UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2021

Finward Bancorp

(Exact name of registrant as specified in its charter)

| Indiana | 000-26128 | 35-1927981 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 9204 Columbia Avenue Munster, Indiana |

46321 | |

| (Address of principal executive offices) | (Zip Code) |

(219) 836-4400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

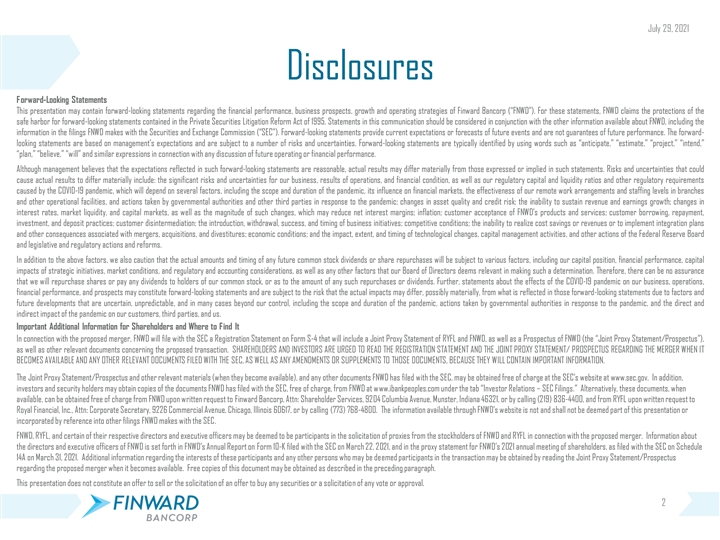

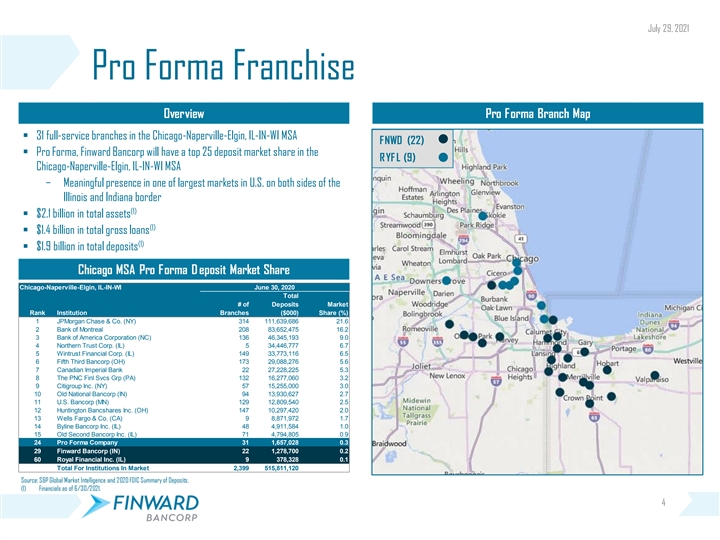

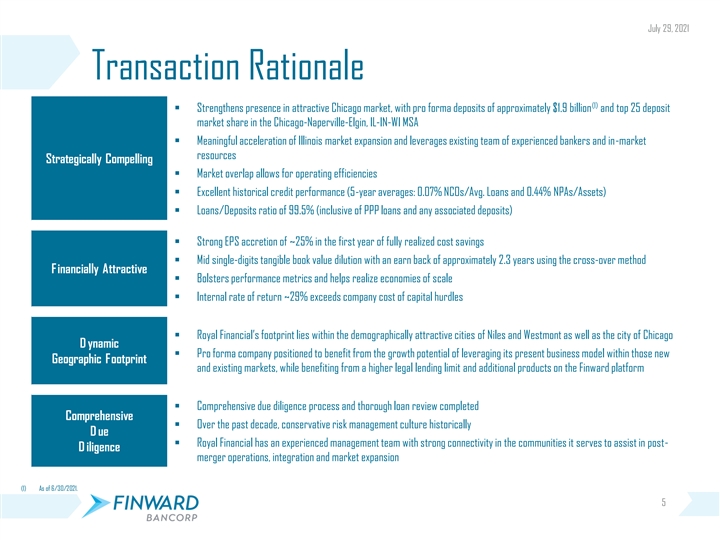

On July 28, 2021, Finward Bancorp (“Finward”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Royal Financial, Inc., a Delaware corporation (“RYFL”). Pursuant to the Merger Agreement, RYFL will merge with and into Finward, with Finward as the surviving corporation (the “Merger”). At a time to be determined at or following the Merger, Royal Savings Bank, an Illinois state chartered savings bank and wholly-owned subsidiary of RYFL (“Royal Bank”), will merge with and into Peoples Bank, the wholly-owned Indiana state chartered commercial bank subsidiary of Finward (“Peoples Bank”), with Peoples Bank as the surviving bank. The Merger Agreement is attached as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The boards of directors of each of Finward and RYFL have approved the Merger and the Merger Agreement. Subject to the approval of the Merger by Finward’s and RYFL’s respective stockholders, regulatory approvals, and other customary closing conditions, the parties anticipate completing the Merger during the first quarter of 2022.

Upon completion of the Merger, each RYFL stockholder will have the right to receive, at the stockholder’s election, 0.4609 shares of Finward common stock or $20.14 in cash, or a combination of both, for each share of RYFL’s common stock, subject to allocation provisions and adjustment, as described below. Stockholders holding less than 101 shares of RYFL common stock will only have the right to receive fixed consideration of $20.14 in cash and will not be entitled to make an election with respect to the merger consideration. The Merger Agreement provides that, in the aggregate, 65% of the outstanding shares of RYFL common stock will be converted into the right to receive shares of Finward common stock and the remaining 35% of the outstanding shares of RYFL common stock will be converted into the right to receive cash. All outstanding options to purchase RYFL common stock, whether or not vested, will be converted into the right to receive at the effective time of the Merger, an amount of cash equal to $20.14 minus the per share exercise price for each share of RYFL common stock subject to an option, less applicable tax withholdings. In addition, at the effective time of the Merger, each award of RYFL restricted stock, whether or not vested, that is outstanding immediately prior to the effective time will fully vest and be cancelled and converted into the right to receive the merger consideration, less applicable tax withholdings. Based on Finward’s closing stock price of $44.00 as of July 28, 2021, the transaction has an implied valuation of approximately $52.9 million.

All of the members of the board of directors of RYFL and one of RYFL’s executive officers, in their capacity as stockholders, have entered into a voting agreement (the “Voting Agreement”) pursuant to which they have agreed to vote their shares of RYFL common stock in favor of the approval and adoption of the Merger Agreement and the Merger. A copy of the Voting Agreement is attached to the Merger Agreement and is also included with this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein. In addition, pursuant to the Merger Agreement and subject to certain terms and conditions, the board of directors of RYFL has agreed to recommend the approval and adoption of the Merger Agreement and the Merger to the RYFL stockholders and will solicit proxies voting in favor of the Merger Agreement and the Merger from RYFL’s stockholders.

The Merger Agreement contains representations, warranties, and covenants of RYFL and Finward including, among others, covenants requiring RYFL (i) to conduct its business in the ordinary course during the period between the execution of the Merger Agreement and the effective time of the Merger or the earlier termination of the Merger Agreement, and (ii) to refrain from engaging in certain kinds of transactions during such period. In addition, RYFL has agreed not to solicit proposals relating to alternative business combination transactions or, subject to certain exceptions, enter into discussions or negotiations or provide confidential information in connection with any proposals for alternative business combinations.

The Merger Agreement also provides certain termination rights for both Finward and RYFL, and further provides that upon termination of the Merger Agreement under certain circumstances, RYFL will be obligated to pay Finward a termination fee of $2,000,000. Also, RYFL may terminate the Merger Agreement if, during the five business day period following the 15th business day prior to the scheduled closing date of the Merger, both (i) the volume weighted average of the daily closing sales prices of a share of Finward common stock during the immediately preceding 15 consecutive trading days is less than $34.42, and (ii) Finward’s share price declines by an amount that is at least 20% greater than the corresponding price decline in the SNL Small Cap U.S. Bank and Thrift Index.

As referenced above, the consummation of the Merger is subject to various conditions, including (i) receipt of the requisite approvals of the Merger Agreement and the Merger by the stockholders of both Finward and RYFL, (ii) receipt of all required regulatory approvals, (iii) the absence of any law or order prohibiting the closing of the Merger, (iv) the effectiveness of the registration statement to be filed by Finward with the Securities and Exchange Commission (the “SEC”) with respect to the Finward common stock to be issued in the Merger, and (v) subject to the conditions described in the succeeding paragraph, the amount of the RYFL Adjusted Consolidated Stockholders’ Equity (as defined in the Merger Agreement) as of the end of the month prior to the effective time of the Merger, after certain adjustments, must not be less than $48,114,000. In addition, each party’s obligation to consummate the Merger is subject to certain other conditions, including the accuracy of the representations and warranties of the other party and compliance of the other party with its covenants.

As referenced above, the merger consideration is subject to adjustment under certain circumstances. In this regard, if the amount of the RYFL Adjusted Consolidated Stockholders’ Equity is less than $48,114,000 but greater than $46,614,000 as of the end of the month prior to the effective time of the Merger, after certain adjustments prescribed in the Merger Agreement have been made, then Finward will waive the condition to closing described above relating to the RYFL Adjusted Consolidated Stockholders’ Equity amount, and the merger consideration will be reduced as described in this paragraph. If the RYFL Adjusted Consolidated Stockholders’ Equity is less than $46,614,000 as of the end of the month prior to the effective time of the Merger, Finward, in its sole discretion, may elect (but will not be required) to waive the condition to closing, in writing, and in such event, the merger consideration will be reduced as follows. If a reduction of the merger consideration is triggered as described in this paragraph above, the cash consideration will be reduced first followed, if necessary, by the stock consideration, in an amount determined pursuant to the formula set forth in the Merger Agreement, which corresponds to the amount by which the RYFL Adjusted Consolidated Stockholders’ Equity is less than the dollar thresholds set forth in this paragraph.

A current director or executive officer of RYFL, as mutually agreed upon prior to closing by Finward and RYFL, will be appointed to the boards of directors of Finward and Peoples Bank effective as of the closing of the Merger.

The foregoing description of the Merger Agreement and the Voting Agreement is not complete and is qualified in its entirety by reference to the Merger Agreement and the Voting Agreement, which are filed as Exhibits 2.1 and 10.1, respectively, to this Current Report on Form 8-K and incorporated by reference herein.

Cautionary Statement Regarding Representations and Warranties

The representations, warranties, and covenants contained in the Merger Agreement were made only for purposes of the Merger Agreement and as of specific dates, were solely for the benefit of the parties to the Merger Agreement, and are subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Merger Agreement. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Merger Agreement and should not rely on the representations, warranties, and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures.

Item 7.01 Regulation FD Disclosure.

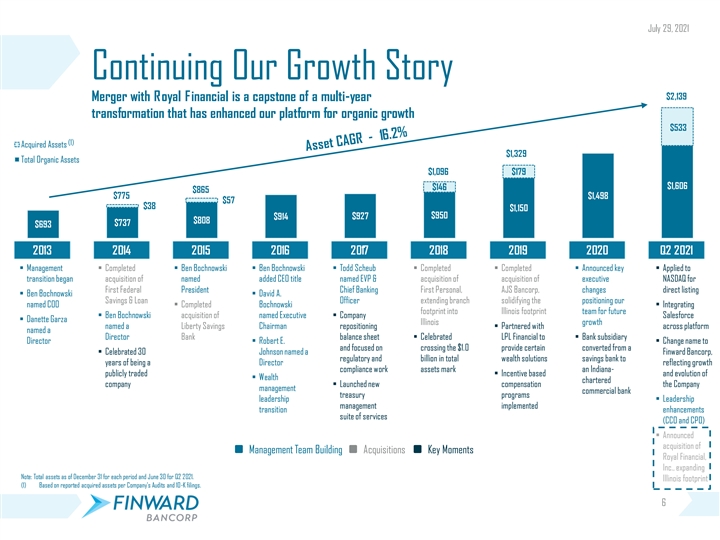

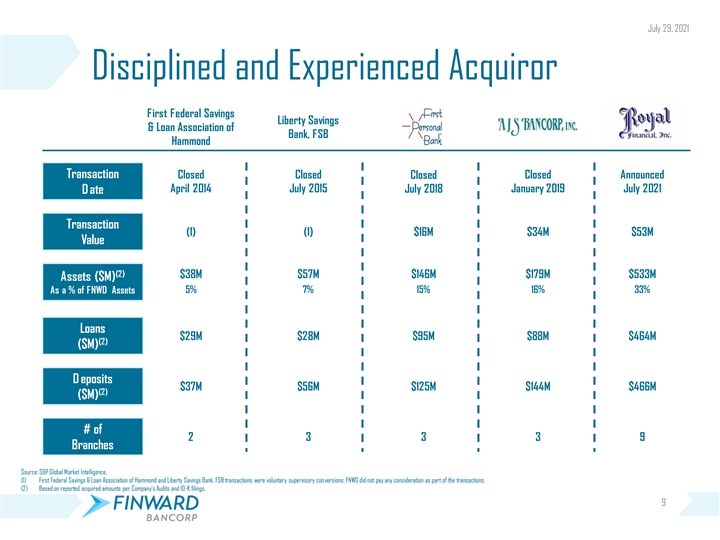

In connection with the execution of the Merger Agreement discussed in Item 1.01 above, Finward and RYFL issued a joint press release. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

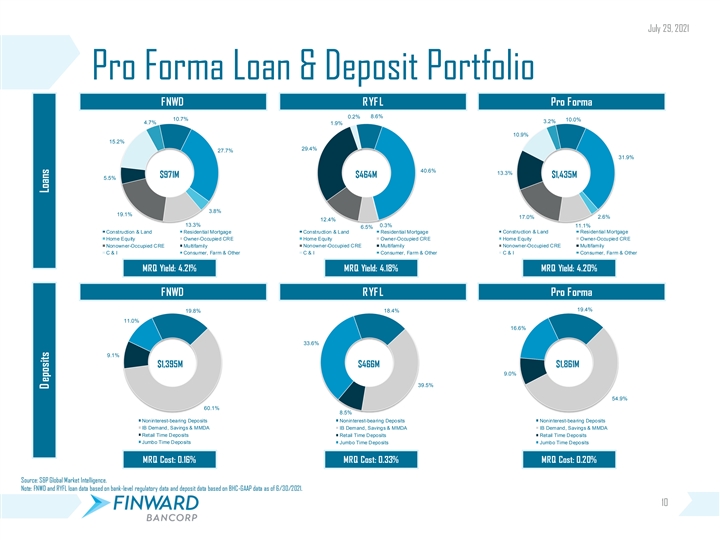

In addition, Finward intends to provide supplemental information regarding the proposed transaction in connection with presentations to analysts and investors. A copy of the slides that will be made available in connection with the presentations is attached hereto as Exhibit 99.2.

Forward-Looking Statements

This Current Report on Form 8-K may contain forward-looking statements regarding the financial performance, business prospects, growth, and operating strategies of Finward and RYFL. For these statements, each of Finward and RYFL claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about Finward and RYFL, including the information in the filings Finward makes with the SEC. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: ability to obtain regulatory approvals and meet other closing conditions to the Merger, including approval by Finward’s and RYFL’s stockholders; delay in closing the Merger; difficulties and delays in integrating Finward’s and RYFL’s businesses or fully realizing cost savings and other benefits; business disruption following the Merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Finward’s and RYFL’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Finward’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Finward or RYFL or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Finward and RYFL do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

Important Additional Information for Shareholders and Where to Find It

In connection with the proposed Merger, Finward will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of RYFL and Finward, as well as a Prospectus of Finward (the “Joint Proxy Statement/Prospectus”), as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/ PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The Joint Proxy Statement/Prospectus and other relevant materials (when they become available), and any other documents Finward has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain copies of the documents Finward has filed with the SEC, free of charge, from Finward at www.ibankpeoples.com under the tab “Investor Relations – SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from Finward upon written request to Finward Bancorp, Attn: Shareholder Services, 9204 Columbia Avenue, Munster, Indiana 46321, or by calling (219) 836-4400, and from RYFL upon written request to Royal Financial, Inc., Attn: Corporate Secretary,

9226 Commercial Avenue, Chicago, Illinois 60617, or by calling (773) 768-4800. The information available through Finward’s website is not and shall not be deemed part of this Current Report on Form 8-K or incorporated by reference into other filings Finward makes with the SEC.

Finward, RYFL, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Finward and RYFL in connection with the proposed Merger. Information about the directors and executive officers of Finward is set forth in Finward’s Annual Report on Form 10-K filed with the SEC on March 22, 2021, and in the proxy statement for Finward’s 2021 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 31, 2021. Additional information regarding the interests of these participants and any other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed Merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. The filing of this report shall not been deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by reason of Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are being furnished with this Current Report on Form 8-K.

| Exhibit No. | Description | |

| 2.1* | Agreement and Plan of Merger by and among Finward Bancorp and Royal Financial, Inc. dated July 28, 2021. | |

| 10.1 | Voting Agreement dated July 28, 2021. | |

| 99.1 | Joint Press Release issued on July 29, 2021. | |

| 99.2 | Investor Presentation | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

| * | Finward has omitted schedules and similar attachments to the subject agreement pursuant to Item 601(b) of Regulation S-K. Finward will furnish a copy of any omitted schedule or similar attachment to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Finward Bancorp | ||||||

| Date: July 29, 2021 | ||||||

| By: |

/s/ Peymon S. Torabi | |||||

| Printed Name: Peymon S. Torabi | ||||||

| Title: Executive Vice President, Chief Financial Officer and Treasurer | ||||||

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

FINWARD BANCORP

AND

ROYAL FINANCIAL, INC.

DATED AS OF JULY 28, 2021

TABLE OF CONTENTS

| ARTICLE I. THE MERGER |

2 | |||||

| 1.01 |

THE MERGER |

2 | ||||

| 1.02 |

RESERVATION OF RIGHT TO REVISE STRUCTURE |

3 | ||||

| 1.03 |

TAX FREE REORGANIZATION |

3 | ||||

| 1.04 |

ABSENCE OF CONTROL |

3 | ||||

| 1.05 |

BANK MERGER |

3 | ||||

| 1.06 |

APPRAISAL RIGHTS |

4 | ||||

| ARTICLE II. MANNER AND BASIS OF EXCHANGE OF STOCK |

4 | |||||

| 2.01 |

MERGER CONSIDERATION |

4 | ||||

| 2.02 |

ELECTION PROCEDURES |

5 | ||||

| 2.03 |

TREATMENT OF RYFL EQUITY AWARDS |

7 | ||||

| 2.04 |

ANTI-DILUTION ADJUSTMENTS |

8 | ||||

| 2.05 |

NO FRACTIONAL SHARES |

8 | ||||

| 2.06 |

EXCHANGE PROCEDURES |

8 | ||||

| ARTICLE III. REPRESENTATIONS AND WARRANTIES OF RYFL |

10 | |||||

| 3.01 |

ORGANIZATION AND AUTHORITY |

11 | ||||

| 3.02 |

AUTHORIZATION |

12 | ||||

| 3.03 |

CAPITALIZATION |

13 | ||||

| 3.04 |

ORGANIZATIONAL DOCUMENTS |

14 | ||||

| 3.05 |

COMPLIANCE WITH LAW |

14 | ||||

| 3.06 |

ACCURACY OF INFORMATION PROVIDED TO FNWD |

14 | ||||

| 3.07 |

LITIGATION AND PENDING PROCEEDINGS |

15 | ||||

| 3.08 |

FINANCIAL STATEMENTS AND REPORTS |

15 | ||||

| 3.09 |

MATERIAL CONTRACTS |

16 | ||||

| 3.10 |

ABSENCE OF UNDISCLOSED LIABILITIES |

17 | ||||

| 3.11 |

TITLE TO PROPERTIES |

17 | ||||

| 3.12 |

LOANS AND INVESTMENTS |

19 | ||||

| 3.13 |

INDEBTEDNESS |

21 | ||||

| 3.14 |

NO ANTITAKEOVER PROVISIONS |

21 | ||||

| 3.15 |

EMPLOYEE BENEFIT PLANS |

21 | ||||

| 3.16 |

LABOR AND EMPLOYMENT MATTERS |

25 | ||||

| 3.17 |

OBLIGATIONS TO EMPLOYEES |

26 | ||||

| 3.18 |

TAXES, RETURNS, AND REPORTS |

26 | ||||

| 3.19 |

DEPOSIT INSURANCE |

27 | ||||

| 3.20 |

INSURANCE |

27 | ||||

| 3.21 |

BOOKS AND RECORDS |

27 | ||||

| 3.22 |

BROKER’S, FINDER’S, OR OTHER FEES |

27 | ||||

| 3.23 |

INTERIM EVENTS |

27 | ||||

| 3.24 |

INSIDER TRANSACTIONS |

29 | ||||

| 3.25 |

INDEMNIFICATION AGREEMENTS |

29 | ||||

| 3.26 |

SHAREHOLDER APPROVAL |

30 | ||||

| 3.27 |

INTELLECTUAL PROPERTY |

30 | ||||

| 3.28 |

INFORMATION TECHNOLOGY |

31 | ||||

| 3.29 |

COMMUNITY REINVESTMENT ACT |

31 | ||||

| 3.30 |

BANK SECRECY AND ANTI-MONEY LAUNDERING COMPLIANCE |

32 | ||||

| 3.31 |

AGREEMENTS WITH REGULATORY AGENCIES |

32 | ||||

| 3.32 |

APPROVAL DELAYS |

32 | ||||

| 3.33 |

INTERNAL CONTROLS |

32 | ||||

| 3.34 |

FIDUCIARY ACCOUNTS |

33 | ||||

| 3.35 |

FAIRNESS OPINION |

33 | ||||

| 3.36 |

ANTITAKEOVER PROVISIONS INAPPLICABLE |

33 | ||||

i

| ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF FNWD |

33 | |||||

| 4.01 |

ORGANIZATION AND AUTHORITY |

34 | ||||

| 4.02 |

AUTHORIZATION |

35 | ||||

| 4.03 |

CAPITALIZATION |

36 | ||||

| 4.04 |

COMPLIANCE WITH LAW |

36 | ||||

| 4.05 |

ABSENCE OF UNDISCLOSED LIABILITIES |

37 | ||||

| 4.06 |

ACCURACY OF INFORMATION PROVIDED TO RYFL |

37 | ||||

| 4.07 |

FINANCIAL STATEMENTS AND REPORTS |

38 | ||||

| 4.08 |

ADEQUACY OF RESERVES |

38 | ||||

| 4.09 |

LITIGATION AND PENDING PROCEEDINGS |

39 | ||||

| 4.10 |

TAXES, RETURNS, AND REPORTS |

39 | ||||

| 4.11 |

DEPOSIT INSURANCE |

39 | ||||

| 4.12 |

INTERIM EVENTS |

39 | ||||

| 4.13 |

BANK SECRECY AND ANTI-MONEY LAUNDERING COMPLIANCE |

39 | ||||

| 4.14 |

COMMUNITY REINVESTMENT ACT. |

40 | ||||

| 4.15 |

APPROVAL DELAYS |

40 | ||||

| 4.16 |

INTERNAL CONTROLS |

40 | ||||

| 4.17 |

FNWD SECURITIES AND EXCHANGE COMMISSION FILINGS |

40 | ||||

| 4.18 |

FINANCIAL CAPABILITY |

40 | ||||

| 4.19 |

WELL-CAPITALIZED |

41 | ||||

| 4.20 |

INFORMATION TECHNOLOGY |

41 | ||||

| 4.21 |

EMPLOYEE BENEFIT PLANS |

41 | ||||

| 4.22 |

AGREEMENTS WITH REGULATORY AGENCIES |

42 | ||||

| ARTICLE V. CERTAIN COVENANTS |

42 | |||||

| 5.01 |

RYFL STOCKHOLDER APPROVAL |

42 | ||||

| 5.02 |

OTHER APPROVALS |

42 | ||||

| 5.03 |

CONDUCT OF BUSINESS |

43 | ||||

| 5.04 |

INSURANCE |

47 | ||||

| 5.05 |

ACCRUALS FOR LOAN LOSS RESERVE AND EXPENSES |

47 | ||||

| 5.06 |

ACQUISITION PROPOSALS |

48 | ||||

| 5.07 |

PRESS RELEASES |

51 | ||||

| 5.08 |

CHANGES AND SUPPLEMENTS TO DISCLOSURE SCHEDULES |

51 | ||||

| 5.09 |

FAILURE TO FULFILL CONDITIONS |

51 | ||||

| 5.10 |

ACCESS; INFORMATION |

51 | ||||

| 5.11 |

FINANCIAL STATEMENTS |

52 | ||||

| 5.12 |

ENVIRONMENTAL |

52 | ||||

| 5.13 |

GOVERNMENTAL REPORTS AND SHAREHOLDER INFORMATION |

54 | ||||

| 5.14 |

ADVERSE ACTIONS |

54 | ||||

| 5.15 |

EMPLOYEE BENEFITS AND EMPLOYEES |

54 | ||||

| 5.16 |

PAYOFF OF CIBC LOAN |

56 | ||||

| 5.17 |

TERMINATION OF ROYAL FINANCIAL, INC. 401(K) PLAN |

56 | ||||

| 5.18 |

DISPOSITION OF FULLY INSURED WELFARE BENEFIT AND SEC. 125 PLANS |

57 | ||||

| 5.19 |

EMPLOYMENT AGREEMENTS |

57 | ||||

| 5.20 |

OFFERS OF EMPLOYMENT |

58 | ||||

| 5.21 |

[RESERVED] |

58 | ||||

| 5.22 |

BANK MERGER |

58 | ||||

| 5.23 |

COOPERATION ON CONVERSION OF SYSTEMS |

58 | ||||

| 5.24 |

INSTALLATION/CONVERSION OF EQUIPMENT |

59 | ||||

| 5.25 |

ANTITAKEOVER PROVISIONS |

59 | ||||

ii

| ARTICLE VI. COVENANTS OF FNWD |

59 | |||||

| 6.01 |

REGULATORY APPROVALS |

59 | ||||

| 6.02 |

SEC REGISTRATION |

60 | ||||

| 6.03 |

FNWD STOCKHOLDER APPROVAL |

61 | ||||

| 6.04 |

EMPLOYEE BENEFIT PLANS AND EMPLOYEE PAYMENTS |

61 | ||||

| 6.05 |

ADVERSE ACTIONS |

63 | ||||

| 6.06 |

D&O INSURANCE AND INDEMNIFICATION |

64 | ||||

| 6.07 |

CHANGES AND SUPPLEMENTS TO FNWD DISCLOSURE SCHEDULES |

65 | ||||

| 6.08 |

FNWD AND PEOPLES BANK BOARDS OF DIRECTORS |

65 | ||||

| 6.09 |

ISSUANCE OF FNWD COMMON STOCK AND CONSIDERATION AVAILABILITY |

65 | ||||

| 6.10 |

FAILURE TO FULFILL CONDITIONS |

66 | ||||

| 6.11 |

SHORT-SWING TRADING EXEMPTION |

66 | ||||

| ARTICLE VII. CONDITIONS PRECEDENT TO THE MERGER |

66 | |||||

| 7.01 |

CONDITIONS PRECEDENT TO FNWD’S OBLIGATIONS |

66 | ||||

| 7.02 |

CONDITIONS PRECEDENT TO RYFL’S OBLIGATIONS |

70 | ||||

| ARTICLE VIII. TERMINATION OF MERGER |

71 | |||||

| 8.01 |

TERMINATION |

71 | ||||

| 8.02 |

EFFECT OF TERMINATION |

75 | ||||

| ARTICLE IX. EFFECTIVE TIME OF THE MERGER |

76 | |||||

| ARTICLE X. CLOSING |

76 | |||||

| 10.01 |

CLOSING DATE AND PLACE |

76 | ||||

| 10.02 |

DELIVERIES |

77 | ||||

| ARTICLE XI. MISCELLANEOUS |

77 | |||||

| 11.01 |

EFFECTIVE AGREEMENT |

77 | ||||

| 11.02 |

WAIVER; AMENDMENT |

78 | ||||

| 11.03 |

NOTICES |

78 | ||||

| 11.04 |

HEADINGS |

79 | ||||

| 11.05 |

SEVERABILITY |

79 | ||||

| 11.06 |

COUNTERPARTS; FACSIMILE |

79 | ||||

| 11.07 |

GOVERNING LAW; ENFORCEMENT; SPECIFIC PERFORMANCE; JURY TRIAL |

79 | ||||

| 11.08 |

ENTIRE AGREEMENT |

80 | ||||

| 11.09 |

SURVIVAL OF REPRESENTATIONS, WARRANTIES, OR COVENANTS |

80 | ||||

| 11.10 |

EXPENSES |

80 | ||||

| 11.11 |

CERTAIN REFERENCES |

80 | ||||

iii

INDEX OF DEFINED TERMS

| TERM |

SECTION | |

| 1933 Act | Section 6.02(a) | |

| 1934 Act | Section 3.03(d) | |

| Acquisition Agreement | Section 5.06(c) | |

| Acquisition Proposal | Section 5.06(e) | |

| Adjusted Stock Consideration | Exhibit 7.01(m) | |

| Adjusted Stock Price | Exhibit 7.01(m) | |

| Adverse Recommendation Change | Section 5.06(c) | |

| Adverse Recommendation Change Notice | Section 5.06(c) | |

| Agreed Director | Section 1.01(b) | |

| Agreement | Preamble | |

| Antitakeover Provision | Section 3.14 | |

| Average FNWD Closing Price | Exhibit 7.01(m) | |

| Bank Merger | Section 1.05 | |

| BHC Act | Recitals | |

| Boenning | Section 3.22 | |

| BSA/AML Law | Section 3.30 | |

| Cash Adjustment Amount | Exhibit 7.01(m) | |

| Cash Consideration | Section 2.01 | |

| Cash Conversion Number | Section 2.01 | |

| Cash Election | Section 2.02(a) | |

| Cash Election Shares | Section 2.02(a) | |

| Cash/Stock Consideration | Section 2.02(a) | |

| Change in Control Payments | Section 5.19 | |

| CIBC LOC | Section 5.16 | |

| Closing | Section 10.01 | |

| Closing Date | Section 10.01 | |

| Closing Shares Amount | Exhibit 7.01(m) | |

| COBRA | Section 5.15(b) | |

| Confidentiality Agreement | Section 11.08 | |

| Code | Section 1.03 | |

| Data Processing Agreement | Section 7.01(l) | |

| DGCL | Section 1.06 | |

| Department | Section 3.15(a)(i) | |

| Designated Environmental Consultant | Section 5.12(a) | |

| Determination Date | Section 8.01(i) | |

| Dispute Matters | Section 7.01(j)(ii) | |

| Dissenting Shares | Section 1.06 | |

| Election Deadline | Section 2.02(b) | |

| Election Form | Section 2.02(a) | |

| Employee Agreements | Section 3.16 | |

| Employment Agreement | Section 5.19 | |

| Environmental Cost Notice | Section 5.12(b) | |

| Environmental Cost Objection | Section 5.12(b) |

iv

| TERM |

SECTION | |

| Environmental Laws | Section 3.11(c) | |

| Environmental Liabilities | Section 5.12(b) | |

| Equity Shortfall | Exhibit 7.01(m) | |

| ERISA | Section 3.15(a) | |

| ERISA Affiliate | Section 3.15(a) | |

| Estimated Clean-up Costs | Section 5.12(b) | |

| Exchange Agent | Section 2.02(a) | |

| Exchange Ratio | Section 2.01 | |

| Exempt Employees | Section 5.15(b) | |

| Exempt RYFL Stock | Section 2.01 | |

| Existing Policy | Section 6.06(b) | |

| Fill Option | Section 8.01(i) | |

| Final Index Price | Section 8.01(i) | |

| Final Price | Section 8.01(i) | |

| First Trigger Fill | Section 8.01(i) | |

| FNWD | Preamble | |

| FNWD Disclosure Schedule | Article IV, 1st paragraph | |

| FNWD Financial Statements | Section 4.07(a) | |

| FNWD IT Assets | Section 4.20 | |

| FNWD Market Value | Section 8.01(i) | |

| FNWD Regulatory Agreement | Section 4.22 | |

| FNWD Stockholders’ Meeting | Section 6.03 | |

| FRB | Recitals | |

| GAAP | Article III, 3rd paragraph | |

| Governmental Authority | Section 5.13 | |

| IBCL | Section 1.01(a) | |

| Independent Environmental Consultant | Section 5.12(b) | |

| Index | Section 8.01(i) | |

| Initial Index Price | Section 8.01(i) | |

| Initial Price | Section 8.01(i) | |

| Investigation Period | Section 5.12(a) | |

| Joint Proxy Statement | Section 6.02(a) | |

| Joint Proxy Statement/Prospectus | Section 6.02(a) | |

| knowledge (relating to FNWD) | Article IV, 3rd paragraph | |

| knowledge (relating to RYFL) | Article III, 3rd paragraph | |

| Law | Section 3.05(a) | |

| Loan(s) | Section 5.03(a)(iv) | |

| Loan Termination Documents | Section 5.16 | |

| Mailing Date | Section 2.02(a) | |

| Material Adverse Effect on FNWD | Article IV, 2nd paragraph | |

| Material Adverse Effect on RYFL | Article III, 2nd paragraph | |

| Material Contracts | Section 3.09(a) | |

| Maximum Amount | Section 6.06(b) | |

| Merger | Section 1.01(a) | |

| Merger Consideration | Section 2.01 |

v

| TERM |

SECTION | |

| Mixed Election | Section 2.02(a) | |

| Mutual Termination of Employment Agreement | Section 5.19 | |

| NASDAQ | Section 6.02(c) | |

| Non-Election | Section 2.02(a) | |

| Non-Election Shares | Section 2.02(a) | |

| Non-Exempt Employees | Section 5.15(b) | |

| Non-Retained Employees | Section 5.15(b) | |

| Odd-Lot Holders | Section 2.01 | |

| Offered Employee | Section 5.20 | |

| Old Certificate | Section 2.06(a) | |

| Option Cancellation Agreement | Section 2.03(a) | |

| OREO | Section 3.11(a) | |

| Outside Date | Section 8.01(b)(iii) | |

| Payoff Amount | Section 5.16 | |

| Payoff Date | Section 5.16 | |

| Peoples Bank | Recitals | |

| Peoples Bank 401(k) Plan | Section 5.17(e) | |

| Person | Sections 2.06(f), 5.06(e) | |

| Plan Termination Date | Section 5.17(b) | |

| Prospectus | Section 6.02(a) | |

| Qualifying Termination Event | Section 6.04(i) | |

| Registration Statement | Section 6.02(a) | |

| Regulatory Approvals | Section 7.01(e) | |

| Related Agreements | Section 11.07 | |

| Release Agreement | Section 5.15(b) | |

| Replacement Policy | Section 6.06(b) | |

| Retained Employees | Section 5.15(b) | |

| Royal Bank | Recitals | |

| RYFL | Preamble | |

| RYFL 401(k) Plan | Section 5.17(a) | |

| RYFL 2018 Equity Plan | Section 2.03(a) | |

| RYFL Adjusted Consolidated Stockholders’ Equity | Section 7.01(m) | |

| RYFL Common Stock | Section 1.02 | |

| RYFL Disclosure Schedule | Article III, 1st paragraph | |

| RYFL Equity Plans | Section 2.03(a) | |

| RYFL Financial Statements | Section 3.08(a) | |

| RYFL Indemnified Party | Section 6.06(a) | |

| RYFL IT Assets | Section 3.28 | |

| RYFL Option Plan | Section 2.03(a) | |

| RYFL Options | Section 2.03(a) | |

| RYFL Plan(s) | Section 3.15(a) | |

| RYFL Regulatory Agreement | Section 3.31 | |

| RYFL Restricted Stock Award RYFL Severance Benefits Plan |

Section 2.03(b) Section 5.15(b) | |

| RYFL Stockholders’ Meeting | Section 5.01 |

vi

| TERM |

SECTION | |

| Sarbanes-Oxley Act | Section 3.05(c) | |

| SEC | Section 4.17 | |

| Second Trigger Fill | Section 8.01(i) | |

| Second Trigger Price | Section 8.01(i) | |

| SEC Reports | Section 4.17 | |

| Shortfall Number | Section 2.02(c)(ii) | |

| Standard Permitted Exceptions | Section 3.11(b) | |

| Stock Consideration | Section 2.01 | |

| Stock Conversion Number | Section 2.01 | |

| Stock Election | Section 2.02(a) | |

| Stock Election Number | Section 2.02(a) | |

| Stock Election Shares | Section 2.02(a) | |

| Subsequent RYFL Financial Statements | Section 5.11 | |

| Subsidiaries (relating to FNWD) | Article IV, 3rd paragraph | |

| Subsidiaries (relating to RYFL) | Article III, 3rd paragraph | |

| Superior Proposal | Section 5.06(f) | |

| Surviving Bank | Section 1.05 | |

| Surviving Corporation | Section 1.01(a) | |

| Termination Fee | Section 8.02(b) | |

| Unpermitted Exceptions | Section 3.11(b) | |

| Voting Agreement | Recitals |

vii

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”) is dated to be effective as of the 28th day of July, 2021, by and between FINWARD BANCORP, an Indiana corporation (“FNWD”), and ROYAL FINANCIAL, INC., a Delaware corporation (“RYFL”).

RECITALS

WHEREAS, FNWD is an Indiana corporation registered as a financial holding company with the Board of Governors of the Federal Reserve System (“FRB”) under the Bank Holding Company Act of 1956, as amended (the “BHC Act”), with its principal office located in Munster, Indiana; and

WHEREAS, RYFL is a Delaware corporation registered as a bank holding company with the FRB under the BHC Act, with its principal office located in Chicago, Illinois; and

WHEREAS, FNWD and RYFL seek to affiliate through a corporate reorganization whereby RYFL will merge with and into FNWD, and thereafter or simultaneously therewith, Royal Savings Bank, an Illinois state chartered savings bank and wholly-owned subsidiary of RYFL (“Royal Bank”), will be merged with and into Peoples Bank, an Indiana state-chartered commercial bank and wholly-owned subsidiary of FNWD (“Peoples Bank”); and

WHEREAS, the Boards of Directors of each of the parties hereto have determined that it is in the best interests of their respective corporations and their respective shareholders to consummate the merger provided for herein and have approved this Agreement, authorized its execution and designated this Agreement a plan of reorganization and a plan of merger; and

WHEREAS, the Boards of Directors of each of the parties hereto intend this Agreement to be designated a plan of reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, and a plan of merger; and

WHEREAS, as an inducement for FNWD to enter into this Agreement, each of the directors and an executive officer of RYFL and Royal Bank have entered into a Voting Agreement with FNWD substantially in the form of Exhibit 5.01 hereto, dated as of the date hereof (the “Voting Agreement”), pursuant to which each such director and executive officer has agreed, among other things, to vote all shares of common stock of RYFL owned by such person in favor of the approval of this Agreement and the transactions contemplated hereby, upon the terms and subject to the conditions set forth in such Voting Agreements.

NOW, THEREFORE, in consideration of the foregoing premises, the representations, warranties, covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereby make this

| AGREEMENT AND PLAN OF MERGER | PAGE 1 |

Agreement and prescribe the terms and conditions of the merger of RYFL with and into FNWD, and the mode of carrying such merger into effect as follows:

ARTICLE I.

THE MERGER

1.01 The Merger.

(a) General Description. Upon the terms and subject to the conditions of this Agreement, at the Effective Time (as defined in Article IX) hereof, RYFL shall merge with and into and under the Articles of Incorporation of FNWD (the “Merger”). FNWD shall survive the Merger (sometimes hereinafter referred to as the “Surviving Corporation”) and shall continue its corporate existence under the laws of the State of Indiana pursuant to the provisions of and with the effect provided in the Indiana Business Corporation Law (the “IBCL”), as amended.

(b) Name, Officers, and Directors. The name of the Surviving Corporation shall be “Finward Bancorp,” and its principal office shall be located at 9204 Columbia Avenue, Munster, Indiana 46321. The officers of FNWD serving at the Effective Time shall continue to serve as the officers of the Surviving Corporation, until such time as their successors shall have been duly elected and have qualified or until their earlier resignation, death, or removal from office. The directors of the Surviving Corporation following the Effective Time shall be those individuals serving as directors of FNWD at the Effective Time, until such time as their successors have been duly elected and have qualified or until their earlier resignation, death, or removal as a director; provided that, FNWD shall take all appropriate action so that, as of the Effective Time and subject to and in accordance with the By-Laws of FNWD, a current director or executive officer of RYFL, as shall be mutually agreed upon by FNWD and RYFL (the “Agreed Director”), shall be appointed as a director of FNWD.

(c) Articles of Incorporation and By-Laws. The Articles of Incorporation and By-Laws of FNWD in existence at the Effective Time shall remain the Articles of Incorporation and By-Laws of the Surviving Corporation following the Effective Time, until such Articles of Incorporation and By-Laws shall be further amended as provided by applicable Law.

(d) Effect of the Merger. At the Effective Time, the title to all assets, real estate, and other property owned by RYFL shall vest in the Surviving Corporation, pursuant to Indiana Code Section 23-1-40-6, as amended, without reversion or impairment. At the Effective Time, all liabilities of RYFL shall become liabilities of the Surviving Corporation, pursuant to Indiana Code Section 23-1-40-6, as amended.

(e) Integration. At the Effective Time and subject to the terms and conditions of this Agreement, the parties hereto currently intend to effectuate, or cause to be effectuated, the Merger, pursuant to the terms of this Agreement and the IBCL, and this Agreement shall also constitute the “plan of merger” pursuant to Indiana Code Section 23-1-40-1. If required, the parties agree to enter into a separate short-form plan of merger evidencing the terms required by Indiana Code Section 23-1-40-1. The parties agree to cooperate and to take all reasonable actions prior to or following the Effective Time, including executing all requisite documentation, as may be reasonably necessary to effect the Merger in accordance with the terms and conditions hereof.

| AGREEMENT AND PLAN OF MERGER | PAGE 2 |

1.02 Reservation of Right to Revise Structure. At FNWD’s election, the Merger may alternatively be structured so that (a) RYFL is merged with and into any other direct or indirect wholly-owned subsidiary of FNWD; or (b) any direct or indirect wholly-owned subsidiary of FNWD is merged with and into RYFL; provided that, no such change shall (1) alter or change the amount or kind of the Merger Consideration (as defined in Section 2.01) or the treatment of the holders of common stock, par value $0.01 per share, of RYFL (the “RYFL Common Stock”) (including the holders of RYFL Restricted Stock Awards, as defined in Section 2.03(b)), or the holders of options for RYFL Common Stock, (2) prevent the parties from obtaining the opinions of counsel referred to in Sections 7.01(h) and 7.02(h) or otherwise cause the transaction to fail to qualify for the tax treatment described in Section 1.03 or adversely affect the tax treatment of RYFL’s stockholders pursuant to this Agreement, or (3) materially impede, delay or jeopardize consummation of the transactions contemplated by this Agreement or result in any adverse change to the benefits and other arrangements provided to or on behalf of RYFL’s directors, officers and other employees. In the event of such a revision, the parties agree to execute an appropriate amendment to this Agreement (to the extent such amendment only changes the method of effecting the business combination and does not substantively affect this Agreement or the rights and obligations of the parties or their respective shareholders) in order to reflect such revision.

1.03 Tax Free Reorganization. FNWD and RYFL intend for the Merger to qualify as a reorganization within the meaning of Section 368(a) and related sections of the Internal Revenue Code of 1986, as amended (the “Code”), and that this Agreement shall constitute a “plan of reorganization” for purposes of Sections 354 and 361 of the Code, and agree to cooperate and to take such actions as may be reasonably necessary to assure such result. Following the Effective Time, neither FNWD nor any Subsidiary knowingly shall take any action, cause any action to be taken, fail to take any action, or cause any action to fail to be taken, which action or failure to act could prevent the Merger from qualifying as a reorganization within the meaning of Section 368(a) of the Code. Within forty-five (45) days following the Effective Time, the Surviving Corporation shall comply with the reporting requirements of Section 1.6045B-1(a)(2) of the Treasury Regulations.

1.04 Absence of Control. Subject to any specific provisions of this Agreement, it is the intent of the parties to this Agreement that neither FNWD nor RYFL by reason of this Agreement shall be deemed (until consummation of the transactions contemplated hereby) to control, directly or indirectly, the other party or any of its respective Subsidiaries (as defined in the introductory paragraphs to Article III and Article IV) and shall not exercise or be deemed to exercise, directly or indirectly, a controlling influence over the management or policies of such other party or any of its respective Subsidiaries.

1.05 Bank Merger. The parties will cooperate and use reasonable best efforts to effect the merger of Royal Bank with and into Peoples Bank (the “Bank Merger”) at a time to be determined at or following the Effective Time of the Merger pursuant to a merger agreement substantially in the form of the Bank Merger Agreement attached hereto as Exhibit 1.05. At the effective time of the Bank Merger, the separate corporate existence of Royal Bank will terminate. Peoples Bank will be the surviving bank (the “Surviving Bank”) and will continue its corporate existence under applicable Law. The Articles of Incorporation of Peoples Bank, as then in effect, will be the Articles of Incorporation of the Surviving Bank, and the By-Laws of Peoples Bank, as then in effect, will be the By-Laws of the Surviving Bank. The directors of the Surviving Bank

| AGREEMENT AND PLAN OF MERGER | PAGE 3 |

following the effective time of the Bank Merger shall be those individuals serving as directors of Peoples Bank at the effective time of the Bank Merger, until such time as their successors have been duly elected and have qualified or until their earlier resignation, death, or removal as a director; provided that, Peoples Bank shall take all appropriate action so that, as of the Effective Time and subject to and in accordance with the By-Laws of Peoples Bank, the Agreed Director shall be appointed as a director of Peoples Bank. The officers of Peoples Bank serving at the effective time of the Bank Merger shall continue to serve as the officers of the Surviving Bank, until such time as their successors shall have been duly elected and have qualified or until their earlier resignation, death, or removal from office.

1.06 Appraisal Rights. Notwithstanding anything to the contrary contained in this Agreement, to the extent appraisal rights are available to holders of RYFL Common Stock pursuant to the provisions of any applicable Law (as defined in Section 3.05(a)), including Section 262 of the Delaware General Corporation Law (“DGCL”), any shares of RYFL Common Stock held by a Person (as defined in Section 2.06(f)) whose shares were not voted in favor of the Merger or consented thereto in writing, and who has properly exercised appraisal rights with respect to such shares in accordance with Section 262 of the DGCL, and complies with and satisfies any other provisions of applicable Law concerning the rights of such Person to dissent from the Merger and to require appraisal of such Person’s shares, and who has not withdrawn such objection or waived such rights prior to the Effective Time (collectively with respect to all such RYFL shareholders, the “Dissenting Shares”), shall not be converted pursuant to Section 2.01, but instead shall be entitled only to such rights as are granted by Section 262 of the DGCL; provided that, each Dissenting Share held by a Person at the Effective Time who shall, after the Effective Time, withdraw the demand for appraisal or lose the right of appraisal, in either case pursuant to applicable Law, shall be deemed to have been converted, as of the Effective Time, into the right to receive the consideration, without interest, as is determined in accordance with Article II. At the Effective Time, any holder of Dissenting Shares shall cease to have any rights with respect thereto, except the rights set forth in Section 262 of the DGCL and as provided in the preceding sentence. RYFL shall provide FNWD prompt written notice of any demands received by RYFL for the appraisal of shares of RYFL Common Stock, any withdrawal of any such demand, and any other demand, notice, or instrument delivered to RYFL prior to the Effective Time pursuant to the DGCL that relates to such demand, and FNWD shall have the opportunity and right to direct all negotiations and proceedings with respect to such demands. Except with the prior written consent of FNWD, RYFL shall not make any payment with respect to, or settle or offer to settle, any such demands.

ARTICLE II.

MANNER AND BASIS OF EXCHANGE OF STOCK

2.01 Merger Consideration. Subject to the terms and conditions of this Agreement, at the Effective Time, each share of RYFL Common Stock issued and outstanding immediately prior to the Effective Time (other than Dissenting Shares, shares held as treasury stock of RYFL, and shares held directly or indirectly by FNWD, except shares held in a fiduciary capacity or in satisfaction of a debt previously contracted, if any; collectively, the “Exempt RYFL Stock”) shall become and be converted into the right to receive in accordance with this Article II, at the election of the holder thereof, either (or a combination of): (i) 0.4609 shares of FNWD common stock (the

| AGREEMENT AND PLAN OF MERGER | PAGE 4 |

“Exchange Ratio”) (as adjusted in accordance with the terms of this Agreement), without par value (the stock consideration to be paid in the Merger is referred to herein as the “Stock Consideration”), or (ii) $20.14 in cash (the cash consideration to be paid in the Merger is referred to herein as the “Cash Consideration”) (with the Stock Consideration and the Cash Consideration collectively referred to herein as the “Merger Consideration”); provided that, notwithstanding any other provision of this Agreement to the contrary, the RYFL shareholders owning less than 101 shares of RYFL Common Stock as of the Effective Time (the “Odd-Lot Holders”) will only be entitled to receive $20.14 per share in cash, will not be entitled to make an election with respect to the Merger Consideration in accordance with the terms hereof, and will not be entitled to receive any of the Stock Consideration; provided further that, in the aggregate, sixty-five percent (65%) of RYFL’s Common Stock issued and outstanding immediately prior to the Effective Time (the “Stock Conversion Number”) will be converted and exchanged for the Stock Consideration and, that in the aggregate, thirty-five percent (35%) of RYFL’s Common Stock issued and outstanding immediately prior to the Effective Time (the “Cash Conversion Number”) will be converted and exchanged for the Cash Consideration.

2.02 Election Procedures.

(a) Cash and Stock Elections. An election form and other appropriate and customary transmittal materials (which shall specify that delivery shall be effected, and risk of loss and title to certificates shall pass, only upon proper delivery of such certificates to Broadridge Corporate Issuer Solutions, Inc., as FNWD’s stock transfer agent (the “Exchange Agent”)) in such form as designated by FNWD and the Exchange Agent, and in such form as reasonably acceptable to RYFL (the “Election Form”), shall be mailed on such date as RYFL and FNWD shall mutually agree upon (the “Mailing Date”) to each holder of record of RYFL Common Stock on the date which is five (5) business days prior to the Mailing Date, other than the Odd-Lot Holders. FNWD shall be solely responsible for the payment of any fees and expenses of the Exchange Agent. Each Election Form shall permit the holder of record of RYFL Common Stock (or in the case of nominee record holders, the beneficial owner through proper instructions and documentation) to (i) elect to receive the Cash Consideration for all of such holder’s shares of RYFL Common Stock (a “Cash Election”), (ii) elect to receive the Stock Consideration for all of such holder’s shares of RYFL Common Stock (a “Stock Election”), (iii) elect to receive Stock Consideration for a portion of such holder’s RYFL Common Stock and Cash Consideration for the remaining portion of such holder’s RYFL Common Stock (the “Cash/Stock Consideration”) (an election to receive the Cash/Stock Consideration is referred to as a “Mixed Election”), or (iv) make no election with respect to the receipt of the Cash Consideration or the Stock Consideration (a “Non-Election”); provided, however, that, notwithstanding any other provision of this Agreement to the contrary, the Stock Conversion Number shall be converted and exchanged into the Stock Consideration, and the Cash Conversion Number shall be converted and exchanged into the Cash Consideration. Shares of RYFL Common Stock as to which a Cash Election (including as part of a Mixed Election) has been made, and shares which are held by Odd-Lot Holders, are referred to herein as “Cash Election Shares.” Shares of RYFL Common Stock as to which a Stock Election (including as part of a Mixed Election) has been made are referred to herein as “Stock Election Shares.” Shares of RYFL Common Stock as to which no election has been made (or as to which an Election Form is not properly completed and returned in a timely fashion) are referred to herein as “Non-Election Shares.” The aggregate number of shares of RYFL Common Stock with respect to which a Stock Election has been made is referred to herein as the “Stock Election Number.”

| AGREEMENT AND PLAN OF MERGER | PAGE 5 |

(b) Delivery of Election. To be effective, a properly completed Election Form shall be received by the Exchange Agent on or before 5:00 p.m., Eastern Time, on such date as mutually agreed upon between FNWD and RYFL (which date shall be at least five (5) business days prior to the anticipated Closing Date and shall be publicly announced by FNWD and RYFL as soon as practicable prior to such date)) (the “Election Deadline”), accompanied by the certificates representing RYFL Common Stock as to which such Election Form is being made or by an appropriate guarantee of delivery of such certificates, as set forth in the Election Form, from a member of any registered national securities exchange or a commercial bank or trust company in the United States; provided that, any such guarantee shall be subject to the condition that such certificates are in fact delivered to the Exchange Agent by the time required in such guarantee of delivery and failure to deliver the certificates covered by such guarantee of delivery within the time set forth in such guarantee shall be deemed to invalidate any otherwise properly made election, unless otherwise determined by FNWD, in its sole discretion. For shares of RYFL Common Stock (if any) held in book entry form, FNWD shall establish procedures for delivery of such shares, which procedures shall be reasonably acceptable to RYFL. If a holder of RYFL Common Stock either (i) does not submit a properly completed Election Form in a timely fashion, or (ii) revokes the holder’s Election Form prior to the Election Deadline (without later submitting a properly completed Election Form prior to the Election Deadline), the shares of RYFL Common Stock held by such holder shall be designated Non-Election Shares. All Election Forms shall automatically be revoked, and all certificates returned, if the Exchange Agent is notified in writing by FNWD and RYFL that this Agreement has been terminated. Subject to the terms of this Agreement and of the Election Form, the Exchange Agent shall have reasonable discretion to determine whether any election, revocation, or change has been properly or timely made and to disregard immaterial defects in any Election Form, and any good faith decisions of the Exchange Agent regarding such matters shall be binding and conclusive. Neither FNWD nor the Exchange Agent shall be under any obligation to notify any Person of any defect in an Election Form.

(c) Allocation. The allocation among the holders of shares of RYFL Common Stock of rights to receive the Cash Consideration and the Stock Consideration will be made as set forth in this Section 2.02(c) (with the Exchange Agent to determine, consistent with Section 2.02(a), whether fractions of Cash Election Shares, Stock Election Shares, or Non-Election Shares, as applicable, shall be rounded up or down).

(i) Aggregate Stock Consideration Oversubscribed. If the Stock Election Number exceeds the Stock Conversion Number, then all Cash Election Shares and all Non-Election Shares shall be converted into the right to receive the Cash Consideration, and, subject to Section 2.05 hereof, each holder of Stock Election Shares will be entitled to receive the Stock Consideration in respect of that number of Stock Election Shares held by such holder equal to the product obtained by multiplying (x) the number of Stock Election Shares held by such holder by (y) a fraction, the numerator of which is the Stock Conversion Number and the denominator of which is the Stock Election Number, with the remaining number of such holder’s Stock Election Shares being converted into the right to receive the Cash Consideration;

(ii) Aggregate Stock Consideration Undersubscribed. If the Stock Election Number is less than the Stock Conversion Number (the amount by which the Stock Conversion Number exceeds the Stock Election Number being referred to herein as the

| AGREEMENT AND PLAN OF MERGER | PAGE 6 |

“Shortfall Number”), then all Stock Election Shares shall be converted into the right to receive the Stock Consideration and the Non-Election Shares and the Cash Election Shares shall be treated in the following manner:

(A) Adjustment to Non-Election Share Allocation Only. If the Shortfall Number is less than or equal to the number of Non-Election Shares, then all Cash Election Shares shall be converted into the right to receive the Cash Consideration and, subject to Section 2.05 hereof, each holder of Non-Election Shares shall receive the Stock Consideration in respect of that number of Non-Election Shares held by such holder equal to the product obtained by multiplying (x) the number of Non-Election Shares held by such holder by (y) a fraction, the numerator of which is the Shortfall Number and the denominator of which is the total number of Non-Election Shares, with the remaining number of such holder’s Non-Election Shares being converted into the right to receive the Cash Consideration; or

(B) Adjustment to Both Non-Election Share Allocation and Cash Election Share Allocation. If the Shortfall Number exceeds the number of Non-Election Shares, then all Non-Election Shares shall be converted into the right to receive the Stock Consideration, and, subject to Section 2.05 hereof, each holder of Cash Election Shares shall receive the Stock Consideration in respect of that number of Cash Election Shares equal to the product obtained by multiplying (x) the number of Cash Election Shares held by such holder by (y) a fraction, the numerator of which is the amount by which the Shortfall Number exceeds the total number of Non-Election Shares and the denominator of which is the total number of Cash Election Shares, with the remaining number of such holder’s Cash Election Shares being converted into the right to receive the Cash Consideration.

2.03 Treatment of RYFL Equity Awards.

(a) Stock Options. All options to purchase RYFL Common Stock granted under the Royal Financial, Inc. 2005 Stock Option Plan (the “RYFL Option Plan”) and the Royal Financial, Inc. 2018 Equity Incentive Plan (the “RYFL 2018 Equity Plan, collectively with the RYFL Option Plan, the “RYFL Equity Plans”) which are outstanding immediately prior to the Election Deadline, whether or not vested (“RYFL Options”), shall be converted into the right to receive at the Effective Time, an amount of cash equal to $20.14 minus the per share exercise price for each share of RYFL Common Stock subject to a RYFL Option; provided that, there shall be withheld from such cash payment any taxes required to be withheld by applicable Law. Such payment shall be made by RYFL immediately prior to the Effective Time. The Compensation Committee of RYFL shall take any required action under the RYFL Equity Plans regarding this treatment of the RYFL Options, and RYFL shall use its best efforts to obtain from all holders of a RYFL Option their agreement to the treatment of their options in the manner contemplated by this Section 2.03(a) on or before the Election Deadline by executing and delivering to FNWD an agreement in the form of Exhibit 2.03(a) attached hereto (an “Option Cancellation Agreement”). RYFL shall amend the RYFL Equity Plans accordingly (or take such other action as is necessary to cause all outstanding RYFL Options to terminate as of the Effective Time) prior to the Effective Time. Each such RYFL Option shall be cancelled and cease to exist by virtue of such payment. Execution by every holder of RYFL Options of an Option Cancellation Agreement shall not be a condition precedent to the consummation of the transactions contemplated herein.

| AGREEMENT AND PLAN OF MERGER | PAGE 7 |

(b) Restricted Stock. At the Effective Time, each award of shares of RYFL Common Stock granted under the RYFL 2018 Equity Plan that is subject to vesting or other lapse restrictions, whether or not vested, and that is outstanding immediately prior to the Effective Time (an “RYFL Restricted Stock Award”) shall fully vest and be cancelled and be converted into the right to receive the Merger Consideration. FNWD shall issue the consideration described in this Section 2.03(b), less applicable tax withholdings, in the same manner as the Merger Consideration is delivered to other RYFL shareholders.

2.04 Anti-Dilution Adjustments. If FNWD changes (or establishes a record date for changing) the number of shares of FNWD common stock issued and outstanding prior to the Effective Time by way of a stock split, stock dividend, or similar transaction with respect to the outstanding FNWD common stock, and the record date therefor shall be prior to the Effective Time, the Exchange Ratio shall be adjusted accordingly so that each shareholder of RYFL at the Effective Time shall receive, in the aggregate, such number of shares of FNWD common stock representing the same percentage of the outstanding shares of FNWD common stock that such shareholders would have received if any of the foregoing actions had not occurred. No adjustment shall be made under this Section 2.04 solely as a result of FNWD changing its cash dividend levels or issuing additional shares of FNWD common stock, provided it receives value for such shares or such shares are issued in connection with an FNWD employee benefit plan or similar plan.

2.05 No Fractional Shares. Notwithstanding any other provision in this Agreement, no fractional shares of FNWD common stock and no certificates or scrip therefor, or other evidence of ownership thereof, will be issued in the Merger; instead, FNWD shall pay to each holder of RYFL Common Stock who otherwise would be entitled to a fractional share of FNWD common stock an amount in cash (without interest) determined by multiplying such fraction by the volume-weighted average of the daily closing sales prices of a share of FNWD’s common stock, rounded to the nearest cent, during the 15 consecutive trading days immediately preceding the second business day prior to the Closing Date.

2.06 Exchange Procedures.

(a) At and after the Effective Time, each physical certificate or book-entry account statement evidencing outstanding shares of RYFL Common Stock (each, an “Old Certificate”) (other than the Exempt RYFL Stock) shall represent only the right to receive the Merger Consideration in accordance with the terms of this Agreement. No later than one business day prior to the Closing Date, FNWD shall (i) provide the Exchange Agent with authorization to issue a sufficient number of shares of FNWD common stock to be used to issue the aggregate Stock Consideration to holders of RYFL Common Stock, and (ii) deposit, or cause to be deposited, with the Exchange Agent an amount of cash sufficient to pay the aggregate Cash Consideration payable to holders of RYFL Common Stock (together with cash for any fractional shares payable pursuant to Section 2.05).

(b) As promptly as practicable after the Effective Time, but no later than five business days after the Effective Time (and provided RYFL has delivered to the Exchange Agent all

| AGREEMENT AND PLAN OF MERGER | PAGE 8 |

information which is necessary for the Exchange Agent to perform its obligations hereunder), the Exchange Agent shall mail to each holder of RYFL Common Stock who did not surrender, or who improperly surrendered, such shareholders’ Old Certificates to the Exchange Agent, a letter of transmittal, in a form agreed by the parties, providing instructions to the RYFL shareholder as to the transmittal to the Exchange Agent of the Old Certificates in exchange for the issuance of the Merger Consideration applicable thereto pursuant to the terms of this Agreement.

(c) FNWD shall cause a book-entry account statement representing that number of whole shares of FNWD common stock that each holder of RYFL Common Stock has the right to receive pursuant to Sections 2.01 and 2.02 as the holder’s proportionate share of the aggregate Stock Consideration and/or a check in the amount of such holder’s proportionate share of the aggregate Cash Consideration, as applicable, along with any cash in lieu of fractional shares or dividends or distributions which such holder shall be entitled to receive, if any, to be delivered to such shareholder as soon as reasonably practicable after the shareholder delivers to the Exchange Agent (or FNWD, as the case may be) the Old Certificates (or bond or other indemnity commercially reasonable and satisfactory to FNWD if any of such certificates are lost, stolen, or destroyed) owned by such shareholder accompanied by a properly completed and executed letter of transmittal, in the form and substance commercially reasonable and satisfactory to FNWD, and any other documents required by this Agreement or reasonably requested by FNWD or the Exchange Agent. No interest will be paid on any Merger Consideration that any such holder is entitled to receive pursuant to this Article II.

(d) No dividends or other distributions on FNWD common stock with a record date occurring after the Effective Time shall be paid to the holder of any unsurrendered Old Certificate representing shares of RYFL Common Stock until the holder thereof surrenders such Old Certificates in accordance with this Article II. After becoming so entitled in accordance with this Section 2.06, the record holder thereof also shall be entitled to receive any such dividends or other distributions, without any interest thereon, that were previously payable with respect to shares of FNWD common stock such holder had the right to receive upon surrender of the Old Certificate(s).

(e) The stock transfer books of RYFL shall be closed immediately prior to the Effective Time, and from and after the Effective Time there shall be no transfers on the stock transfer records of RYFL of any shares of RYFL Common Stock. If, after the Effective Time, Old Certificates are presented to FNWD, they shall be cancelled and exchanged for the Merger Consideration deliverable in respect thereof pursuant to this Agreement in accordance with the procedures set forth in this Article II.

(f) FNWD shall be entitled to rely upon RYFL’s stock transfer books to establish the identity of those individuals, partnerships, corporations, trusts, joint ventures, organizations, or other entities (each, a “Person”) entitled to receive the Merger Consideration, which books shall be conclusive with respect thereto. In the event of a dispute with respect to ownership of stock represented by any Old Certificate, FNWD shall be entitled to deposit any Merger Consideration represented thereby in escrow with an independent third party selected by FNWD and thereafter be relieved from any and all liability with respect to any claims thereto.

(g) If any Old Certificate shall have been lost, stolen, or destroyed, upon the making of an affidavit of that fact by the Person claiming such Old Certificate to be lost, stolen, or destroyed

| AGREEMENT AND PLAN OF MERGER | PAGE 9 |

and, if required by FNWD, the posting by such Person of a bond or other indemnity commercially reasonable and satisfactory to FNWD as indemnity against any claim that may be made against it with respect to such Old Certificate, FNWD will issue in exchange for such affidavit of lost, stolen, or destroyed Old Certificate, the Merger Consideration deliverable in respect thereof pursuant to, and in accordance with, the other terms and conditions of this Article II.

(h) Notwithstanding anything in this Agreement to the contrary, at the Effective Time, all shares of RYFL Common Stock that are held as treasury stock of RYFL or owned by FNWD (other than shares held in a fiduciary capacity or in satisfaction of a debt previously contracted) shall be cancelled and shall cease to exist, and no stock of FNWD or other consideration shall be exchanged therefor.

(i) Notwithstanding the foregoing, no party hereto, nor the Exchange Agent, shall be liable to any former holder of RYFL Common Stock for any amount properly delivered to a public official pursuant to applicable abandoned property, escheat, or similar laws.

(j) If outstanding Old Certificates are not surrendered or the payment for them is not claimed prior to the date on which the Merger Consideration payable therefor would otherwise escheat to, or become the property of, any government unit or agency, the unclaimed Merger Consideration shall, to the extent permitted by abandoned property and any other applicable Law, become the property of FNWD (and to the extent not in its possession shall be delivered to it), free and clear of all claims or interest of any Person previously entitled thereto. Any former shareholder of RYFL who has not theretofore complied with this Article II shall thereafter look only to the Surviving Corporation for payment of the Merger Consideration and any unpaid dividends and distributions on FNWD’s common stock deliverable in respect of each former share of RYFL Common Stock such shareholder holds as determined pursuant to this Agreement, in each case, without any interest thereon. Neither the Exchange Agent nor any party to this Agreement shall be liable to any holder of shares of RYFL Common Stock for any Merger Consideration properly delivered to a public official pursuant to applicable abandoned property, escheat, or similar laws.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES OF RYFL

On or prior to the date hereof, RYFL has delivered to FNWD a schedule (the “RYFL Disclosure Schedule”) setting forth, among other things, items the disclosure of which are necessary or appropriate either in response to an express disclosure requirement contained in a provision hereof or as an exception to one or more representations or warranties contained in this Article III or to one or more of its covenants contained in Article V. However, for purposes of the RYFL Disclosure Schedule, any item disclosed on any schedule therein is deemed to be fully disclosed with respect to other sections of this Agreement under which such item may be relevant, but only to the extent that it is reasonably clear on the face of such schedule that such item applies to such other section of this Agreement, and such item is described in sufficient detail to enable FNWD to identify the items to which it applies.

For the purpose of this Agreement, and in relation to RYFL, a “Material Adverse Effect on RYFL” means any effect that (i) is material and adverse to the results of operations, properties,

| AGREEMENT AND PLAN OF MERGER | PAGE 10 |

assets, liabilities, condition (financial or otherwise), value or business of RYFL and its Subsidiaries (as defined below in this introduction to Article III) on a consolidated basis, or (ii) would materially impair the ability of RYFL or any of its Subsidiaries to perform its obligations under this Agreement or any related agreement or otherwise materially threaten or materially impede the consummation of the Merger and the other transactions contemplated by this Agreement; provided that, Material Adverse Effect on RYFL shall not be deemed to include the impact of (a) changes in banking and similar Laws of general applicability to banks or their holding companies or interpretations thereof by courts or governmental authorities, (b) changes in Laws, but only to the extent that the effects of such change are not disproportionately adverse to the financial condition, results of operations or business of such party, as compared to other banking institutions with assets of less than $10 billion whose primary market area is located in the same primary market area within which such party operates, (c) changes in GAAP or regulatory accounting requirements applicable to banks or their holding companies generally, (d) effects of any action or omission taken with the prior written consent of FNWD or at the direction of FNWD, (e) changes resulting from professional expenses (such as legal, accounting, consulting and investment bankers’ fees) incurred in connection with this Agreement or the transactions contemplated herein, (f) the impact of the announcement of this Agreement and the transactions contemplated hereby, and the effect of compliance with this Agreement on the business, financial condition, or results of operations of RYFL and its Subsidiaries, (g) changes in general economic, legal, regulatory, social, or political conditions (including the outbreak or escalation of hostilities, war, acts of war, acts of terrorism, sabotage, natural disasters, public health emergencies, or other force majeure events, whether, as applicable, inside or outside the United States, whether or not pursuant to the declaration of a national emergency or war, or the occurrence of any military or terrorist attack upon or within the United States, or any of its territories, possessions or diplomatic or consular offices or upon any military installation, equipment, or personnel of the United States), or any national or global epidemic, pandemic, or disease outbreak (including COVID-19), or the material worsening of such conditions threatened or existing as of the date of this Agreement, unless it uniquely affects RYFL or any of its Subsidiaries on a consolidated basis, and (h) any changes in general economic or capital market conditions affecting banks and their holding companies generally, including, without limitation, changes in interest rates and currency exchange rates.

For the purpose of this Agreement, and in relation to RYFL and its Subsidiaries, “knowledge” means those facts that are actually known by the executive officers of RYFL and its Subsidiaries who are listed on Section 3.0 of the RYFL Disclosure Schedule, after due inquiry. Additionally, for the purpose of this Agreement, and in relation to RYFL, its “Subsidiaries” shall mean any entity which is required to be consolidated with RYFL for financial reporting purposes pursuant to United States generally accepted accounting principles (“GAAP”).

Accordingly, RYFL hereby represents and warrants to FNWD as follows, except as set forth in the RYFL Disclosure Schedule:

3.01 Organization and Authority.

(a) RYFL is a corporation duly organized, validly existing, and in good standing under the laws of the state of Delaware and is a registered bank holding company under the BHC Act. RYFL has full power and authority (corporate and otherwise) to own and lease its properties as presently owned and leased and to conduct its business in the manner and by the means utilized as

| AGREEMENT AND PLAN OF MERGER | PAGE 11 |

of the date hereof. RYFL has previously provided FNWD with a complete list of its Subsidiaries. Except for Royal Bank and as provided in Section 3.01(a) of the RYFL Disclosure Schedule, RYFL owns directly no voting stock or equity securities of any corporation, partnership, association, or other entity.

(b) Royal Bank is an Illinois state-chartered savings bank existing under the laws of the State of Illinois. Royal Bank has full power and authority (corporate and otherwise) to own and lease its properties as presently owned and leased and to conduct its business in the manner and by the means utilized as of the date hereof. Except as set forth in Section 3.01(b) of the RYFL Disclosure Schedule, no Subsidiary owns voting stock or equity securities of any corporation, partnership, association, or other entity.

3.02 Authorization.

(a) RYFL has the requisite corporate power and authority to enter into this Agreement and to perform its obligations hereunder, subject to the fulfillment of the conditions precedent set forth in Sections 7.02(e) and (f) hereof. This Agreement and its execution and delivery by RYFL have been duly authorized and approved by the Board of Directors of RYFL and, assuming due execution and delivery by FNWD, constitutes a valid and binding obligation of RYFL, subject to the terms and conditions hereof, and is enforceable in accordance with its terms, except to the extent limited by general principles of equity and public policy and by bankruptcy, insolvency, fraudulent transfer, reorganization, liquidation, moratorium, readjustment of debt, or other laws of general application relating to or affecting the enforcement of creditors’ rights.