Exhibit 10.14

Finward Bancorp

Executive Incentive Plan

Adopted by the Board on October 27, 2017

Revised Plan approved by the Compensation Committee on December 13, 2021

Revised Plan approved by the Board on December 17, 2021

Annual Incentive Plan

Framework

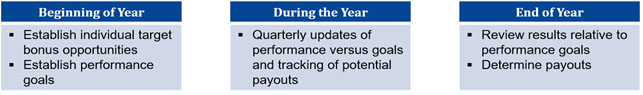

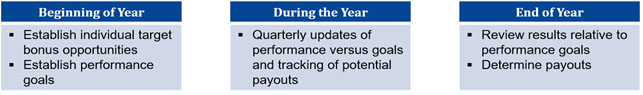

The executive annual incentive plan will use a target bonus framework, with a target bonus established for each participant at the beginning of the year. Payouts will be determined as a percentage of the target opportunity based on performance relative to criteria established at the beginning of the year.

The Plan shall be administered by the Compensation and Benefits Committee of the Board of Directors of Finward Bancorp (the “Compensation Committee”). The Compensation Committee shall make recommendations to the independent directors of the Board for approval.

Performance Period

The Plan operates on a calendar year schedule — January 1 through December 31.

Incentive Award Opportunities

Initial target award opportunities will be 30% of salary for the Executive Chairman and the CEO and 20% to 30% of salary for all other executive participants. Payouts will be determined relative to the target award opportunity based on the actual salary earned during the year.

Determination and Range of Payouts

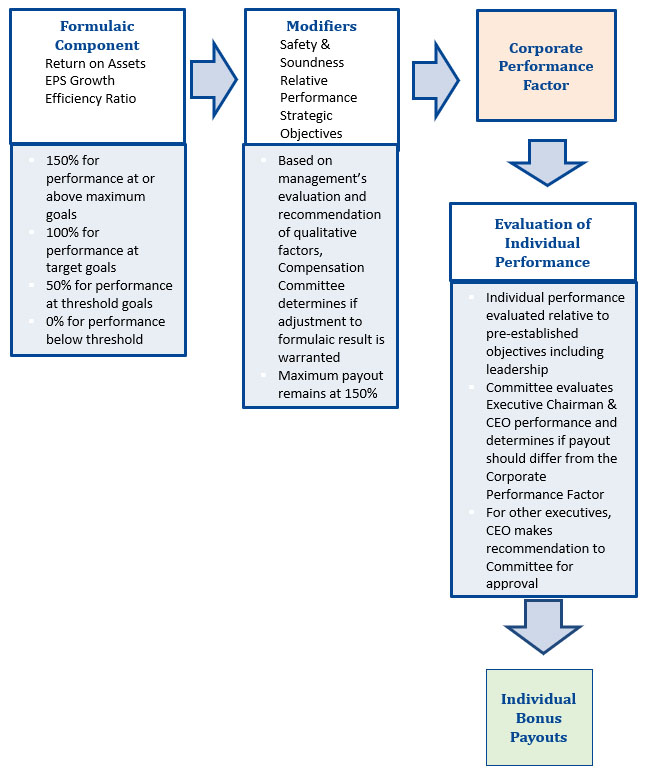

Payouts will be determined based on results relative to formulaic financial performance criteria, subject to adjustment based on defined modifiers.

Formulaic Component

The Plan relies on the formulaic with modifier incentive plan model. This model provides for payouts at, above or below target based on results versus key financial goals. The Committee may modify payouts up or down based on strategic and individual goals, as well as defined risk criteria. The formulaic component of the incentive plan will include Return on Assets, EPS Growth and Efficiency Ratio. The Compensation Committee shall determine the weightings on an annual basis.

Payouts will be determined independently for each measure. For each measure, the target performance level will equal the budget, so performance in line with the budget will result in a payout at target for that measure. Threshold and maximum performance levels will be set for each measure, and can result in payouts ranging from 50% to 150% of target. Performance below the threshold performance level will result in $0 payout for that measure. Payouts will be interpolated based on actual budget performance between threshold and target or between target and maximum.

A common guideline is to suggest that threshold performance goals should have an 85-90% probability of attainment, target should have a 50-60% probability of attainment, and maximum goals should have a 10-15% probability of attainment. When setting threshold and maximum goals, the Committee should give consideration to how historical results have varied relative to budget in the past, the range of results in the peer data, what would be required to achieve the different performance levels (in terms of loan growth, fee income growth, etc.), and what percentage of incremental earnings (or loss of earnings) would be shared by executives.

Illustrative Framework of Performance and Payout Range and Calculated Payout

|

Measure |

Threshold (50% of target payout) |

Target/Budget (target payout) |

Maximum (150% of target payout) |

Actual |

% of Target Payout |

|

ROA |

1.01% |

1.06% |

1.17% |

1.04% |

98.1% |

|

EPS Growth |

2.72% |

6.80% |

10.20% |

3.30% |

48.5% |

|

Efficiency Ratio |

69.92% |

66.59% |

63.26% |

66.92% |

99.5% |

|

Total Payout based on Formulaic Component (if equally weighted) |

82.2% |

||||

Corporate Performance Modifiers

The Compensation Committee may adjust the corporate performance results of the formulaic measures based on the following potential modifiers:

|

■ |

Safety and Soundness (based on CAMELS, ERM Dashboard, and Board Risk Survey): The Compensation Committee may elect to reduce payouts by up to 20% if there are safety and soundness concerns, with the potential for no payout if there are significant poor risk outcomes or regulatory issues. |

|

■ |

Relative Performance Comparisons: Management will evaluate Peoples Bank performance relative to a peer group as approved by the Strategic Planning Committee and the Board. The Compensation Committee may adjust payouts up to +/- 20% for performance significantly above or below the peer median. |

|

■ |

Strategic Objectives: Management, in collaboration with the Strategic Planning Committee, will identify one to three specific goals related to the Bank’s strategic priorities at the beginning of the year. The Compensation Committee may adjust payouts up to +/- 20% based on performance relative to those goals. |

Individual Performance Modifier

The Compensation Committee may also adjust payouts based on individual performance, including, without limitation, leadership skills. Individual performance may be evaluated through the use of tools such as performance evaluations, 360 peer evaluations, and Board evaluations. Executives will have specific goals established at the beginning of the year. At the end of the year, the Compensation Committee will evaluate the performance of the Executive Chairman and CEO relative to those goals and determine whether to make any adjust to the incentive payout.

The CEO will evaluate the performance of the other executives relative to their established goals and will make a recommendation to the Compensation Committee as to whether to any adjustments should be made to the incentive payout. Absent significant performance concerns, generally, there would be no adjustments and if recommended, adjustments for individual performance will not exceed +/- 20%.

Summary of Payout Determination

Award Distributions

The Compensation Committee retains final authority and discretion to determine appropriate payouts under the Plan and to make recommendations to the independent directors of the Board for approval. Upon approval of the award payout by the independent directors of the Board, participants receive the awards through payroll, generally on the second pay in February.

Payments under this Plan are taxable income to participants in the year paid and will be subject to tax withholding.

Long-Term Incentives

Award Vehicle

Executives will be eligible to receive annual grants of time-based restricted stock.

Grant Sizes

The CEO will have a target long-term incentive opportunity equal to 25% of base salary and all other executives will have a target long-term incentive opportunity within a range of 10-20% of base salary. The target incentive will be adjusted based on actual results as compared to budget and other factors deemed relevant by the Compensation Committee. The intent is for the grant target to remain within a range of 10-25% of salary.

Award Vesting

Shares become fully vested three years from the grant date of the award. Unless otherwise determined by the Compensation Committee, Executives may satisfy all or part of their tax withholding obligations in connection with an Award by having the Bank withhold otherwise deliverable shares consistent with the terms and conditions set forth in the applicable stock option and incentive plan.

Terms and Conditions

The information represented below is subject to change and does not constitute a binding agreement.

Effective Date

This Plan is effective January 1, 2018, and may be amended from time to time, subject to the approval of the independent directors of the Board.

Plan Administration

The Compensation Committee has the sole authority to interpret the Plan and to make or nullify any rules and procedures, as necessary, for proper administration of the Plan. Any determination by the Compensation Committee will be final and binding.

The Compensation Committee will annually review the plan to ensure proper alignment with the Bank’s business objectives.

Program Changes or Discontinuance

The Bank has developed this Plan based on existing business, market and economic conditions; current services; and staff assignments. If substantial changes occur that affect these conditions, services, assignments, or forecasts, the Bank may add to, amend, modify or discontinue any of the terms or conditions of the Plan at any time. Examples of substantial changes may include mergers, dispositions or other corporate transactions, changes in laws or accounting principles or other events that would in the absence of some adjustment, frustrate the intended operation of this arrangement.

The Compensation Committee may, at its sole discretion, waive any part of the Plan, as it deems appropriate.

Plan Interpretation

If there is any ambiguity as to the meaning of any terms or provisions of this Plan or any questions as to the correct interpretation of any information contained therein, the Bank's interpretation expressed by the Compensation Committee will be final and binding.

Changes in Incentive Targets

Participants who receive a promotion or change roles where the participant becomes eligible or ineligible for an award or experience a change in incentive opportunity will receive a prorated award based on their status and the effective date of the promotion or role change. Award amounts will be calculated using the participant’s base earnings and the incentive target for the applicable period. Base earnings refers to the base salary earned for the performance period and excludes referral fees, commissions and any other previously paid performance compensation.

Participants that have an approved leave of absence are eligible to receive a prorated award calculated using their time in active status as permitted by the Family Medical Leave Act or other applicable state and federal laws and regulations.

Termination of Employment

To encourage employee retention, a participant must be an active employee of the Bank on the date the incentive award is paid to receive an award (please see exceptions for death, disability and retirement below). Participants who terminate employment during the performance period will not be eligible to receive an award. Participants who have given notice of resignation after the performance period and before payout are not eligible to receive an award.

Death, Disability or Retirement

Participants who cease to be an active Peoples Bank employee due to death, disability or retirement (minimum age 65) will be eligible for a payout based on their actual salary earned during the performance period. The payout will be determined at the same time as all other participants, based on corporate and individual performance results.

Clawback

In the event that, within 3 years of an incentive payout, the Bank is required to prepare an accounting revision or restatement or determined that the incentives were paid based on inaccurate performance metric results, the Compensation Committee will determine whether a clawback of the incentives is appropriate. The Compensation Committee will consider whether the payout would have been reduced based on the revised, restated or corrected financials, the difference between the actual payout and what the payout would have been based on the revised, restated or corrected financials, and whether there was any misconduct on the part of plan participants that led to the revision, restatement or incorrect results. If the Compensation Committee determines a clawback is appropriate, the Committee will provide the Participant with a written notice of the amount of excess incentive payments awarded under the Plan that the Participant must reimburse the Bank. The participant may elect to reimburse the Bank by having outstanding awards reduced (including holdbacks or long-term incentives), having future incentive payments reduced, or writing a check payable to the Bank for an amount equal to the written notification.

Additionally, in the event that the Compensation Committee determines that an incentive recipient engaged in fraud or intentional misconduct that resulted in significant financial and/or reputational harm to the Bank, the Compensation Committee will determine whether it is appropriate to clawback any incentive compensation awarded during the preceding 3 years (including equity awards granted). The Committee will consider the extent of the fraud or misconduct and resulting harm, as well as the length of time during which the misconduct occurred, when determining whether and to what extent a clawback is appropriate.

Ethics Statement

The altering, inflating, and/or inappropriate manipulation of performance/financial results or any other infraction of recognized ethical business standards, will subject the employee to disciplinary action up to and including termination of employment. In addition, any incentive compensation as provided by this Plan to which the employee would otherwise be entitled will be revoked or if paid, be obligated to repay any incentive award earned during the award period in which the wrongful conduct occurred regardless of employment status.

Miscellaneous

Any participant awards shall not be subject to assignment, pledge or other disposition, nor shall such amounts be subject to garnishment, attachment, transfer by operation of law or any legal process.

Participation in the Plan does not confer rights to participation in other Bank programs or plans, including annual or long-term incentive plans, non-qualified retirement or deferred compensation plans or other executive perquisite programs.

The Plan does not give any participant the right to be retained in the employ of the Bank, nor will the Plan interfere with the right of the Bank to discharge any participant at any time for any reason.

In the absence of an authorized, written employment contract, the relationship between employees and the Bank is one of at-will employment. This Plan does not alter the relationship.

This Plan and the transactions and payments hereunder shall, in all respects, be governed by, and construed and enforced in accordance with the laws of the State of Indiana.

Each provision in this Plan is severable, and if any provision is held to be invalid, illegal, or unenforceable, the validity, legality and enforceability of the remaining provisions shall not, in any way, be affected or impaired thereby.

This Plan is proprietary and confidential to Finward Bancorp and Peoples Bank and its respective employees, and is not to be shared outside the organization other than as required by law or regulatory requirements.