UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under § 240.14a-12 |

|

Finward Bancorp |

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

9204 Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

| Notice of Annual Meeting of Shareholders | ||

|

To Be Held on May 5, 2023 |

To the Shareholders of Finward Bancorp:

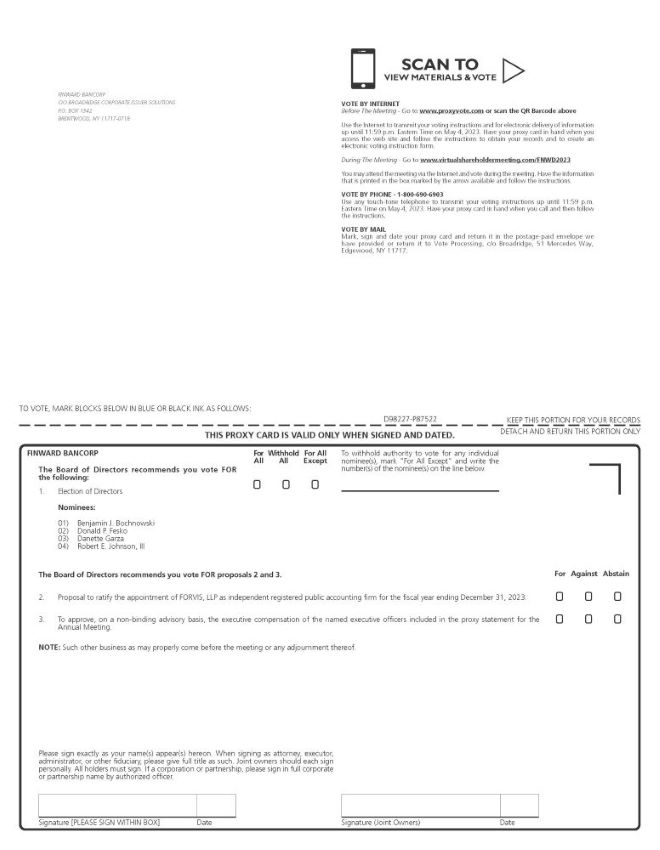

We cordially invite you to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Finward Bancorp, an Indiana corporation (the “Bancorp”), to be held on Friday, May 5, 2023, commencing at 9:00 a.m., Central Daylight Time. The Annual Meeting will be held completely as a virtual meeting of shareholders instead of an in person meeting. You may attend the meeting online, submit questions, and vote your shares electronically during the meeting via the internet at www.virtualshareholdermeeting.com/FNWD2023. To enter the Annual Meeting, you will need the 16-digit control number that is printed in the box marked by the arrow on the accompanying proxy card. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts.

The Annual Meeting will be held for the following purposes:

|

1. |

Election of Directors. Election of four directors of the Bancorp to serve three-year terms expiring in 2026; |

|

2. |

Ratification of Auditors. Ratification of the appointment of FORVIS, LLP as independent registered public accountants for the Bancorp for the year ending December 31, 2023; |

|

3. |

Advisory Vote on Compensation. A non-binding advisory vote regarding the executive compensation of the Bancorp’s named executive officers disclosed in this proxy statement, commonly referred to as a “Say on Pay” proposal; and |

|

4. |

Other Business. Other matters as may properly come before the meeting or at any adjournment. |

You can vote online at the meeting or any adjournment of the meeting if you are a shareholder of record at the close of business on March 3, 2023.

We urge you to read the enclosed proxy statement carefully so you will have information about the business to come before the Annual Meeting or any adjournment. Please sign, date, and return the accompanying proxy promptly in the postage-paid envelope furnished for that purpose, or follow the related internet or telephone voting instructions. If you hold shares through a broker or other nominee, you should follow the procedures provided by your broker or nominee.

A copy of our Annual Report for the fiscal year ended December 31, 2022, is enclosed. The Annual Report is not a part of the proxy soliciting material enclosed with this letter.

|

By Order of the Board of Directors |

|

|

|

|

|

Leane E. Cerven |

|

|

Executive Vice President, Chief Risk Officer, General Counsel and Secretary |

Munster, Indiana

March 30, 2023

It is important that you return your proxy promptly. Therefore, whether or not you plan to attend the Annual Meeting online, please sign, date and complete the enclosed proxy and return it in the enclosed envelope, which requires no postage if mailed in the United States, or follow the related internet or telephone voting instructions.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 5, 2023

The Notice of Annual Meeting of Shareholders, the Proxy Statement,

Annual Report, and 2022 Form 10-K are available at www.proxyvote.com

TABLE OF CONTENTS

|

Page |

|

ITEMS OF BUSINESS |

1 |

|

VOTING INFORMATION |

1 |

|

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

3 |

|

PROPOSAL 1 – ELECTION OF DIRECTORS |

5 |

|

Board Diversity |

7 |

|

Nominees for Class II Directors – Term Expiring at the Annual Meeting of Shareholders in 2026 |

8 |

|

Class III Directors – Term Expiring at the Annual Meeting of Shareholders in 2024 |

9 |

|

Class I Directors – Term Expiring at the Annual Meeting of Shareholders in 2025 |

10 |

|

Recommendation of the Board of Directors |

10 |

|

CORPORATE GOVERNANCE |

11 |

|

Director Independence |

11 |

|

Leadership Structure of the Board of Directors |

11 |

|

Meetings of the Board of Directors |

12 |

|

Board Committees |

12 |

|

Risk Oversight |

14 |

|

Communications with Directors |

14 |

|

Employee, Officer, and Director Hedging |

15 |

|

Code of Ethics |

15 |

|

Stock Ownership Guidelines |

15 |

|

EXECUTIVE COMPENSATION |

16 |

|

Summary Compensation Table for 2022 |

16 |

|

2015 Stock Option and Incentive Plan |

17 |

|

2022 Executive Annual Incentive Plan |

18 |

|

Employees’ Savings and Profit Sharing Plan |

19 |

|

Group Medical and Insurance Coverage |

20 |

|

BOLI Insurance |

20 |

|

Unqualified Deferred Compensation Plan |

20 |

|

Outstanding Equity Awards at Fiscal 2022 Year-End |

21 |

|

Potential Payments Upon Termination or Change in Control |

22 |

|

Employment Agreements |

22 |

|

Pay Versus Performance |

28 |

|

Compensation of Directors for 2022 |

29 |

|

Post 2004 Unfunded Deferred Compensation Plan for the Directors of Peoples Bank |

31 |

|

TRANSACTIONS WITH RELATED PERSONS |

31 |

|

RISK MANAGEMENT AND AUDIT COMMITTEE REPORT |

32 |

|

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

33 |

|

Required Shareholder Approval |

33 |

|

Recommendation of the Board of Directors |

33 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S SERVICES AND FEES |

33 |

|

Audit Fees |

33 |

|

Audit-Related Fees |

33 |

|

Tax Fees |

33 |

|

All Other Fees |

33 |

|

Preapproval Policy |

33 |

|

PROPOSAL 3 – ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

34 |

|

Background |

34 |

|

Required Shareholder Approval |

36 |

|

Recommendation of the Board of Directors |

36 |

|

DELINQUENT SECTION 16 REPORTS |

37 |

|

SHAREHOLDER PROPOSALS |

37 |

|

HOUSEHOLDING |

37 |

|

OTHER MATTERS |

38 |

9204 Columbia Avenue

Munster, Indiana 46321

(219) 836-4400

| Proxy Statement | ||

|

|

||

|

For the Annual Meeting of Shareholders To Be Held on May 5, 2023 |

||

The Board of Directors of Finward Bancorp, an Indiana corporation (the “Bancorp”), is soliciting proxies to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held completely virtually at 9:00 a.m., Central Daylight Time, on May 5, 2023, and at any adjournment of the meeting. You may attend the meeting online, submit questions, and vote your shares electronically during the meeting via the internet at www.virtualshareholdermeeting.com/FNWD2023. The Bancorp’s principal asset consists of 100% of the issued and outstanding shares of Common Stock of Peoples Bank (the “Bank”). We expect to first mail this proxy statement and the form of proxy to our shareholders on or about March 31, 2023.

ITEMS OF BUSINESS

At the Annual Meeting, shareholders will:

|

● |

vote on the election of four directors to serve three-year terms expiring in 2026; |

|

● |

ratify the selection of FORVIS, LLP as auditors for the Bancorp for 2023; |

|

● |

hold a non-binding advisory vote regarding the executive compensation of the Bancorp’s named executive officers disclosed in this proxy statement; and |

|

● |

transact any other matters of business that properly come before the meeting. |

We do not expect any other items of business because the deadline for shareholder nominations and proposals has already passed. If other matters do properly come before the meeting, the accompanying proxy gives discretionary authority to the persons named in the proxy to vote on any other matters brought before the meeting. Those persons intend to vote the proxies in accordance with their best judgment.

VOTING INFORMATION

Who is entitled to vote?

Shareholders of record at the close of business on March 3, 2023, the record date, may vote at the Annual Meeting. On the record date, there were 4,304,916 shares of the Bancorp’s Common Stock issued and outstanding, and the Bancorp had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting on all matters properly presented.

How many votes are required to elect directors?

The four nominees for director receiving the most votes will be elected. Abstentions and instructions to withhold authority to vote for a nominee will result in the nominee receiving fewer votes but will not count as votes against the nominee.

How many votes are required to ratify the selection of FORVIS, LLP as independent registered public accountants for the Bancorp for 2023?

More votes cast in favor of this proposal than are cast against it are required to ratify FORVIS, LLP as the Bancorp’s auditors for 2023. Abstentions and broker non-votes will have no effect on this proposal.

How many votes are required to approve, on an advisory basis, the executive compensation of the Bancorp’s named executive officers?

More votes cast in favor of this proposal than are cast against it are required to approve, on a non-binding advisory basis, the executive compensation of the Bancorp’s named executive officers. Abstentions and broker non-votes will have no effect on the advisory vote on executive compensation.

How do I vote my shares?

If you are a “shareholder of record,” you can vote by mailing the enclosed proxy card or by following the related internet or telephone voting instructions. The proxy, if properly signed and returned to the Bancorp and not revoked prior to its use, will be voted in accordance with the instructions contained in the proxy. If you return your signed proxy card but do not indicate your voting preferences, the proxies named in the proxy card will vote on your behalf “FOR” the four nominees for director listed below, “FOR” the ratification of FORVIS, LLP as auditors of the Bancorp for 2023, “FOR” the approval of the executive compensation paid to the Bancorp’s named executive officers, and, as to any other matter that may be properly brought before the Annual Meeting, in accordance with the judgment of the proxies.

If you have shares held by a broker or other nominee, you may instruct the broker or nominee to vote your shares by following the instructions the broker or nominee provides to you. If you do not submit specific voting instructions to your broker or nominee, the organization that holds your shares may generally vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not submit specific voting instructions to your broker, the shares will be treated as “broker non-votes.” The proposal to ratify FORVIS, LLP as our auditors for 2023 is considered routine and therefore may be voted upon by your broker if you do not give instructions to your broker. However, brokers will not have discretion to vote your shares on the election of directors or on the advisory vote on the compensation of the Bancorp’s executive officers. Accordingly, if your shares are held in street name and you do not submit voting instructions to your broker, your shares will not be counted in determining the outcome of the election of the director nominees or the advisory vote on the executive compensation of the Bancorp’s named executive officers.

Proxies solicited by this proxy statement may be exercised only at the Annual Meeting and any adjournment thereof and will not be used for any other meeting.

Can I change my vote after I have mailed my proxy card?

You have the right to revoke your proxy at any time before it is exercised by (1) notifying the Bancorp’s Corporate Secretary (Leane E. Cerven, 9204 Columbia Avenue, Munster, Indiana 46321) in writing, (2) delivering a later-dated proxy, or (3) attending the Annual Meeting online and voting electronically (attendance at the online meeting will not, by itself, revoke a proxy).

Can I vote my shares at the meeting?

We will not be holding an in person Annual Meeting. Rather, the meeting will be completely virtual and will be held at the time and internet address mentioned in the Notice of Annual Meeting of Shareholders included with these materials. If you are a shareholder of record, you may attend the meeting online and vote your shares electronically during the meeting via internet at www.virtualshareholdermeeting.com/FNWD2023. You will need the information printed in the box marked by the arrow on the accompanying proxy card and you should follow the instructions provided when you login. However, we encourage you to vote by proxy card even if you plan to attend the online meeting.

If your shares are held by a broker or other nominee, you must obtain a proxy from the broker or other nominee giving you the right to vote the shares at the meeting.

What constitutes a quorum?

The holders of over 50% of the outstanding shares of Common Stock as of the record date must be present electronically or by proxy at the Annual Meeting to constitute a quorum. In determining whether a quorum is present, shareholders who abstain, cast broker non-votes, or withhold authority to vote on one or more director nominees will be deemed present at the Annual Meeting. Once a share is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting.

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 3, 2023, certain information as to those persons who were known by management to be beneficial owners of more than 5% of the Bancorp’s Common Stock and as to the shares of the Common Stock beneficially owned by the persons named in the “Summary Compensation Table” (referred to in this proxy statement as “Named Executive Officers”) and by all directors and executive officers as a group. Persons and groups owning more than 5% of the Common Stock are required to file certain reports regarding such ownership with the Bancorp and the Securities and Exchange Commission (“SEC”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based on such reports, management knows of no persons, other than as set forth in the table below, who owned more than 5% of the Common Stock at March 3, 2023. Individual beneficial ownership of shares by the Bancorp’s directors is set forth in the table below under “Election of Directors.” Unless otherwise noted below, the address of each director, executive officer, and beneficial owner of more than 5% of the Bancorp’s Common Stock is c/o Finward Bancorp, 9204 Columbia Avenue, Munster, IN 46321.

|

Name and Address of |

Amount and Nature |

Percent of Shares of |

||||||

|

Executive Officers and Certain Directors |

||||||||

|

David A. Bochnowski |

364,491 | (2) | 8.5 | % | ||||

|

Benjamin J. Bochnowski |

25,955 | (3) | * | |||||

|

Robert T. Lowry |

26,444 | (4) | * | |||||

|

Peymon S. Torabi |

9,066 | (5) | * | |||||

|

Todd M. Scheub |

19,485 | (6) | * | |||||

|

Leane E. Cerven |

18,677 | (7) | * | |||||

|

All current directors and executive officers as a group (15 persons) |

588,277 | (8) | 13.7 | % | ||||

|

Other Beneficial Owners of More than 5% of the Common Stock |

||||||||

|

Fourthstone LLC |

379,458 | (9) | 8.8 | % | ||||

|

* |

Under 1% of outstanding shares. |

|

(1) |

For each individual or group disclosed in the table above, the figures in this column are based on 4,304,916 shares of Common Stock issued and outstanding as of March 3, 2023, plus the number of shares of Common Stock each such individual or group has the right to acquire on or within 60 days after March 3, 2023, computed in accordance with Rule 13d‑3(d)(1) under the Exchange Act. |

|

(2) |

Includes 241,061 shares held jointly with Mr. Bochnowski’s spouse, 24,990 shares as to which Mr. Bochnowski’s spouse has voting and dispositive power, and 17,600 shares that are owned by his children for which his spouse is custodian or trustee. Also includes 8,729 shares held as co-trustee of funds for the benefit of Mr. Bochnowski’s children, 61,460 shares purchased by Mr. Bochnowski under the Bancorp’s Employees’ Savings and Profit Sharing Plan (the “Profit Sharing Plan”), 8,280 shares held in Mr. Bochnowski’s individual retirement account as to which Mr. Bochnowski has dispositive and voting power, 1,929 shares of restricted stock over which Mr. Bochnowski has voting but not dispositive power, and 442 shares solely owned. |

|

(3) |

Includes 450 shares held jointly with Mr. Bochnowski’s spouse, 3,619 shares of restricted stock over which Mr. Bochnowski has voting but not dispositive power, 1,732 shares purchased by Mr. Bochnowski under the Profit Sharing Plan as to which Mr. Bochnowski has voting and dispositive power, 904 shares held in Mr. Bochnowski’s individual retirement account as to which Mr. Bochnowski has dispositive and voting power, and 19,214 shares solely owned. |

|

(4) |

Includes 7,315 shares held jointly with Mr. Lowry’s spouse, 2,342 shares held in his individual retirement account for which he has dispositive and voting power, and 720 shares owned by Mr. Lowry’s spouse in an individual retirement account. Also includes 2,020 shares of restricted stock over which Mr. Lowry has voting but not dispositive power, 13,948 shares purchased by Mr. Lowry under the Profit Sharing Plan as to which Mr. Lowry has dispositive and voting power, and 99 shares solely owned. |

|

(5) |

Includes 1,428 shares held jointly with Mr. Torabi’s spouse, 1,627 shares of restricted stock over which Mr. Torabi has voting but not dispositive power, 5,918 shares purchased by Mr. Torabi under the Profit Sharing Plan, and 93 shares solely owned. |

|

(6) |

Includes 5,589 shares held jointly with Mr. Scheub’s spouse, 3,021 shares of restricted stock over which Mr. Scheub has voting but not dispositive power, and 10,875 shares purchased by Mr. Scheub under the Profit Sharing Plan as to which Mr. Scheub has dispositive and voting power. |

|

(7) |

Includes 6,586 shares owned jointly with Ms. Cerven’s spouse, 1,866 shares of restricted stock over which Ms. Cerven has voting but not dispositive power, 9,285 shares owned by Ms. Cerven’s spouse in an individual retirement account, 140 shares purchased by Ms. Cerven under the Profit Sharing Plan as to which Ms. Cerven has dipositive and voting power, and 800 shares owned by Ms. Cerven in an individual retirement account. On January 6, 2023, the Bancorp announced that, effective at the close of business on May 5, 2023, Ms. Cerven will be retiring from her role at the Bancorp and the Bank. Ms. Cerven’s retirement is not related to any disagreement with the Bancorp regarding any financial, accounting, or other matters. |

|

(8) |

Includes 94,073 shares held under the Profit Sharing Plan and 17,374 shares of restricted stock granted under the Bancorp’s 2015 Stock Option and Incentive Plan (the “2015 Plan”). |

|

(9) |

This information is based solely on a Schedule 13G filed with the SEC on February 14, 2023, by Fourthstone LLC (“Fourthstone”), along with its affiliates Fourthstone LLC, Fourthstone Master Opportunity Fund Ltd., Fourthstone GP LLC, Fourthstone QP Opportunity Fund LP, and Fourthstone Small-Cap Financials Fund LP. Fourthstone holds these shares of Common Stock on behalf of its advisory clients. The registered office of Fourthstone LLC, Fourthstone Master Opportunity Fund Ltd., Fourthstone GP LLC, Fourthstone QP Opportunity Fund LP, and Fourthstone Small-Cap Financials Fund LP is 575 Maryville Centre Drive, Suite 110, St. Louis, MO 63141. |

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board of Directors (the “Board”) currently consists of eleven members. The By-Laws provide that the Board of Directors is to be divided into three classes, with each class containing directors as nearly equal in number as the then total number of directors constituting the entire Board permits. The members of each class are elected for a term of three years and until their successors are elected and qualified. One class of directors is elected annually. The term of the Class II directors expires at the Annual Meeting. The term of the Class III directors expires at the 2024 Annual Meeting, and the term of the Class I directors expires at the 2025 Annual Meeting.

The four nominees for director this year are Benjamin J. Bochnowski, Donald P. Fesko, O.D., FACHE, Danette Garza, J.D., CPA, and Robert E. Johnson, III, each of whom is a current director of the Bancorp. If the shareholders elect these nominees at the Annual Meeting, the terms of Mr. Bochnowski, Mr. Fesko, Ms. Garza, and Mr. Johnson will expire in 2026. No director or nominee for director is related to any other director or executive officer of the Bancorp or nominee for director by blood, marriage, or adoption, except that David A. Bochnowski is Benjamin J. Bochnowski’s father. Except as otherwise described above, there are no arrangements or understandings between any nominee and any other person pursuant to which the nominee was selected.

On January 27, 2023, David A. Bochnowski, the current Executive Chairman of the Board, informed the Board of his decision to retire as Executive Chairman and as a member of the Board effective as of June 30, 2023. Mr. Bochnowski’s retirement is not related to any disagreement with the Bancorp or the Bank regarding any financial, accounting, or other matters. In conjunction with Mr. Bochnowski’s retirement, on January 27, 2023, the Board appointed Benjamin J. Bochnowski, currently the Bancorp’s President and Chief Executive Officer and a member of the Board, to succeed David Bochnowski as the Chairman of the Board, effective as of June 30, 2023.

Pursuant to the Bancorp’s Corporate Governance Guidelines, directors are permitted to serve on the Board until they reach the age of 76, at which time they are required to retire from the Board effective as of the conclusion of the annual shareholders meeting following the date on which the director attains age 76. Director James Wieser will attain the age of 76 prior to the date of the Annual Meeting and, under the Bancorp’s Corporate Governance Guidelines, would be required to retire from the Board effective as of the conclusion of the Annual Meeting. However, on January 13, 2023, the Nominating and Corporate Governance Committee approved the waiver of the retirement requirement for Director Wieser so that he may continue to serve until the end of his current term as a Class III Director, which term will expire at the Annual Meeting of Shareholders in 2024.

The following table provides information on the nominees for the position of director of the Bancorp and for each director continuing in office after the Annual Meeting, including the number and percent of shares of Common Stock beneficially owned as of the record date.

|

Name |

Age |

Present Principal Occupation |

Director |

Shares |

Percent Class(1) |

||||||||||||

|

Nominees for Director |

|||||||||||||||||

|

(Class II – Term expiring at annual meeting of shareholders in 2026) |

|||||||||||||||||

|

Benjamin J. Bochnowski |

42 |

President and Chief Executive Officer of the Bancorp |

2014 | 25,955 | (2) | * | |||||||||||

|

Donald P. Fesko, O.D., FACHE |

50 |

President and Chief Executive Officer of Community Foundation of Northwest Indiana |

2005 | 3,952 | (3) | * | |||||||||||

|

Danette Garza, J.D., CPA |

68 |

Attorney and Certified Public Accountant; Chief Executive Officer of Jack Gray Logistics Network, Inc., Gary, Indiana |

2013 | 6,493 | (4) | * | |||||||||||

|

Robert E. Johnson, III |

53 |

President and Chief Executive Officer of Cimcor, Inc. |

2016 | 2,863 | (5) | * | |||||||||||

|

Directors Continuing in Office |

|||||||||||||||||

|

(Class III – Term expiring at annual meeting of shareholders in 2024) |

|||||||||||||||||

|

David A. Bochnowski |

77 |

Executive Chairman of the Bancorp |

1977 | 364,491 | (2) | 8.5 | % | ||||||||||

|

Kenneth V. Krupinski |

75 |

Retired Certified Public Accountant; past President of Swartz Retson & Co., P.C., Merrillville, Indiana |

2003 | 12,577 | (6) | * | |||||||||||

|

Anthony M. Puntillo, D.D.S., M.S.D. |

56 |

Orthodontist and Chief Executive Officer of Puntillo and Crane Orthodontics, PC |

2004 | 4,788 | (7) | * | |||||||||||

|

James L. Wieser, J.D. |

75 |

Attorney with Wieser & Wyllie LLP, Schererville, Indiana |

1999 | 8,463 | (8) | * | |||||||||||

|

(Class I – Term expiring at annual meeting of shareholders in 2025) |

|||||||||||||||||

|

Joel Gorelick |

75 |

Retired; former President and Chief Operating Officer of the Bancorp, Charter Chairman Emeritus of the Lake County Economic Alliance, Inc., and Director and Chairman of the Audit Committee of the Indiana Economic Development Corporation |

2000 | 52,463 | (9) | 1.2 | % | ||||||||||

|

Amy W. Han, Ph.D. |

59 |

Director for Clinical Affairs and Education of Indiana University School of Medicine – Northwest |

2008 | 7,275 | (10) | * | |||||||||||

|

Robert W. Youman |

60 |

Investment Advisor and Managing Director with Horwitz & Associates |

2022 | 25,285 | (11) | * | |||||||||||

* Under 1% of outstanding shares.

|

(1) |

For each individual disclosed in the table above, the figures in this column are based on 4,304,916 shares of common stock issued and outstanding as of March 3, 2023, plus the number of shares of common stock each such individual has the right to acquire on or within 60 days after March 3, 2023, computed in accordance with Rule 13d‑3(d)(1) under the Exchange Act. |

|

(2) |

For further information regarding the beneficial ownership of these shares, see “Security Ownership by Certain Beneficial Owners and Management” beginning on page 3. |

|

(3) |

Includes 2,918 shares held jointly with Dr. Fesko’s spouse, 179 shares of restricted stock over which Dr. Fesko has voting but not dispositive power, and 855 shares solely owned. |

|

(4) |

Includes 600 shares held in Ms. Garza’s individual retirement account, 148 shares of restricted stock over which Ms. Garza has voting but not dispositive power, and 5,745 shares solely owned. |

|

(5) |

Includes 173 shares of restricted stock over which Mr. Johnson has voting but not dispositive power, and 2,690 shares solely owned. |

|

(6) |

Includes 11,084 shares held jointly with Mr. Krupinski’s spouse, 1,000 shares held in Mr. Krupinski’s individual retirement account, 296 shares of restricted stock over which Mr. Krupinski has voting but not dispositive power, and 197 shares solely owned. |

|

(7) |

Includes 253 shares of restricted stock over which Dr. Puntillo has voting but not dispositive power, 3,378 shares held as trustee, and 1,157 shares solely owned. |

|

(8) |

Includes 7,293 shares held jointly with Mr. Wieser’s spouse, 234 shares of restricted stock over which Mr. Wieser has voting but not dispositive power, and 936 shares solely owned. |

|

(9) |

Includes 832 shares held jointly with Mr. Gorelick’s spouse, 296 shares of restricted stock over which Mr. Gorelick has voting but not dispositive power, 48,558 shares held in Mr. Gorelick’s individual retirement account, 917 shares held by Mr. Gorelick’s spouse in her individual retirement account, 1,460 shares owned as custodian for Mr. Gorelick’s children, and 400 shares solely owned. |

|

(10) |

Includes 6,674 shares held jointly with Dr. Han’s spouse, 247 shares of restricted stock over which Dr. Han has voting but not dispositive power, and 354 shares solely owned. |

|

(11) |

Includes 22,594 shares held in Mr. Youman’s individual retirement account, 2,392 shares held as trustee, and 299 shares solely owned. |

Each of the Bancorp’s directors and director nominees has particular experience, qualifications, attributes, and skills that qualify him or her to serve as a director of the Bancorp. These particular attributes are set forth below for each such director or director nominee.

Board Diversity

Listing Rule 5605(f) (the “Diverse Board Representation Rule”) of The NASDAQ Stock Market, LLC (“Nasdaq”) requires each Nasdaq-listed company, subject to certain exceptions, to have or explain why it does not have (1) at least one director who self-identifies as female, and (2) at least one director who self-identifies as Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+. All Nasdaq-listed companies must have, or explain why they do not have, at least one diverse director by August 7, 2023. All companies listed on the Nasdaq Capital Market, such as the Bancorp, must have, or explain why they do not have, at least two diverse directors by August 6, 2026.

In addition, Listing Rule 5606 (the “Board Diversity Disclosure Rule”) requires each Nasdaq-listed company, subject to certain exceptions, to provide statistical information about the company’s board of directors, in a uniform format, related to each director’s self-identified gender, race, and self-identification as LGBTQ+.

Although we are not required to fully comply with the Diverse Board Representation Rule until 2026, we believe we presently meet the requirements of that rule based on the self-identified characteristics of the current members of our Board. In the matrix below, we have provided the statistical information required by the Board Diversity Disclosure Rule.

| Board Diversity Matrix (as of March 28, 2023) | ||||

| Total Number of Directors | 11 | |||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

|

Part I: Gender Identity Directors |

2 |

9 |

0 |

0 |

|

Part II: Demographic Background African American or Black Alaskan Native or Native American Asian Hispanic or Latinx Native Hawaiian or Pacific Islander White Two or More Races or Ethnicities |

0 0 1 1 0 0 0 |

1 0 0 0 0 8 0 |

0 0 0 0 0 0 0 |

0 0 0 0 0 0 0 |

| LGBTQ+ | 0 | |||

| Did Not Disclose Demographic Background | 0 | |||

Nominees for Class II Directors – Term Expiring at the Annual Meeting of Shareholders in 2026

Benjamin J. Bochnowski currently serves as President and Chief Executive Officer of the Bancorp and Chief Executive Officer of Peoples Bank. Mr. Bochnowski joined the Bancorp in 2010, became Executive Vice President and Chief Operating Officer of the Bancorp in 2013, was promoted to President and Chief Operating Officer in 2015, and became the Chief Executive Officer in 2016. He is a Director and member of the Executive Committee of the Indiana Bankers Association, and serves on the Membership Committee of the American Bankers Association. He also serves on the Board of Directors of One Region, a non-profit business organization focused on population growth. Mr. Bochnowski volunteers with the Volunteer Income Tax Assistance (VITA) Program for low-income individuals, and has been a mentor for the Entrepreneurship Boot Camp for Veterans at Purdue University.

Benjamin J. Bochnowski currently serves as President and Chief Executive Officer of the Bancorp and Chief Executive Officer of Peoples Bank. Mr. Bochnowski joined the Bancorp in 2010, became Executive Vice President and Chief Operating Officer of the Bancorp in 2013, was promoted to President and Chief Operating Officer in 2015, and became the Chief Executive Officer in 2016. He is a Director and member of the Executive Committee of the Indiana Bankers Association, and serves on the Membership Committee of the American Bankers Association. He also serves on the Board of Directors of One Region, a non-profit business organization focused on population growth. Mr. Bochnowski volunteers with the Volunteer Income Tax Assistance (VITA) Program for low-income individuals, and has been a mentor for the Entrepreneurship Boot Camp for Veterans at Purdue University.

Donald P. Fesko, O.D., FACHE, is the President and Chief Executive Officer of Community Foundation of Northwest Indiana, a position he has held since 2016. Prior to that, he served as Chief Executive Officer of Community Hospital from 2005 to 2016. Dr. Fesko has significant health care expertise, and is active in the Bank’s communities. These attributes are of value to the Bancorp in offering Bank products and services to the health care industry and to other Bank customers. He also served on a compensation committee for the Community Foundation of Northwest Indiana, bringing him expertise of value to his service as the Chair of the Compensation and Benefits Committee, and as a member of the Nominating and Corporate Governance Committee and the Strategic Planning Committee.

Donald P. Fesko, O.D., FACHE, is the President and Chief Executive Officer of Community Foundation of Northwest Indiana, a position he has held since 2016. Prior to that, he served as Chief Executive Officer of Community Hospital from 2005 to 2016. Dr. Fesko has significant health care expertise, and is active in the Bank’s communities. These attributes are of value to the Bancorp in offering Bank products and services to the health care industry and to other Bank customers. He also served on a compensation committee for the Community Foundation of Northwest Indiana, bringing him expertise of value to his service as the Chair of the Compensation and Benefits Committee, and as a member of the Nominating and Corporate Governance Committee and the Strategic Planning Committee.

Danette Garza, J.D., CPA, served as Probate Commissioner for the Lake County Superior Court from 2013 to 2017. In 2015, she took ownership of Jack Gray Transport Logistics Network, Inc., a bulk and break bulk hauler and stevedore operation located in Gary, Indiana. She is a certified public accountant as well as a licensed attorney specializing in corporate, estate planning, and elder law. She brings to the Board financial expertise and strong business acumen. The Board draws on her professional strengths and civic involvement as resources to help with the Bancorp’s strategic direction and capitalize on strategic opportunities of the Bancorp. She serves as the Chair of the Risk Management and Audit Committee, and as a member of the Wealth Management Committee, the Strategic Planning Committee, and the Credit Committee.

Danette Garza, J.D., CPA, served as Probate Commissioner for the Lake County Superior Court from 2013 to 2017. In 2015, she took ownership of Jack Gray Transport Logistics Network, Inc., a bulk and break bulk hauler and stevedore operation located in Gary, Indiana. She is a certified public accountant as well as a licensed attorney specializing in corporate, estate planning, and elder law. She brings to the Board financial expertise and strong business acumen. The Board draws on her professional strengths and civic involvement as resources to help with the Bancorp’s strategic direction and capitalize on strategic opportunities of the Bancorp. She serves as the Chair of the Risk Management and Audit Committee, and as a member of the Wealth Management Committee, the Strategic Planning Committee, and the Credit Committee.

Robert E. Johnson, III, currently is the President and Chief Executive Officer of Cimcor, Inc., a position he has held since 1997. Cimcor, Inc. develops cutting edge IT security software to enable companies to maintain IT system integrity, take immediate action to change, and meet compliance regulations. Prior to Cimcor, Mr. Johnson was the manager of business systems for Kvaerner Metals and Manager of Process Automation & Control for Davy McKee Corporation. Mr. Johnson was appointed Chairman of the board of directors for The Methodist Hospitals in 2020. He has been a member of The Methodist Hospitals board since 2009, and has previously served as the Chair of the Finance Committee and as Vice-Chairman of the board. Mr. Johnson is the former Chairman of the board of directors of the Legacy Foundation. He is a member of the Indiana District Export Council (IDEC), a non-profit operating under the auspices of the U.S. Department of Commerce that promotes and supports exporting as a way to strengthen Indiana companies, and is also a member of the board of One Region, a regional economic development organization. Mr. Johnson’s cyber security and information technology knowledge and record of community engagement and entrepreneurship add strong expertise and value to the Bancorp’s oversight responsibilities and community banking efforts. Mr. Johnson’s experience, as described above, assists in his role as the Chair of the Strategic Planning Committee, and as a member and former chair of the Risk Management and Audit Committee.

Robert E. Johnson, III, currently is the President and Chief Executive Officer of Cimcor, Inc., a position he has held since 1997. Cimcor, Inc. develops cutting edge IT security software to enable companies to maintain IT system integrity, take immediate action to change, and meet compliance regulations. Prior to Cimcor, Mr. Johnson was the manager of business systems for Kvaerner Metals and Manager of Process Automation & Control for Davy McKee Corporation. Mr. Johnson was appointed Chairman of the board of directors for The Methodist Hospitals in 2020. He has been a member of The Methodist Hospitals board since 2009, and has previously served as the Chair of the Finance Committee and as Vice-Chairman of the board. Mr. Johnson is the former Chairman of the board of directors of the Legacy Foundation. He is a member of the Indiana District Export Council (IDEC), a non-profit operating under the auspices of the U.S. Department of Commerce that promotes and supports exporting as a way to strengthen Indiana companies, and is also a member of the board of One Region, a regional economic development organization. Mr. Johnson’s cyber security and information technology knowledge and record of community engagement and entrepreneurship add strong expertise and value to the Bancorp’s oversight responsibilities and community banking efforts. Mr. Johnson’s experience, as described above, assists in his role as the Chair of the Strategic Planning Committee, and as a member and former chair of the Risk Management and Audit Committee.

Class III Directors – Term Expiring at the Annual Meeting of Shareholders in 2024 (except as noted)

David A. Bochnowski is the Executive Chairman of the Bancorp, a position he has held since 2016. Mr. Bochnowski was previously the Chief Executive Officer of the Bancorp for 35 years and has over 43 years of banking experience. He has an in-depth knowledge of the Bancorp and its subsidiaries having managed the growth and operations of the companies through numerous business cycles. An attorney with experience in federal laws and regulations applicable to the industry, he has also been actively involved in national and state issues impacting the community banking industry. He maintains a high profile in business and not for profit community activities throughout Northwest Indiana. Mr. Bochnowski also serves as the Chair of the Executive Committee. As previously disclosed, on January 27, 2023, Mr. Bochnowski informed the Board of his decision to retire as Executive Chairman and as a member of the Board effective as of June 30, 2023.

David A. Bochnowski is the Executive Chairman of the Bancorp, a position he has held since 2016. Mr. Bochnowski was previously the Chief Executive Officer of the Bancorp for 35 years and has over 43 years of banking experience. He has an in-depth knowledge of the Bancorp and its subsidiaries having managed the growth and operations of the companies through numerous business cycles. An attorney with experience in federal laws and regulations applicable to the industry, he has also been actively involved in national and state issues impacting the community banking industry. He maintains a high profile in business and not for profit community activities throughout Northwest Indiana. Mr. Bochnowski also serves as the Chair of the Executive Committee. As previously disclosed, on January 27, 2023, Mr. Bochnowski informed the Board of his decision to retire as Executive Chairman and as a member of the Board effective as of June 30, 2023.

Kenneth V. Krupinski, CPA (Inactive), is the retired past President of an accounting firm and was a CPA for 43 years. He is also actively involved in the Bank’s community. Mr. Krupinski’s extensive accounting background enables him to provide value to the Board in his role as the Chair of the Nominating and Corporate Governance Committee, and as a member of the Bancorp’s Risk Management and Audit Committee, the Executive Committee, the Credit Committee, and the Wealth Management Committee.

Kenneth V. Krupinski, CPA (Inactive), is the retired past President of an accounting firm and was a CPA for 43 years. He is also actively involved in the Bank’s community. Mr. Krupinski’s extensive accounting background enables him to provide value to the Board in his role as the Chair of the Nominating and Corporate Governance Committee, and as a member of the Bancorp’s Risk Management and Audit Committee, the Executive Committee, the Credit Committee, and the Wealth Management Committee.

Anthony M. Puntillo, D.D.S., M.S.D., founded Puntillo and Crane Orthodontics, PC, a dental specialty practice with multiple locations in Northwest Indiana, in 1994. He is the co-owner and senior partner of the practice. He also serves as a Director of the American Board of Orthodontics, is a past President of the Great Lakes Association of Orthodontists, and is a member of various other orthodontics associations. He is professionally active in the Bank’s communities. His experience and profile assist the Bancorp and the Bank with their business lending strategies. Dr. Puntillo serves as the Lead Independent Director for the Bancorp and the Bank, is the Vice-Chairman of the Board and the Executive Committee, and serves as a member of the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee.

Anthony M. Puntillo, D.D.S., M.S.D., founded Puntillo and Crane Orthodontics, PC, a dental specialty practice with multiple locations in Northwest Indiana, in 1994. He is the co-owner and senior partner of the practice. He also serves as a Director of the American Board of Orthodontics, is a past President of the Great Lakes Association of Orthodontists, and is a member of various other orthodontics associations. He is professionally active in the Bank’s communities. His experience and profile assist the Bancorp and the Bank with their business lending strategies. Dr. Puntillo serves as the Lead Independent Director for the Bancorp and the Bank, is the Vice-Chairman of the Board and the Executive Committee, and serves as a member of the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee.

James L. Wieser, J.D., is an attorney with over 50 years of experience. He concentrates his practice in the areas of real estate development and the representation of small businesses. This experience assists the Bancorp and the Bank in their real estate and small business lending. He has also served on several audit and risk management committees of not-for-profit organizations. He serves as a member of the Compensation and Benefits Committee, the Executive Committee, the Credit Committee, and the Wealth Management Committee.

James L. Wieser, J.D., is an attorney with over 50 years of experience. He concentrates his practice in the areas of real estate development and the representation of small businesses. This experience assists the Bancorp and the Bank in their real estate and small business lending. He has also served on several audit and risk management committees of not-for-profit organizations. He serves as a member of the Compensation and Benefits Committee, the Executive Committee, the Credit Committee, and the Wealth Management Committee.

Class I Directors – Term Expiring at the Annual Meeting of Shareholders in 2025

Joel Gorelick served as President and Chief Operating Officer of the Bancorp until January 2013 when he retired, and has over 50 years of banking experience including retail and commercial banking. He is a Director and Chairman of the Audit Committee of the Indiana Economic Development Corporation and a Charter Chairman Emeritus of the Lake County Economic Alliance, Inc. He has detailed knowledge of commercial lending facilities as well as the intricacies of daily banking operations. His expertise has been utilized as an instructor for educational seminars offered by the Indiana Bankers Association. He has a high profile within the community and is active in numerous community activities. This experience assists him in his role as Chair of the Credit Committee and as a member of the Risk Management and Audit Committee, Strategic Planning Committee, and the Executive Committee.

Joel Gorelick served as President and Chief Operating Officer of the Bancorp until January 2013 when he retired, and has over 50 years of banking experience including retail and commercial banking. He is a Director and Chairman of the Audit Committee of the Indiana Economic Development Corporation and a Charter Chairman Emeritus of the Lake County Economic Alliance, Inc. He has detailed knowledge of commercial lending facilities as well as the intricacies of daily banking operations. His expertise has been utilized as an instructor for educational seminars offered by the Indiana Bankers Association. He has a high profile within the community and is active in numerous community activities. This experience assists him in his role as Chair of the Credit Committee and as a member of the Risk Management and Audit Committee, Strategic Planning Committee, and the Executive Committee.

Amy W. Han, Ph.D., completed a Ph.D. in Psychology from the University of Notre Dame in 2003. Prior to graduate work, Dr. Han worked as a management consultant in the areas of human resource management and strategic management with Norrell Services and AT&T in Chicago. She currently serves as the Director for Clinical Affairs and Education at the Northwest campus of Indiana University School of Medicine. Dr. Han lends expertise to the Board in the human resources management and strategic management areas. She brings leadership skills and the ability to help individuals achieve their goals to the Board of Directors. She is also very knowledgeable about the means and methods of providing good customer service to individuals in Northwest Indiana and greater Chicagoland. Additionally, Dr. Han has expertise in diversity, equity, and inclusion matters, having created IU’s first Scholarly Concentration in Urban Medicine, Health Disparities and Social Determinants of Health, directly impacting the community. Dr. Han also serves on several local boards. This experience assists her in her role as the Chair of the Wealth Management Committee, and as a member of the Compensation and Benefits Committee, the Nominating and Corporate Governance Committee, and the Executive Committee.

Amy W. Han, Ph.D., completed a Ph.D. in Psychology from the University of Notre Dame in 2003. Prior to graduate work, Dr. Han worked as a management consultant in the areas of human resource management and strategic management with Norrell Services and AT&T in Chicago. She currently serves as the Director for Clinical Affairs and Education at the Northwest campus of Indiana University School of Medicine. Dr. Han lends expertise to the Board in the human resources management and strategic management areas. She brings leadership skills and the ability to help individuals achieve their goals to the Board of Directors. She is also very knowledgeable about the means and methods of providing good customer service to individuals in Northwest Indiana and greater Chicagoland. Additionally, Dr. Han has expertise in diversity, equity, and inclusion matters, having created IU’s first Scholarly Concentration in Urban Medicine, Health Disparities and Social Determinants of Health, directly impacting the community. Dr. Han also serves on several local boards. This experience assists her in her role as the Chair of the Wealth Management Committee, and as a member of the Compensation and Benefits Committee, the Nominating and Corporate Governance Committee, and the Executive Committee.

Robert W. Youman, CPA (Inactive), is an Investment Advisor and Managing Director of Horwitz & Associates, positions he has held since January 2016. He has worked in the securities industry for over thirty years focusing on serving community banks and their investors. Mr. Youman began his career with KPMG LLP where he specialized in audits of community banks. He served as a member of the board of directors of Royal Financial, Inc. and its wholly-owned Illinois state-chartered savings bank subsidiary, Royal Savings Bank, from 2017 to 2022. Mr. Youman lives in Illinois and is familiar with the financial services markets in the Chicagoland area. He also has extensive experience in the areas of community banking, finance, mergers and acquisitions, strategic planning, and wealth management. This experience assists him in his role as a member of the Risk Management and Audit Committee, the Strategic Planning Committee, the Credit Committee, and the Wealth Management Committee.

Robert W. Youman, CPA (Inactive), is an Investment Advisor and Managing Director of Horwitz & Associates, positions he has held since January 2016. He has worked in the securities industry for over thirty years focusing on serving community banks and their investors. Mr. Youman began his career with KPMG LLP where he specialized in audits of community banks. He served as a member of the board of directors of Royal Financial, Inc. and its wholly-owned Illinois state-chartered savings bank subsidiary, Royal Savings Bank, from 2017 to 2022. Mr. Youman lives in Illinois and is familiar with the financial services markets in the Chicagoland area. He also has extensive experience in the areas of community banking, finance, mergers and acquisitions, strategic planning, and wealth management. This experience assists him in his role as a member of the Risk Management and Audit Committee, the Strategic Planning Committee, the Credit Committee, and the Wealth Management Committee.

Recommendation of the Board of Directors

The Board unanimously recommends that shareholders vote “FOR” the Class II Director nominees set forth above. Proxies solicited by the Board will be so voted, unless shareholders specify otherwise on their proxy cards.

CORPORATE GOVERNANCE

Director Independence

All of the directors except David A. Bochnowski and Benjamin J. Bochnowski meet the standards for independence of Board members set forth in the Listing Standards for the Nasdaq Stock Market. Directors David Bochnowski and Benjamin Bochnowski are not independent because they are employees of the Bancorp. Moreover, all of the members of the Bancorp’s Risk Management and Audit Committee, Compensation and Benefits Committee, and Nominating and Corporate Governance Committee meet the independence standards set forth in the SEC rules and the Nasdaq Listing Standards.

The Board of Directors of the Bancorp determines the independence of each of the directors under the Listing Standards of the Nasdaq Stock Market, which for purposes of determining the independence of the Risk Management and Audit Committee members also incorporate the standards of the SEC included in Reg. § 240.10A-3(b)(1). Among other things, the Board considers current or previous employment relationships as well as material transactions or relationships between the Bancorp or its subsidiaries and the directors, members of their immediate family, or entities in which the directors have a significant interest. The purpose of this review is to determine whether any relationships or transactions exist or have occurred that are inconsistent with a determination that the director is independent.

The non-management directors of the Board meet in executive session without the presence of David Bochnowski and Benjamin Bochnowski. In addition, the Board will meet in executive session without David Bochnowski and Benjamin Bochnowski at least twice a year, in accordance with Nasdaq Listing Rule 5605(b)(2) and Nasdaq IM-5605-2.

Leadership Structure of the Board of Directors

The Bancorp’s By-Laws currently provide that the Board may designate a Chairman of the Board, and may designate such Chairman of the Board as an officer of the Bancorp. As a result, the Chairman of the Board may simultaneously serve as an officer of the Bancorp. In this regard, David A. Bochnowski serves as the Executive Chairman of the Board, which is designated as an executive officer position of the Bancorp. On January 27, 2023, David A. Bochnowski informed the Board of his decision to retire as Executive Chairman and as a member of the Board effective as of June 30, 2023. In conjunction with Mr. Bochnowski’s retirement, on January 27, 2023, the Board appointed Benjamin J. Bochnowski, currently the Bancorp’s President and Chief Executive Officer and a member of the Board, to succeed David Bochnowski as the Chairman of the Board, effective as of June 30, 2023. The appointment of Benjamin Bochnowski as Chairman is the result of the implementation of the Bancorp’s normal succession planning process.

In addition, the Board evaluates, from time to time as appropriate, whether the same individual should serve as Chairman of the Board and Chief Executive Officer or whether these positions should be held by different individuals, based on what the Board considers to be in the best interests of the Bancorp and its shareholders. In this regard, since 2016, David A. Bochnowski has served as Executive Chairman of the Board of the Bancorp, and Benjamin J. Bochnowski has served as the Chief Executive Officer of the Bancorp while also serving as a member of the Board. The Board believes this leadership structure has been appropriate for the Bancorp during this period, as it has provided a balance between the two roles of Chairman and Chief Executive Officer. In this regard, by separating the Chairman and Chief Executive Officer roles, the Bancorp has been able to benefit from David Bochnowski’s guidance, significant historical experience with the Bancorp and its business, and overall board leadership acumen, while at the same time having Benjamin Bochnowski focus his responsibilities on setting the strategic direction for the Bancorp and the day-to-day leadership and performance of the Bancorp’s business.

Upon David Bochnowski’s retirement from the Board and Benjamin Bochnowski’s appointment as Chairman, effective as of June 30, 2023, the positions of Chairman and Chief Executive Officer of the Bancorp will once again be combined. From 1981 to 2016, David Bochnowski served as both Chairman of the Board and Chief Executive Officer of the Bancorp. The Board determined it was appropriate to permit the same individual to serve as both Chairman and Chief Executive Officer during this period, and with Benjamin Bochnowski’s appointment as Chairman, the Board once again has determined that such a combined role is appropriate for the Bancorp’s leadership structure. In this regard, the combined role will promote unified leadership and direction for the Board and for executive management during an important period of growth for the Bancorp’s business, and it will allow for a single, clear focus for the chain of command to execute the Bancorp’s business plans. Moreover, the Bancorp receives active and effective management and oversight of its operations by the Board’s independent directors, which includes the position of a Lead Independent Director of the Board, as discussed below. In light of these considerations, the Board believes the combination of the Chairman and Chief Executive Officer positions upon the effectiveness of Benjamin Bochnowski’s appointment as Chairman is an appropriate leadership structure for the Bancorp going forward. In the future, the Board once again may determine to separate the roles of Chief Executive Officer and Chairman of the Board, if the Board determines this to be in the best interests of the Bancorp and its shareholders. To ensure the preservation of good governance, the Board has and will continue to maintain the position of Lead Independent Director so that there will be a strong, independent leader in place to facilitate the consideration of matters and actions taken by the non-employee, independent directors.

Since February 2022, Anthony M. Puntillo has served as Lead Independent Director of the Board. The Lead Independent Director is appointed to serve in such capacity until his or her successor is duly appointed, or until his or her earlier removal or resignation, or until such time as he or she is no longer an independent director of the Board. The Lead Independent Director is tasked with helping develop agendas for each of the Board’s meetings and presiding as the chair of executive sessions which are generally held in conjunction with each of the Board’s regularly scheduled meetings. The Lead Independent Director is also tasked with identifying and developing, in conjunction with the Chairman of the Board and the Nominating and Corporate Governance Committee, the Board’s compositional needs and criteria for director candidates, and coordinating responses to questions and/or concerns from shareholders or other interested parties that may be communicated to the Bancorp’s non-employee directors. The Lead Independent Director serves at the discretion of the independent directors of the Board and may be removed from the position, with or without cause, by a majority vote of the Board’s independent directors or by the appointment of a new Lead Independent Director at any time.

The Bancorp’s management and the Board believe the current and future leadership structure described above is appropriate because it is advantageous to and in the best interests of the Bancorp and its shareholders. In addition, this leadership structure promotes clear direction for the Board and the Bancorp’s management, while at the same time providing a mechanism for strong, independent governance in circumstances where it is advisable or necessary to have the non-employee, independent directors consider matters and take action.

Meetings of the Board of Directors

During the fiscal year ended December 31, 2022, the Board of Directors of the Bancorp met or acted by written consent 17 times. No director attended fewer than 80% of the aggregate total number of meetings during the last fiscal year of the Board of Directors of the Bancorp held while he or she served as director and of meetings of committees on which he or she served during that fiscal year.

Board Committees

Executive Committee

The Board of Directors has appointed an Executive Committee, composed of Directors David Bochnowski (Chairman), Puntillo (Vice Chair), Benjamin Bochnowski, Gorelick, Han, Krupinski, and Wieser. David Bochnowski will step down as Chairman and as a member of the Executive Committee effective as of his retirement from the Board on June 30, 2023. At that time, Benjamin Bochnowski has been appointed to become Chairman of the Executive Committee. The Executive Committee is authorized to exercise the powers of the Board of Directors between regular Board meetings, except with respect to the declaration of dividends and other extraordinary corporate transactions. During the year ended December 31, 2022, the Executive Committee met or acted by written consent nine times.

Nominating and Corporate Governance Committee

The Board of Directors has a Nominating and Corporate Governance Committee, which currently consists of Directors Krupinski (Chair), Han (Vice Chair), Fesko, and Puntillo. The Board of Directors has adopted a written Charter of the Nominating and Corporate Governance Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. The primary functions of the Nominating and Corporate Governance Committee are to retain and terminate any search firm to be used to identify director candidates; to assess the need for new directors; to review and reassess the adequacy of the Bancorp’s Corporate Governance Guidelines and recommend any proposed changes to the Board for approval; to lead the Board in its annual review of the Board’s performance and report its findings to the Board; to recommend to the Board director nominees for each committee of the Bancorp; to review and reassess the adequacy of its written Charter; and to annually review its own performance. The Nominating and Corporate Governance Committee identifies potential nominees for director based on specified objectives in terms of the composition of the Board, taking into account such factors as areas of expertise and geographic, occupational, gender, race, and age diversity. The Nominating Committee assesses the effectiveness of its efforts to have a diverse Board of Directors by periodically reviewing the current Board members for geographic, occupational, gender, race, and age diversity. Nominees will be evaluated on the basis of their experience, judgment, integrity, ability to make independent inquiries, understanding of the Bancorp, and willingness to devote adequate time to Board duties. During the year ended December 31, 2022, the Nominating and Corporate Governance Committee met or acted by written consent seven times.

The Nominating and Corporate Governance Committee also will consider director candidates recommended by the Bancorp’s shareholders. The Nominating and Corporate Governance Committee evaluates candidates recommended by shareholders using the same criteria it applies to evaluate other director candidates. A shareholder who wishes to nominate an individual as a director candidate at next year’s annual meeting of shareholders, rather than recommend the individual to the Board as a potential nominee, must comply with the advance notice requirements described under “Shareholder Proposals.”

Risk Management and Audit Committee

The Board of Directors has appointed a Risk Management and Audit Committee, established in accordance with Section 3(a)(58)(A) of the Exchange Act, which is composed of Directors Garza (Chair), Johnson (Vice Chair), Gorelick, Krupinski, and Youman. The Risk Management and Audit Committee is comprised solely of independent directors, as defined in the SEC rules and the Nasdaq Listing Standards. In addition, the Board of Directors has determined that Directors Garza and Johnson are “audit committee financial experts,” as that term is defined in the Exchange Act.

The Risk Management and Audit Committee functions as the Bancorp’s liaison with its external auditors and reviews audit findings presented by the Bancorp’s internal auditor. The Risk Management and Audit Committee, along with the external auditors and internal auditor, monitors controls for material weaknesses and/or improvements in the audit function. The Risk Management and Audit Committee also monitors or, if necessary, establishes policies designed to promote full disclosure of the Bancorp’s financial condition. The Board of Directors has adopted a written Charter for the Risk Management and Audit Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. During the year ended December 31, 2022, the Risk Management and Audit Committee met or acted by written consent eight times.

Compensation and Benefits Committee

The Board of Directors has appointed a Compensation and Benefits Committee composed of Directors Fesko (Chair), Wieser (Vice Chair), Han, and Puntillo. The Compensation and Benefits Committee is comprised solely of independent directors, as defined in the SEC rules and the Nasdaq Listing Standards. The Compensation and Benefits Committee is responsible for reviewing, determining, and establishing the compensation of directors and (as the Bank’s Compensation and Benefits Committee) the salaries, bonuses, and other compensation of the executive officers of the Bank. The Board of Directors has adopted a written Charter for the Compensation and Benefits Committee, a copy of which is available on the Bancorp’s website at www.ibankpeoples.com. During the year ended December 31, 2022, the Compensation and Benefits Committee met or acted by written consent 13 times. For 2022, the Compensation and Benefits Committee consulted Meridian Compensation Partners, LLC and considered surveys provided by Compdata Surveys (Banking and Finance Survey), and McLagan Survey (Regional Community Banks) in determining the executive compensation and director compensation.

Strategic Planning Committee

The Board of Directors has appointed a Strategic Planning Committee composed of Directors Johnson (Chair), Fesko (Vice Chair), Garza, Gorelick, and Youman. The Committee is responsible for reviewing the Bancorp’s strategic plan and capital plan and recommending such plans to the Board, and ensuring the successful execution of the Bancorp’s strategic plan and capital plan by monitoring management’s progress in achieving plan objectives. During the year ended December 31, 2022, the Strategic Planning Committee met or acted by written consent four times.

Wealth Management Committee

The Board of Directors has appointed a Wealth Management Committee composed of Directors Han (Chair), Wieser (Vice Chair), Garza, Krupinski, and Youman. The primary function of the Wealth Management Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by monitoring the functioning of the Wealth Management Group. The Committee also provides oversight to assist in its compliance with all applicable laws, rules, regulations, and internal policies of the Bank. During the year ended December 31, 2022, the Wealth Management Committee met or acted by written consent four times.

Credit Committee

The Board of Directors has appointed a Credit Committee composed of Directors Gorelick (Chair), Krupinski (Vice Chair), Garza, Wieser, and Youman. The Committee assists the Board of Directors in fulfilling its oversight responsibilities by monitoring credit and lending strategies and credit risk management, reviewing the quality and performance of the Bank’s credit portfolio, and reviewing and approving certain loan requests as specified in the applicable loan approval policies. During the year ended December 31, 2022, the Credit Committee met or acted by written consent 11 times.

Risk Oversight

The Board of Directors plays an active role in the oversight of credit risk, market risk, operational risk, liquidity risk, and similar risks of the business of the Bancorp. It performs this role primarily through its Committee structure. The Risk Management and Audit Committee of the Bancorp has oversight responsibilities with respect to financial information of the Bancorp, the systems of internal controls established by management and the Board, and compliance and risk management, accounting and financial reporting processes. Members of the Risk Management and Audit Committee have the opportunity to communicate as needed with the chief executive officer, chief financial officer, chief credit officer, chief risk officer, general counsel, internal auditor, and compliance officer of the Bank as well as the Bancorp’s outside auditor and other directors of the Bancorp. The Committee also is authorized to retain independent counsel and accountants to the extent deemed necessary to assist with its risk oversight responsibilities. In addition, the Compensation and Benefits Committee evaluates the compensation programs of the Bancorp to ensure that they do not create incentives among management employees to take undue risks. The Bank also has a Strategic Planning Committee that, among other things, monitors risks relating to liquidity, investments, and interest rate risk and a Credit Committee that, among other things, monitors risk in the credit portfolio.

Communications with Directors

The Board of Directors of the Bancorp has implemented a process whereby shareholders may send communications to the Board’s attention. Any shareholder desiring to communicate with the Board, or one or more specific members thereof, should communicate in a writing addressed to Finward Bancorp, Board of Directors, c/o Corporate Secretary, 9204 Columbia Avenue, Munster, Indiana 46321. The Corporate Secretary of the Bancorp has been instructed by the Board to promptly forward all such communications to the specified addressees thereof. All of the Bancorp’s directors then in office attended the Annual Meeting of Shareholders held on May 20, 2022.

Employee, Officer, and Director Hedging

The Board has adopted the Finward Bancorp Insider Trading Policy (the “Insider Trading Policy”) that, among other things, prohibits a director, executive officer, or employee from entering into any hedging, derivative, or other equivalent transaction that is specifically designed to reduce or limit the extent to which declines in the trading price of the Bancorp’s common stock would affect the value of the shares of Bancorp common stock owned by the executive officer or director. The Insider Trading Policy provides that examples of prohibited hedging transactions include (i) short-term trading of the Bancorp’s common stock (the practice of purchasing and selling shares of the same class of Bancorp stock within a six month period, or vice versa); (ii) short sales of the Bancorp’s common stock (the practice of selling a security that the seller does not own); (iii) transactions in put options, call options, or other derivative securities relating to the Bancorp’s common stock; (iv) entering into prepaid variable forward sale contracts, equity swaps, exchange funds, or zero cost collars relating to the Bancorp’s common stock; and (v) placing standing or limit orders on the Bancorp’s common stock. Under the policy, except as otherwise permitted by the Bancorp’s Board, directors, executive officers and other employees also are prohibited from pledging, hypothecating, or otherwise encumbering shares of the Bancorp’s common stock as collateral for indebtedness, including holding such shares in a margin account.

The information provided under this Employee, Officer, and Director Hedging section shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Bancorp specifically incorporates this information by reference.

Code of Ethics

The Bancorp has adopted a Code of Business Conduct and Ethics (the “Ethics Code”) that applies to all of the Bancorp’s directors, officers, and employees, including its principal executive officer, principal financial officer, principal accounting officer, and controller. The Ethics Code is posted on the Bancorp’s website at www.ibankpeoples.com. The Bancorp intends to disclose any waivers of the Ethics Code for directors or executive officers of the Bancorp and any amendments to the Ethics Code by posting such waivers and amendments on its website.

Stock Ownership Guidelines

On January 27, 2023, the Bancorp’s Board adopted stock ownership guidelines (the “Stock Ownership Guidelines”), which require that each director serving on the Board and each executive officer of the Bancorp attain and maintain a level of ownership of shares of the Bancorp’s Common Stock having a value at least equal to the following ownership thresholds specified in the Stock Ownership Guidelines:

|

Position |

Minimum Ownership Level |

|

Chief Executive Officer |

3x annual base salary |

|

Executive Chairman |

3x annual base salary |

|

All Other Executive Officers |

1x annual base salary |

|

Non-Employee Directors |

$100,000 in market value |

Shares of the Bancorp’s Common Stock that count toward satisfaction of the minimum ownership thresholds in the Stock Ownership Guidelines include: (i) shares beneficially owned by the director or executive officer (including shares held by his or her immediate family members or held in trust for the benefit of the director or executive officer or his or her immediate family members), including shares held in the Peoples Bank Employees’ Savings & Profit Sharing Plan and Trust and other retirement accounts or deferred compensation plans, and shares held indirectly through partnerships, trusts, or other entities to the extent the director or executive officer has an economic interest in such shares; (ii) shares of time-based restricted stock (whether vested or unvested); and (iii) shares of performance based restricted stock, but only upon the certification of the achievement of the applicable performance goals.

Each director and executive officer who is the recipient of the Bancorp’s Common Stock upon the vesting of an award under the 2015 Plan or any other stock incentive program of the Company must hold 100% of those shares for at least one year from the date of vesting, in addition to any retention period required as a vesting condition. Further, after expiration of one year from the date of vesting, each director and executive officer must continue to retain at least 75% of the net shares of the Bancorp’s Common Stock acquired on vesting of restricted stock, restricted stock units, performance shares, or on exercise of stock options until he or she is in compliance with the minimum ownership level in the Stock Ownership Guidelines. However, a director or executive officer may sell the Bancorp’s Common Stock acquired by exercising stock options for the limited purposes of paying the exercise price of the stock option and any applicable tax liability, or on vesting of other equity incentive awards for the limited purpose of paying any applicable tax liability.

Each director and executive officer must satisfy his or her applicable minimum ownership level of the Bancorp’s Common Stock within five years of becoming subject to the Stock Ownership Guidelines. In the event that the Stock Ownership Guidelines place a financial hardship on any director or executive, the Nominating and Corporate Governance Committee may, in its discretion, develop an alternative stock ownership guideline for such director or executive officer that reflects the intention of the Stock Ownership Guidelines and the director or executive officer’s personal circumstances. The Nominating and Corporate Governance Committee may also, in its discretion, consider exceptions for charitable gifts, estate planning transactions, and certain other limited circumstances.

If a director or executive officer fails to comply with the Stock Ownership Guidelines, the Nominating and Corporate Governance Committee may take any action it deems advisable, including but not limited to, payment of future annual or long-term cash incentives in the form of shares of restricted stock or reduced future equity compensation awards.

EXECUTIVE COMPENSATION

The following table presents information for compensation awarded to, earned by, or paid to the Named Executive Officers for 2021 and 2022:

Summary Compensation Table for 2022

|

Name and Principal Position |

Year |

Salary ($)(1) |

Stock ($)(2) |

Non-Equity Incentive Plan Compensation ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

|||||||||||

|

Benjamin J. Bochnowski |

2022 |

$398,336 | $103,642 | – | $49,504 | $551,482 | |||||||||||

|

President and Chief Executive Officer and Chief Executive Officer of the Bank |

2021 |

$386,734 | $59,049 | $145,103 | $58,682 | $649,568 | |||||||||||

|

Peymon S. Torabi |

2022 |

$216,993 | $42,013 | – | $28,146 | $287,152 | |||||||||||

|

Executive Vice President, Chief Financial Officer and Treasurer |

2021 |