| NorthWest Indiana Bancorp |

| Financial Highlights |

As of or for the year ended December 31,

(Dollars in thousands, except for per share & ratio data )

| 2014 | 2013 | |||||||

| Earnings: | ||||||||

| Net revenue (a) | $ | 31,437 | $ | 29,786 | ||||

| Noninterest expense | 21,015 | 19,821 | ||||||

| Pre-provision profit | 10,422 | 9,965 | ||||||

| Provision for loan losses | 875 | 450 | ||||||

| Net income | $ | 7,394 | $ | 7,118 | ||||

| Common share data: | ||||||||

| Net income per share: | ||||||||

| Basic | $ | 2.60 | $ | 2.50 | ||||

| Diluted | 2.60 | 2.50 | ||||||

| Book value per share | 26.78 | 23.50 | ||||||

| Price per share | 26.50 | 25.00 | ||||||

| Cash dividends declared | 0.97 | 0.85 | ||||||

| Dividend payout ratio | 37.32 | % | 33.94 | % | ||||

| Dividend yield | 3.66 | % | 3.40 | % | ||||

| Selected balance sheet data (period-end): | ||||||||

| Total assets | $ | 775,044 | $ | 693,453 | ||||

| Loans | 488,153 | 437,821 | ||||||

| Deposits | 633,946 | 572,893 | ||||||

| Total stockholders' equity | 76,165 | 66,761 | ||||||

| Selected ratios: | ||||||||

| Return on Equity | 10.14 | % | 10.17 | % | ||||

| Return on Assets | 0.97 | % | 1.03 | % | ||||

| Tier 1 capital to adjusted average assets | 9.18 | % | 9.97 | % | ||||

| Tier 1 capital to risk-weighted assets | 13.63 | % | 14.32 | % | ||||

| Total capital to risk-weighted assets | 14.84 | % | 15.58 | % | ||||

(a) Net revenue represents the Bancorp's net interest income, plus noninterest income.

2014 Annual Report

Chairman’s Note: In last year’s letter, I mentioned that Ben Bochnowski would join me as a co-writer of this year’s annual report. I’m happy to share the following pages with him.

|

|

|

David A. Bochnowski Chairman & Chief Executive Officer |

Benjamin Bochnowski President & Chief Operating Officer |

Dear Shareholder:

2014 can be summed up in two words: ambitious and productive. Peoples turned in another record earnings year, while at the same time integrating the first acquisition in our history, growing our lending team, introducing exciting new electronic banking products, and expanding our wealth management operations. This translated into a return on your equity of 10.14%, building on the success of past years that led American Banker magazine in 2014 to name Peoples Bank as a Top 200 Community Bank for the 10th year in a row.

It is safe to say that for Peoples Bank, the troubles of the Great Recession are behind us. Asset quality is strong, and earnings rose consistently throughout the year. A strong capital position, combined with excellent credit quality, have allowed Peoples to grow to unprecedented levels. At the end of 2014, your Bank reached $775 million in assets, which is 20% higher than our asset size at the depths of the Great Recession. Peoples Bank is bigger than it has ever been, and our employees have helped us get there. Today, there are almost 200 individuals on the Peoples Team, and we are extremely proud to say that we were named as a Best Place to Work in Indiana for the second year in a row.

2014 was also a milestone for Peoples Bank, and a cause to celebrate. August marked the 30th anniversary of Peoples’ Initial Public Offering. For those shareholders that invested then, we thank you for your faith, and your capital, that have made this Bank into what it is today. Back then, the Bank raised $3.1 million to go public, and since then, we have worked hard every day for every dollar that was raised. Today, that equity has grown to almost $80 million, and since the time the Bank started paying dividends, it has done so every quarter since. Together, those dividends from a single $10 share purchased in 1984 have added up to over $36,000; dividends and price appreciation together resulted in a 3,650% total return over that time.

At the same time, we continue to look to the future. A year ago, this letter outlined a vision for the future: Remaining independent, while investing in the future in order to continue to deliver exceptional value for all of the Bank’s stakeholders. That vision has not changed. What has changed are the achievements that bring us closer to that goal. An exceptional 2014 has given Peoples Bank the confidence to continue to grow into the future.

Our achievements can be attributed, in part, to the strong character of our team members who have made a difference in our success over the years. The Peoples family was saddened earlier this year by the passing of Frank J. Bochnowski, who lent his talents to our cause as legal counsel, corporate secretary and, following his retirement from management, as a director. Buck, as he was known, matched his keen intellect with a pleasant outgoing manner. We will miss his wit and wisdom, but take comfort in his lasting legacy of commitment to excellence.

2014 Wrap-Up

Strong Capital

Tier 1 capital, a key regulatory measure, landed at 9.2% for the year, which is very strong despite the double-digit growth that the Bank saw during 2014. The Bank managed capital through both strong loan growth and an acquisition. This capital is the engine that drives the Bank forward, allows us to invest into the future, and supports continued loan growth, new locations, and new technologies.

Lending and Asset Quality

As the economy has improved, our strong capital has positioned Peoples Bank to be the lender of choice of our customers. We have grown our lending team by over 30% by adding both commercial and residential lenders, resulting in a record year for loan originations at Peoples Bank. These loans have proven to be strong local credits, creating a strong margin in a continued low-rate environment. In fact, Peoples Bank was recognized as the Regional Development Company’s Lender of the Year for 2014, with several bankers on our team winning individual awards.

Non-Performing Loans ended the year at 1.10%. Counting a loan that settled in early 2015, that number is unchanged from a year ago at 0.90%, and indicates continued strength and stability in the Peoples Bank loan portfolio. The Bank’s credit standards and underwriting are helping to hold that number at a steady level, despite the asset growth that the Bank has seen over the past year.

Wealth Management

The Bank’s Wealth Management Group is unique in the local market: We offer a wide range of products, from traditional bank trust services to investment and retirement planning. We also believe that we do it better than the rest—that’s why we are proud that Peoples Bank Wealth Management has been named the best in Northwest Indiana for two years running by Northwest Indiana Business Quarterly magazine.

This is great news for our customers, and great news for our shareholders too. Wealth Management income was up again in 2014, and the growth was significant: Income from wealth operations was up 15% from 2013 to 2014, and assets under management are at an all-time high because of a dedicated and talented staff.

Retail Banking

Retail Banking, in many ways, is the most visible part of what any bank does. Peoples Bank is no different, and today, we have more Banking Centers than ever, with 14 full-service locations to serve our customers. Complemented by our electronic offerings, Peoples Bank is there for our customers where and when they need us. This wide network of Banking Centers and 24/7 approach to banking has helped the Bank maintain a strong, stable source of core funds. Our cost of funds was unchanged from 2013 to 2014 as we grew the Bank, and that has been a great competitive advantage for Peoples. In fact, Peoples Bank is better than 98% of its peers when it comes to funding, and 70% of our funds now come from checking, savings and money market accounts.

Electronic Banking and Cybersecurity

Peoples Bank prides itself on its high-touch, high-tech approach to banking. We have launched several exciting electronic banking services over the past few years, all in support of a fuller banking experience for our customers. While some banks cut service in favor of electronic banking, our philosophy is that electronic banking complements the high levels of service that our customers have come to expect. Our goal is to unify the banking experience across all channels, and make transactions smoother and faster so that we can focus on partnering with our customers to achieve their financial goals. To that end, we rolled out Consumer Mobile Check Deposit in January of 2014, offering customers the convenience of depositing checks from their mobile device. With Business Mobile Banking with Check Deposit, launched the same month, our business customers can use the Bank’s app to conduct transactions from their mobile device as well. The year ended with the introduction of People Pay, a peer-to-peer payment system, for consumer online banking customers.

Regardless of size, industry, or location, cyber-attacks are a new reality of life. Peoples Bank takes the integrity and security of our customers very seriously; our customers have entrusted us with their financial well-being, and it is incumbent upon us to deliver on that expectation. Our information security systems far exceed the minimums required by our federal regulators and, to that end, we strive to meet more stringent requirements of industry best practices. As cyber attackers get more sophisticated, so does Peoples Bank. We invest every year into systems to better protect our customers, and are engaging in Bank-wide training to involve every employee in cyber-security efforts. At the same time, we are improving our behind-the-scenes security so that security measures become more transparent to the customer, with the goal of enhancing the customer experience—not disrupting it.

NWIN Performance

At December 31, 2014, your NWIN stock reported a closing price of $26.50, up from $25.00 a year earlier. Management was pleased that during the year, our price achieved a high of $27.95. While we cannot control the vagaries of the financial markets, we are confident that Peoples Bank will continue to deliver superior results.

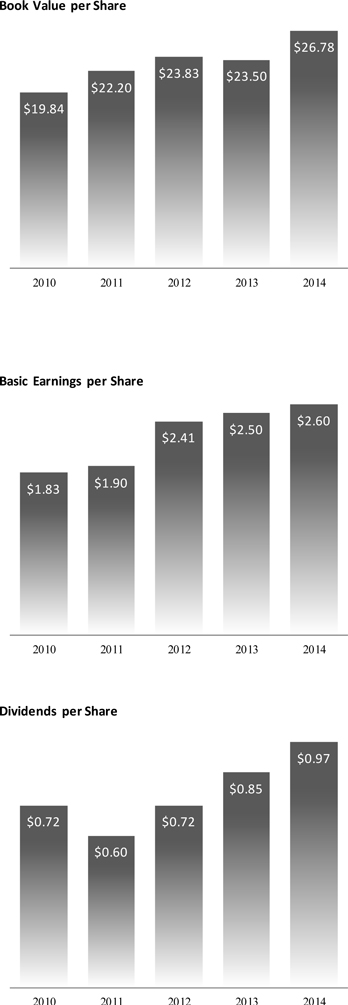

Your company’s performance during 2014 was outstanding compared to our peers on several levels. Our dividend yield at December 31, 2014 stood at 3.7%. During the year, NWIN’s book value climbed to $26.78 per share, up from $23.50 at the end of 2013. Taking into account the Bank’s superior financial performance, capital ratio, and asset quality among other factors, the Board of Directors raised the dividend on your shares from $.22 per share to $.25, an increase of 13.63%. Consistent with regulatory expectations for capital following the Great Recession, the Board continues to target an average dividend payout ratio range of 30% to 40% of annual earnings.

In January of 2015, Monroe Securities issued a quarterly banking report that reinforced the strength of our performance. The data reported the return on assets of the nation’s banks at ..73% and .79% for the Midwest Region. NWIN compares very favorably with an ROA of .97% for the year. Similarly, the report shows return on equity for the nation at 6.97% and 7.60% for the Midwest Region. Your company again compares very favorably with a double digit ROE of 10.14%.

Looking Ahead: 2015 and Beyond

As always, Peoples remains focused on the fundamentals of Banking. Strong asset quality, efficient operations and a superb customer experience are at the core of our You First Banking brand. Peoples Bank knows that in order to remain at the top of our game, we must keep pace with our customers. To that end, we are planning another ambitious year in 2015 that will help deliver exceptional performance and set the course for future success. At the center of this is a commitment to create value for all of our stakeholders and drive financial performance forward.

Business Banking

As our market emerges from the Great Recession, Peoples Bank is well placed to be the financial partner of choice as local businesses look to expand their operations. From lending needs to building financial security, Peoples Bank partners with business owners as they invest in their enterprises and help to grow the local economy. The Bank will continue to build its award-winning lending team, focused on developing full-service relationships. Commercial lending activity directly supports the Bank’s growth and drives loan yield, while helping to position the Bank to tackle the anticipated interest rate cycle.

Mortgage Lending

Like commercial lending, the local housing market is definitely gathering steam. 2014 was a record year for mortgage originations at Peoples Bank, and we are gearing up for another great year in 2015. In order to grow with the housing market, Peoples Bank plans to further expand its mortgage lending team. Our lending team will be supported by new lending products, and upgraded technology platforms that enhance the customer experience and provide for the smooth, efficient closing that both our lenders and customers expect.

Wealth Management

Peoples Bank has an outstanding Wealth Management team, and their goal heading into 2015 is to improve on what we have while reaching even more customers in Northwest Indiana. To reach more customers and drive wealth management income growth, the Bank plans to grow the Wealth Management team. At the same time, we are focused on enhancing the customer experience, and more tightly integrating information systems between the Bank’s wealth management and retail operations.

Retail Banking

In order to support continued growth at Peoples Bank, we are stepping up efforts to grow our retail banking center network. These investments directly support our industry-leading ability to gather core accounts. Our goal is to upgrade our Highland Banking Center this year, while starting work on a second Valparaiso-area location. While these new brick-and-mortar facilities will be the centerpiece of our retail strategy, there is much additional work that improves the customer experience across the banking center network. Planned upgrades to ATMs will provide a more robust experience, as will in-bank improvements to further speed transactions so that we can focus on customer engagement.

Cybersecurity

2015 will be no different than 2014 in that the Bank will be on high alert for cybersecurity events. The pace of bank-wide training efforts and investments in infrastructure will accelerate in 2015. Management is also highly focused on integrating cybersecurity even more tightly with Enterprise Risk Management systems.

Our goal at Peoples Bank is industry-leading technology to prevent and detect attacks, and 100% Bank-wide preparedness for cyber-attacks. The increasing intensity and complexity of information security is a new layer for the banking industry, but Peoples Bank is ready to tackle these new challenges head-on so that we can continue to safeguard customer information.

A New Generation of Leadership

Your Board of Directors has actively pursued long-term succession planning with great success, upholding our commitment to identify and develop talent to fill key roles and ensure continuity of leadership that will take the Bank to the next level.

New leaders have ascended to senior positions at your company: among them are Bob Lowry, chief financial officer; Todd Scheub, chief lending officer; and Leane Cerven, general counsel. At the same time, the Bank’s proven team in retail banking, led by John Diederich, and wealth management, led by Terry Quinn, have joined our effort to move the Bank forward. Tanya Buerger, chief information and technology officer, has been instrumental in ensuring that Peoples Bank has technology that is second to none. The transition has been seamless, as demonstrated by our success over the past three years as the transition has been occurring.

In January of 2015, the Board of Directors unanimously approved Benjamin Bochnowski as President and Chief Operating Officer of the Bancorp. This position was most recently held by Joel Gorelick, who ably dispatched his duties leading up to his retirement in January of 2013. Ben will be supported in his new role by a forward-looking management team that in recent years has welcomed new leaders in new positions to help lead the Bank into the future.

Ben brings to the table a demonstrated history of performance. Born and raised in the area, he has an inherent sense of community and is dedicated to the long-term growth of the Bank. His promotion followed a performance path with benchmarks designed by independent members of the Board who measured his banking knowledge, leadership, teamwork and ability to design and execute our strategic plan. For the last three years Ben has been responsible for the strategic direction of the company, and has led the team that has delivered record results in all three years.

Our family is both proud and humbled by Ben’s new role, as he becomes the fourth generation to assume this key leadership post. The challenge of leading a 21st century community bank brings excitement and responsibility. Ben is dedicated to our mission as he leads the team that has set a course for continued excellence into the future. The new generation of leadership of your company will continue to make the most of every opportunity to partner with and provide value to our customers, community, team members, and shareholders.

As always, thank you for your confidence and support.

Sincerely,

|

|

| David A. Bochnowski | Benjamin Bochnowski |

| Chairman & Chief Executive Officer | President & Chief Operating Officer |

Financial Trends

Market Information

The Bancorp’s Common Stock is traded in the over-the-counter market and quoted on the OTC Bulletin Board. The Bancorp’s stock is not actively traded. As of February 20, 2015, the Bancorp had 2,851,417 shares of common stock outstanding and 407 stockholders of record. This does not reflect the number of persons or entities who may hold their stock in nominee or “street” name through brokerage firms. Set forth below are the high and low bid prices during each quarter for the years ended December 31, 2014 and December 31, 2013. The bid prices reflect inter-dealer prices without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. Also set forth is information concerning the dividends declared by the Bancorp during the periods reported. Note 11 to the Financial Statements describes regulatory limits on the Bancorp’s ability to pay dividends.

| Dividends | ||||||||||||||

| Per Share Prices | Declared Per | |||||||||||||

| High | Low | Common Share | ||||||||||||

| Year Ended December 31, 2014 | 1st Quarter | $ | 27.95 | $ | 25.00 | $ | 0.22 | |||||||

| 2nd Quarter | 26.90 | 24.88 | 0.25 | |||||||||||

| 3rd Quarter | 27.10 | 25.75 | 0.25 | |||||||||||

| 4th Quarter | 26.50 | 25.16 | 0.25 | |||||||||||

| Year Ended December 31, 2013 | 1st Quarter | $ | 25.30 | $ | 19.10 | $ | 0.19 | |||||||

| 2nd Quarter | 25.00 | 22.00 | 0.22 | |||||||||||

| 3rd Quarter | 25.00 | 23.00 | 0.22 | |||||||||||

| 4th Quarter | 25.20 | 23.25 | 0.22 | |||||||||||

2014 Board of Directors

David A. Bochnowski, Director since 1977 Chairman, Chief Executive Officer of the Bancorp

Stanley E. Mize, Director since 1997 Retired; former President of Stan Mize Towne & Country Auto Sales, Inc.

James L. Wieser, Director since 1999 Attorney and Senior Partner, Wieser & Wyllie, LLP

Edward J. Furticella, Director since 2000 Former Executive Vice President and CFO of the Bancorp; currently Professor, Department Head of the Accounting Program and Director of the Masters of Accountancy Program at Purdue University Calumet

Joel Gorelick, Director since 2000 Retired; former President and Chief Operating Officer of the Bancorp

Kenneth V. Krupinski, Director since 2003 Certified Public Accountant, Swartz Retson, P.C.

Anthony M. Puntillo, D.D.S., M.S.D., Director since 2004 Orthodontist, CEO of Puntillo and Crane Orthodontics, P.C.

Donald P. Fesko, Director since 2005 Chief Executive Officer, Community Hospital

Amy W. Han, Ph.D., Director since 2008 Indiana University School of Medicine – Northwest

Danette Garza, Director since 2013 Attorney At Law, Certified Public Accountant, Owner of Continental Languages, LLC

Benjamin J. Bochnowski, Director since 2014 President, Chief Operating Officer of the Bancorp

Leroy F. Cataldi, P.D., Director Emeritus Lourdes M. Dennison, Director Emeritus John Freyek, Director Emeritus Gloria C. Gray-Weissman, Director Emeritus

2014 Board Committees

Compensation and Benefits Kenneth V. Krupinski, Chairman Donald P. Fesko Amy W. Han Stanley E. Mize

Executive Committee David A. Bochnowski, Chairman Edward J. Furticella Joel Gorelick Stanley E. Mize James L. Wieser

Nominating and Corporate Governance Stanley E. Mize, Chairman Donald P. Fesko Edward J. Furticella Danette Garza Amy W. Han Kenneth V. Krupinski Anthony M. Puntillo James L. Wieser

Risk Management Edward J. Furticella, Chairman Danette Garza Kenneth V. Krupinski Stanley E. Mize Anthony M. Puntillo

Strategic Planning James L. Wieser, Chairman Edward J. Furticella Danette Garza Kenneth V. Krupinski Stanley E. Mize Anthony M. Puntillo

Wealth Management Donald P. Fesko, Chairman Joel Gorelick Amy W. Han |

|

Corporate Information

Officers of NorthWest Indiana Bancorp and Peoples Bank

David A. Bochnowski

Chairman, Chief Executive Officer

Benjamin J. Bochnowski

President, Chief Operating Officer

John J. Diederich

Executive Vice President

Robert T. Lowry

Executive Vice President, Chief Financial Officer and Treasurer

Leane E. Cerven

Executive Vice President, General Counsel and Corporate Secretary

Officers of Peoples Bank

Tanya A. Buerger

Senior Vice President, Chief Information and Technology Officer

Terrence M. Quinn

Senior Vice President, Chief Wealth Management Officer

Todd M. Scheub

Senior Vice President, Chief Lending Officer

Management Personnel of Peoples Bank

Finance and Controls Group

Peymon S. Torabi

Senior Vice President, Controller

Jason A. Griffin

Assistant Vice President, Assistant Controller

Teresa A. Ponto

Assistant Vice President, Staff Accountant

Michaelene M. Smith

Assistant Vice President, Accounting

Human Resource Group

Karen K. Myers

Vice President, Manager, Human Resources

Jill M. Knight

Vice President, Training Coordinator

Michelle L. Havens

Assistant Vice President, Human Resource Generalist

Tonika L. Housler

Assistant Vice President, Human Resource Specialist

Lending Group

}Business Lending

Daniel W. Moser

Senior Vice President, Construction and Development Lending and Portfolio Manager

Brian E. Rusin

Vice President, Manager, Business Banking

Gregory Bracco, Vice President, Team Manager, Business Banking

Daniel J. Duncan

Vice President, Business Banker

Ronald P. Knestrict

Vice President, Business Banker

J. Daniel Magura

Vice President, Business Banker

Donald P. McCormick

Vice President, Business Banker

Kevin W. Crose, Assistant Vice President, Business Banker

Kimberly S. Modigell, Assistant Vice President, Business Banker

Linda J. Banis

Assistant Vice President, Administrative Assistant

}Loan Collections

Donald D. Evans

Assistant Vice President, Manager of Collections and Consumer Lending Officer

}Retail Lending

Brian S. Gill

Vice President, Manager, Retail Lending

Jeremy A. Gorelick

Vice President, Mortgage Loan Originator

Austin P. Logue

Vice President, Mortgage Loan Originator

Rachel C. Lentz

Assistant Vice President, Mortgage Loan Originator

Nancy L. Weckler

Assistant Vice President, Loan Underwriting

Marketing Group

Marilyn Furticella

Vice President, Marketing

Sarah R. Ricciardi,

Assistant Vice President, Marketing Coordinator

Operations and Technology Group

}Bank Operations

Mary D. Mulroe

Vice President, Process Management

Donna M. Gin

Vice President, Operations & Technology

}Deposit Operations

Sheldon Cutler

Vice President, Deposit Operations

Theresa M. Johnson, Assistant Vice President, Deposit Operations

}Information Technology

Matthew S. Manoski

Vice President, Manager, Information Technology

Jonathan M. Foster

Assistant Vice President, Information Technology

Kurt M. Miller

Assistant Vice President, Information Technology

}Loan Operations

Karen M. Sulek

Vice President, Manager, Loan Operations

Bonnie J. Connors

Assistant Vice President, Loan Operations

Antoinette S. Shettles

Assistant Vice President, Loan Operations

Margaret Travis

Assistant Vice President, Loan Operations

Sharon V. Vacendak

Assistant Vice President, Loan Operations

}Systems Delivery

Julie M. Bonnema

Vice President, Manager, Systems Delivery

Kimberlee Klisiak, Assistant Vice President, Systems Delivery

Retail Banking Group

Carla J. Houck

Vice President, Retail Banking Group

Meredith L. Bielak

Vice President, Retail Banking Manager

Cynthia S. Miles

Assistant Vice President, Retail Banking Assistant

}Banking Centers

Michael A. Cronin

Vice President, Manager, Schererville Banking Center

Candice N. Logue

Vice President, Manager, Munster & Highland Banking Centers

Sandra L. Sigler

Vice President, Manager, Woodmar & Hammond Banking Centers

Kelly A. Stoming

Vice President, Manager

Charman F. Williamson

Vice President, Manager, Merrillville Broadway Banking Center

Rebecca L. Bach

Assistant Vice President, Manager, Dyer Banking Center

Jennifer L. Connell

Assistant Vice President, Manager, Hobart Banking Center

Diane E. Dalton

Assistant Vice President, Manager, Gary Banking Center

Jessica S. Higareda

Assistant Vice President, Manager, East Chicago Banking Center

Matthew G. Lambert

Assistant Vice President, Manager, Merrillville Taft Banking Center

Sharon Morales

Assistant Vice President, Manager, Crown Point Banking Center

Cynthia J. Sausman

Assistant Vice President, Manager, Valparaiso Banking Center

Donna M. Vurva

Assistant Vice President, Manager

Nadia M. Grisolia

Assistant Vice President, Assistant Manager

Nancy M. Kaczka

Assistant Vice President, Assistant Manager, Munster Banking Center

Amy L. Kopack

Manager, St. John Banking Center

Risk Management Group

Lisa J. Anderson, Vice President, Manager, Credit Administration

Christine M. Friel

Vice President, Manager, Loan Review

Linda C. Nemeth

Vice President, Internal Auditor

Michael J. Shimala

Vice President, Compliance & Security Officer

Angelica M. Leal, Assistant Vice President, Compliance & Security

Jennifer M. Purbaugh, Assistant Vice President, Loan Review

Wealth Management Group

Mary T. Ciciora

Vice President, Senior Wealth Management Officer

Thomas C. Devine

Vice President, Wealth Management Officer

David J. Kwait

Vice President, Staff Attorney/Legal Counsel and Wealth Management Officer

Randall H. Walker

Vice President, Wealth Management Officer

Stephan A. Ziemba

Vice President, Senior Wealth Management Officer

Joyce M. Barr

Assistant Vice President, Wealth Management Officer

Other Management Personnel

Laura J. Spicer

Assistant Vice President, Executive Assistant to the Chairman