| NorthWest Indiana Bancorp |

| Financial Highlights |

| December 31, | December 31, | |||||||

| (Dollars in thousands, except for per share and ratios data) | 2015 | 2014 | ||||||

| Earnings: | ||||||||

| Net revenue (a) | 34,220 | 31,437 | ||||||

| Noninterest expense | 23,616 | 21,015 | ||||||

| Pre-provision profit | 10,604 | 10,422 | ||||||

| Provision for loan losses | 954 | 875 | ||||||

| Net income | 7,852 | 7,394 | ||||||

| Earnings per common share data: | ||||||||

| Net income per share: | ||||||||

| Basic | 2.75 | 2.60 | ||||||

| Diluted | 2.75 | 2.60 | ||||||

| Cash dividends declared | 1.06 | 0.97 | ||||||

| Book value | 28.37 | 26.78 | ||||||

| Selected balance sheet data (period-end): | ||||||||

| Total assets | 864,893 | 775,044 | ||||||

| Loans | 571,898 | 488,153 | ||||||

| Deposits | 714,875 | 633,946 | ||||||

| Total stockholders' equity | 80,909 | 76,165 | ||||||

| Selected ratios: | ||||||||

| Return on Equity | 9.90 | % | 10.14 | % | ||||

| Return on Assets | 0.96 | % | 0.97 | % | ||||

| Common equity tier 1 capital to risk-weighted assets | 12.4 | % | N/A | |||||

| Tier 1 capital to risk-weighted assets | 12.4 | % | 13.6 | % | ||||

| Total capital to risk-weighted assets | 13.5 | % | 14.8 | % | ||||

| Tier 1 capital to adjusted average assets | 9.0 | % | 9.2 | % | ||||

(a) Net revenue represents the Bancorp's net interest income, plus noninterest income.

2015 Annual Report

|

Dear Shareholder:

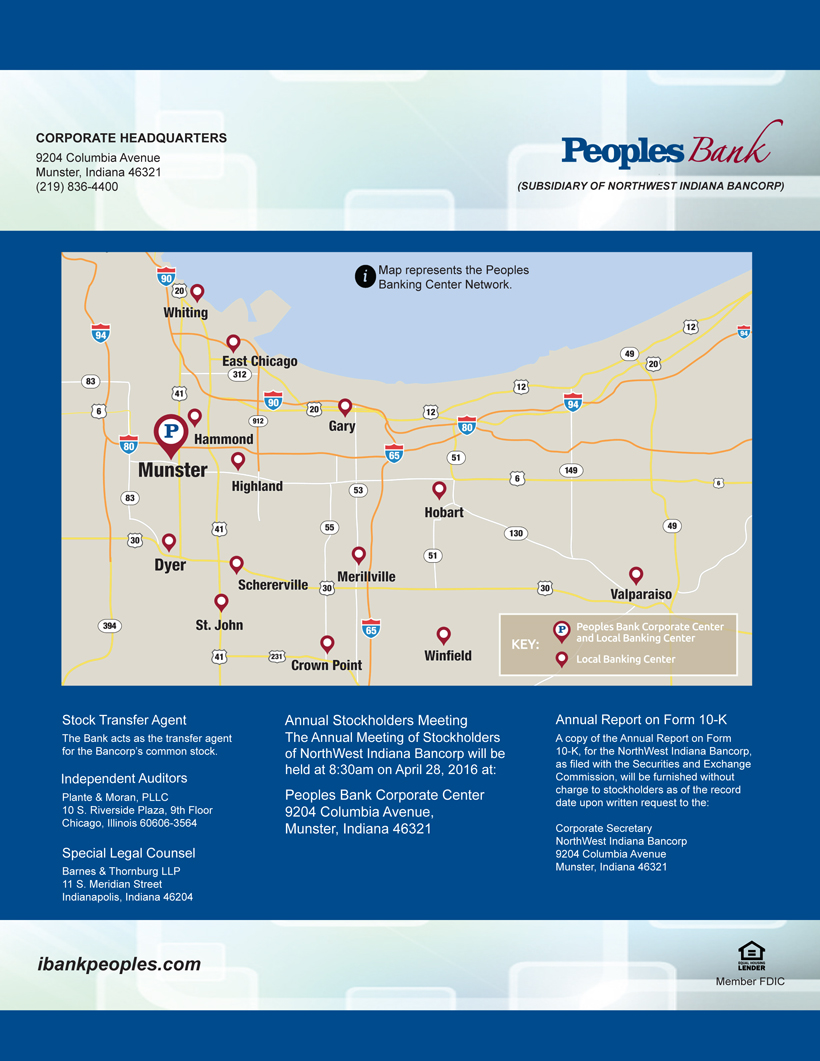

Success is often a mix of hard work and opportunity, and both came together to make 2015 another record year for Peoples Bank. The economy continues to strengthen and the team at Peoples Bank has worked extremely hard to be a part of the exciting things happening in our local markets. Of the Bank’s 11.6% growth, roughly half was organic and half was inorganic through our acquisition of Liberty Savings, with locations in Whiting and Winfield, Indiana.

Peoples has the team in place to capture the momentum that we see locally – and the experience to harness it for our shareholders. The Bank’s efforts to deepen customer relationships have resulted in solid growth, and the skilled integration of two mergers has significantly broadened our reach. All of this translated into a high return on your equity over the past three years, which in turn led American Banker magazine to name Peoples as a Top 200 Community Bank for the 11th consecutive year.

The banking landscape has seen a world of change in the past decade. New technology, ever-changing regulations and rapid consolidation are just a few of the challenges facing Peoples. This company has a proud history of adapting so that we can continue to help our customers achieve their financial goals, help our employees grow, help our communities thrive, and create a solid return for our shareholders at the same time.

Our brand, You First Banking, is all about creating value for our stakeholders: our customers, our employees, our communities, and our shareholders. We do that by engaging our stakeholders, understanding their goals, partnering with them, and going above and beyond to help them realize those goals.

To continue to create that value, Peoples Bank has a three-part goal: continue to achieve scale, strive for elite financial performance, and remain independent. There are more than 200 individuals who come to Peoples Bank every day dedicated to making that goal a reality, and 2015 shows the result of that hard work. The Bank has grown sustainably, and because of that hard work, the outlook for the future is extremely positive.

NWIN Performance

We are happy to report that NWIN’s stock price ended the year at $30.80, a 16% increase throughout the year. Moreover, the total return was over 20% for the calendar year; total return was over 75% for the years 2013-2015. These strong figures were driven by both solid price appreciation and another dividend increase of $0.08 per share, or 8%, in 2015. Dividend yield stood at 3.5% for year-end, while NWIN’s book value climbed from $26.78 per share to $28.37.

NWIN’s stock performance continues to compare extremely favorably to peer. In its most recent quarterly banking summary, Monroe Securities reported an average ROA of 0.75% nationally and 0.80% in the Midwest region; they also reported average ROE at 7.15% nationally and 7.56% in the Midwest. NWIN outperformed both at an ROA of 0.96% and a ROE of 9.90%, respectively. Further, the report pegs the average price-to-book ratio at 100% nationally and 94% in the Midwest; NWIN ended the year trading at 115% of book value.

2015 Wrap-Up

Last year, this letter outlined the Bank’s vision for 2015, and we are happy to report positive results on all fronts under the stewardship of the Bank’s leadership team. Peoples has a seasoned, forward-thinking team that has led the Bank out of the Great Recession and towards a promising future. Capital remained solid through the end of the year, with a Tier 1 capital ratio of 9.0%, providing a stable foundation on which the Bank can continue to grow.

Commercial lending activity was strong in 2015, growing by $59 million during the year. Commercial loans now comprise over 60% of the Bank’s portfolio, driving a strong margin. This has been a strategic focus for the Bank in recent years, and the results speak for themselves. An expanded team of Business Bankers has delivered high-quality growth, as both Non-Performing Loan and Non-Performing Asset ratios both ended the year near just 1%.

Mortgage lending was similarly strong, with record originations at Peoples Bank. A growing team of mortgage lenders had more products to offer into a strong local market. As a result, over $47 million in fixed rate mortgages were sold in the secondary market, which brought a gain of $1.2 million for the Bank. Loan balances were also boosted by the acquisition of Liberty Savings in the amount of $28 million, enhancing overall loan yield.

Core funding has been a competitive advantage for Peoples Bank in recent years, and the Bank built on that success again in 2015. Core funds grew by $71 million, and accounted for roughly ¾ of all deposits at Peoples Bank. These stable funds were a key driver of the Bank’s performance in 2015, and represent the skill with which we have been able to deliver on our customers’ expectations.

Income from Wealth Management operations increased by over 3% in 2015, contributing $1.7 million to earnings. Peoples made large investments in order to enhance Wealth Management platforms and products, at the same time investing in its team so that they are best equipped to partner with our customers for the future. The Wealth team has grown in recent years, as have assets under management, which ended the year just over $280 million.

The Bank’s cybersecurity efforts intensified in 2015, with major investments into security technology and training on the human front. Risks are constantly evolving in the financial services industry, and the Bank has been quick to react to threats. We take responsibility very seriously for the safekeeping of our customers’ privacy and personal information. Peoples continues to expand its electronic banking offerings in order to enhance the customer experience – but we only do so after a careful vetting process so that our customers can bank safely and with confidence.

Vision for the Future

Nothing demonstrates ability like results – and another record year in 2015 says volumes about the entire team at Peoples Bank. With assets at an all-time high and strong fundamentals, the leadership team has the confidence to push into the future with the strength of the Bank’s You First brand.

Your company has been undergoing a transition in leadership over the past several years, and we are in the final stages of that transition. Ben was appointed President of the Bank in early 2015, and he has had responsibility for the overall strategic direction and performance of the company for the past two years.

Peoples has created a solid formula for success. In 2016, we will continue to focus on the things we do best. A customer-centric approach will drive growth in business banking, mortgage lending, retail banking and wealth management. New products and superb service will back that brand promise in order to deliver a seamless customer experience. Talent development will ensure we have the right people with the right skills in order to exceed our customers’ expectations.

Growth also means expanding our footprint. The Bank has plans to open a newer, upgraded Banking Center in Highland that is designed around the customer experience. Combined with new technologies, this will serve as a model for future banking centers that are built around the relationships that we have with our customers. Plans to further expand into Porter County are also in the works.

As customers change, so does Peoples Bank. We are using technology to enhance the customer experience – not to replace it. In an increasingly complex world, the human side of banking is more important than ever. Peoples is committed to building those individual relationships that are the essence of community banking. This is at the core of our culture and our business. The Bank’s success has been because of the people who are our stakeholders, and it is because of them that we continue to strive for excellence now and as we move into the future.

Peoples Bank had a great year in 2015. We want to thank you for your continued support and confidence as we look forward to 2016.

| Sincerely, | |

|

|

| David A. Bochnowski | Benjamin Bochnowski |

| Chairman & Chief Executive Officer | President & Chief Operating Officer |

Market Information

The Bancorp’s Common Stock is traded in the over-the-counter market and quoted on the OTC Bulletin Board. The Bancorp’s stock is not actively traded. As of February 19, 2016, the Bancorp had 2,856,657 shares of common stock outstanding and 407 stockholders of record. This does not reflect the number of persons or entities who may hold their stock in nominee or “street” name through brokerage firms. Set forth below are the high and low bid prices during each quarter for the years ended December 31, 2015 and December 31, 2014. The bid prices reflect inter-dealer prices without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. Also set forth is information concerning the dividends declared by the Bancorp during the periods reported. Note 11 to the Financial Statements describes regulatory limits on the Bancorp’s ability to pay dividends.

| Dividends | ||||||||||||||

| Per Share Prices | Declared Per | |||||||||||||

| High | Low | Common Share | ||||||||||||

| Year Ended December 31, 2015 | 1st Quarter | $ | 27.75 | $ | 26.50 | $ | 0.25 | |||||||

| 2nd Quarter | 27.35 | 26.40 | 0.27 | |||||||||||

| 3rd Quarter | 31.99 | 26.25 | 0.27 | |||||||||||

| 4th Quarter | 31.10 | 29.26 | 0.27 | |||||||||||

| Year Ended December 31, 2014 | 1st Quarter | $ | 27.95 | $ | 25.00 | $ | 0.22 | |||||||

| 2nd Quarter | 26.90 | 24.88 | 0.25 | |||||||||||

| 3rd Quarter | 27.10 | 25.75 | 0.25 | |||||||||||

| 4th Quarter | 26.50 | 25.16 | 0.25 | |||||||||||

| 2015 Board of Directors | 2015 Board Committees |

| David A. Bochnowski, Director since 1977 | Compensation and Benefits |

| Chairman, Chief Executive Officer of the Bancorp | Kenneth V. Krupinski, Chairman |

| Donald P. Fesko | |

| Stanley E. Mize, Director since 1997 | Amy W. Han |

| Retired; former President of Stan Mize Towne & Country | Stanley E. Mize |

| Auto Sales, Inc. | |

| Executive Committee | |

| James L. Wieser, Director since 1999 | David A. Bochnowski, Chairman |

| Attorney and Senior Partner, Wieser & Wyllie, LLP | Edward J. Furticella |

| Joel Gorelick | |

| Edward J. Furticella, Director since 2000 | Stanley E. Mize |

| Former Executive Vice President and CFO of the | James L. Wieser |

| Bancorp; currently Professor, Department Head of the | |

| Accounting Program and Director of the Masters of | Nominating and Corporate Governance |

| Accountancy Program at Purdue University Calumet | Stanley E. Mize, Chairman |

| Donald P. Fesko | |

| Joel Gorelick, Director since 2000 | Edward J. Furticella |

| Director Indiana Economics Development Corporation | Danette Garza |

| Past Chairman/Director Lake County Economic Alliance | Amy W. Han |

| Kenneth V. Krupinski | |

| Kenneth V. Krupinski, Director since 2003 | Anthony M. Puntillo |

| Certified Public Accountant, Swartz Retson, P.C. | James L. Wieser |

| Anthony M. Puntillo, D.D.S., M.S.D., Director since | Risk Management |

| 2004 | Edward J. Furticella, Chairman |

| Orthodontist, CEO of Puntillo and Crane Orthodontics, | Danette Garza |

| P.C. | Kenneth V. Krupinski |

| Stanley E. Mize | |

| Donald P. Fesko, Director since 2005 | Anthony M. Puntillo |

| Chief Executive Officer, Community Hospital | |

| Strategic Planning | |

| Amy W. Han, Ph.D., Director since 2008 | James L. Wieser, Chairman |

| Indiana University School of Medicine – Northwest | Edward J. Furticella |

| Danette Garza | |

| Danette Garza, Director since 2013 | Joel Gorelick |

| Attorney At Law, Certified Public Accountant, | Kenneth V. Krupinski |

| Owner of Continental Languages, LLC | Stanley E. Mize |

| Anthony M. Puntillo | |

| Benjamin J. Bochnowski, Director since 2014 | |

| President, Chief Operating Officer of the Bancorp | Wealth Management |

| Donald P. Fesko, Chairman | |

| Leroy F. Cataldi, P.D., Director Emeritus | Joel Gorelick |

| Lourdes M. Dennison, Director Emeritus | Amy W. Han |

| Martin A. Dybel, Director Emeritus | |

| John Freyek, Director Emeritus | |

| Gloria C. Gray-Weissman, Director Emeritus | |

| Officers

of NorthWest Indiana Bancorp and Peoples Bank |

Officers of Peoples Bank |

| David A. Bochnowski | Tanya A. Leetz |

| Chairman, Chief Executive Officer | Senior Vice President, Chief Information |

| Benjamin J. Bochnowski | and Technology Officer |

| President, Chief Operating Officer | Terrence M. Quinn |

| John J. Diederich | Senior Vice President, Chief Wealth |

| Executive Vice President | Management Officer |

| Robert T. Lowry | Todd M. Scheub |

Executive Vice President, Chief Financial Officer and Treasurer |

Senior Vice President, Chief Lending Officer |

| Leane E. Cerven | |

Executive Vice President, General Counsel and Corporate Secretary |