in the current low interest rate environment.

The Bancorp’s borrowed funds are primarily comprised of repurchase agreements and FHLB advances that are used to fund asset growth not supported by deposit generation. At December 31, 2012, borrowed funds totaled $49.5 million compared to $52.0 million at December 31, 2011, a decrease of $2.5 million (4.8%). During 2012, management reduced borrowed funds with an average rate of 1.32%, while relying more on low cost core deposits for funding. Retail repurchase agreements totaled $16.3 million at December 31, 2012, compared to $15.4 million at December 31, 2011, an increase of $903 thousand (5.9%). FHLB advances totaled $33.0 million, decreasing $3.0 million or 8.3%. The Bancorp’s FHLB line of credit carried a zero balance at December 31, 2012 and 2011. Other short-term borrowings totaled $207 thousand at December 31, 2012, compared to $618 thousand at December 31, 2011.

| 15 |

Liquidity and Capital Resources

The Bancorp’s primary goals for funds and liquidity management are to generate sufficient cash to fund current loan demand, meet deposit withdrawals, and pay dividends and operating expenses. Because profit and liquidity are often conflicting objectives, management attempts to maximize the Bank’s net interest margin by making adequate, but not excessive, liquidity provisions. Furthermore, funds are managed so that future profits will not be significantly impacted as funding costs increase.

Changes in the liquidity position result from operating, investing and financing activities. Cash flows from operating activities are generally the cash effects of transactions and other events that enter into the determination of net income. The primary investing activities include loan originations, loan repayments, investments in interest bearing balances in financial institutions, and the purchase, sale, and maturity of investment securities. Financing activities focus almost entirely on the generation of customer deposits. In addition, the Bancorp utilizes borrowings (i.e., repurchase agreements, FHLB advances and federal funds purchased) as a source of funds.

During 2012, cash and cash equivalents increased $7.4 million compared to an increase of $15.4 million for 2011. During 2012, the primary sources of cash and cash equivalents were from maturities and sales of securities, deposit originations, loan sales and repayments, an FHLB advance, and cash from operating activities. The primary uses of cash and cash equivalents were loan originations, purchase of securities, expenditures for premises and equipment, FHLB advance repayments, and the payment of common stock dividends. During 2012, cash from operating activities totaled $8.5 million, compared to $14.8 million for 2011. The 2012 decrease in cash provided by operating activities was primarily a result of timing differences of customer ACH deposit activity. Cash outflows from investing activities totaled $36.3 million during 2012, compared to outflows of $7.9 million during 2011. The changes for the current year were related to increased loan originations, the purchase of loan participations, purchases of securities, and increased investment in premises and equipment as detailed in the notes to the financial statements. Net cash inflows from financing activities totaled $35.2 million in 2012, compared to net cash inflows of $8.4 million in 2011. The change during 2012 was primarily due to an increase in deposits and other borrowed funds as detailed in the notes to the financial statements. The Bancorp paid dividends on common stock on a cash basis of $1.9 million and $1.7 million during 2012 and 2011, respectively. During 2012, the Bancorp’s Board of Directors increased dividends as earnings and capital improved.

Management strongly believes that safety and soundness is enhanced by maintaining a high level of capital. Stockholders' equity totaled $67.7 million at December 31, 2012, compared to $63.0 million at December 31, 2011, an increase of $4.7 million (7.5%). The increase was primarily the result of $6.9 million in net income for 2012. Additional items increasing stockholders' equity was $141 thousand from the sale of treasury stock, and $16 thousand from stock-based compensation plans. Decreasing stockholders' equity were the Bancorp’s declaration of $2.0 million in cash dividends, and $197 thousand from the change in other comprehensive income. At December 31, 2012, book value per share was $23.83 compared to $22.20 for 2011.

The Bancorp is subject to risk-based capital guidelines adopted by the Board of Governors of the Federal Reserve System (the FRB), and the Bank is subject to risk-based capital guidelines adopted by the FDIC. As applied to the Bancorp and the Bank, the FRB and FDIC capital requirements are substantially the same. These regulations divide capital into two tiers. The first tier (Tier 1) includes common equity, certain non-cumulative perpetual preferred stock and minority interests in equity accounts of consolidated subsidiaries, less goodwill and certain other intangible assets. Supplementary (Tier 2) capital includes, among other things, cumulative perpetual and long-term limited-life preferred stock, mandatory convertible securities, certain hybrid capital instruments, term subordinated debt and the allowance for loan losses, subject to certain limitations, less required deductions. The Bancorp and the Bank are required to maintain a total risk-based capital ratio of 8%, of which 4% must be Tier 1 capital. In addition, the FRB and FDIC regulations provide for a minimum Tier 1 leverage ratio (Tier 1 capital to adjusted average assets) of 3% for financial institutions that meet certain specified criteria, including that they have the highest regulatory rating and are not experiencing or anticipating significant growth. All other financial institutions are required to maintain a Tier 1 leverage ratio of 3% plus an additional cushion of at least one to two percent.

The following table shows that, at December 31, 2012, the Bancorp’s capital exceeded all regulatory capital requirements. At December 31, 2012, the Bancorp’s and the Bank’s regulatory capital ratios were substantially the same. The dollar amounts are in millions.

| Minimum | ||||||||||||||||||||||||

| Required To Be | ||||||||||||||||||||||||

| Well Capitalized | ||||||||||||||||||||||||

| Minimum Required | Under Prompt | |||||||||||||||||||||||

| For Capital | Corrective | |||||||||||||||||||||||

| At December 31, 2012 | Actual | Adequacy Purposes | Action Regulations | |||||||||||||||||||||

| Amount | Ratio | Amount | Ratio | Amount | Ratio | |||||||||||||||||||

| Total capital to risk-weighted assets | $ | 70.1 | 14.6 | % | $ | 38.3 | 8.0 | % | $ | 47.9 | 10.0 | % | ||||||||||||

| Tier 1 capital to risk-weighted assets | $ | 64.1 | 13.4 | % | $ | 19.1 | 4.0 | % | $ | 28.7 | 6.0 | % | ||||||||||||

| Tier 1 capital to adjusted average assets | $ | 64.1 | 9.4 | % | $ | 20.5 | 3.0 | % | $ | 34.2 | 5.0 | % | ||||||||||||

| 16 |

The Bancorp’s ability to pay dividends to its shareholders is entirely dependent upon the Bank’s ability to pay dividends to the Bancorp. Under Indiana law, the Bank may pay dividends from its undivided profits (generally, earnings less losses, bad debts, taxes and other operating expenses) as is considered expedient by the Bank’s Board of Directors. However, the Bank must obtain the approval of the Indiana Department of Financial Institutions (DFI) for the payment of a dividend if the total of all dividends declared by the Bank during the current year, including the proposed dividend, would exceed the sum of retained net income for the year to date plus its retained net income for the previous two years. For this purpose, “retained net income,” means net income as calculated for call report purposes, less all dividends declared for the applicable period. The aggregate amount of dividends that may be declared by the Bank in 2013, with prior DFI approval is $8.7 million plus 2013 net profits. Moreover, the FDIC and the Federal Reserve Board may prohibit the payment of dividends if it determines that the payment of dividends would constitute an unsafe or unsound practice in light of the financial condition of the Bank. On November 30, 2012, the Board of Directors of the Bancorp declared a fourth quarter dividend of $0.19 per share. The Bancorp’s fourth quarter dividend was paid to shareholders on January 4, 2013.

Results of Operations – Comparison of 2012 to 2011

Net income for 2012 was $6.9 million, compared to $5.4 million for 2011, an increase of $1.5 million (27.3%). The increase in net income for 2012 was the result of lower interest expense, lower required provisions for loan losses, and higher noninterest income. The earnings represent a return on average assets of 1.02% for 2012 compared to 0.84% for 2011. The return on average equity was 10.27% for 2012 compared to 8.90% for 2011.

Net interest income for 2012 was $23.7 million, a decrease of $28 thousand (0.1%) from $23.8 million for 2011. During the year, the Bancorp’s cost of funds continued to be positively impacted by the Federal Reserve’s actions in maintaining a low short-term interest rate environment, however, the Bancorp’s yield on interest earning assets is being negatively impacted by lower long-term interest rates. The weighted-average yield on interest-earning assets was 4.14% for 2012 compared to 4.49% for 2011. The weighted-average cost of funds was 0.39% for 2012 compared to 0.56% for 2011. The impact of the 4.14% return on interest earning assets and the 0.39% cost of funds resulted in a net interest spread of 3.75% for 2012 compared to 3.93% for 2011. During 2012, total interest income decreased by $911 thousand (3.4%) while total interest expense decreased by $883 thousand (27.3%). The net interest margin was 3.77% for 2012 compared to 3.96% for 2011. The Bancorp’s tax equivalent net interest margin for 2012 was 3.96% compared to 4.17% for 2011.

During 2012, interest income from loans decreased by $228 thousand (1.1%) compared to 2011. The change was primarily due to a decrease in the weighted-average yield of the loan portfolio. The weighted-average yield on loans outstanding was 4.88% for 2012 compared to 5.10% for 2011. Loan balances averaged $423.6 million for 2012, an increase of $13.8 million (3.4%) from $409.8 million for 2011. During 2012, interest income from securities and other interest earning assets decreased by $683 thousand (11.2%) compared to 2011. The decrease was due to a decrease in the weighted average yield. The weighted-average yield on securities and other interest earning assets was 2.62% for 2012 compared to 3.20% for 2011. Securities and other interest earning assets averaged $206.3 million for 2012, up $15.6 million (8.2%) from $190.7 million for 2011.

Interest expense for deposits decreased by $898 thousand (36.3%) during 2012 compared to 2011. The change was due to a decrease in the weighted-average rate paid on deposits. The weighted-average rate paid on deposits for 2012 was 0.29% compared to 0.47% for 2011. Total deposit balances averaged $538.6 million for 2012, an increase of $12.6 million (2.4%) from $526.0 million for 2011. Interest expense for borrowed funds increased by $15 thousand (2.0%) during 2012 compared to 2011. The change was due to higher average balances. The weighted-average cost of borrowed funds was 1.32% for 2012 compared to 1.50% for 2011. Borrowed funds averaged $58.7 million during 2012, an increase of $8.2 million (16.2%) from $50.5 million for 2011.

Noninterest income for 2012 was $7.5 million, an increase of $1.3 million (20.6%) from $6.2 million for 2011. During 2012, fees and service charges totaled $2.7 million, an increase of $176 thousand (7.0%) from $2.5 million for 2011. The increase was the result of a concentrated effort made during the year to assess the competiveness of deposit fee and service charges in addition to additional fees related to loan activities. Fees from Wealth Management operations totaled $1.3 million for 2012, an increase of $87 thousand (7.4%) from $1.2 million for 2011. The increase in Wealth Management income is related to growth in assets under management and market value changes. Gains from the sale of securities totaled $1.1 million for the current year, an increase of $154 thousand (15.9%) from $1.0 million for 2011. Current market conditions continue to provide opportunities to manage securities cash flows, while recognizing gains from the sales of securities. Gains from loan sales totaled $987 thousand for the current year, an increase of $731 thousand (285.5%), compared to $256 thousand for 2011. The increase in gains from the sale of loans is a result of increased customer refinance activity to low rate fixed rate mortgages as well as a sale of seasoned fixed rate mortgages with high prepayment speeds, which resulted in a one-time gain of $183 thousand. Due to the passing of a senior manager during the third quarter, the Bancorp received a $587 thousand benefit from bank owned life insurance. For 2012, foreclosed real estate sales gains totaled $430 thousand, a decrease of $457 thousand (51.5%) from gains of $887 thousand for 2011. The decrease is partly related to the Bancorp’s favorable settlement in its lawsuit against the lead lender of a commercial real estate participation loan in 2011. Income from the increase in the cash value of bank owned life insurance totaled $381 thousand for 2012, a decrease of $17 thousand (4.3%), compared to $398 thousand for 2011. During 2012, other-than-temporary impairment of $6 thousand was recognized compared to $1 thousand of impairment recognized during 2011. During 2012, other noninterest income totaled $96 thousand, an increase of $33 thousand (52.4%) from $63 thousand for 2011.

| 17 |