Exhibit 99.1

Fall 2017 Investor Presentation

Forward Looking Statements Fall 2017 “Forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 may be included in this release. A variety of factors could cause the Bancorp’s actual results to differ from those expected at the time of this release. These include, but are not limited to, changes in economic conditions in the Bancorp’s market area, changes in policies by regulatory agencies, fluctuation in interest rates, demand for loans in the Bancorp’s market area, economic conditions in the financial services industry, the Bancorp’s ability to successfully integrate the operations of recently acquired institutions, competition and other risks set forth in the Bancorp’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10 - K for the year ended December 31, 2016. Readers are urged to carefully review and consider the various disclosures made by the Bancorp in its periodic reports filed with the Securities and Exchange Commission. Forward - looking statements speak only as of the date they are made, and the Bancorp undertakes no obligation to update them in light of new information or future events. 2

SUSTAINED PERFORMANCE Fall 2017 3

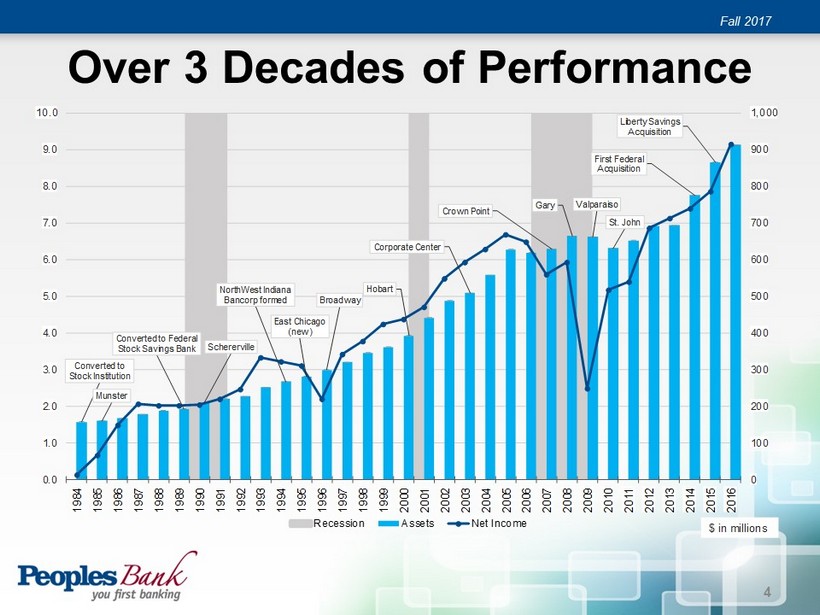

Over 3 Decades of Performance Fall 2017 Converted to Stock Institution Munster Converted to Federal Stock Savings Bank Schererville NorthWest Indiana Bancorp formed East Chicago (new) Broadway Hobart Corporate Center Crown Point Gary Valparaiso St. John First Federal Acquisition Liberty Savings Acquisition 0 100 200 300 400 500 600 700 800 900 1,000 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Recession Assets Net Income $ in millions 4

Value - Driven Culture Fall 2017 Long - Term Value Shareholders Customers Employees Community 5

2017 PERFORMANCE SUMMARY Fall 2017 6

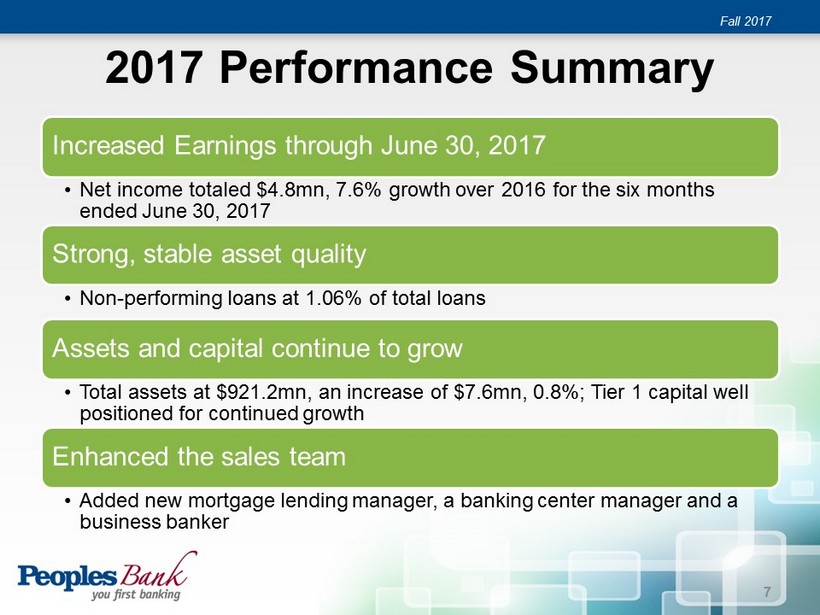

2017 Performance Summary Increased Earnings through June 30, 2017 • Net income totaled $4.8mn, 7.6% growth over 2016 for the six months ended June 30, 2017 Strong, stable asset quality • Non - performing loans at 1.06% of total loans Assets and capital continue to grow • Total assets at $921.2mn, an increase of $7.6mn, 0.8%; Tier 1 capital well positioned for continued growth Enhanced the sales team • Added new mortgage lending manager, a banking center manager and a business banker Fall 2017 7

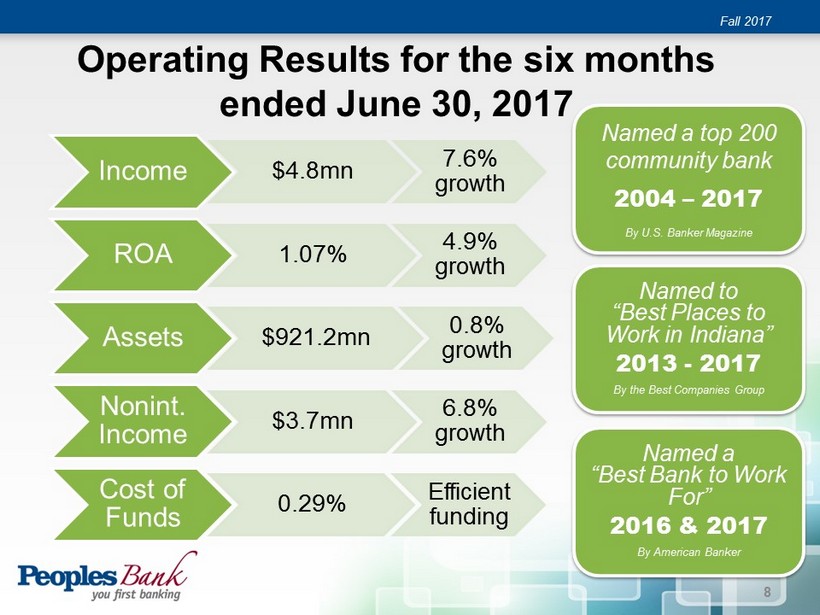

Operating Results for the six months ended June 30, 2017 Income $4.8mn 7.6% growth ROA 1.07% 4.9% growth Assets $921.2mn 0.8% growth Nonint. Income $3.7mn 6.8% growth Cost of Funds 0.29% Efficient funding Fall 2017 Named to “Best Places to Work in Indiana” 2013 - 2017 By the Best Companies Group Named a top 200 community bank 2004 – 2017 By U.S. Banker Magazine Named a “Best Bank to Work F or” 2016 & 2017 By American Banker 8

Assets Fall 2017 Sustained Growth • Up $7.6mn in 2017 • 5.8% 5 year compound annual growth rate • $166.2mn in total loan originations resulting in $17.4mn of net loan growth for 2017 • Growth reflects focus on loan originations and acquisition strategies 9

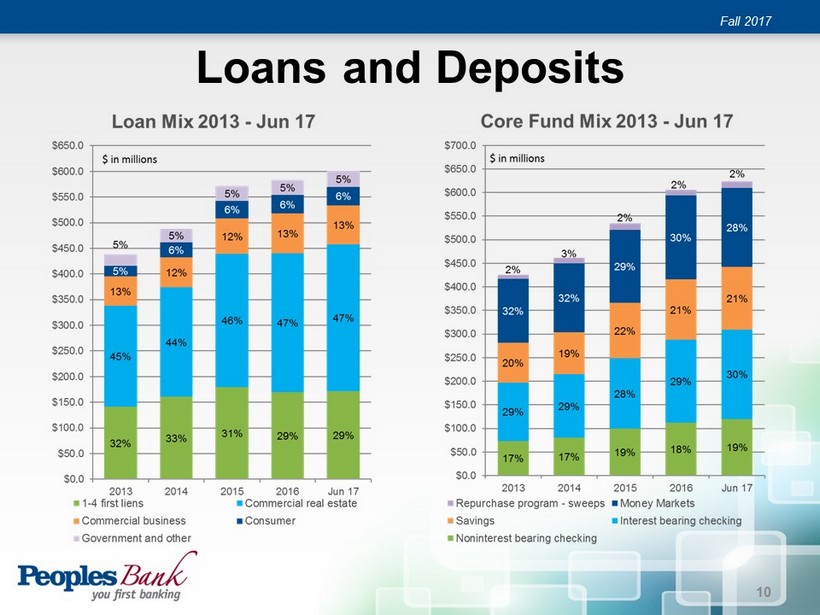

Loans and Deposits Fall 2017 10

Asset Quality Fall 2017 Nonperforming loans • Stable at 1.06% Texas Ratio • Ratio was 25.0% in 2012, down to 11.0% at Jun 17 Total classification ratio • Ratios was 12.0% at Jun 17 • ALL reserves are proportionate to risk ¹Nonaccruing loans + accruing loans 90 days past due 11

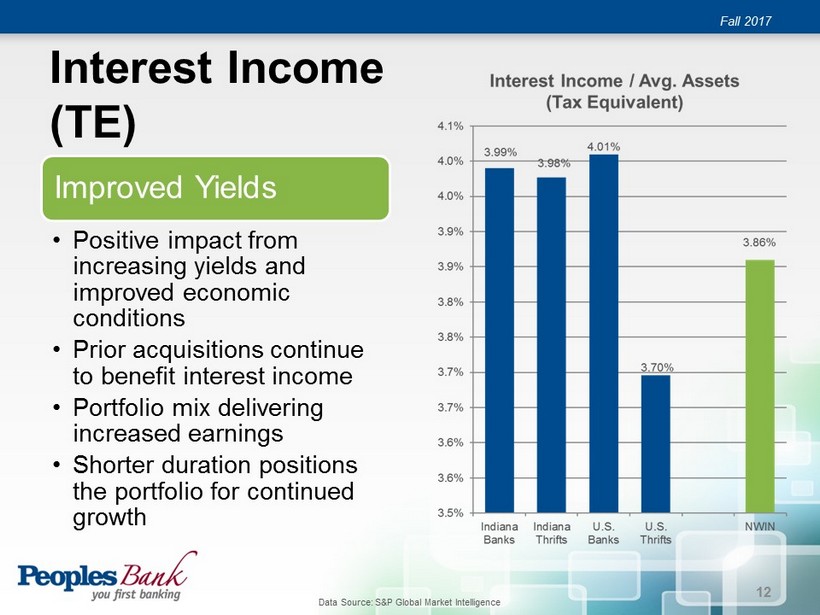

Interest Income (TE) Fall 2017 Improved Yields • Positive impact from increasing yields and improved economic conditions • Prior acquisitions continue to benefit interest income • Portfolio mix delivering increased earnings • Shorter duration positions the portfolio for continued growth 12 Data Source: S&P Global Market Intelligence

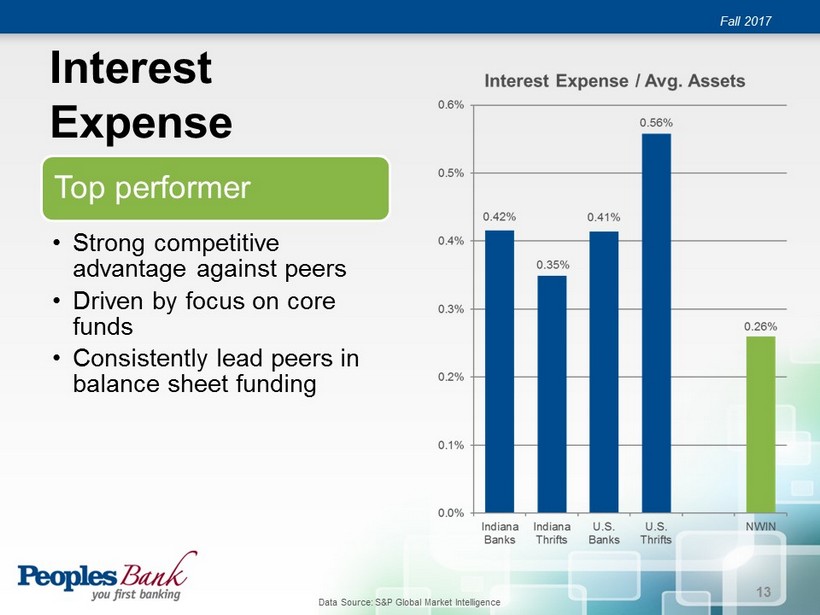

Interest Expense Fall 2017 Top performer • Strong competitive advantage against peers • Driven by focus on core funds • Consistently lead peers in balance sheet funding 13 Data Source: S&P Global Market Intelligence

Net Interest Margin (TE) Fall 2017 Outperforms peers • Results of strong funding management • Continues to expand as asset yields improve • Main driver of ROA 14 Data Source: S&P Global Market Intelligence

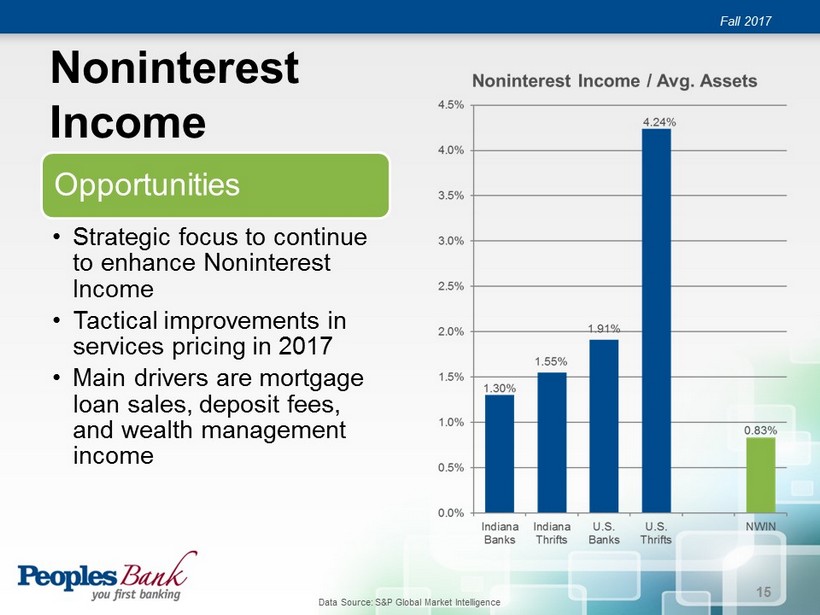

Noninterest Income Fall 2017 Opportunities • Strategic focus to continue to enhance Noninterest Income • Tactical improvements in services pricing in 2017 • Main drivers are mortgage loan sales, deposit fees, and wealth management income 15 Data Source: S&P Global Market Intelligence

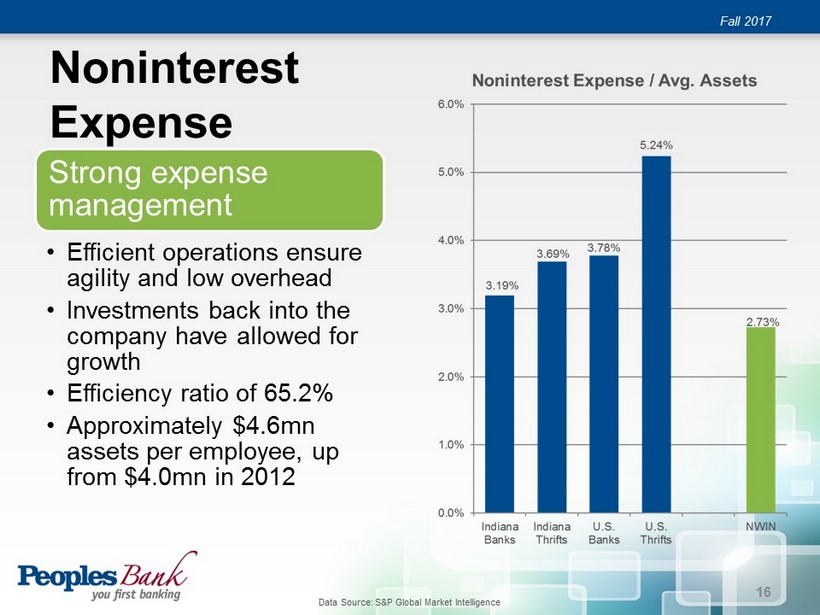

Noninterest Expense Fall 2017 Strong expense management • Efficient operations ensure agility and low overhead • Investments back into the company have allowed for growth • Efficiency ratio of 65.2% • Approximately $4.6mn assets per employee, up from $4.0mn in 2012 16 Data Source: S&P Global Market Intelligence

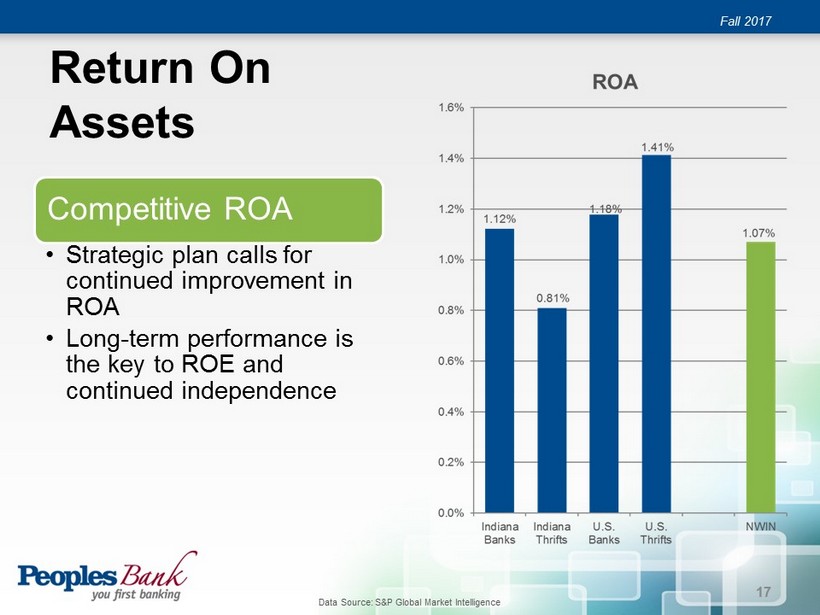

Return On Assets Fall 2017 Competitive ROA • Strategic plan calls for continued improvement in ROA • Long - term performance is the key to ROE and continued independence 17 Data Source: S&P Global Market Intelligence

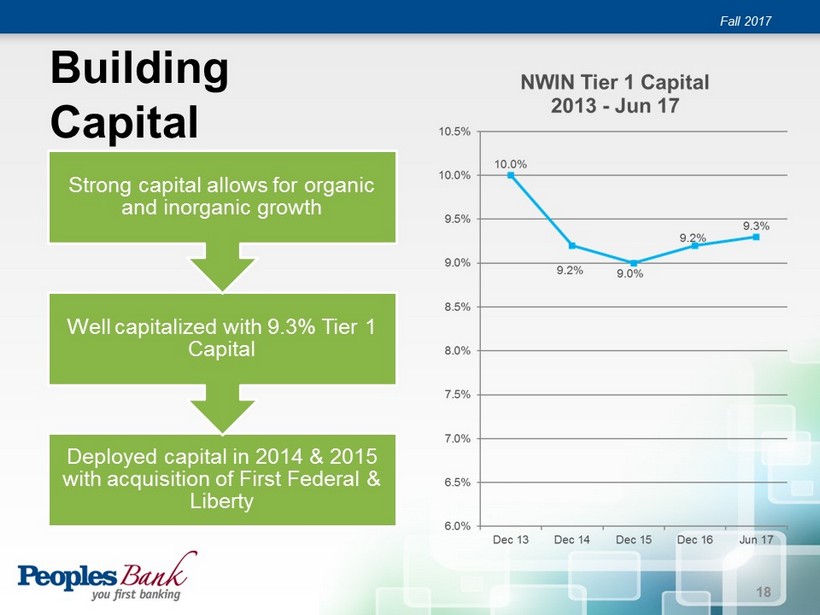

Building Capital Fall 2017 Deployed capital in 2014 & 2015 with acquisition of First Federal & Liberty Well capitalized with 9.3% Tier 1 Capital Strong capital allows for organic and inorganic growth 18

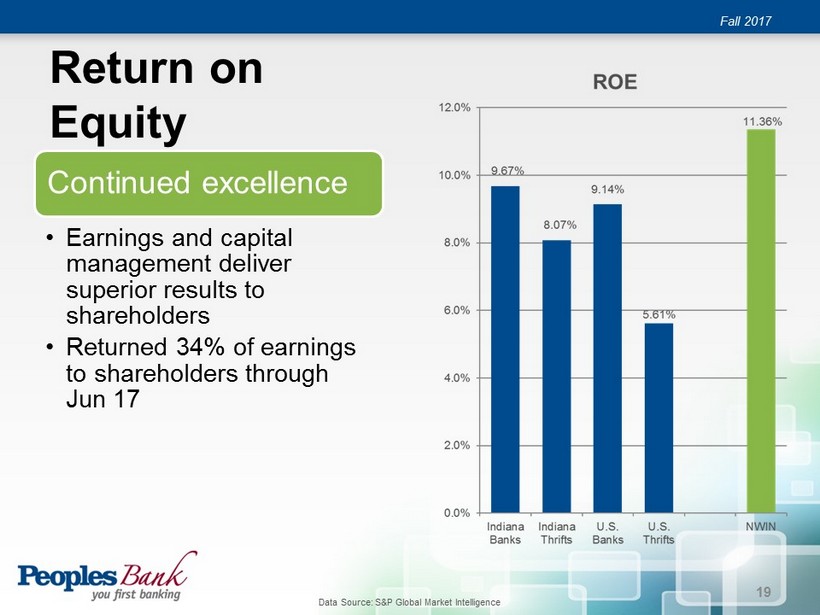

Return on Equity Fall 2017 Continued excellence • Earnings and capital management deliver superior results to shareholders • Returned 34% of earnings to shareholders through Jun 17 19 Data Source: S&P Global Market Intelligence

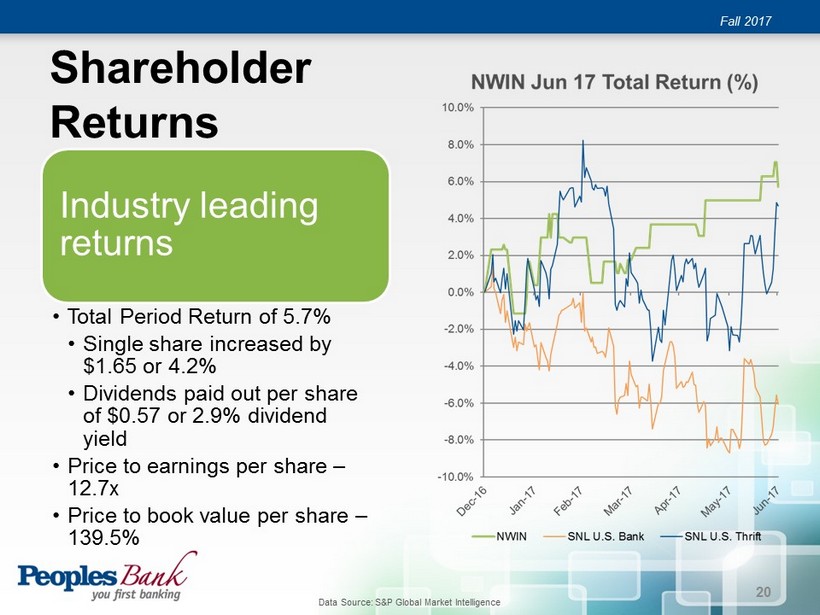

Shareholder Returns Fall 2017 Industry leading returns • Total Period Return of 5.7% • Single share increased by $1.65 or 4.2% • Dividends paid out per share of $0.57 or 2.9% dividend yield • Price to earnings per share – 12.7x • Price to book value per share – 139.5% 20 Data Source: S&P Global Market Intelligence

WHAT’S AHEAD Fall 2017 21

Q2 2017: Highlights (Three months ended June 30, 2017) • Net income totals $2.5mn, up 12.8% over Q2 2016 Earnings growth • Loan originations totaled $83.4mn Loan growth • Consumer, business, and not for profit balances grew by $4.1mn, 4.5% annual growth rate Core deposit growth [excludes cds and public funds] • ROA - 1.11% • ROE - 11.30% Key performance indicators reflect quality growth Fall 2017 22

Peoples Banking Center Network Fall 2017 16 full - service banking centers Focused on Strategic Growth • Well positioned to capture projected population growth • Strong potential in existing footprint • Active plans to enhance Porter County market presence 23

Strategic Priorities • Incremental improvement to ROA • Noninterest income growth • Efficient overhead management Profitability • Enrich risk management culture • Align risk management with strategy • Execute effective risk strategies Risk Management • Achieve business operational efficiencies • Foster a change management culture • Enhance the customer experience Innovation & Technology • Talent management • Inorganic growth opportunities • Position the Bank for the future Strategy Fall 2017 24

Thank you.