1 A NASDAQ Traded Company – Symbol FNWD Annual Shareholder Meeting Presentation May 22, 2025

2 Overview of Finward Bancorp May 22, 2025 Forward-Looking Statements: This presentation may contain forward-looking statements regarding the financial performance, business prospects, growth and operating strategies of Finward Bancorp (“FNWD”). For these statements, FNWD claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about FNWD, including the information in the filings FNWD makes with the Securities and Exchange Commission (“SEC”). Forward- looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: changes in domestic and international trade policies, including tariffs and other non-tariff barriers, and the effects of such changes on the Bank and its customers; the ability of Peoples Bank (the “Bank”) to demonstrate compliance with the terms of the previously disclosed consent order and memorandum of understanding entered into between the Bank and the Federal Deposit Insurance Corporation (“FDIC”) and the Indiana Department of Financial Institutions (“DFI”), or to demonstrate compliance to the satisfaction of the FDIC and/or DFI within prescribed time frames; the Bank’s agreement under the memorandum of understanding to refrain from paying cash dividends without prior regulatory approval; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates, market liquidity, and capital markets, as well as the magnitude of such changes, which may reduce net interest margins; the aggregate effects of inflation experienced in recent years; further deterioration in the market value of securities held in the Bancorp’s investment securities portfolio, whether as a result of macroeconomic factors or otherwise; customer acceptance of the Bancorp’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, regulatory actions by the Federal Deposit Insurance Corporation and Indiana Department of Financial Institutions, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Bancorp’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning matters attributable to the Bancorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, The Bancorp does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, and regulatory and accounting considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends.

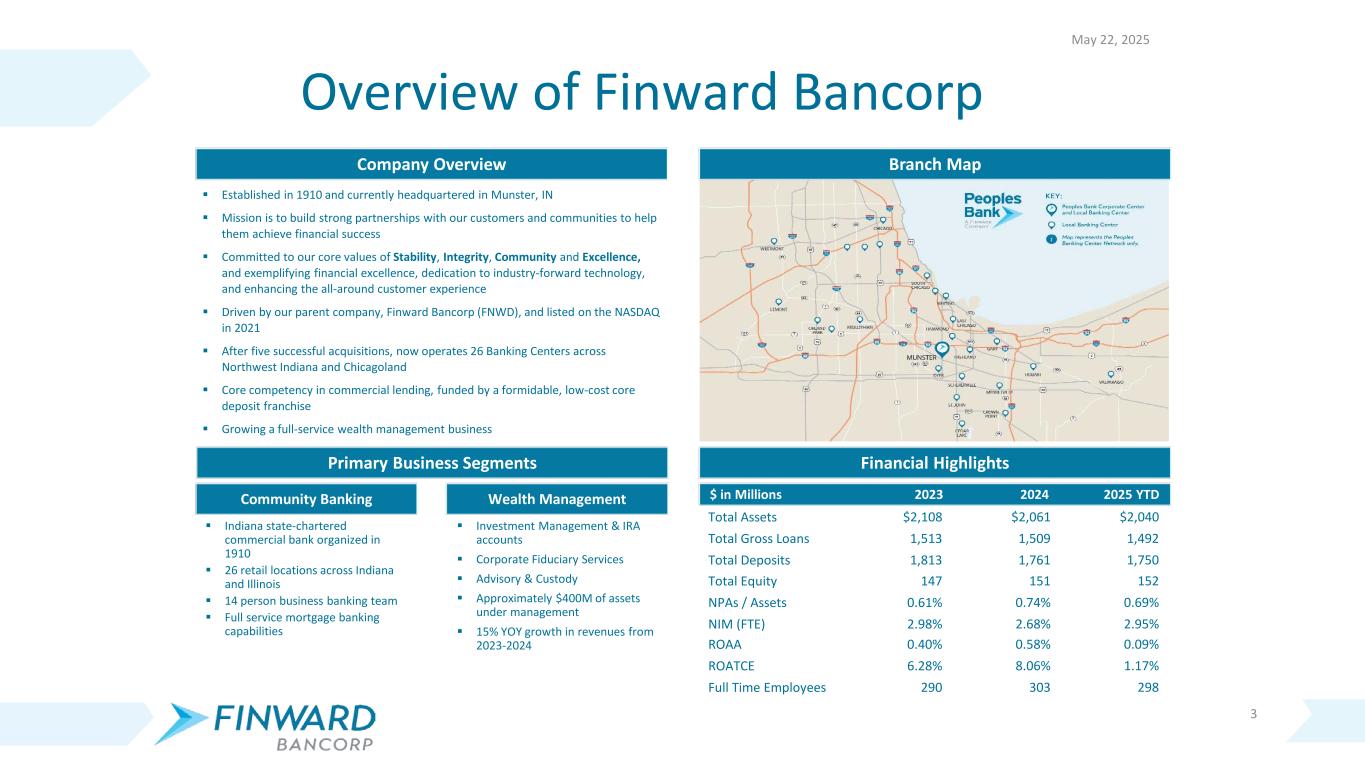

3 Overview of Finward Bancorp Company Overview Branch Map Primary Business Segments Financial Highlights Established in 1910 and currently headquartered in Munster, IN Mission is to build strong partnerships with our customers and communities to help them achieve financial success Committed to our core values of Stability, Integrity, Community and Excellence, and exemplifying financial excellence, dedication to industry-forward technology, and enhancing the all-around customer experience Driven by our parent company, Finward Bancorp (FNWD), and listed on the NASDAQ in 2021 After five successful acquisitions, now operates 26 Banking Centers across Northwest Indiana and Chicagoland Core competency in commercial lending, funded by a formidable, low-cost core deposit franchise Growing a full-service wealth management business Community Banking Wealth Management Indiana state-chartered commercial bank organized in 1910 26 retail locations across Indiana and Illinois 14 person business banking team Full service mortgage banking capabilities Investment Management & IRA accounts Corporate Fiduciary Services Advisory & Custody Approximately $400M of assets under management 15% YOY growth in revenues from 2023-2024 $ in Millions 2023 2024 2025 YTD May 22, 2025 Total Assets Total Gross Loans Total Deposits Total Equity NPAs / Assets NIM (FTE) ROAA ROATCE Full Time Employees $2,108 1,513 1,813 147 0.61% 2.98% 0.40% 6.28% 290 $2,061 1,509 1,761 151 0.74% 2.68% 0.58% 8.06% 303 $2,040 1,492 1,750 152 0.69% 2.95% 0.09% 1.17% 298

4 Executive Management Team Officer Years of Banking Experience Year Started in Current Position Year Started at Finward Bancorp Position with Company Benjamin J. Bochnowski 16 2016 2010 President & Chief Executive Officer Robert T. Lowry 39 2021 1985 Executive VP & Chief Operating Officer Todd M. Scheub 32 2022 1996 Executive VP, Chief Revenue Officer & Peoples Bank President Benjamin Schmitt 20 2024 2024 Executive VP, Chief Financial Officer and Treasurer David Kwait 14 2023 2011 Senior VP & Chief Risk Officer, General Counsel and Corporate Secretary Jill Washington 21 2021 2021 Senior VP & Chief People Officer Deep leadership team with decades of combined experience Seasoned banking team with deep ties to core operating markets Risk-aligned corporate culture, promoting responsibility and accountability May 22, 2025

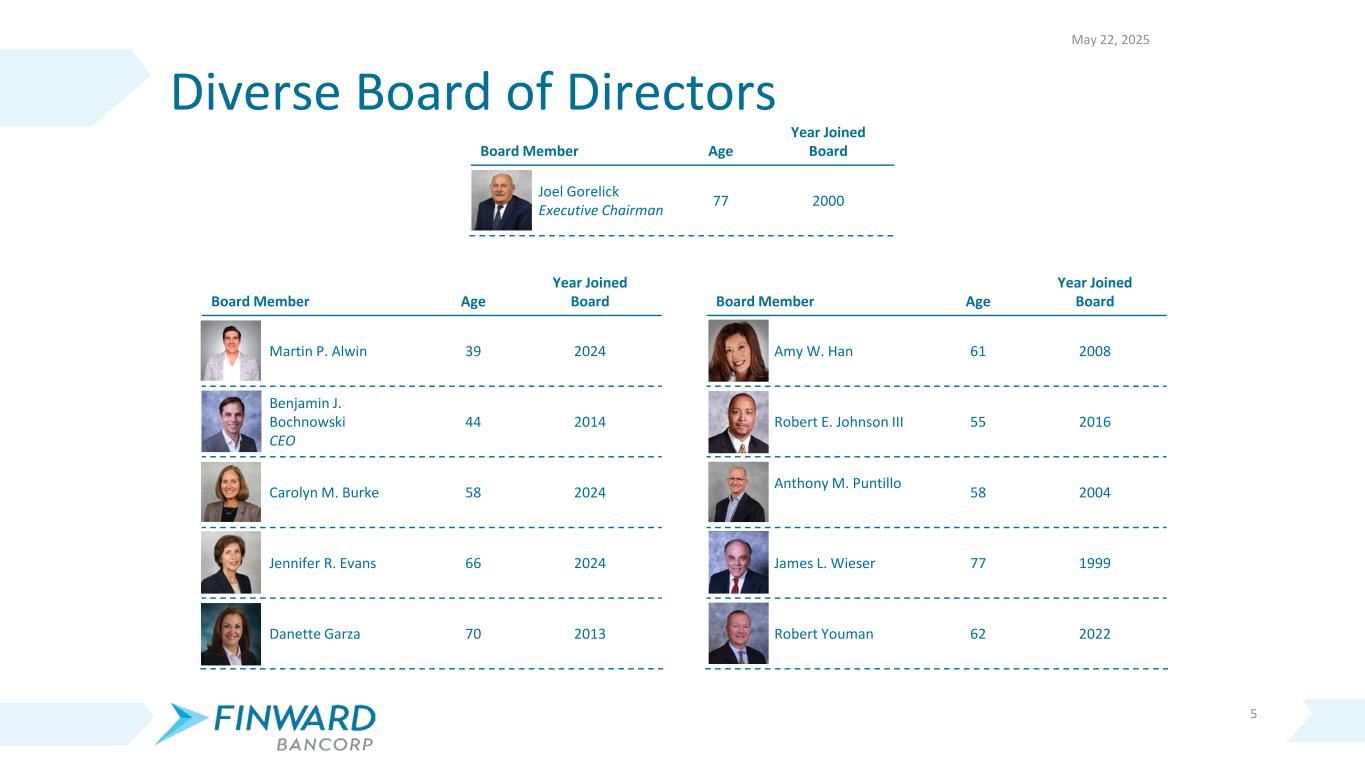

5 Diverse Board of Directors Board Member Age Year Joined Board Joel Gorelick Executive Chairman 77 2000 Board Member Age Year Joined Board Martin P. Alwin 39 2024 Benjamin J. Bochnowski CEO 44 2014 Carolyn M. Burke 58 2024 Jennifer R. Evans 66 2024 Danette Garza 70 2013 Board Member Age Year Joined Board Amy W. Han 61 2008 Robert E. Johnson III 55 2016 Anthony M. Puntillo 58 2004 James L. Wieser 77 1999 Robert Youman 62 2022 May 22, 2025

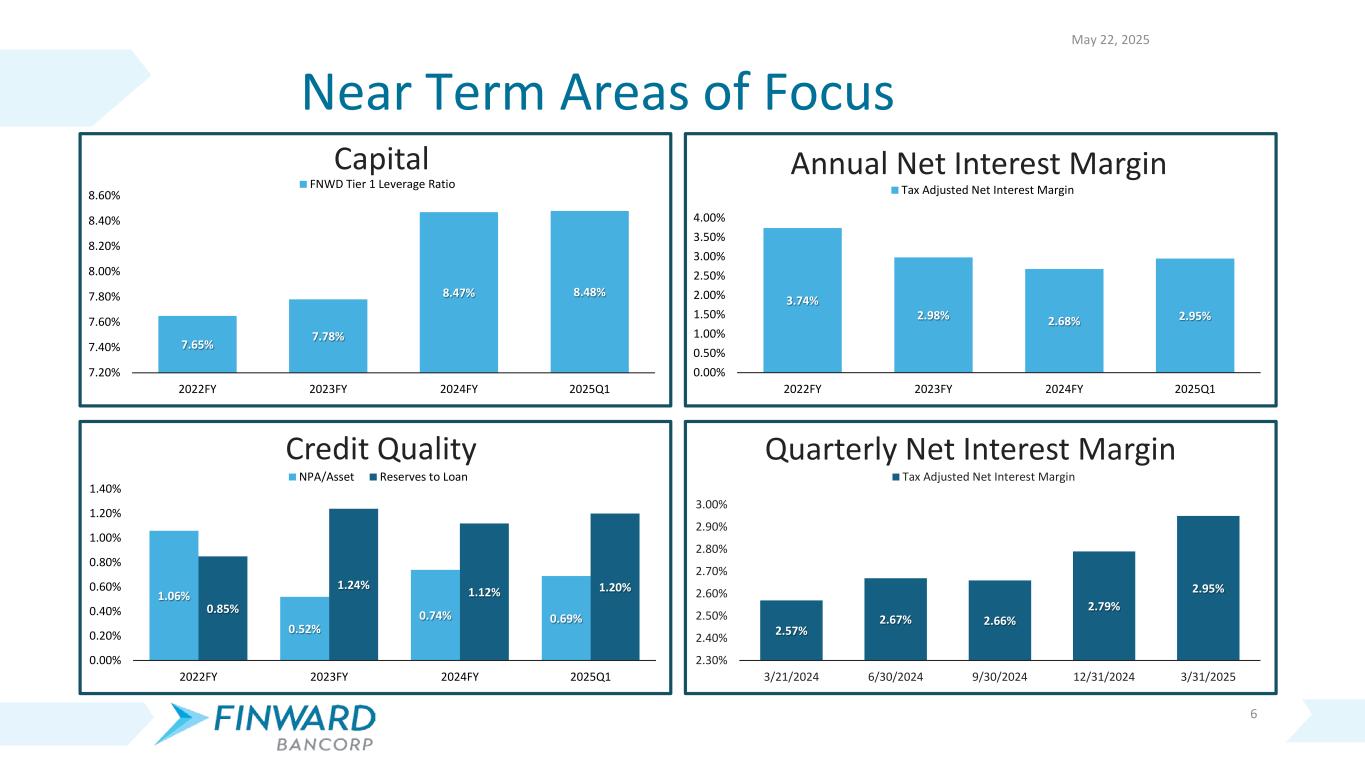

Near Term Areas of Focus 6 Capital Credit Quality Annual Net Interest Margin 7.65% 7.78% 8.47% 8.48% 7.20% 7.40% 7.60% 7.80% 8.00% 8.20% 8.40% 8.60% 2022FY 2023FY 2024FY 2025Q1 FNWD Tier 1 Leverage Ratio 1.06% 0.52% 0.74% 0.69% 0.85% 1.24% 1.12% 1.20% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2022FY 2023FY 2024FY 2025Q1 NPA/Asset Reserves to Loan Quarterly Net Interest Margin May 22, 2025 3.74% 2.98% 2.68% 2.95% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2022FY 2023FY 2024FY 2025Q1 Tax Adjusted Net Interest Margin 2.57% 2.67% 2.66% 2.79% 2.95% 2.30% 2.40% 2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3/21/2024 6/30/2024 9/30/2024 12/31/2024 3/31/2025 Tax Adjusted Net Interest Margin

Current Strategy Drivers 7 • Improving Profitability & Net Interest Margin • Significantly improved deposit funding costs (quarterly NIM expansion) • Continued loan portfolio repricing • Optimization of funding/borrowing alternatives • Controlling non-interest expense base and creating efficiencies • Managing Balance Sheet Risk & Continuing to Bolster Capital • Focus on maintaining existing deposits and cultivating new relationships • Opportunistic management of the balance sheet • Diligent monitoring of loan portfolio • Continued limiting of exposure to certain Commercial Real Estate • Expanding capital ratios via enhanced profitability • Management & Corporate Governance • Improved management talent with outside experience • Refreshed Board with independent directors May 22, 2025

THANK YOU