Filed by Finward Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 of the

Securities Exchange Act of 1934

Subject Company: Finward Bancorp

Commission File No. 000-26128

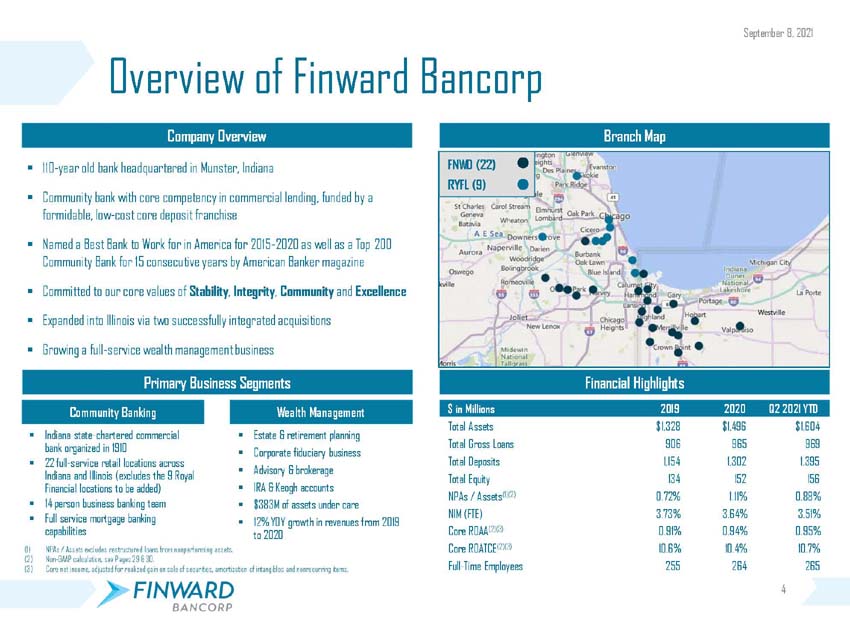

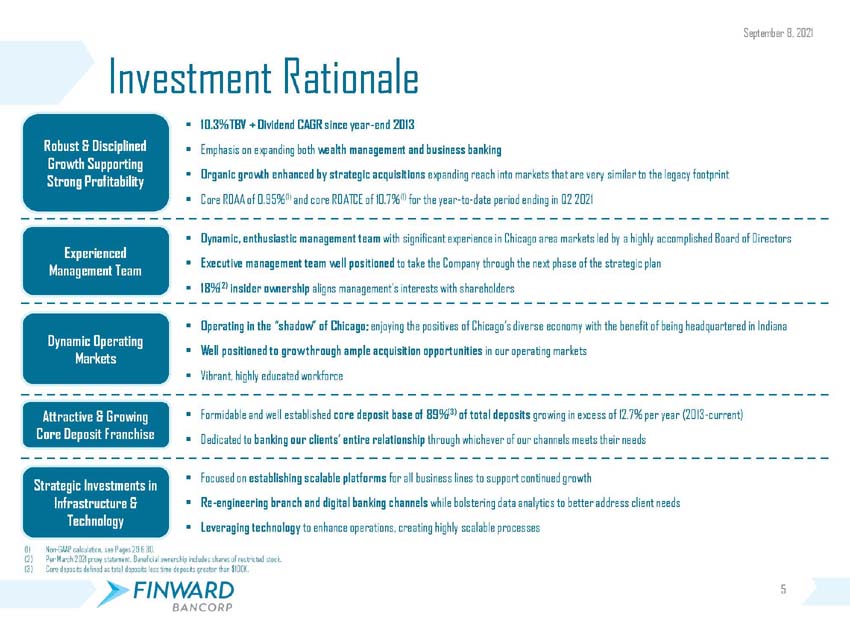

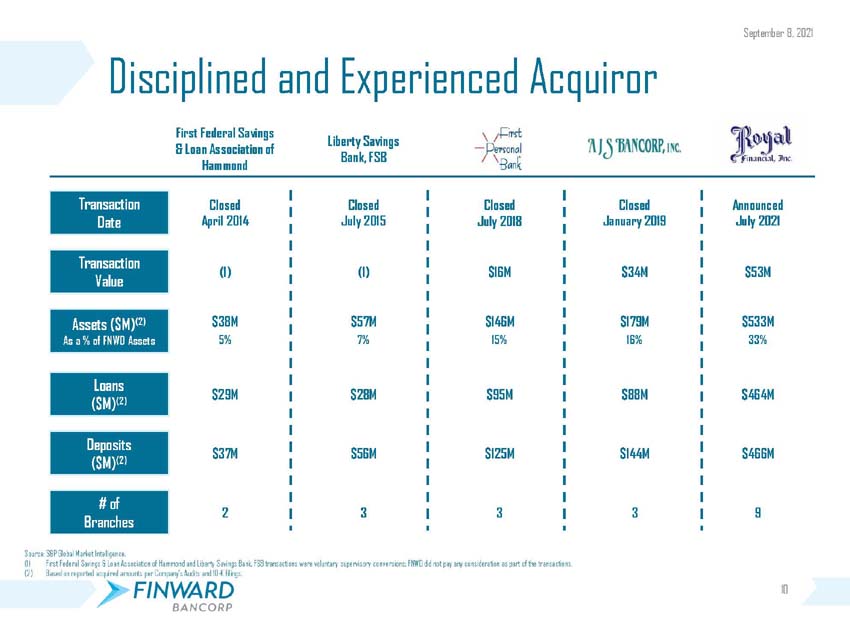

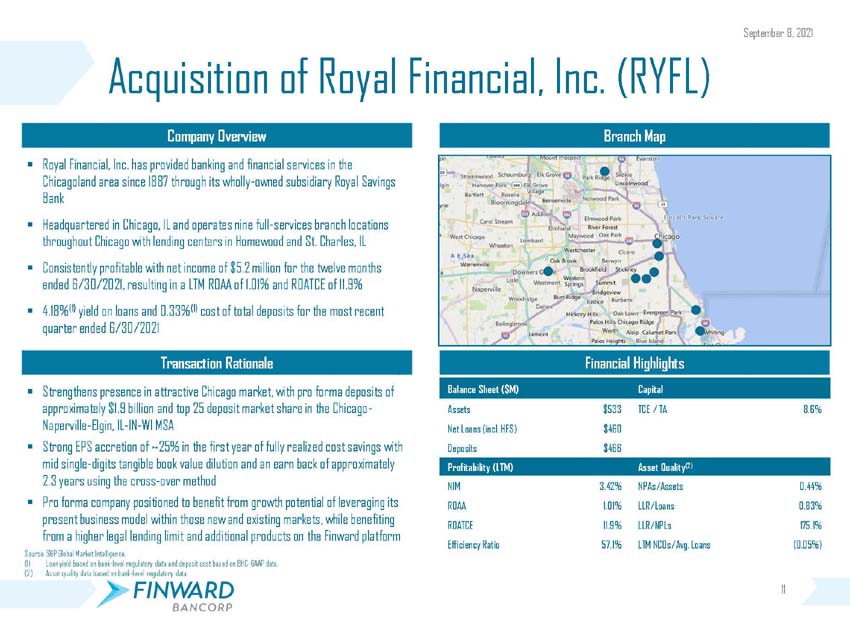

This filing relates to the proposed merger transaction between Finward Bancorp (“Finward”) and Royal Financial, Inc. (“RYFL”) pursuant to the terms of an Agreement and Plan of Merger dated as of July 28, 2021 (the “Merger Agreement”) between Finward and RYFL. The Merger Agreement is on file with the Securities and Exchange Commission (“SEC”) as Exhibit 2.1 to the Current Report on Form 8-K filed by Finward with the SEC on July 29, 2021.

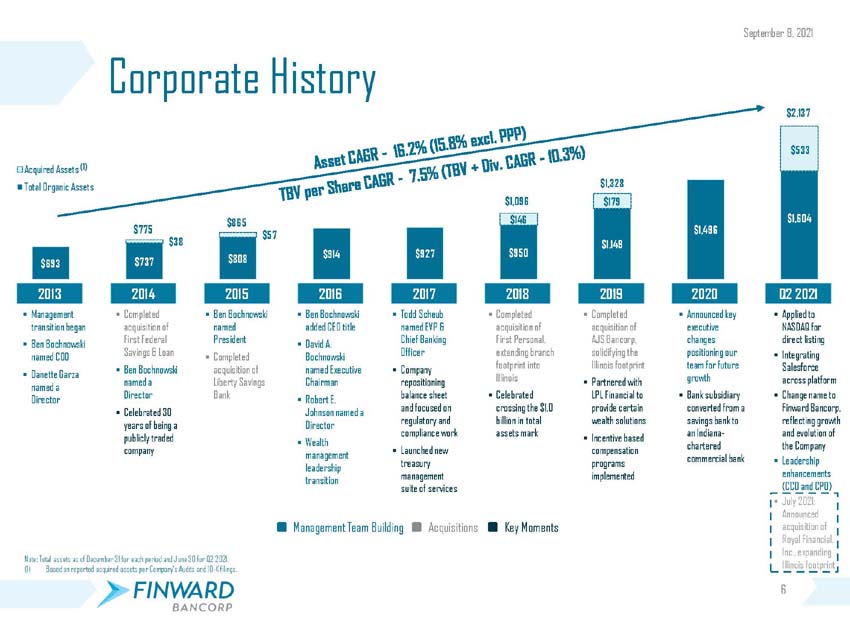

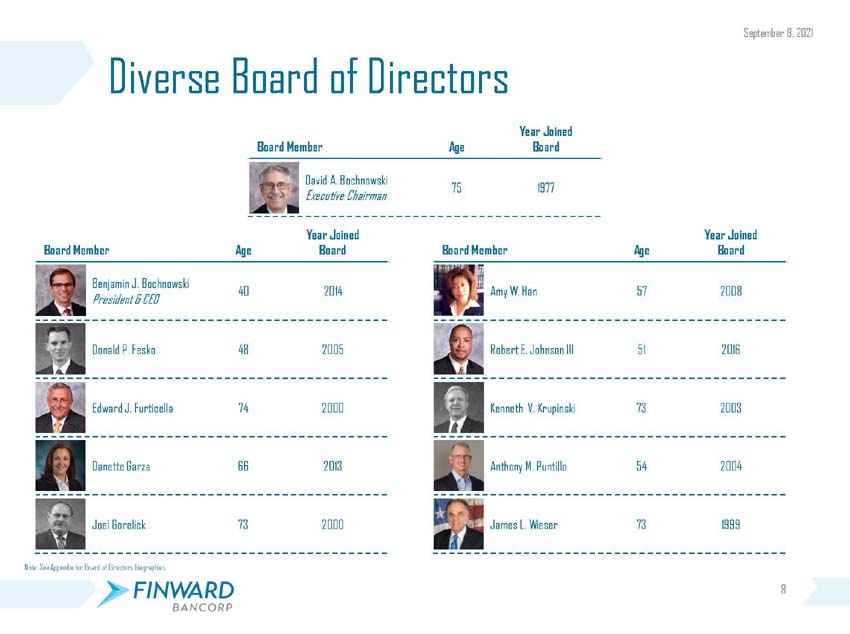

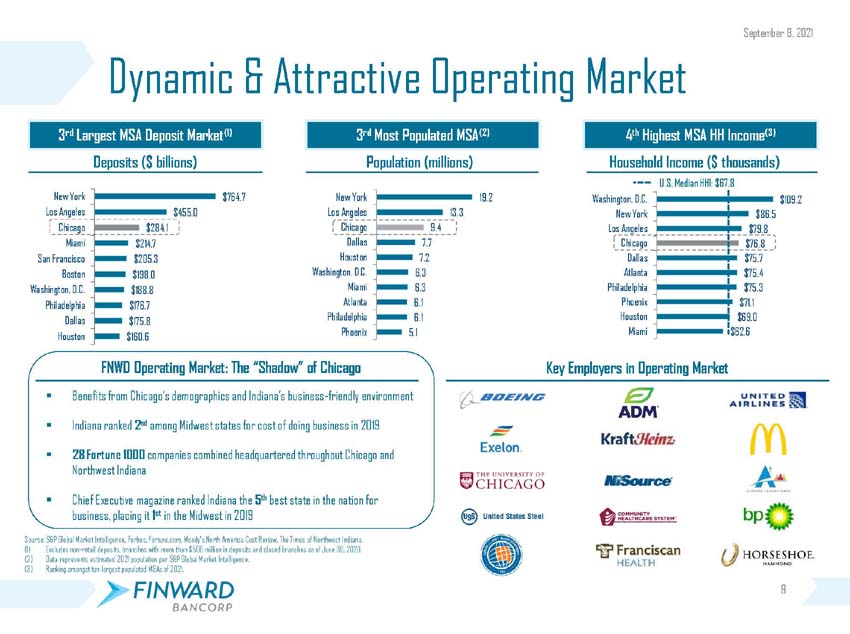

Set forth below are slides from an investor presentation given on September 8, 2021 by Benjamin J. Bochnowski, President and Chief Executive Officer of Finward, at the Raymond James Virtual U.S. Bank Conference.

Additional Information for Shareholders

In connection with the proposed merger with RYFL, Finward will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of RYFL and Finward, as well as a Prospectus of Finward (the “Joint Proxy Statement/Prospectus”), as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/ PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The Joint Proxy Statement/Prospectus and other relevant materials (when they become available), and any other documents Finward has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain copies of the documents Finward has filed with the SEC, free of charge, from Finward at www.ibankpeoples.com under the tab “Investor Relations – SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from Finward upon written request to Finward Bancorp, Attn: Shareholder Services, 9204 Columbia Avenue, Munster, Indiana 46321, or by calling (219) 836-4400, and from RYFL upon written request to Royal Financial, Inc., Attn: Corporate Secretary, 9226 Commercial Avenue, Chicago, Illinois 60617, or by calling (773) 768-4800. The information available through Finward’s website is not and shall not be deemed part of this document or incorporated by reference into other filings Finward makes with the SEC.

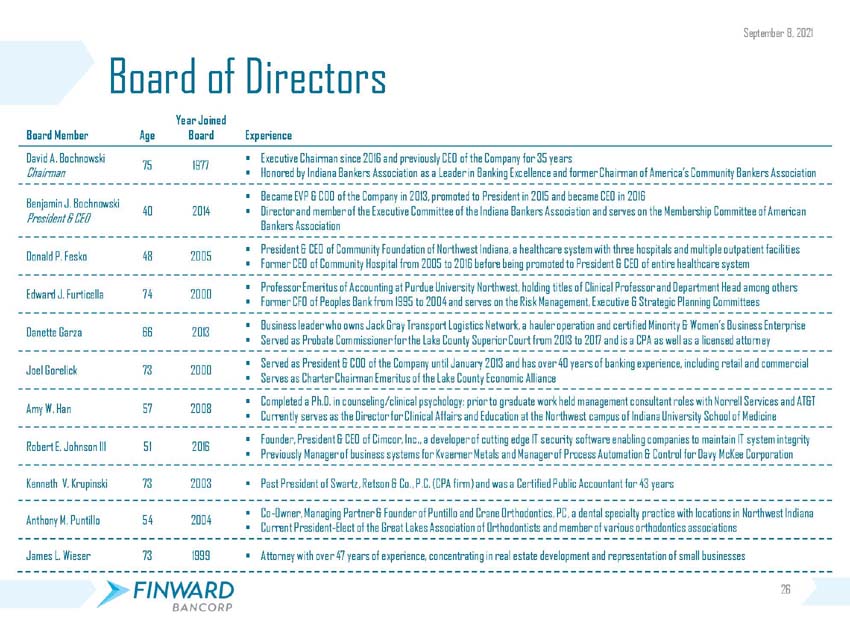

Finward, RYFL, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Finward and RYFL in connection with the proposed merger. Information about the directors and executive officers of Finward is set forth in Finward’s Annual Report on Form 10-K filed with the SEC on March 22, 2021, and in the proxy statement for Finward’s 2021 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 31, 2021. Additional information regarding the interests of these participants and any other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Forward-Looking Statements

This document may contain forward-looking statements regarding the financial performance, business prospects, growth, and operating strategies of Finward and RYFL. For these statements, each of Finward and RYFL claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about Finward and RYFL, including the information in the filings Finward makes with the SEC. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Finward’s and RYFL’s stockholders; delay in closing the merger; difficulties and delays in integrating Finward’s and RYFL’s businesses or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Finward’s and RYFL’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Finward’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Finward or RYFL or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Finward and RYFL do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

* * * * * * * * * *

Filed by Finward Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 of the

Securities Exchange Act of 1934

Subject Company: Finward Bancorp

Commission File No. 000-26128