2013 Annual Report

Dear Shareholder:

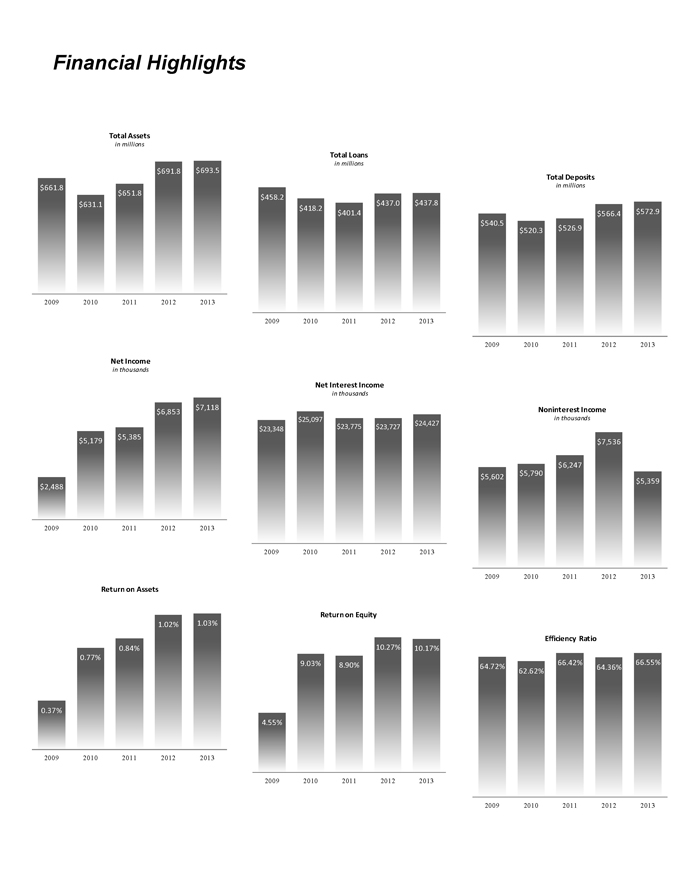

In 2013, the Peoples team executed at a high level and delivered another year of stellar performance. We reported record earnings of $7.1 million which surpassed last year’s record of $6.9 million. Highlights of the year included a strong capital position, improved asset quality, enhanced electronic delivery channels, expansion through a pending bank acquisition, and the successful execution of banking fundamentals and a management succession plan. Investors reacted well to our progress as the price of your stock rose steadily throughout the year.

As the economy and banking industry recover from the lingering effects of the Great Recession, our strategic plan has let us emerge from the storm stronger than ever to take advantage of opportunities for creating shareholder value in a consolidating industry. Our strategic vision is clear: we will remain an independent bank with sustained core earnings that will drive asset growth and result in the Bancorp reaching a larger scale. Growth will not be pursued for its own sake; but rather to help the Bancorp absorb increased regulatory and operational costs, reinvest in growing our core business, and continue to deliver an exceptional experience to our customers.

2013 Achievements

Strong Capital Position – Because of our balance sheet strategy, we attained our strongest capital position since the onset of the Great Recession. At the end of the year, stockholders equity stood at 9.6% of total assets with our Tier 1 regulatory ratio at 10.0% and our Total Risk Based regulatory ratio at 15.6%. As a result, the Bancorp is well positioned to pursue strategies that will provide greater economic growth in our community and financial security for our customers. We have the earnings record and capital to expand our footprint, increase the outreach of our loan production to consumers and small business, and invest in technology-driven delivery channels in response to changing customer banking preferences.

Improved Asset Quality – The last several years challenged the banking industry’s ability to maintain strong asset quality; and the Bancorp was no exception. Our loan work-out team, headed by Chief Lending Officer Todd Scheub, endeavored throughout the year with great success to reduce our non-performing loans to normal levels. The results are nearly without parallel among community banks, as our ratio of non-performing loans to total loans declined from 2.63% at the end of 2012 to .90% at the end of December 2013. Consequently, our non-performing loan ratio fell to levels not seen since the beginning of the recession, permitting the Bancorp to reduce our loan loss provision expense during the year.

Electronic Banking – For today’s customer, the best technology provides the most value to the customer’s banking experience. Your Bank offers customer banking technology that rivals the biggest banks in the country and we deliver for our customers on the strength of our team. The Bancorp will continue to invest in technologies that streamline processes and enhance the customer experience. Our technology enhancements were ambitious, consistent with our belief that the Bank has to be positioned today for the increased electronic banking demands of tomorrow’s customers. The goal of these investments is to empower customers to focus on financial needs, not process. Similarly, our goal is to empower our team members with technology to engage our customers and not focus on process. Our customer surveys show that our electronic and mobile banking efforts have met with success as we have attracted new and younger customers and households to our customer base.

| 1 |

Banking Fundamentals – The Bancorp does not stray from the fundamentals of banking. We keep an eye on the bottom line by watching our expenses, maintaining our core earnings by growing core accounts, and diversifying income through expansion of our Wealth Management products and services. Like the customers and households we serve, we tightened our belts this year and reduced operating expenses by $298 thousand while continuing to make smart investments that drive the Bank’s strategic plan.

Focusing on the fundamentals of banking has consistently resulted in high returns to our shareholders as measured by key banking performance metrics. We are pleased that our results received national recognition during the year as the NorthWest Indiana Bancorp again was named one of the top 200 Community Banks in America by U.S. Banker magazine. This award is based upon the three-year average return on equity (ROE) of publicly traded community banks.

Maintaining our core earnings, or net interest margin, is highly dependent on our ability to grow core deposits. For the Bancorp, this means growing our checking, savings, and money market accounts in order to maintain a low cost of funding. Combined, these accounts grew 5.7% or $22.5 million, and at year-end represented 72.8% of the Bancorp’s deposit base.

Consumers have shown a growing demand throughout the nation for banking as well as investment and fiduciary services. To meet this growing demand as well as to diversify our income sources, the Bancorp established a Wealth Management Group to serve the growing financial needs of our customers. Again this year, Wealth Management operations increased their income by over 10%, and at year-end the market value of assets under management was $266.9 million.

Expanding Our Footprint – Your Board of Directors and Management Team understand that the landscape of the banking industry is changing, both locally and nationally. As banks consolidate, the Bancorp strives to be on “offense” and on the buy side of the equation in order to remain independent.

Over the years, we have looked at a number of such opportunities with our analysis determining that the targets were not a good fit each time. That changed in the last quarter of 2013 as we announced the acquisition, subject to regulatory approvals, of First Federal Savings and Loan of Hammond; a small but important first step to achieving a larger scale.

The transaction is a unique voluntary supervisory merger conversion that will add $38 million in assets and two banking center locations with minimal expense to the Bancorp. No cash or shares will be paid in the acquisition, with our costs limited mainly to the accounting and legal fees of the transaction. This deal will be accretive to earnings in 2014 and final regulatory approval is expected by the end of the first quarter of 2014.

| 2 |

Management Succession – The goal of our management succession plan is to build a strong forward looking management team capable of leading the successful implementation of the Bancorp’s strategic plan and continuing our tradition of outstanding performance.

Our Senior Management group has demonstrated exceptional experience and achievements, and collectively has over two hundred years of banking experience. Internally, they operate under the title of the G-10; and beginning in 2012, they took responsibility for mapping the strategic direction of the Bancorp and executing the plan under the leadership of Ben Bochnowski. Despite the economic stress and slow recovery of the past few years, the G-10 produced a Board-approved plan that resulted in record earnings in 2012 and 2013.

The Board initiated an independent and rigorous review of the long-term leadership requirements of the Bancorp that included the attributes and skill sets an individual must possess to lead a community bank. These included vision, honesty, integrity, communication, passion and commitment, initiative, teamwork, organization skills, time management, and the ability to focus on priorities.

As a next step in the Bancorp’s succession plan, the Board’s outside Directors unanimously agreed to promote Ben Bochnowski to the position of Chief Operating Officer (COO) of the Bancorp and Peoples Bank. This position leads the execution of the strategic plan and provides oversight for day-to-day banking activities with all operating units of the Bancorp reporting directly to the COO. The COO coordinates with the Chairman and CEO in the overall administration of the Bancorp and Bank.

The Board recognized Ben’s vision, talent, and passion for community banking along with his proven track record of performance. He becomes the fourth generation of the Bochnowski family to serve the Bank’s stakeholders, and he will uphold the Bank’s ongoing commitment to help consumers and small business owners achieve their financial goals. As a part of his new role, Ben will join me as a co-writer of next year’s annual report.

NWIN Performance

At the end of December 2013, your stock in the NorthWest Indiana Bancorp (NWIN) had a closing price of $25.00 per share, an increase of 30.9% over the closing price of $19.10 a year earlier. The Bancorp’s performance permitted your Directors to increase your dividend per share from $.19 per share to $.22 per share, an increase of 15.7%. The Monroe Securities Chicago Area Trading Multiples Report for the fourth quarter of 2013 listed 25 companies including NWIN. According to this report, seven of these companies were paying a dividend to their shareholders, and the highest dividend yield came from your company, NWIN, at 3.5%.

| 3 |

2014 Opportunities

The Bancorp’s franchise is built upon three pillars: asset growth, funding growth and income growth. Supporting these pillars is Enterprise Risk Management (ERM), a system that serves to ensure that value from pursuit of opportunities presented by each pillar is realized safely. Executing ERM is the responsibility of every member of the Peoples team in support of achieving the desired outcome of our strategic initiatives.

2013 was a highly successful year with earnings bolstered by the favorable disposition of several problem loans. The resolution of one of those credits resulted in the collection of $1.4 million in back interest which improved our interest income last year. That advantageous outcome will not be repeated this year, and the Bancorp will be challenged to safely and soundly ensure the replacement of that income source without stressing our commitment to the principles of ERM.

I’m pleased to report that your Bank was named one of the 2013 Best Places to Work in Indiana, based on results of surveys of our employees and employment practices conducted by Best Companies Group. Along with our customers, our employees are the Bank’s most valuable assets and we remain committed to providing a dynamic and positive work environment.

During 2013, the Bancorp recruited several experienced business bankers and mortgage lenders who have been tasked with engaging our customers to safely and soundly enhance our loan originations. These seasoned professionals have been added to the mix of our experienced lenders and we are optimistic that their combined ability will increase income from loan balances that will grow as the economic recovery takes hold.

The Bancorp will continue its commitment to growing our core deposits as an essential ingredient to maintaining a reliable, low-cost source of funding for the Bancorp’s growth. Success hinges on having the right products and ensuring that the Bancorp has traditional as well as electronic channels to efficiently deliver those products to our customers. This year we will continue to sharpen our banking processes so that we have more time to devote to customer relationship-building and engagement.

Growing our Wealth Management group will continue to be a driver of our effort to create a diversified source of income. By adding well trained professionals to our staff and re-energizing our delivery of wealth management products and services, Wealth Management will provide our customers the value as well as the resources to help them reach their financial goals. Effectively scaling up our wealth management line of business also will create value for our shareholders through increased income from products and services.

This year, the Bancorp is again committed to carefully reviewing our expense structure while recognizing that in order to drive future growth, we need to make investments for the future. It continues to be incumbent on the Bancorp to grow efficiently so that revenue growth outpaces expense growth, which was a key achievement for 2013. Expense management strategies will be utilized to drive efficient operations so that the Bancorp can invest in growing our business.

| 4 |

A Personal Note

With much happiness, it is my pleasure to inform you that in the latter part of January 2014, my medical team concluded that the treatments for multiple myeloma that was diagnosed in late May of 2013 were a complete success. My prior condition, which stems from exposure to Agent Orange, a highly toxic defoliant, during my tour of duty in Vietnam some 43 years ago, is in complete remission and I am cancer free. The power of modern medicine as practiced by the professionals at Community Hospital in Munster, especially Dr. Erwin Robin, and the Stem Cell Transplant Team of Dr. Jayesh Mehta of Northwestern University Hospital in Chicago, along with the Grace of God, deserve the credit for my favorable outcome. The outpouring of support from my family, the Peoples family, and friends has been a humbling experience. I am grateful for your prayers and shall always cherish the difference so many of you made during this experience.

On behalf of your Directors and the entire Peoples team, I thank you for your continuing support of the Bancorp and encourage you to refer your family, friends, and business associates to us to fulfill their lending and financial needs.

| Sincerely, | |

| |

| David A. Bochnowski | |

| Chairman and Chief Executive Officer |

| 5 |

Selected Consolidated Financial Data

in thousands of dollars, except per share data

| Fiscal Year Ended | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||||||

| Statement of Income: | ||||||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 26,157 | $ | 26,075 | $ | 26,986 | $ | 30,086 | $ | 32,189 | $ | 35,167 | $ | 35,768 | $ | 34,979 | $ | 30,024 | $ | 26,614 | ||||||||||||||||||||

| Total interest expense | 1,730 | 2,348 | 3,231 | 4,989 | 8,841 | 12,933 | 17,882 | 15,737 | 9,758 | 6,858 | ||||||||||||||||||||||||||||||

| Net interest income | 24,427 | 23,727 | 23,755 | 25,097 | 23,348 | 22,234 | 17,886 | 19,242 | 20,266 | 19,756 | ||||||||||||||||||||||||||||||

| Provision for loan losses | 450 | 2,350 | 3,510 | 5,570 | 8,540 | 2,388 | 552 | 15 | 245 | 385 | ||||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 23,977 | 21,377 | 20,245 | 19,527 | 14,808 | 19,846 | 17,334 | 19,227 | 20,021 | 19,371 | ||||||||||||||||||||||||||||||

| Noninterest income | 5,359 | 7,536 | 6,247 | 5,790 | 5,602 | 4,528 | 4,431 | 4,219 | 3,540 | 3,312 | ||||||||||||||||||||||||||||||

| Noninterest expense | 19,821 | 20,119 | 19,928 | 19,341 | 18,735 | 16,999 | 14,525 | 14,296 | 13,771 | 13,174 | ||||||||||||||||||||||||||||||

| Net noninterest expense | 14,462 | 12,583 | 13,681 | 13,551 | 13,133 | 12,471 | 10,094 | 10,077 | 10,231 | 9,862 | ||||||||||||||||||||||||||||||

| Income tax expenses/(benefit) | 2,397 | 1,941 | 1,179 | 797 | (813 | ) | 1,445 | 1,651 | 2,674 | 3,118 | 3,219 | |||||||||||||||||||||||||||||

| Cumulative effect of changes in accounting | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

| Net income | $ | 7,118 | $ | 6,853 | $ | 5,385 | $ | 5,179 | $ | 2,488 | $ | 5,930 | $ | 5,589 | $ | 6,475 | $ | 6,672 | $ | 6,290 | ||||||||||||||||||||

| Basic earnings per common share | $ | 2.50 | $ | 2.41 | $ | 1.90 | $ | 1.83 | $ | 0.88 | $ | 2.11 | $ | 1.99 | $ | 2.32 | $ | 2.40 | $ | 2.28 | ||||||||||||||||||||

| Diluted earnings per common share | $ | 2.50 | $ | 2.41 | $ | 1.90 | $ | 1.83 | $ | 0.88 | $ | 2.10 | $ | 1.98 | $ | 2.30 | $ | 2.37 | $ | 2.24 | ||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.85 | $ | 0.72 | $ | 0.60 | $ | 0.72 | $ | 1.21 | $ | 1.44 | $ | 1.44 | $ | 1.40 | $ | 1.32 | $ | 1.24 | ||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||||||

| Balance Sheet: | ||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 693,453 | $ | 691,845 | $ | 651,758 | $ | 631,053 | $ | 661,017 | $ | 664,732 | $ | 628,718 | $ | 617,518 | $ | 627,439 | $ | 557,393 | ||||||||||||||||||||

| Loans receivable | 437,821 | 436,981 | 401,401 | 418,233 | 458,245 | 489,509 | 468,459 | 471,716 | 469,043 | 433,790 | ||||||||||||||||||||||||||||||

| Investment securities | 194,296 | 187,475 | 186,962 | 160,452 | 144,333 | 126,722 | 114,644 | 99,012 | 79,979 | 79,979 | ||||||||||||||||||||||||||||||

| Deposits | 572,893 | 566,409 | 526,881 | 520,271 | 540,527 | 528,148 | 512,931 | 512,931 | 525,731 | 451,573 | ||||||||||||||||||||||||||||||

| Borrowed funds | 44,929 | 49,505 | 52,013 | 48,618 | 63,022 | 74,795 | 76,930 | 51,501 | 51,152 | 57,201 | ||||||||||||||||||||||||||||||

| Total stockholders' equity | 66,761 | 67,651 | 62,960 | 56,089 | 53,078 | 52,773 | 52,733 | 49,902 | 46,433 | 44,097 | ||||||||||||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||||||

| Interest Rate Spread During Period: | ||||||||||||||||||||||||||||||||||||||||

| Average effective yield on loans and investment securities | 4.03 | % | 4.14 | % | 4.50 | % | 4.84 | % | 5.16 | % | 5.78 | % | 6.21 | % | 6.02 | % | 5.49 | % | 5.31 | % | ||||||||||||||||||||

| Average effective cost of deposits and borrowings | 0.28 | % | 0.39 | % | 0.56 | % | 0.82 | % | 1.45 | % | 2.19 | % | 3.18 | % | 2.77 | % | 1.82 | % | 1.40 | % | ||||||||||||||||||||

| Interest rate spread | 3.75 | % | 3.75 | % | 3.94 | % | 4.02 | % | 3.71 | % | 3.59 | % | 3.03 | % | 3.25 | % | 3.67 | % | 3.91 | % | ||||||||||||||||||||

| Net interest margin | 3.77 | % | 3.77 | % | 3.96 | % | 4.04 | % | 3.74 | % | 3.65 | % | 3.10 | % | 3.31 | % | 3.71 | % | 3.94 | % | ||||||||||||||||||||

| Return on average assets | 1.03 | % | 1.02 | % | 0.84 | % | 0.77 | % | 0.37 | % | 0.91 | % | 0.91 | % | 1.04 | % | 1.14 | % | 1.17 | % | ||||||||||||||||||||

| Return on average equity | 10.17 | % | 10.27 | % | 8.90 | % | 9.03 | % | 4.55 | % | 10.96 | % | 10.78 | % | 13.42 | % | 14.67 | % | 14.64 | % | ||||||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 15.6 | % | 14.6 | % | 14.3 | % | 12.9 | % | 11.5 | % | 12.0 | % | 12.0 | % | 11.1 | % | 10.7 | % | 11.2 | % | ||||||||||||||||||||

| Total capital to risk-weighted assets | 14.3 | % | 13.4 | % | 13.1 | % | 11.7 | % | 10.3 | % | 10.8 | % | 11.0 | % | 12.1 | % | 11.6 | % | 12.2 | % | ||||||||||||||||||||

| Tier 1 capital leverage ratio | 10.0 | % | 9.4 | % | 9.2 | % | 8.5 | % | 7.8 | % | 8.2 | % | 8.3 | % | 8.0 | % | 7.9 | % | 8.0 | % | ||||||||||||||||||||

| Allowance for loan losses to total loans | 1.64 | % | 1.93 | % | 1.99 | % | 2.18 | % | 1.33 | % | 1.19 | % | 0.98 | % | 0.90 | % | 0.89 | % | 0.90 | % | ||||||||||||||||||||

| Allowance for loan losses to non-performing loans | 181.81 | % | 73.34 | % | 56.03 | % | 37.82 | % | 32.93 | % | 46.97 | % | 53.16 | % | 153.95 | % | 198.00 | % | 371.00 | % | ||||||||||||||||||||

| Non-performing loans to total loans | 0.90 | % | 2.63 | % | 3.56 | % | 5.77 | % | 4.05 | % | 2.54 | % | 1.02 | % | 0.58 | % | 0.45 | % | 0.24 | % | ||||||||||||||||||||

| Total loan accounts | 4,416 | 4,416 | 4,567 | 4,594 | 4,846 | 5,193 | 5,268 | 5,422 | 5,370 | 5,213 | ||||||||||||||||||||||||||||||

| Total deposit accounts | 27,970 | 27,790 | 28,303 | 28,912 | 32,616 | 33,692 | 30,760 | 33,963 | 32,866 | 32,502 | ||||||||||||||||||||||||||||||

| Total branches (all full service) | 12 | 12 | 12 | 12 | 11 | 10 | 9 | 8 | 8 | 8 | ||||||||||||||||||||||||||||||

(1) Includes the $1.6 million one-time special assessment on FDIC-assessable deposits to recapitalize SAIF.

| 6 |

Business

NorthWest Indiana Bancorp (the Bancorp) is a bank holding company registered with the Board of Governors of the Federal Reserve System. Peoples Bank (the Bank), an Indiana bank, is a wholly owned subsidiary of the Bancorp. The Bancorp has no other business activity other than being the holding company for the Bank.

The Bancorp conducts business from its Corporate Center in Munster and its twelve full-service offices located in Crown Point, Dyer, East Chicago, Gary, Hammond, Hobart, Merrillville, Munster, St. John, Schererville, and Valparaiso, Indiana. The Bancorp is primarily engaged in the business of attracting deposits from the general public and the origination of loans secured by single family residences and commercial real estate, as well as, construction loans, various types of consumer loans and commercial business loans, and loans to local municipalities. In addition, the Bancorp's Wealth Management Group provides estate and retirement planning, guardianships, land trusts, profit sharing and 401(k) retirement plans, IRA and Keogh accounts, and investment agency accounts. The Wealth Management Group may also serve as the personal representative of estates and act as trustee for revocable and irrevocable trusts.

The Bancorp's common stock is traded in the over-the-counter market and is quoted on the OTC Bulletin Board. On January 31, 2014, the Bancorp had 2,841,164 shares of common stock outstanding and 407 stockholders of record. This does not reflect the number of persons or entities who may hold their stock in nominee or "street" name through brokerage firms.

| 7 |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

General

The Bancorp's earnings are dependent upon the earnings of the Bank. The Bank's earnings are primarily dependent upon net interest margin. The net interest margin is the difference between interest income earned on loans and investments and interest expense paid on deposits and borrowings stated as a percentage of average interest earning assets. The net interest margin is perhaps the clearest indicator of a financial institution's ability to generate core earnings. Fees and service charges, wealth management operations income, gains and losses from the sale of assets, provisions for loan losses, income taxes and operating expenses also affect the Bancorp's profitability.

A summary of the Bancorp’s significant accounting policies is detailed in Note 1 to the Bancorp’s consolidated financial statements included in this report. The preparation of our financial statements requires management to make estimates and assumptions that affect our financial condition and operating results. Actual results could differ from those estimates. Estimates associated with the allowance for loan losses, fair values of foreclosed real estate, financial instruments and status of contingencies are particularly susceptible to material change in the near term as further information becomes available and future events occur.

At December 31, 2013, the Bancorp had total assets of $693.5 million and total deposits of $572.9 million. The Bancorp's deposit accounts are insured up to applicable limits by the Deposit Insurance Fund (DIF) that is administered by the Federal Deposit Insurance Corporation (FDIC), an agency of the federal government. At December 31, 2013, stockholders' equity totaled $66.8 million, with book value per share at $23.50. Net income for 2013 was $7.1 million, or $2.50 basic and diluted earnings per common share. The return on average assets was 1.03%, while the return on average stockholders’ equity was 10.17%.

Recent Developments

The Current Economic and Regulatory Environment. We continue to operate in an uncertain economic and regulatory environment, which presents risks associated with our business. In this regard, the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") contains comprehensive provisions governing the practices and oversight of large and small financial institutions alike, including several provisions that profoundly affect the regulation of community banks, thrifts, and small bank and thrift holding companies, such as the Bancorp. The Dodd-Frank Act also established a new financial regulator, the Consumer Financial Protection Bureau (the "CFPB"), which has broad authority to regulate consumer financial products and services and entities offering such products and services, including banks. Additional legislative or regulatory action that may impact our business may result from the numerous provisions and multiple studies mandated under the Dodd-Frank Act.

The evolving regulatory environment causes uncertainty with respect to the manner in which we conduct our business and requirements that may be imposed by our regulators. Regulators have implemented and continue to propose new regulations and supervisory guidance and have been increasing their examination and enforcement action activities. We expect that regulators will continue taking formal enforcement actions against financial institutions in addition to addressing supervisory concerns through non-public supervisory actions or criticisms. We are unable to predict the nature, extent or impact of any additional changes to statutes or regulations, including the interpretation, implementation or enforcement thereof, that may occur in the future.

The impact of the evolving regulatory environment on our business and operations depends upon final implementing regulations and guidance issued by the regulatory agencies, the actions of our competitors, and other marketplace participants, and the behavior of consumers. Regulatory actions could require us to limit or change our business practices, limit our ability to pursue business opportunities, limit our product offerings, require continued investment of management time and resources in compliance efforts, limit fees we can charge for services, require us to meet more stringent capital, liquidity, and leverage ratio requirements (including those under Basel III, as discussed below), increase costs, impact the value of our assets, or otherwise adversely affect our business.

Compliance and other regulatory requirements and expenditures have increased for the Bancorp and other financial institutions, and we expect them to continue to increase as regulators adopt new rules and increase their scrutiny of financial institutions, including controls and operational processes. The additional expense, time, and resources needed to comply with ongoing regulatory requirements may impact our business and results of operations.

New Capital Rules. On July 2, 2013, the Federal Reserve approved final rules that substantially amend the regulatory risk-based capital rules applicable to the Bancorp and the Bank. The FDIC and the Office of the Comptroller of the Currency (“OCC”) have subsequently approved these rules. The final rules were adopted following the issuance of proposed rules by the Federal Reserve in June 2012, and implement the “Basel III” regulatory capital reforms and changes required by the Dodd-Frank Act. “Basel III” refers to two consultative documents released by the Basel Committee on Banking Supervision in December 2009, the rules text released in December 2010, and loss absorbency rules issued in January 2011, which include significant changes to bank capital, leverage and liquidity requirements.

| 8 |

The rules include new risk-based capital and leverage ratios, which would be phased in from 2015 to 2019, and would refine the definition of what constitutes “capital” for purposes of calculating those ratios. The new minimum capital level requirements applicable to the Bancorp and the Bank under the final rules would be: (i) a new common equity Tier 1 capital ratio of 4.5%; (ii) a Tier 1 capital ratio of 6% (increased from 4%); (iii) a total capital ratio of 8% (unchanged from current rules); and (iv) a Tier 1 leverage ratio of 4% for all institutions. The final rules also establish a “capital conservation buffer” above the new regulatory minimum capital requirements, which must consist entirely of common equity Tier 1 capital. The capital conservation buffer will be phased-in over four years beginning on January 1, 2016, as follows: the maximum buffer will be 0.625% of risk-weighted assets for 2016, 1.25% for 2017, 1.875% for 2018, and 2.5% for 2019 and thereafter. This will result in the following minimum ratios beginning in 2019: (i) a common equity Tier 1 capital ratio of 7.0%, (ii) a Tier 1 capital ratio of 8.5%, and (iii) a total capital ratio of 10.5%. Under the final rules, institutions are subject to limitations on paying dividends, engaging in share repurchases, and paying discretionary bonuses if its capital level falls below the buffer amount. These limitations establish a maximum percentage of eligible retained income that could be utilized for such actions.

Basel III provided discretion for regulators to impose an additional buffer, the “countercyclical buffer,” of up to 2.5% of common equity Tier 1 capital to take into account the macro-financial environment and periods of excessive credit growth. However, the final rules permit the countercyclical buffer to be applied only to “advanced approach banks” (i.e. , banks with $250 billion or more in total assets or $10 billion or more in total foreign exposures), which currently excludes the Bancorp and the Bank. The final rules also implement revisions and clarifications consistent with Basel III regarding the various components of Tier 1 capital, including common equity, unrealized gains and losses, as well as certain instruments that will no longer qualify as Tier 1 capital, some of which will be phased out over time. However, the final rules provide that small depository institution holding companies with less than $15 billion in total assets as of December 31, 2009 (which includes the Bancorp) will be able to permanently include non-qualifying instruments that were issued and included in Tier 1 or Tier 2 capital prior to May 19, 2010 in additional Tier 1 or Tier 2 capital until they redeem such instruments or until the instruments mature.

The final rules also contain revisions to the prompt corrective action framework, which is designed to place restrictions on insured depository institutions, including the Bank, if their capital levels begin to show signs of weakness. These revisions take effect January 1, 2015. Under the prompt corrective action requirements, which are designed to complement the capital conservation buffer, insured depository institutions will be required to meet the following increased capital level requirements in order to qualify as “well capitalized:” (i) a new common equity Tier 1 capital ratio of 6.5%; (ii) a Tier 1 capital ratio of 8% (increased from 6%); (iii) a total capital ratio of 10% (unchanged from current rules); and (iv) a Tier 1 leverage ratio of 5% (increased from 4%).

The final rules set forth certain changes for the calculation of risk-weighted assets, which we will be required to utilize beginning January 1, 2015. The standardized approach final rule utilizes an increased number of credit risk exposure categories and risk weights, and also addresses: (i) an alternative standard of creditworthiness consistent with Section 939A of the Dodd-Frank Act; (ii) revisions to recognition of credit risk mitigation; (iii) rules for risk weighting of equity exposures and past due loans; (iv) revised capital treatment for derivatives and repo-style transactions; and (v) disclosure requirements for top-tier banking organizations with $50 billion or more in total assets that are not subject to the “advance approach rules” that apply to banks with greater than $250 billion in consolidated assets. Based on our current capital composition and levels, we believe that we would be in compliance with the requirements as set forth in the final rules if they were presently in effect.

Acquisition Activity. On December 20, 2013, the Bank signed a definitive agreement to acquire First Federal Savings and Loan Association of Hammond (the “Association”), a federal mutual savings association headquartered in Hammond, Indiana. The Bank will acquire the Association by merging the Association with and into the Bank immediately following the Association’s voluntary supervisory conversion from mutual to stock form. Neither the Bancorp nor the Bank will issue or pay any shares, cash, or other consideration in the merger. The Bank’s acquisition of the Association is subject to customary closing conditions, including regulatory approvals by the OCC, FDIC, and DFI. No approval of the members of the Association is required for the transaction. The Bank and the Association make certain customary representations and warranties in the definitive acquisition agreement, which will terminate at the closing. The Association has a home office and branch office in Lake County, Indiana, and is expected to add approximately $40.7 million in assets to the Bank, based on the Association’s September 30, 2013 financial statements. The merger is expected to close in the second quarter of 2014.

| 9 |

Financial Condition

During the year ended December 31, 2013, total assets increased by $1.6 million (0.2%), to $693.5 million, with interest-earning assets decreasing by $8.4 million (1.3%). At December 31, 2013, interest-earning assets totaled $644.7 million and represented 93.0% of total assets. Loans totaled $437.8 million and represented 67.9% of interest-earning assets, 63.1% of total assets and 76.4% of total deposits. The loan portfolio, which is the Bancorp’s largest asset, is a significant source of both interest and fee income. The Bancorp’s lending strategy emphasizes quality growth, product diversification, and competitive and profitable pricing. The loan portfolio includes $161.9 million (36.9%) in residential real estate loans, $144.4 million (33.0%) in commercial real estate loans, $57.8 million (13.2%) in commercial business loans, $30.8 million (7.0%) in multifamily loans, $21.5 million (4.9%) in construction and land development loans, $21.6 million (4.9%) in government and other loans, and $237 thousand (0.1%) in consumer loans. Adjustable rate loans comprised 59.7% of total loans at year-end. During 2013, loan balances increased by $840 thousand (0.2%), with government, residential real estate, and home equity line of credit balances increasing while commercial business, commercial real estate, construction and land development, and multifamily balances decreased. The increase in loans during the year is the result of improving credit and economic conditions.

The Bancorp is primarily a portfolio lender. Mortgage banking activities historically have been limited to the sale of fixed rate mortgage loans with contractual maturities greater than 15 years. However, during 2012, as a result of the low interest rate environment, management began selling some newly originated fixed rate mortgage loans with contractual maturities greater than 10 years in an effort to reduce interest rate risk. These loans are identified as held for sale when originated and sold, on a loan-by-loan basis, in the secondary market. During 2013, the Bancorp sold $13.2 million in newly originated fixed rate mortgage loans, compared to $26.4 million during 2012. Net gains realized from the mortgage loan sales totaled $379 thousand for 2013, compared to $804 thousand for 2012. Also, during the second quarter of 2012, the Bancorp conducted a $3.4 million one-time sale of portfolio fixed rate mortgage loans, which the Bancorp’s management considered an interest rate risk mitigation strategy to reduce loan prepayment risk. The segment of loans that were sold had a higher premium value and was projected to prepay significantly faster than the mortgage portfolio's average repayment speed. The gain realized from the prepayment risk reduction strategy totaled $183 thousand and was recorded during the second quarter of 2012. The proceeds from the loan sale were used to fund loans with longer durations and similar yields to the loans that were included in the sales strategy. At December 31, 2013, the Bancorp had $136 thousand in loans that were classified as held for sale.

The allowance for loan losses (ALL) is a valuation allowance for probable incurred credit losses, increased by the provision for loan losses, and decreased by charge-offs net of recoveries. A loan is charged off against the allowance by management as a loss when deemed uncollectible, although collection efforts continue and future recoveries may occur. The determination of the amounts of the ALL and provisions for loan losses is based on management’s current judgments about the credit quality of the loan portfolio with consideration given to all known relevant internal and external factors that affect loan collectability as of the reporting date. The appropriateness of the current period provision and the overall adequacy of the ALL are determined through a disciplined and consistently applied quarterly process that reviews the Bancorp’s current credit risk within the loan portfolio and identifies the required allowance for loan losses given the current risk estimates.

Non-performing loans include those loans that are 90 days or more past due and those loans that have been placed on non-accrual status. Non-performing loans totaled $4.0 million at December 31, 2013, compared to $11.5 million at December 31, 2012, a decrease of $7.5 million or 65.2%. The ratio of non-performing loans to total loans was 0.90% at December 31, 2013, compared to 2.63% at December 31, 2012. The ratio of non-performing loans to total assets was 0.57% at December 31, 2013, compared to 1.66% at December 31, 2012. The decrease in non-performing loans for 2013 is related to loans moving off of non-accrual status, pay downs and charge-offs. At December 31, 2013, all non-performing loans are also accounted for on a non accrual basis, except for three loans totaling $174 thousand that were classified as accruing and 90 days past due.

Loans, internally classified as substandard, totaled $12.2 million at December 31, 2013, compared to $19.7 million at December 31, 2012 a decrease of $7.5 million or 38.1%. The current level of substandard loans is concentrated in one accruing commercial real estate hotel loan in the amount of $4.8 million which is the largest loan in this group. Substandard loans include non-performing loans and potential problem loans, where information about possible credit issues or other conditions causes management to question the ability of such borrowers to comply with loan covenants or repayment terms. No loans were internally classified as doubtful or loss at December 31, 2013 or December 31, 2012. In addition to identifying and monitoring non-performing and other classified loans, management maintains a list of watch loans. Watch loans represent loans management is closely monitoring due to one or more factors that may cause the loan to become classified as substandard. Watch loans totaled $7.5 million at December 31, 2013, compared to $17.7 million at December 31, 2012 a decrease of $10.2 million or 57.6%. The decrease in watch loans is related to the upgrades and balance reductions of commercial real estate and commercial business loan balances, including the complete payoff of all out-of-market participation loans.

| 10 |

A loan is considered impaired when, based on current information and events, it is probable that a borrower will be unable to pay all amounts due according to the contractual terms of the loan agreement. At December 31, 2013, impaired loans totaled $9.9 million, compared to $19.9 million at December 31, 2012 a decrease of $10.0 million or 50.3%. The December 31, 2013, impaired loan balances consist of ten commercial real estate and commercial business loans totaling $9.0 million that are secured by business assets and real estate, and are personally guaranteed by the owners of the businesses. In addition, seven mortgage loans totaling $887 thousand, which are troubled debt restructurings have also been classified as impaired. The December 31, 2013 ALL contained $1.7 million in specific allowances for collateral deficiencies, compared to $2.0 million at December 31, 2012. Typically, management does not individually classify smaller-balance homogeneous loans, such as residential mortgages or consumer loans, as impaired, unless they are troubled debt restructurings.

At December 31, 2013, the Bancorp classified eleven loans totaling $9.3 million as troubled debt restructurings, which involves modifying the terms of a loan to forego a portion of interest or principal or reducing the interest rate on the loan to a rate materially less than market rates, or materially extending the maturity date of a loan. The Bancorp’s troubled debt restructurings includes one commercial real estate hotel loan in the amount of $4.8 million, for which significant deferrals of principal repayments were granted; one commercial real estate loan in the amount of $2.4 million for which a significant deferral of principal and interest repayment was granted; one commercial real estate loan in the amount of $535 thousand for which a significant deferral of principal and interest repayment was granted by the Bank as required by a bankruptcy plan; one development loan in the amount of $707 thousand for which credit underwriting concessions were granted; and seven mortgage loans totaling $887 thousand, for which maturity dates were materially extended. At December 31, 2013, $8.1 million of the Bancorp’s loans classified as troubled debt restructurings are accruing loans. The valuation basis for the Bancorp’s troubled debt restructurings is based on the present value of cash flows, unless consistent cash flows are not present, then the fair value of the collateral securing the loan is the basis for valuation.

At December 31, 2013, management is of the opinion that there are no loans, except those discussed above, where known information about possible credit problems of borrowers causes management to have serious doubts as to the ability of such borrowers to comply with the present loan repayment terms and which will imminently result in such loans being classified as past due, non-accrual or a troubled debt restructure. Management does not presently anticipate that any of the non-performing loans or classified loans would materially impact future operations, liquidity or capital resources.

For 2013, $450 thousand in provisions to the ALL were required, compared to $2.4 million for 2012 a decrease of $1.9 million or 80.8%. The ALL provision decrease for 2013 is primarily a result of improved asset quality. The current year ALL provisions were primarily related to the current credit risk in the commercial real estate loan portfolio and 2013 loan originations. For 2013, charge-offs, net of recoveries, totaled $1.7 million, compared to $1.9 million for 2012. The net loan charge-offs for 2013 were comprised of $788 thousand in commercial real estate loans, $567 thousand in commercial business loans, $332 thousand in commercial real estate participation loans, $153 thousand in residential real estate loans, and $17 thousand in consumer loans. The ALL provisions take into consideration management’s current judgments about the credit quality of the loan portfolio, loan portfolio balances, changes in the portfolio mix and local economic conditions. In determining the provision for loan losses for the current period, management has given consideration to historically elevated risks associated with the local economy, changes in loan balances and mix, and asset quality.

The ALL to total loans was 1.64% at December 31, 2013, compared to 1.93% at December 31, 2012. The ALL to non-performing loans (coverage ratio) was 181.82% at December 31, 2013, compared to 73.34% at December 31, 2012. The December 31, 2013 balance in the ALL account of $7.2 million is considered adequate by management after evaluation of the loan portfolio, past experience and current economic and market conditions. While management may periodically allocate portions of the allowance for specific problem loans, the whole allowance is available for any loan charge offs that occur. The allocation of the ALL reflects performance and growth trends within the various loan categories, as well as consideration of the facts and circumstances that affect the repayment of individual loans, and loans which have been pooled as of the evaluation date, with particular attention given to non-performing loans and loans which have been classified as substandard, doubtful or loss. Management has allocated reserves to both performing and non-performing loans based on current information available.

At December 31, 2013, foreclosed real estate totaled $1.1 million, which was comprised of nine properties, compared to $425 thousand and ten properties at December 31, 2012. During 2013, loans totaling $1.6 million were transferred into foreclosed real estate, while net sales of foreclosed real estate totaled $369 thousand. Most transfers to foreclosed real estate occurred during the last five months of the year. Net gains from the 2013 sales totaled $17 thousand. At the end of December 2013 all of the Bancorp’s foreclosed real estate is located within its primary market area.

| 11 |

At December 31, 2013, the Bancorp's investment portfolio totaled $194.3 million and was invested as follows: 51.7% in U.S. government agency mortgage-backed securities and collateralized mortgage obligations, 37.9% in municipal securities, 9.4% in U.S. government agency debt securities, and 1.0% in trust preferred securities. During 2013, securities increased by $6.8 million (3.6%). In addition, at December 31, 2013, the Bancorp had $3.1 million in FHLB stock.

As of December 31, 2013, three of the Bancorp’s four investments in trust preferred securities are in “payment in kind” status. Payment in kind status results in a temporary delay in the payment of interest. As a result of a delay in the collection of the interest payments, management placed these securities on non-accrual status. At December 31, 2013, the cost basis of the three trust preferred securities on non-accrual status totaled $3.9 million. Current estimates indicate that the interest payment delays may continue through 2019. One trust preferred security with a cost basis of $1.3 million remains on accrual status.

Deposits are a fundamental and cost-effective source of funds for lending and other investment purposes. The Bancorp offers a variety of products designed to attract and retain customers, with the primary focus on building and expanding relationships. At December 31, 2013, deposits totaled $572.9 million. During 2013, deposits increased by $6.5 million (1.1%). The 2013 change in deposits was comprised of the following: certificates of deposit decreased by $16.1 million (9.3%), checking accounts increased by $3.7 million (2.0%), savings accounts increased by $6.8 million (8.8%), and money market deposit accounts (MMDA’s) increased by $12.1 million (9.7%). During 2013, management continues to allow higher cost certificates of deposit to mature while relying on funding from checking, MMDA, and savings deposits. The increase in checking, savings, and MMDA balances is a result of customer preferences for liquid investments in the current low interest rate environment.

The Bancorp’s borrowed funds are primarily comprised of repurchase agreements and FHLB advances that are used to fund asset growth not supported by deposit generation. At December 31, 2013, borrowed funds totaled $44.9 million compared to $49.5 million at December 31, 2012, a decrease of $4.6 million (9.3%). During 2013, management reduced borrowed funds while relying more on low cost core deposits for funding. Retail repurchase agreements totaled $14.0 million at December 31, 2013, compared to $16.3 million at December 31, 2012, a decrease of $2.3 million (7.0%). FHLB advances totaled $30.9 million, decreasing $2.3 million or 13.9%. The Bancorp’s FHLB line of credit carried a balance of $714 thousand at December 31, 2013 compared to no balance at December 31, 2012. Other short-term borrowings totaled $84 thousand at December 31, 2013, compared to $207 thousand at December 31, 2012.

Liquidity and Capital Resources

The Bancorp’s primary goals for funds and liquidity management are to generate sufficient cash to fund current loan demand, meet deposit withdrawals, and pay dividends and operating expenses. Because profit and liquidity are often conflicting objectives, management attempts to maximize the Bank’s net interest margin by making adequate, but not excessive, liquidity provisions. Furthermore, funds are managed so that future profits will not be significantly impacted as funding costs increase.

Changes in the liquidity position result from operating, investing and financing activities. Cash flows from operating activities are generally the cash effects of transactions and other events that enter into the determination of net income. The primary investing activities include loan originations, loan repayments, investments in interest bearing balances in financial institutions, and the purchase, sale, and maturity of investment securities. Financing activities focus almost entirely on the generation of customer deposits. In addition, the Bancorp utilizes borrowings (i.e., repurchase agreements, FHLB advances and federal funds purchased) as a source of funds.

During 2013, cash and cash equivalents decreased $12.6 million compared to an increase of $7.4 million for 2012. During 2013, the primary sources of cash and cash equivalents were from maturities and sales of securities, deposit originations, loan sales and repayments, an FHLB advance, and cash from operating activities. The primary uses of cash and cash equivalents were loan originations, purchase of securities, expenditures for premises and equipment, FHLB advance repayments, and the payment of common stock dividends. During 2013, cash from operating activities totaled $7.2 million, compared to $8.5 million for 2012. The 2013 decrease in cash provided by operating activities was primarily a result of timing differences of customer ACH deposit activity. Cash outflows from investing activities totaled $19.2 million during 2013, compared to outflows of $36.3 million during 2012. The changes for the current year were related to increased loan originations, the purchase of loan participations, purchases of securities, and increased investment in premises and equipment as detailed in the notes to the financial statements. Net cash outflows from financing activities totaled $600 thousand in 2013, compared to net cash inflows of $35.2 million in 2012. The change during 2013 was primarily due to a decrease in FHLB advances and other borrowed funds as detailed in the notes to the financial statements. The Bancorp paid dividends on common stock on a cash basis of $2.3 million and $1.9 million during 2013 and 2012, respectively. During 2013, the Bancorp’s Board of Directors increased dividends as earnings and capital improved.

Management strongly believes that safety and soundness is enhanced by maintaining a high level of capital. Stockholders' equity totaled $66.8 million at December 31, 2013, compared to $67.7 million at December 31, 2012, a decrease of $0.9 million (1.3%). The decrease was primarily the result of $5.5 million change in other comprehensive income for 2013 related to decreases in the values of available-for-sale securities. Additional items decreasing stockholders' equity was $142 thousand from the sale of treasury stock, and the Bancorp’s declaration of $2.4 million in cash dividends. Increasing stockholders' equity was net income of $7.1 million. At December 31, 2013, book value per share was $23.50 compared to $23.83 for 2012.

| 12 |

The Bancorp is subject to risk-based capital guidelines adopted by the Board of Governors of the Federal Reserve System (the FRB), and the Bank is subject to risk-based capital guidelines adopted by the FDIC. As applied to the Bancorp and the Bank, the FRB and FDIC capital requirements are substantially the same. These regulations divide capital into two tiers. The first tier (Tier 1) includes common equity, certain non-cumulative perpetual preferred stock and minority interests in equity accounts of consolidated subsidiaries, less goodwill and certain other intangible assets. Supplementary (Tier 2) capital includes, among other things, cumulative perpetual and long-term limited-life preferred stock, mandatory convertible securities, certain hybrid capital instruments, term subordinated debt and the allowance for loan losses, subject to certain limitations, less required deductions. The Bancorp and the Bank are required to maintain a total risk-based capital ratio of 8%, of which 4% must be Tier 1 capital. In addition, the FRB and FDIC regulations provide for a minimum Tier 1 leverage ratio (Tier 1 capital to adjusted average assets) of 3% for financial institutions that meet certain specified criteria, including that they have the highest regulatory rating and are not experiencing or anticipating significant growth. All other financial institutions are required to maintain a Tier 1 leverage ratio of 3% plus an additional cushion of at least one to two percent.

The following table shows that, at December 31, 2013, the Bancorp’s capital exceeded all regulatory capital requirements. At December 31, 2013, the Bancorp’s and the Bank’s regulatory capital ratios were substantially the same. The dollar amounts are in millions.

| Minimum | ||||||||||||||||||||||||

| Required To Be | ||||||||||||||||||||||||

| Well Capitalized | ||||||||||||||||||||||||

| Minimum Required | Under Prompt | |||||||||||||||||||||||

| For Capital | Corrective | |||||||||||||||||||||||

| Actual | Adequacy Purposes | Action Regulations | ||||||||||||||||||||||

| At December 31, 2013 | Amount | Ratio | Amount | Ratio | Amount | Ratio | ||||||||||||||||||

| Total capital to risk-weighted assets | $ | 75.0 | 15.6 | % | $ | 38.5 | 8.0 | % | $ | 48.2 | 10.0 | % | ||||||||||||

| Tier 1 capital to risk-weighted assets | $ | 69.0 | 14.3 | % | $ | 19.3 | 4.0 | % | $ | 28.9 | 6.0 | % | ||||||||||||

| Tier 1 capital to adjusted average assets | $ | 69.0 | 10.0 | % | $ | 20.8 | 3.0 | % | $ | 34.6 | 5.0 | % | ||||||||||||

The Bancorp’s ability to pay dividends to its shareholders is entirely dependent upon the Bank’s ability to pay dividends to the Bancorp. Under Indiana law, the Bank may pay dividends from its undivided profits (generally, earnings less losses, bad debts, taxes and other operating expenses) as is considered expedient by the Bank’s Board of Directors. However, the Bank must obtain the approval of the Indiana Department of Financial Institutions (DFI) for the payment of a dividend if the total of all dividends declared by the Bank during the current year, including the proposed dividend, would exceed the sum of retained net income for the year to date plus its retained net income for the previous two years. For this purpose, “retained net income,” means net income as calculated for call report purposes, less all dividends declared for the applicable period. An exemption from DFI approval would require that the Bank have been assigned a composite uniform financial institutions rating of 1 or 2 as a result of the most recent federal or state examination; the proposed dividend would not result in a Tier 1 leverage ratio below 7.5%; and that the Bank not be subject to any corrective action, supervisory order, supervisory agreement, or board approved operating agreement. The aggregate amount of dividends that may be declared by the Bank in 2013, with prior DFI approval is $9.4 million plus 2013 net profits. Moreover, the FDIC and the Federal Reserve Board may prohibit the payment of dividends if it determines that the payment of dividends would constitute an unsafe or unsound practice in light of the financial condition of the Bank. On November 22, 2013, the Board of Directors of the Bancorp declared a fourth quarter dividend of $0.22 per share. The Bancorp’s fourth quarter dividend was paid to shareholders on January 4, 2014.

Results of Operations –

Comparison of 2013 to 2012

Net income for 2013 was $7.1 million, compared to $6.9 million for 2012, an increase of $265 thousand (3.9%). The increase in net income for 2013 was the result of lower required provisions for loan losses, and higher net interest income, and lower noninterest expense. The earnings represent a return on average assets of 1.03% for 2013 compared to 1.02% for 2012. The return on average equity was 10.17% for 2013 compared to 10.27% for 2012.

Net interest income for 2013 was $24.4 million, an increase of $700 thousand (3.0%) from $23.7 million for 2012. During the year, the Bancorp’s cost of funds continued to be positively impacted by the Federal Reserve’s actions in maintaining a low short-term interest rate environment, however, the Bancorp’s yield on interest earning assets is being negatively impacted by lower long-term interest rates. The weighted-average yield on interest-earning assets was 4.03% for 2013 compared to 4.14% for 2012. The weighted-average cost of funds was 0.28% for 2013 compared to 0.39% for 2012. The impact of the 4.03% return on interest earning assets and the 0.28% cost of funds resulted in a net interest spread of 3.75% for 2013, which was unchanged compared to 2012. During 2013, total interest income increased by $82 thousand (0.3%) while total interest expense decreased by $618 thousand (26.3%). The net interest margin was 3.77% for 2013, which was unchanged compared to 2012. The Bancorp’s tax equivalent net interest margin for 2013 was 3.98% compared to 3.96% for 2012.

| 13 |

During 2013, interest income from loans increased by $226 thousand (1.1%) compared to 2012. The increase was primarily due to the receipt of $1.4 million of interest from a previously non-performing loan. The weighted-average yield on loans outstanding was 4.79% for 2013 compared to 4.88% for 2012. Loan balances averaged $436.4 million for 2013, an increase of $12.8 million (3.0%) from $423.6 million for 2012. During 2013, interest income from securities and other interest earning assets decreased by $144 thousand (2.6%) compared to 2012. The decrease was due to a decrease in the weighted average yield. The weighted-average yield on securities and other interest earning assets was 2.48% for 2013 compared to 2.62% for 2012. Securities and other interest earning assets averaged $212.3 million for 2013, up $6.0 million (2.9%) from $206.3 million for 2012.

Interest expense for deposits decreased by $432 thousand (27.4%) during 2013 compared to 2012. The change was due to a decrease in the weighted-average rate paid on deposits. The weighted-average rate paid on deposits for 2013 was 0.20% compared to 0.29% for 2012. Total deposit balances averaged $563.3 million for 2013, an increase of $24.7 million (4.6%) from $538.6 million for 2012. Interest expense for borrowed funds decreased by $186 thousand (24.1%) during 2013 compared to 2012. The change was due to higher average balances. The weighted-average cost of borrowed funds was 1.15% for 2013 compared to 1.32% for 2012. Borrowed funds averaged $51.1 million during 2013, a decrease of $7.6 million (12.9%) from $58.7 million for 2012.

Noninterest income for 2013 was $5.4 million, a decrease of $2.2 million (28.9%) from $7.5 million for 2012. During 2013, fees and service charges totaled $2.5 million, a decrease of $140 thousand (5.2%) from $2.7 million for 2012. The decrease was the result of lower loan and consumer deposit related fees. Fees from Wealth Management operations totaled $1.4 million for 2013, an increase of $133 thousand (10.5%) from $1.3 million for 2012. The increase in Wealth Management income is related to growth in assets under management and market value changes. Gains from the sale of securities totaled $630 thousand for the current year, a decrease of $490 thousand (43.8 %) from $1.1 million for 2012. Current market conditions continue to provide opportunities to manage securities cash flows, while recognizing gains from the sales of securities. Gains from loan sales totaled $379 thousand for the current year, a decrease of $608 thousand (61.6%), compared to $987 thousand for 2012. The decrease in gains from the sale of loans is the result of the sale of seasoned fixed rate mortgages with accelerated rates of prepayment, which resulted in a one-time gain of $183 thousand for the year ended December 31, 2012. During the third quarter of 2012, a senior manager passed away and the Bancorp received a $587 thousand benefit from bank owned life insurance. For 2013, foreclosed real estate sales gains totaled $17 thousand, a decrease of $413 thousand (96.0%) from gains of $430 thousand for 2012. The decrease is partly related to the Bancorp’s favorable settlement in its lawsuit against the lead lender of a commercial real estate participation loan in 2012. In 2013, no income from the increase in the cash value of bank owned life insurance was recorded, compared to $587 thousand for 2012. During 2013, no other-than-temporary impairment was recognized compared to $6 thousand of impairment recognized during 2012. During 2013, other noninterest income totaled $19 thousand, a decrease of $77 thousand (80.2%) from $96 thousand for 2012.

Noninterest expense for 2013 was $19.8 million, down $298 thousand (1.5%) from $20.1 million for 2012. During 2013, compensation and benefits totaled $10.6 million, a decrease of $184 thousand (1.7%) from $10.8 million for 2012. The decrease in compensation and benefits is the result of the Bancorp’s continued efforts to closely monitor and manage staffing levels. Occupancy and equipment expense totaled $3.1 million for 2013, an increase of $56 thousand (1.8%) compared to $3.1 million for 2012. The increase in occupancy and equipment expense is the result of slightly higher building operating expenses during 2013. Data processing expense totaled $1.0 million for 2013, a decrease of $52 thousand (4.8%) from $1.1 million for 2012. The change is a result of lower contract costs. Federal deposit insurance premiums totaled $503 thousand for 2013, a decrease of $68 thousand (11.9%) from $571 thousand for 2012. The decrease was the result of lower FDIC assessment rates. Marketing expense related to banking products totaled $509 thousand for the year, an increase of $129 thousand (33.9%) from $380 thousand for 2012. Statement and check processing expense totaled $310 thousand for the year, a decrease of $7 thousand (2.2%) from $317 thousand for 2012. Professional service expense totaled $288 thousand for the year, an increase of $9 thousand (3.2%) from $279 thousand for 2012. The increase in professional services is primarily related to slightly higher legal expense. Other expenses related to banking operations totaled $3.5 million for 2013, an increase of $181 thousand (5.0%) from $3.7 million for 2012. The Bancorp’s efficiency ratio for 2013 was 66.55% compared to 64.36% for 2012. The higher efficiency ratio is primarily the result of lower total noninterest income. The ratio is determined by dividing total noninterest expense by the sum of net interest income and total noninterest income for the period.

| 14 |

The Bancorp had an income tax expense for 2013 of $2.4 million compared to income tax expense of $1.9 million for 2012, an increase to expense of $456 thousand (23.5%). The combined effective federal and state tax rates for the Bancorp were 25.2% for 2013 and 22.1% for 2012. The current year’s higher effective tax rate is the result of higher taxable income as a percentage of total income, higher earnings, and lower tax preferred income, as well as an adjustment to the Bancorp’s state deferred tax asset for a reduction in tax rates. Details of deferred and current tax items can be found in Note 6 – Income Taxes.

Critical Accounting Policies

Critical accounting policies are those accounting policies that management believes are most important to the portrayal of the Bancorp’s financial condition and that require management’s most difficult, subjective or complex judgments. The Bancorp’s most critical accounting policies are summarized below. Other accounting policies, including those related to the fair values of financial instruments and the status of contingencies, are summarized in Note 1 to the Bancorp’s consolidated financial statements.

Valuation of Investment Securities – The fair values of securities available for sale are determined on a recurring basis by obtaining quoted prices on nationally recognized securities exchanges or pricing models utilizing significant observable inputs such as matrix pricing, which is a mathematical technique widely used in the industry to value debt securities without relying exclusively on quoted prices for the specific securities but rather by relying on the securities’ relationship to other benchmark quoted securities. Different judgments and assumptions used in pricing could result in different estimates of value. In certain cases where market data is not readily available because of lack of market activity or little public disclosure, values may be based on unobservable inputs and classified in Level 3 of the fair value hierarchy.

At the end of each reporting period securities held in the investment portfolio are evaluated on an individual security level for other-than-temporary impairment in accordance with the Investments – Debt and Equity Securities Topic of the Accounting Standards Codification. Significant judgments are required in determining impairment, which include making assumptions regarding the estimated prepayments, loss assumptions and the change in interest rates.

We consider the following factors when determining an other-than-temporary impairment for a security: The length of time and the extent to which the market value has been less than amortized cost; the financial condition and near-term prospects of the issuer; the underlying fundamentals of the relevant market and the outlook for such market for the near future; and an assessment of whether the Bancorp has (1) the intent to sell the debt securities or (2) more likely than not will be required to sell the debt securities before its anticipated market recovery. If either of these conditions is met, management will recognize other-than-temporary impairment. If, in management’s judgment, an other-than-temporary impairment exists, the cost basis of the security will be written down for the credit loss, and the unrealized loss will be transferred from accumulated other comprehensive loss as an immediate reduction of current earnings. Management will utilize an independent valuation specialist to value securities for other-than-temporary impairment.

Allowance for Loan Losses – The Bancorp maintains an Allowance for Loan Losses (ALL) to absorb probable incurred credit losses that arise from the loan portfolio. The ALL is increased by the provision for loan losses, and decreased by charge-offs net of recoveries. The determination of the amounts of the ALL and provisions for loan losses is based upon management’s current judgments about the credit quality of the loan portfolio with consideration given to all known relevant internal and external factors that affect loan collectability. The methodology used to determine the current year provision and the overall adequacy of the ALL includes a disciplined and consistently applied quarterly process that combines a review of the current position with a risk assessment worksheet. Factors that are taken into consideration in the analysis include an assessment of national and local economic trends, a review of current year loan portfolio growth and changes in portfolio mix, and an assessment of trends for loan delinquencies and loan charge-off activity. Particular attention is given to non-accruing loans and accruing loans past due 90 days or more, and loans that have been classified as substandard, doubtful, or loss. Changes in the provision are directionally consistent with changes in observable data.

Commercial and industrial, and commercial real estate loans that exhibit credit weaknesses and loans that have been classified as impaired are subject to an individual review. Where appropriate, ALL allocations are made to these loans based on management’s assessment of financial position, current cash flows, collateral values, financial strength of guarantors, industry trends, and economic conditions. ALL allocations for homogeneous loans, such as residential mortgage loans and consumer loans, are based on historical charge-off activity and current delinquency trends. Management has allocated general reserves to both performing and non-performing loans based on historical data and current information available.

Risk factors for non-performing and internally classified loans are based on an analysis of either the projected discounted cash flows or the estimated collateral liquidation value for individual loans defined as substandard or doubtful. Estimated collateral liquidation values are based on established loan underwriting standards and adjusted for current mitigating factors on a loan-by-loan basis. Aggregate substandard loan collateral deficiencies are determined for residential, commercial real estate, commercial business, and consumer loan portfolios. These deficiencies are then stated as a percentage of the total substandard balances to determine the appropriate risk factors.

| 15 |

Risk factors for performing and non-classified loans are based on a weighted average of net charge-offs for the most recent three years, which are then stated as a percentage of average loans for the same period. Historical risk factors are calculated for residential, commercial real estate, commercial business, and consumer loans. The three year weighted average historical factors are then adjusted for current subjective risks attributable to: regional and national economic factors; loan growth and changes in loan composition; organizational structure; composition of loan staff; loan concentrations; policy changes and out of market lending activity.

The risk factors are applied to these types of loans to determine the appropriate level for the ALL. Adjustments may be made to these allocations that reflect management’s judgment on current conditions, delinquency trends, and charge-off activity. Based on the above discussion, management believes that the ALL is currently adequate, but not excessive, given the risk inherent in the loan portfolio.

Impact of Inflation and Changing Prices The financial statements and related data presented herein have been prepared in accordance with accounting principles generally accepted in the United States of America, which require the measurement of financial position and operating results in terms of historical dollars, without considering changes in the relative purchasing power of money over time due to inflation. The primary assets and liabilities of the Bancorp are monetary in nature. As a result, interest rates have a more significant impact on the Bancorp’s performance than the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or magnitude as the prices of goods and services.

Forward-Looking Statements

Statements contained in this report that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions are also intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. The Bancorp cautions readers that forward-looking statements, including without limitation, those relating to the Bancorp’s future business prospects, interest income and expense, net income, liquidity, and capital needs are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements, due to, among other things, factors identified in this report.

| 16 |

Report of Independent

Registered

Public Accounting Firm

Board of Directors

NorthWest Indiana Bancorp and Subsidiary

Munster, Indiana

We have audited the accompanying consolidated balance sheets of NorthWest Indiana Bancorp and Subsidiary (the “Company”) as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in stockholders' equity, and cash flows for the years then ended. The consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of NorthWest Indiana Bancorp and Subsidiary as of December 31, 2013 and 2012, and the consolidated results of their operations and cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

| |

| Plante & Moran, PLLC |

Chicago, Illinois

February 25, 2014

| 17 |

Consolidated Balance Sheets

| December 31, | ||||||||

| (Dollars in thousands) | 2013 | 2012 | ||||||

| ASSETS | ||||||||

| Cash and non-interest bearing deposits in other financial institutions | $ | 11,758 | $ | 8,512 | ||||

| Interest bearing deposits in other financial institutions | 9,256 | 24,827 | ||||||

| Federal funds sold | 110 | 412 | ||||||

| Total cash and cash equivalents | 21,124 | 33,751 | ||||||

| Securities available-for-sale | 194,296 | 187,475 | ||||||

| Loans held-for-sale | 136 | 323 | ||||||

| Loans receivable | 437,821 | 436,981 | ||||||

| Less: allowance for loan losses | (7,189 | ) | (8,421 | ) | ||||

| Net loans receivable | 430,632 | 428,560 | ||||||

| Federal Home Loan Bank stock | 3,086 | 3,086 | ||||||

| Accrued interest receivable | 2,480 | 2,483 | ||||||

| Premises and equipment | 17,260 | 17,678 | ||||||

| Foreclosed real estate | 1,084 | 425 | ||||||

| Cash value of bank owned life insurance | 16,396 | 12,516 | ||||||

| Prepaid FDIC insurance premium | - | 991 | ||||||

| Other assets | 6,959 | 4,557 | ||||||

| Total assets | $ | 693,453 | $ | 691,845 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Deposits: | ||||||||

| Non-interest bearing | $ | 73,430 | $ | 75,228 | ||||

| Interest bearing | 499,463 | 491,181 | ||||||

| Total | 572,893 | 566,409 | ||||||

| Repurchase agreements | 14,031 | 16,298 | ||||||

| Borrowed funds | 30,898 | 33,207 | ||||||

| Accrued expenses and other liabilities | 8,870 | 8,280 | ||||||

| Total liabilities | 626,692 | 624,194 | ||||||

| Stockholders' Equity: | ||||||||

| Preferred stock, no par or stated value; 10,000,000 shares authorized, none outstanding | - | - | ||||||

| Common stock, no par or stated value; 10,000,000 shares authorized; | ||||||||

| shares issued: December 31, 2013 - 2,897,202 | ||||||||

| December 31, 2012 - 2,888,902 | ||||||||

| shares outstanding: December 31, 2013 - 2,841,164 | ||||||||

| December 31, 2012 - 2,839,137 | 361 | 361 | ||||||

| Additional paid-in capital | 5,229 | 5,189 | ||||||

| Accumulated other comprehensive income | (3,151 | ) | 2,339 | |||||

| Retained earnings | 65,519 | 60,817 | ||||||

| Treasury stock, common shares at cost: December 31, 2013 - 56,038 | ||||||||

| December 31, 2012 - 49,765 | (1,197 | ) | (1,055 | ) | ||||

| Total stockholders' equity | 66,761 | 67,651 | ||||||

| Total liabilities and stockholders' equity | $ | 693,453 | $ | 691,845 | ||||

See accompanying notes to consolidated financial statements.

| 18 |

Consolidated Statements of Income

| (Dollars in thousands, except per share data) | Year Ended December 31, | |||||||

| 2013 | 2012 | |||||||

| Interest income: | ||||||||

| Loans receivable | ||||||||

| Real estate loans | $ | 17,772 | $ | 17,168 | ||||

| Commercial loans | 3,101 | 3,466 | ||||||

| Consumer loans | 18 | 31 | ||||||