UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under § 240.14a-12 |

|

NorthWest Indiana Bancorp |

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

(5) |

Total fee paid: |

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid: |

|

|

|

||

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

||

|

(3) |

Filing Party: |

|

|

|

||

|

(4) |

Date Filed: |

|

|

|

9204 Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

Notice of Special Meeting of Shareholders

To Be Held on March 3, 2021

To the Shareholders of NorthWest Indiana Bancorp:

We cordially invite you to attend the Special Meeting of Shareholders (the “Special Meeting”) of NorthWest Indiana Bancorp, an Indiana corporation (the “Bancorp”), to be held on Wednesday, March 3, 2021, at 9:00 a.m., Central Standard Time. The Special Meeting will be held completely as a virtual meeting of shareholders instead of an in-person meeting. You may attend the meeting online, submit questions, and vote your shares electronically during the meeting via the internet at www.virtualshareholdermeeting.com/NWIN2021SM. To enter the Special Meeting, you will need the 16-digit control number that is printed in the box marked by the arrow on the accompanying proxy card. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts.

The sole purpose of the Special Meeting is to vote on a proposal to amend the Bancorp’s Articles of Incorporation to change the name of the Bancorp from “NorthWest Indiana Bancorp” to “Finward Bancorp.” We believe the name change will better reflect the Bancorp’s current geographic footprint and identify and associate the name and image of the Bancorp with the banking and financial products and services the Bancorp currently offers and intends to offer in the future.

Only holders of record of the Bancorp’s common stock, without par value, as of the close of business on January 22, 2021 are entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements of the Special Meeting.

YOUR VOTE IS VERY IMPORTANT. For the proposal to amend the Bancorp’s Articles of Incorporation to change the Bancorp’s name to be approved, more votes must be cast by all holders of shares of common stock in favor of the proposal than are cast against it.

Please read the accompanying proxy statement carefully so that you will have information about the proposal to be presented at the Special Meeting. A proxy card also accompanies this notice. Whether or not you plan to attend the Special Meeting, please mark, sign, date, and return the enclosed proxy card in the enclosed postage-paid envelope, or use one of the voting methods described in the accompanying proxy statement, so that your shares may be voted in accordance with your wishes.

You may revoke your proxy at any time before the Special Meeting by following the directions on the proxy card or by virtually attending the Special Meeting and voting online. However, if you hold your shares in “street name” with a bank, broker, or other nominee, and you wish to attend and vote at the Special Meeting, you will need to obtain a legal proxy issued in your name from your bank, broker, or other nominee.

The board of directors of the Bancorp recommends that shareholders vote “FOR” the proposal to amend the Bancorp’s Articles of Incorporation to change the name of the Bancorp from “NorthWest Indiana Bancorp” to “Finward Bancorp.”

|

By Order of the Board of Directors,

Leane E. Cerven Executive Vice President, Chief Risk Officer, General Counsel and Secretary |

|

|

Munster, Indiana |

|

|

January 27, 2021 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 3, 2021

The Notice of Special Meeting of Shareholders and the Proxy Statement for the

Special Meeting of Shareholders are available at www.proxyvote.com

TABLE OF CONTENTS

|

Page |

||

|

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING |

1 |

|

|

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

4 |

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

5 |

|

|

PROPOSAL – TO APPROVE AN AMENDMENT TO THE BANCORP’S ARTICLES OF INCORPORATION TO CHANGE THE BANCORP’S NAME TO FINWARD BANCORP |

7 |

|

| General | 7 | |

| Reasons for the Articles Amendment and Name Change | 7 | |

| Potential Effects of the Name Change | 8 | |

| Interests of Certain Persons in the Action Taken | 8 | |

| No Dissenters’ Rights | 8 | |

| Vote Required | 8 | |

| Board of Directors Recommendation | 9 | |

|

SHAREHOLDER PROPOSALS |

9 |

|

|

HOUSEHOLDING |

9 |

|

|

OTHER MATTERS |

9 |

|

|

WHERE YOU CAN FIND MORE INFORMATION |

10 |

|

| Appendices | ||

| A Amendment to Articles of Incorporation of NorthWest Indiana Bancorp | ||

9204 Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

Proxy Statement

For the Special Meeting of Shareholders

To Be Held on March 3, 2021

The Board of Directors of NorthWest Indiana Bancorp, an Indiana corporation (the “Bancorp”), is soliciting proxies to be voted at the Special Meeting of Shareholders (the “Special Meeting”) of the Bancorp to be held completely virtually at 9:00 a.m., Central Standard Time, on March 3, 2021, and at any adjournment of the meeting. You may attend the meeting online, submit questions, and vote your shares electronically during the meeting via the internet at:

www.virtualshareholdermeeting.com/NWIN2021SM

The Bancorp’s principal asset consists of 100% of the issued and outstanding shares of common stock of Peoples Bank, an Indiana state-chartered commercial bank (the “Bank”). We expect to first mail this proxy statement and the form of proxy to our shareholders on or about February 1, 2021.

The sole purpose of the Special Meeting is to vote on a proposal to amend the Bancorp’s Articles of Incorporation to change the name of the Bancorp from “NorthWest Indiana Bancorp” to “Finward Bancorp.” We believe the name change will better reflect the Bancorp’s current geographic footprint and identify and associate the name and image of the Bancorp with the banking and financial products and services the Bancorp currently offers and intends to offer in the future.

The Bancorp’s Common Stock is quoted on the OTC Pink Marketplace, which is maintained by OTC Markets Group, Inc., under the symbol “NWIN.” The last sale price of our Common Stock as reported on the OTC Pink Marketplace on January 22, 2021 was $41.00. In connection with the name change, we plan to change our stock symbol and CUSIP number, as well.

We do not expect any other items of business to come before the Special Meeting. If other matters do properly come before the meeting, the accompanying proxy gives discretionary authority to the persons named in the proxy to vote on any other matters brought before the meeting. Those persons intend to vote the proxies in accordance with their best judgment.

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

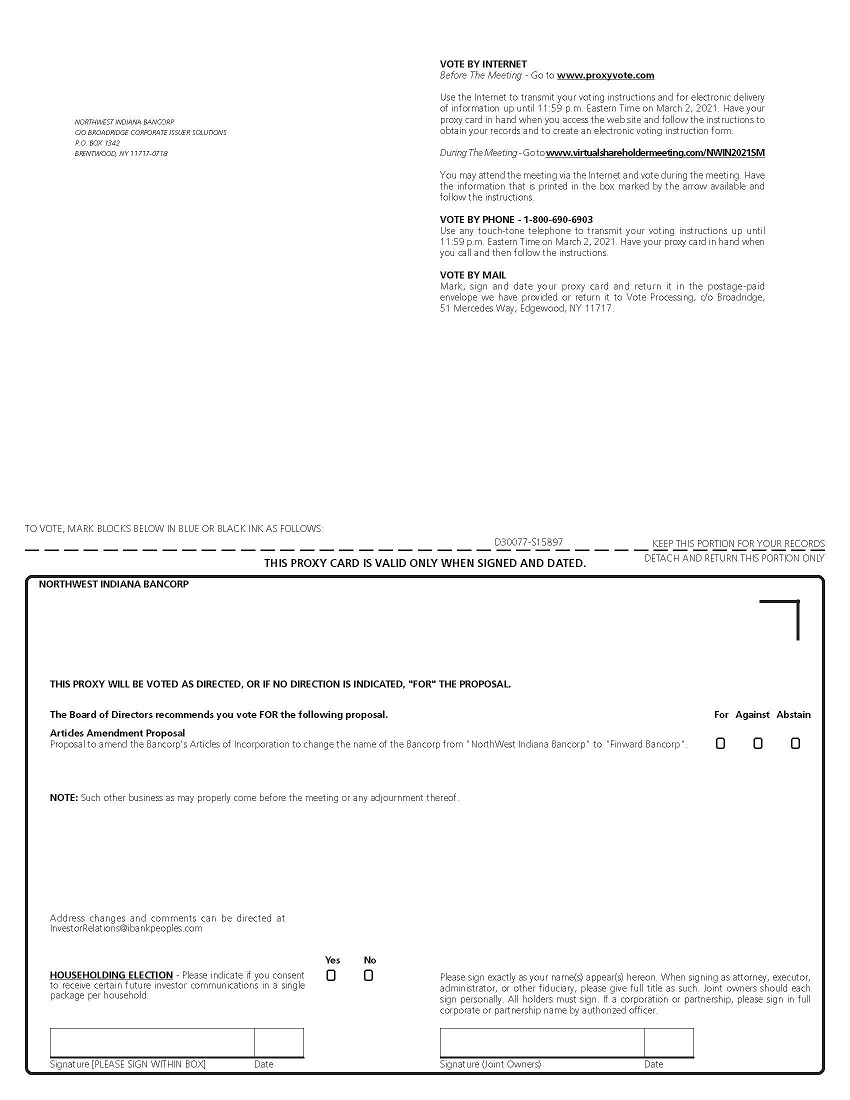

What proposal will shareholders vote on at the Special Meeting?

At the Special Meeting, our shareholders will consider and vote on only one proposal – to amend the Bancorp’s Articles of Incorporation to change the name of the Bancorp from “NorthWest Indiana Bancorp” to "Finward Bancorp” (the “Articles Amendment”).

Who is entitled to vote?

Shareholders of record at the close of business on January 22, 2021 (the “Record Date”) may vote at the Special Meeting. On the Record Date, there were 3,462,510 shares of the Bancorp’s common stock, without par value (the “Common Stock”) issued and outstanding, and the Bancorp had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Special Meeting on all matters properly presented.

What vote is required to approve the Articles Amendment?

For the Articles Amendment to be approved, the number of votes cast in favor of the proposal must exceed the number of votes cast in opposition to the proposal. Abstentions and broker non-votes will be treated as present for quorum purposes. However, because an abstention is not treated as a vote for or against a proposal, it will not have any effect on the outcome of the vote.

How do I vote my shares?

If you are a “shareholder of record,” you can vote by mailing the enclosed proxy card or by following the related internet or telephone voting instructions. The proxy, if properly signed and returned to the Bancorp and not revoked prior to its use, will be voted in accordance with the instructions contained in the proxy. If you return your signed proxy card but do not indicate your voting preferences, the proxies named in the proxy card will vote on your behalf “FOR” the approval of the Articles Amendment, and, as to any other matter that may be properly brought before the Special Meeting, in accordance with the judgment of the proxies.

If you have shares held by a broker or other nominee, you may instruct the broker or nominee to vote your shares by following the instructions the broker or nominee provides to you. If you do not submit specific voting instructions to your broker or nominee, the organization that holds your shares may generally vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not submit specific voting instructions to your broker, the shares will be treated as “broker non-votes.” The Articles Amendment proposal is not considered to be a routine matter and, therefore, brokers will not have discretion to vote your shares on the proposal. Accordingly, if your shares are held in street name and you do not submit voting instructions to your broker, your shares will not be counted in determining the outcome of the Articles Amendment proposal.

Proxies solicited by this proxy statement may be exercised only at the Special Meeting and any adjournment thereof and will not be used for any other meeting.

Can I change my vote after I have mailed my proxy card?

You have the right to revoke your proxy at any time before it is exercised by (1) notifying the Bancorp’s Corporate Secretary (Leane E. Cerven, 9204 Columbia Avenue, Munster, Indiana 46321) in writing, (2) delivering a later-dated proxy, or (3) attending the Special Meeting online and voting electronically (attendance at the online meeting will not, by itself, revoke a proxy).

Can I vote my shares at the meeting?

The Special Meeting will be completely virtual and will be held at the time and internet address mentioned in the Notice of Special Meeting of Shareholders included with these materials. If you are a shareholder of record, you may attend the meeting online and vote your shares electronically during the meeting via the internet at www.virtualshareholdermeeting.com/NWIN2021SM. You will need the information printed in the box marked by the arrow on the accompanying proxy card and you should follow the instructions provided when you login. However, we encourage you to vote by proxy card even if you plan to attend the online meeting.

If your shares are held by a broker or other nominee, you must obtain a proxy from the broker or other nominee giving you the right to vote the shares at the meeting.

What constitutes a quorum?

The holders of over 50% of the outstanding shares of Common Stock as of the Record Date must be present electronically or by proxy at the Special Meeting to constitute a quorum. In determining whether a quorum is present, shareholders who abstain or cast broker non-votes will be deemed present at the Special Meeting. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting.

What happens if additional matters are presented at the meeting?

Other than the Articles Amendment proposal described in this proxy statement, we are not aware of any other business to be acted upon at the Special Meeting. If you grant a proxy, the individuals named as proxies on the proxy card will have the discretion to vote your shares on any other matters properly presented for a vote at the meeting in accordance with our by-laws and Indiana law.

How does the Board of Directors recommend shareholders vote?

Our Board of Directors recommends that you vote “FOR” the approval of the Articles Amendment proposal.

Where can shareholders find voting results of the Special Meeting?

We will announce preliminary results at the Special Meeting and publish final results in a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) within four business days after the meeting.

How can shareholders obtain additional information about the Bancorp?

We file annual, quarterly and other reports, proxy statements and other information with the SEC which can be accessed by the public, without charge, on the SEC’s website www.sec.gov.

We also make available free of charge through our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Information about us can be found on the internet at www.ibankpeoples.com. Please note that our website address is provided as an inactive textual reference only. Information contained on or accessible through our website is not part of this proxy statement, and is therefore not incorporated by reference unless such information is otherwise specifically referenced elsewhere in this proxy statement.

The foregoing documents may be obtained as explained above, or you may request a free copy of any or all of these documents, including exhibits that are specifically incorporated by reference into these documents, by writing to or calling the Bancorp at the following address or telephone number or via the internet at:

NorthWest Indiana Bancorp

9204 Columbia Avenue

Munster, Indiana 46321

Attn: Shareholder Services

(219) 836-4400

Website: www.ibankpeoples.com

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of January 22, 2021, which is the most recent practicable date, certain information regarding the beneficial share ownership of the Bancorp’s Common Stock by: (i) each of the directors and named executive officers (“NEOs”) of the Bancorp; and (ii) the directors and executive officers of the Bancorp as a group. Persons and groups owning more than 5% of the Common Stock are required to file certain reports regarding such ownership with the Bancorp and the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based on such reports, management knows of no persons, other than as set forth in the table below, who owned more than 5% of the Common Stock at January 22, 2021. Unless otherwise noted below, the address of each beneficial owner of more 5% of the Bancorp’s Common Stock is c/o NorthWest Indiana Bancorp, 9204 Columbia Avenue, Munster, IN 46321.

|

Name |

Position |

Shares Beneficially Owned(1) |

Percent of Class(2) |

|||

|

DIRECTORS AND EXECUTIVE OFFICERS: |

||||||

|

David A. Bochnowski |

Executive Chairman of the Bancorp |

360,298(3) |

10.4% |

|||

|

Benjamin J. Bochnowski |

President and Chief Executive Officer of the Bancorp; Director |

21, 598(4) |

* |

|||

|

Robert T. Lowry |

Executive Vice President, Chief Operating Officer |

24,866(5) |

* |

|||

|

Peymon S. Torabi(6) |

Executive Vice President, Chief Financial Officer and Treasurer |

7,776(7) |

* |

|||

|

Todd M. Scheub |

Executive Vice President, Chief Banking Officer |

17,380(8) |

* |

|||

|

Leane E. Cerven |

Executive Vice President, Chief Risk Officer, General Counsel and Corporate Secretary |

14,626(9) |

* |

|||

|

Donald P. Fesko |

Director |

3,099(10) |

* |

|||

|

Edward J. Furticella |

Director |

63,924(11) |

1.8% |

|||

|

Danette Garza |

Director |

4,504(12) |

* |

|||

|

Joel Gorelick |

Director |

51,012(13) |

1.5% |

|||

|

Amy W. Han |

Director |

5,550(14) |

* |

|||

|

Robert E. Johnson, III |

Director |

1,631(15) |

* |

|||

|

Kenneth V. Krupinski |

Director |

11,034(16) |

* |

|||

|

Anthony M. Puntillo |

Director |

3,983(17) |

* |

|||

|

James L. Wieser |

Director |

6,507(18) |

* |

|||

|

All executive officers and directors as a group (16 persons) |

611,404(19) |

17.7% |

|

* |

Indicates less than 1% of the total number of outstanding shares of the Bancorp’s Common Stock. |

|

(1) |

Amounts reported include shares of Common Stock held directly, as well as shares held in retirement accounts, by certain members of the named individuals’ families or held by trusts of which the named individual is a trustee or substantial beneficiary. Inclusion of shares shall not constitute an admission of beneficial ownership or voting or investment power over included shares. |

|

(2) |

For each individual or group disclosed in the table above, the figures in this column are based on 3,462,510 shares of Common Stock issued and outstanding as of January 22, 2021, which is the most recent practicable date, plus the number of shares of Common Stock each such individual or group has the right to acquire on or within 60 days after January 22, 2021, computed in accordance with Rule 13d-3(d)(1) under the Exchange Act. |

|

(3) |

Includes 236,878 shares held jointly with Mr. Bochnowski’s spouse, 24,990 shares as to which Mr. Bochnowski’s spouse has voting and dispositive power, and 17,600 shares that are owned by his children for which his spouse is custodian or trustee. Also includes 8,729 shares held as co-trustee of funds for the benefit of Mr. Bochnowski’s children, 60,350 shares purchased by Mr. Bochnowski under the Bancorp’s Employees’ Savings and Profit Sharing Plan (the “Profit Sharing Plan”), 8,530 shares held in Mr. Bochnowski’s individual retirement account as to which Mr. Bochnowski has dispositive and voting power, and 3,221 shares of restricted stock over which Mr. Bochnowski has voting but not dispositive power. |

|

(4) |

Includes 3,649 shares of restricted stock over which Mr. Bochnowski has voting but not dispositive power, 1,662 shares purchased by Mr. Bochnowski under the Profit Sharing Plan as to which Mr. Bochnowski has voting and dispositive power, and 746 shares held in Mr. Bochnowski’s individual retirement account as to which Mr. Bochnowski has dispositive and voting power. |

|

(5) |

Includes 5,674 shares held jointly with Mr. Lowry’s spouse, 2,185 shares held in his individual retirement account for which he has dispositive and voting power, and 665 shares owned by Mr. Lowry’s spouse in an individual retirement account. Also includes 2,322 shares of restricted stock over which Mr. Lowry has voting but not dispositive power, and 14,020 shares purchased by Mr. Lowry under the Profit Sharing Plan as to which Mr. Lowry has dispositive and voting power. |

|

(6) |

Mr. Torabi was appointed as the Executive Vice President, Chief Financial Officer and Treasurer of the Bancorp effective January 1, 2021. Mr. Torabi is not an NEO for 2020, but he is disclosed in the table above because he will be an NEO for 2021, as determined pursuant to Regulation S-K Item 402. |

|

(7) |

Includes 1,846 shares held jointly with Mr. Torabi’s spouse, 971 shares of restricted stock over which Mr. Torabi has voting but not dispositive power, and 4,959 shares purchased by Mr. Torabi under the Profit Sharing Plan. |

|

(8) |

Includes 3,447 shares held jointly with Mr. Scheub’s spouse, 3,839 shares of restricted stock over which Mr. Scheub has voting but not dispositive power, and 10,094 shares purchased by Mr. Scheub under the Profit Sharing Plan as to which Mr. Scheub has dispositive and voting power. |

|

(9) |

Includes 5,357 shares owned jointly with Ms. Cerven’s spouse, 1,800 shares of restricted stock over which Ms. Cerven has voting but not dispositive power, 6,535 shares owned by Ms. Cerven’s spouse in an individual retirement account, 134 shares purchased by Ms. Cerven under the Profit Sharing Plan as to which Ms. Cerven has dipositive and voting power, and 800 shares owned by Ms. Cerven in an individual retirement account. |

|

(10) |

Includes 2,543 shares held jointly with Dr. Fesko’s spouse, and 477 shares of restricted stock over which Dr. Fesko has voting but not dispositive power. |

|

(11) |

Includes 36,512 shares held jointly with Mr. Furticella’s spouse, 25,326 shares held in Mr. Furticella’s individual retirement account, 1,439 shares held by Mr. Furticella’s spouse in her individual retirement account, and 647 shares of restricted stock over which Mr. Furticella has voting but not dispositive power. |

|

(12) |

Includes 600 shares held in Ms. Garza’s individual retirement account and 498 shares of restricted stock over which Ms. Garza has voting but not dispositive power, 3,400 shares solely owned, and 6 shares purchased through the Dividend Reinvestment Plan. |

|

(13) |

Includes 462 shares of restricted stock over which Mr. Gorelick has voting but not dispositive power, 47,808 shares held in Mr. Gorelick’s individual retirement account, 882 shares held by Mr. Gorelick’s spouse in her individual retirement account, and 1,460 shares owned as custodian for Mr. Gorelick’s children. |

|

(14) |

Includes 4,945 shares held jointly with Dr. Han’s spouse and 600 shares of restricted stock over which Dr. Han has voting but not dispositive power, and 5 shares purchased through the Dividend Reinvestment Plan. |

|

(15) |

Includes 388 shares of restricted stock over which Mr. Johnson has voting but not dispositive power, and 1,243 shares solely owned. |

|

(16) |

Includes 9,449 shares held jointly with Mr. Krupinski’s spouse, 1,000 shares held in Mr. Krupinski’s 401(k) for which Mr. Krupinski has voting and dispositive power, and 585 shares of restricted stock over which Mr. Krupinski has voting but not dispositive power. |

|

(17) |

Includes 605 shares of restricted stock over which Dr. Puntillo has voting but not dispositive power. |

|

(18) |

Includes 5,875 shares held jointly with Mr. Wieser’s spouse, and 632 shares of restricted stock over which Mr. Wieser has voting but not dispositive power. |

|

(19) |

Includes 98,634 shares held under the Profit Sharing Plan and 23,269 shares of restricted stock granted under the Bancorp’s 2015 Stock Option and Incentive Plan. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements made in this proxy statement are “forward-looking statements” within the meaning and protections of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. All statements other than statements of historical fact, including statements regarding our financial position, business strategy, and the plans and objectives of our management for future operations, are forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” and other similar words and expressions relating to the future.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially, and adversely or positively, from the expectations of the Bancorp that are expressed or implied by any forward-looking statement. Risks, uncertainties, and factors that could cause the Bancorp’s actual results to vary materially from those expressed or implied by any forward-looking statement include but are not limited to:

|

● |

the significant risks and uncertainties for our business, results of operations, and financial condition, as well as our regulatory capital and liquidity ratios and other regulatory requirements caused by the COVID-19 pandemic, which will depend on several factors, including the scope and duration of the pandemic, its influence on financial markets, the effectiveness of our remote work arrangements and staffing levels in branches and other operational facilities, and actions taken by governmental authorities and other third parties in response to the pandemic; |

|

● |

the use of proceeds of future offerings of securities; |

|

● |

capital management activities, including possible future sales of new securities, or possible repurchases or redemptions by the Bancorp of outstanding debt or equity securities; |

|

● |

changes in asset quality and credit risk; |

|

● |

our ability to sustain revenue and earnings growth; |

|

● |

changes in interest rates, market liquidity, and capital markets, as well as the magnitude of such changes, which may reduce net interest margins; |

|

● |

inflation; |

|

● |

customer acceptance of the Bancorp’s products and services; |

|

● |

customer borrowing, repayment, investment, and deposit practices; |

|

● |

customer disintermediation; |

|

● |

the introduction, withdrawal, success, and timing of asset/liability management strategies or of mergers and acquisitions and other business initiatives and strategies; |

|

● |

competitive conditions; |

|

● |

our ability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; |

|

● |

changes in fiscal, monetary, and tax policies; |

|

● |

factors that may cause the Bancorp to incur impairment charges on its investment securities; |

|

● |

electronic, cyber, and physical security breaches; |

|

● |

claims and litigation liabilities, including related costs, expenses, settlements, and judgments, or the outcome of matters before regulatory agencies, whether pending or commencing in the future; |

|

● |

changes in accounting principles and interpretations; |

|

● |

economic conditions; |

|

● |

the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms; and |

|

● |

other factors and risk described in our other filings we make with the SEC under the Exchange Act. |

In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, and regulatory and accounting considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. Further, statements about the effects of the COVID-19 pandemic on our business, operations, financial performance, and prospects may constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable, and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties, and us.

Because such forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such statements. The foregoing list of important factors is not exclusive and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of documents incorporated by reference, the dates of those documents. We do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of us.

PROPOSAL – TO APPROVE AN AMENDMENT TO THE BANCORP’S ARTICLES OF INCORPORATION TO CHANGE THE BANCORP’S NAME TO FINWARD BANCORP

General

The Bancorp’s Board of Directors has unanimously approved, and recommends that the Bancorp’s shareholders approve, an amendment to the Bancorp’s Articles of Incorporation to change the Bancorp’s name to “Finward Bancorp.” A copy of the proposed Articles of Amendment to the Bancorp’s Articles of Incorporation is attached to this proxy statement as Appendix A.

Reasons for the Articles Amendment and Name Change

Our principle reason for approving and recommending the Articles Amendment and name change is to align the Bancorp’s corporate name with the changing dynamics of the business direction of the Bancorp, including those that have occurred in recent years and those that are expected to occur in future years. Specifically, we believe the change of the Bancorp’s name to “Finward Bancorp” better reflects the Bancorp’s current geographic footprint and identifies and associates the name and image of the Bancorp and its subsidiaries with the banking and financial products and services the Bancorp currently offers and intends to offer in the future, as well as the Bancorp’s commitment to invest in technology that enhances the customer experience and drives operating efficiency. At the same time, the new name will continue to represent the Bancorp’s mission and values, namely that we are guided by our mission to help customers and communities be more successful, while grounded in the shared values of stability, integrity, community, and excellence.

The Bancorp has grown and evolved in recent years, and this growth has prompted us to re-evaluate the corporate name and branding that best captures the progression and advancement of our business and the services we provide the Bank’s customers. This dynamic “forward movement” in our business and strategic direction resulted in our Board approving the new name “Finward Bancorp,” which constitutes a combination of the concepts of financial services and forward movement. For example, the Bancorp has experienced the following growth and undergone the following advancements just since 2013:

|

● |

Acquisitions. The Bancorp has completed four acquisitions since 2014, including (i) the acquisition of First Federal Savings and Loan Association of Hammond in 2014, which added approximately $37.9 million of assets to the Bancorp’s balance sheet; (ii) the acquisition of Liberty Savings Bank, FSB in 2015, which added approximately $57.3 million in assets to the Bancorp’s balance sheet; (iii) the acquisition of First Personal Financial Corp. in 2018, which represented the Bancorp’s first expansion into the South Suburban Chicagoland, Illinois market; and (iv) the acquisition of AJS Bancorp, Inc. in 2019, which further expanded the Bancorp’s presence in the South Suburban Chicagoland market. |

|

● |

Geographic Expansion. As a result of the foregoing acquisitions, the Bancorp has expanded its geographic reach from 12 branches located exclusively in Lake and Porter Counties in Northwest Indiana as of December 31, 2013, to 22 banking center locations in Northwest Indiana and South Chicagoland, Illinois as of December 31, 2020. |

|

● |

Asset Growth. The Bancorp’s assets have grown from $693.45 million as of December 31, 2013, to $1.48 billion as of September 30, 2020, a growth rate of approximately 113% during that time period. |

|

● |

Conversion to Commercial Bank. On May 22, 2020, Peoples Bank converted from an Indiana-chartered stock savings bank to an Indiana-chartered commercial bank, reflecting the bank’s brand as a dynamic community banking institution offering a wider array of products and services, including modern electronic banking, wealth management, and fintech services. |

As a result of these developments, the Bancorp’s management and Board believes the current corporate name limits the Bancorp’s brand to a specific geographic area which no longer properly reflects the expanse and coverage of the Bancorp’s business. Therefore, we believe that the proposed change in the Bancorp’s corporate name allows the Bancorp to better represent its business strategy to customers, prospective customers, business partners, as well as the communities in which it operates.

On December 18, 2020, the Board of Directors adopted a resolution approving an amendment to the Bancorp’s Articles of Incorporation to change the name of the Bancorp to “Finward Bancorp” and recommended that the amendment be submitted to shareholders for approval. The Board of Directors believes it is in the best interests of the Bancorp and its shareholders to change the Bancorp’s name to Finward Bancorp and recommends the approval of the name change amendment.

Subject to and following shareholder approval of the Articles Amendment, we plan to cause the amendment to become effective by submitting the Articles Amendment to the Indiana Secretary of State for filing. The amendment will become effective upon filing with the Indiana Secretary of State, which we expect to occur on or about March 3, 2021. The Board of Directors retains the right, without further shareholder action, to decide not to pursue the amendment at any time prior to it becoming effective.

Shareholders will not be required to submit their stock certificates for exchange as a result of the proposed name change. Following the effective date of the Articles Amendment changing the name of the Bancorp, all new stock certificates, if any, issued by the Bancorp will be printed with the Bancorp’s new name.

Potential Effects of the Name Change

The name change will affect all holders of our Common Stock uniformly. The name change is not intended to, and will not, affect any shareholder’s percentage ownership interest in the Bancorp.

Neither the Articles Amendment nor the name change will change the terms of our Common Stock. After the name change, the shares of our capital stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to our capital stock now authorized. Our Common Stock will remain fully paid and non-assessable. In addition, we plan to change our stock symbol and CUSIP number as a result of the name change. Following the effective date of the Articles Amendment and the name change, newly issued stock certificates will bear the Bancorp’s new name, but this will not affect the validity of stock certificates already outstanding.

The proposed Articles Amendment and name change will not affect the par value of our Common Stock. As a result, on the effective date of the Articles Amendment and name change, the stated capital on our balance sheet attributable to the Common Stock will not be affected.

Interests of Certain Persons in the Action Taken

No director, executive officer, nominee for election as a director, associate of any director, executive officer, or nominee, or any other person has any substantial interest, direct or indirect, through security holdings or otherwise, in the actions taken by the Board of Directors or to be taken by the shareholders with respect to the approval of the Articles Amendment that is not shared by all other shareholders.

No Dissenters’ Rights

Under Indiana law, shareholders of the Bancorp are not entitled to dissenters’ rights with respect to the Articles Amendment.

Vote Required

For the Articles Amendment to be approved, the number of votes cast in favor of the proposal must exceed the number of votes cast in opposition to the proposal. Abstentions and broker non-votes will have no impact on the outcome of the vote on this proposal. If a quorum is not present at the Special Meeting, the shareholders entitled to vote at the Special Meeting may adjourn the Special Meeting until a quorum is present. Any signed proxies received by the Bancorp in which no voting instructions are provided on the Articles Amendment proposal will be voted “FOR” the approval of the Articles Amendment.

Board of Directors Recommendation

The Bancorp’s Board of Directors unanimously recommends that shareholders vote “FOR” the approval of the Articles Amendment proposal to change the Bancorp’s name to “Finward Bancorp.”

SHAREHOLDER PROPOSALS

If a shareholder wishes to submit a proposal (including a director nomination) for consideration at the 2022 Annual Meeting of the Bancorp’s Shareholders and wants that proposal included in the proxy statement and form of proxy relating to that meeting, the shareholder must deliver written notice of the proposal to the Secretary of the Bancorp at 9204 Columbia Avenue, Munster, Indiana 46321, and the notice must be received at this address no later than December 4, 2021 (which is 120 calendar days before the corresponding date in 2022 that the Bancorp’s proxy statement was or is expected to be released to shareholders in connection with the 2021 Annual Meeting of the Bancorp’s Shareholders). Any such proposal will be subject to the requirements of the proxy rules under the Exchange Act and, as with any shareholder proposal (regardless of whether included in the Bancorp’s proxy materials), the Bancorp’s articles of incorporation, by-laws, and Indiana law.

If a shareholder wishes to submit a proposal for consideration at the 2022 Annual Meeting of Shareholders, or if shareholder wishes to nominate a candidate for election to the Board, but not for inclusion in the Bancorp’s proxy statement and form of proxy, the Bancorp’s By-Laws require the shareholder to provide the Bancorp with written notice of such proposal or nomination no less than 90 days, nor more than 120 days, prior to the first anniversary of the 2021 Annual Meeting (in the event that the date of the 2022 Annual Meeting of Shareholders is advanced by more than 30 days or delayed by more than 30 days after such anniversary date, the shareholder must provide the Bancorp with written notice of such proposal or recommendation no less than 90 days, nor more than 120 days, prior to the meeting date or, if later, the 10th day following the first public announcement of the date of the 2022 Annual Meeting of Shareholders). Such notice must be sent to the Corporate Secretary of the Bancorp at 9204 Columbia Avenue, Munster, Indiana 46321.

HOUSEHOLDING

We have adopted a procedure approved by the SEC called “householding” for those registered shareholders who consent to this procedure by either checking “Yes” in the “householding election” on the proxy card that accompanies this mailing or by notifying us at the address or phone number below. If you consent to this procedure, multiple shareholders who share the same address who consent to “householding” will receive only one copy of this proxy statement, but each shareholder will continue to receive a separate proxy card. We have undertaken householding to reduce our printing costs and postage fees. Householding also is environmentally friendly and creates less paper for participating shareholders to manage. If you are a beneficial holder, you can request information about householding from your broker, bank, or other nominee.

If you have consented to householding, you will receive or continue to receive a single copy of proxy statement materials for future meetings. However, if you decide you would prefer to receive again multiple copies of the proxy statement materials, upon your request, we will promptly provide you with additional copies. You may elect to receive multiple copies for a specific meeting or opt-out of householding for all future meetings. Requests to receive multiple copies of the proxy statement materials can be made at any time prior to thirty days before the mailing of the proxy materials, which, for our Annual Meeting of Shareholders, typically occurs in March of each year. You may request multiple copies by notifying us in writing to the Bancorp at 9204 Columbia Avenue, Munster, Indiana 46321, Attention: Shareholder Services, or by telephone at (219) 836-4400.

OTHER MATTERS

The Bancorp’s management is not aware of any other matters to be brought before the Special Meeting. However, if other matters are properly brought before the Special Meeting, the persons named in the enclosed form of proxy will have discretionary authority to vote all proxies with respect to such matters in accordance with their judgment.

We will pay the cost of preparing, assembling, and mailing the proxy materials and soliciting proxies for the Special Meeting. We will reimburse brokers and other nominees for costs they incur in mailing proxy materials to beneficial owners in accordance with applicable rules. In addition to solicitation by mail, directors, officers, and employees of the Bancorp may solicit proxies personally, by telephone, electronically, or by other means of communication. If our directors, officers, or employees were to solicit proxies, they would receive no additional compensation for their services. In addition, we may make arrangements with a third-party proxy soliciting firm to assist in soliciting proxies for the Special Meeting. If we engage a third-party soliciting firm, we will pay such firm customary compensation for its service, which will include out-of-pocket expenses.

WHERE YOU CAN FIND MORE INFORMATION

The Bancorp files annual, quarterly, and current reports, proxy statements, and other documents with the SEC under the Exchange Act. The Bancorp’s SEC filings made electronically through the SEC’s EDGAR system are available to the public at the SEC’s website at www.sec.gov. Additionally, reports filed with the SEC, including our financial statements, are posted on our website at www.ibankpeoples.com. The information provided on our website is not a part of this proxy statement.

Statements contained in this proxy statement regarding the contents of any contract or other document are not necessarily complete and each such statement is qualified in its entirety by reference to that contract or other document.

You should rely only on the information contained in this document and the appendix to this document. No one has been authorized to provide you with information that is different from what is contained in this document. You should not assume that the information contained in this document is accurate as of any date other than the date of this document, and the mailing of this document to the Bancorp’s shareholders shall not create any implication to the contrary. All information regarding the Bancorp in this document has been provided by the Bancorp. If any material change occurs during the period that this proxy statement is required to be delivered, this proxy statement will be supplemented or amended.

Appendix A

ARTICLES OF AMENDMENT

OF THE

ARTICLES OF INCORPORATION

OF

NORTHWEST INDIANA BANCORP

The undersigned officer of NorthWest Indiana Bancorp (the “Corporation”), an Indiana corporation existing pursuant to the provisions of the Indiana Business Corporation Law (the “Act”), desiring to give notice of corporate action effectuating the amendment of certain provisions of its Articles of Incorporation (the “Amendment”), hereby certifies the following facts:

Article I

Amendment

Section 1. Name. The name of the Corporation is NorthWest Indiana Bancorp.

Section 2. Date of Incorporation. The date of incorporation of the Corporation is January 31, 1994.

Section 3. Name Following Amendment. The name of the Corporation following this Amendment to the Articles of Incorporation is Finward Bancorp.

Section 4. Amendment. The exact text of Article I of the Articles of Incorporation is now as follows:

“ARTICLE I

Name

The name of the corporation is Finward Bancorp (the “Corporation”).”

Article II

Date of Each Amendment’s Adoption

Section 1. Date of Adoption. The date of the Amendment’s adoption is March 3, 2021.

Section 2. Effective Date. The effective date of this Amendment shall be __________, 2021.

Article III

Registered Agent Information

The Corporation’s non-commercial registered agent and registered office address is Leane E. Cerven, 9204 Columbia Avenue, Munster, Indiana 46321. The email address at which the registered agent will accept electronic service of process is lcerven@ibankpeoples.com. The undersigned represents that the registered agent named above has consented to such appointment.

Article IV

Manner and Adoption of Vote

Section 1. Vote of Directors. This Amendment was adopted and approved by the affirmative vote of the Board of Directors of the Corporation at a meeting thereof duly called and held on December 18, 2020.

Section 2. Vote of Shareholders. Upon approval by the Board of Directors of the Corporation, the Amendment was submitted to the shareholders for approval at a Special Meeting of Shareholders duly called for such purpose and held on March 3, 2021, at which a quorum was present throughout.

The designation, number of outstanding shares, number of votes entitled to be cast by each voting group entitled to vote separately on the Amendment, the number of votes of each voting group represented at the meeting of shareholders, and the number of shares voted in favor or against or having abstained as to the Amendment are set forth below:

|

Designation of Each Voting Group |

Common Stock, without par value |

|

Number of Outstanding Shares |

_____ |

|

Shares Entitled to Vote |

_____ |

|

Number of Shares Represented at the Meeting |

_____ |

|

Shares Voted in Favor |

_____ |

|

Shares Voted Against |

_____ |

|

Shares Abstained |

_____ |

Article IV

Compliance With Legal Requirements

The manner of the adoption of the Articles of Amendment and the vote by which they were adopted constitute full legal compliance with the provisions of the Act, the Articles of Incorporation, and the By-Laws of the Corporation.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the undersigned, being the President and Chief Executive Officer of the Corporation, executes these Articles of Amendment and verifies, subject to penalties of perjury, that the statements contained herein are true, as of this _____ day of __________, 2021.

|

|

NorthWest Indiana Bancorp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

Name: Benjamin J. Bochnowski |

|

|

|

|

Title: President and Chief Executive Officer |

|